We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Annuity Purchase Cost

Comments

-

RPI doesn't cease to exist in 2030. It is still called RPI. However, the government is changing the way it is calculated to "align it" with CPIH. So after 2030 your RPI increases on your annuity will be lower than they would have been pre 2030.FIREDreamer said:I went for the RPI option to guard against future inflation. It isn’t clear what happens post 2030 when RPI ceases to exist.1 -

Thank you.OldMusicGuy said:

RPI doesn't cease to exist in 2030. It is still called RPI. However, the government is changing the way it is calculated to "align it" with CPIH. So after 2030 your RPI increases on your annuity will be lower than they would have been pre 2030.FIREDreamer said:I went for the RPI option to guard against future inflation. It isn’t clear what happens post 2030 when RPI ceases to exist.

I guess annuity providers in calculating annuity rates will allow / reflect this in their annuity rate calculations as it is a known change.0 -

But your starting income is less rubbish than it would have been if RPI wasn't due to be abolished. For the same reason that your starting income is higher than if you had chosen 5%pa fixed escalation.FIREDreamer said:No mention of anything in my documentation. CPIH seems a bit rubbish compared to RPI (based on recent values anyway).

Opting for inflation protection is a hedge against the risk that inflation returns to double digits and stays there. (If inflation is around the 2-3% mark, it will take you 2-3 decades to make up for the lower starting income, based on typical rates for a 65-year old.) And if that happens, it makes little odds whether your annuity goes up by 11% or 12%.0 -

I think people should find out if their payout rate is higher given the expectation that their index linking will be substantially reduced at some time because of a change to the way its calculated. I'm cynical enough to think that insurers might not be doing that.FIREDreamer said:

Thank you.OldMusicGuy said:

RPI doesn't cease to exist in 2030. It is still called RPI. However, the government is changing the way it is calculated to "align it" with CPIH. So after 2030 your RPI increases on your annuity will be lower than they would have been pre 2030.FIREDreamer said:I went for the RPI option to guard against future inflation. It isn’t clear what happens post 2030 when RPI ceases to exist.

I guess annuity providers in calculating annuity rates will allow / reflect this in their annuity rate calculations as it is a known change.And so we beat on, boats against the current, borne back ceaselessly into the past.0 -

This is my understanding too. One good thing about the change in calculations for RPI (from RPI to CPIH) is that a negative number is less likely to occur - for context, there was some concern back in 2008 or so that the nominal amount paid out on RPI annuities would drop (in the end there wasn't a sustained period of deflation).OldMusicGuy said:

RPI doesn't cease to exist in 2030. It is still called RPI. However, the government is changing the way it is calculated to "align it" with CPIH. So after 2030 your RPI increases on your annuity will be lower than they would have been pre 2030.FIREDreamer said:I went for the RPI option to guard against future inflation. It isn’t clear what happens post 2030 when RPI ceases to exist.

0 -

From the insurers' perspective, as their existing index linked gilts (their hedging asset) will have their RPI coupons aligned to CPIH (effectively the new definition of RPI) without any compensation, I don't see that they can 'improve' current pricing to take account of this reduction as suggested above.

Inflation linked annuity pricing has and may continue to improve but it won't be for this reason, nor should it be expected to. It has improved because of the significant shift in real yields. Not sure how much it's improved, but based on some numbers I did to assist a friend, level annuity pricing for 65 year old with 50% spouse income improved by 47% between Nov 20 and now, and 3% escalation annuity pricing by over 65% over the same time period.

I am surprised that it took so long to amend RPI as it was a statistically flawed calculation which systematically overstated inflation. Whether CPIH understates it is another matter.....everyone's basket of goods is different so their inflation rate will be different.1 -

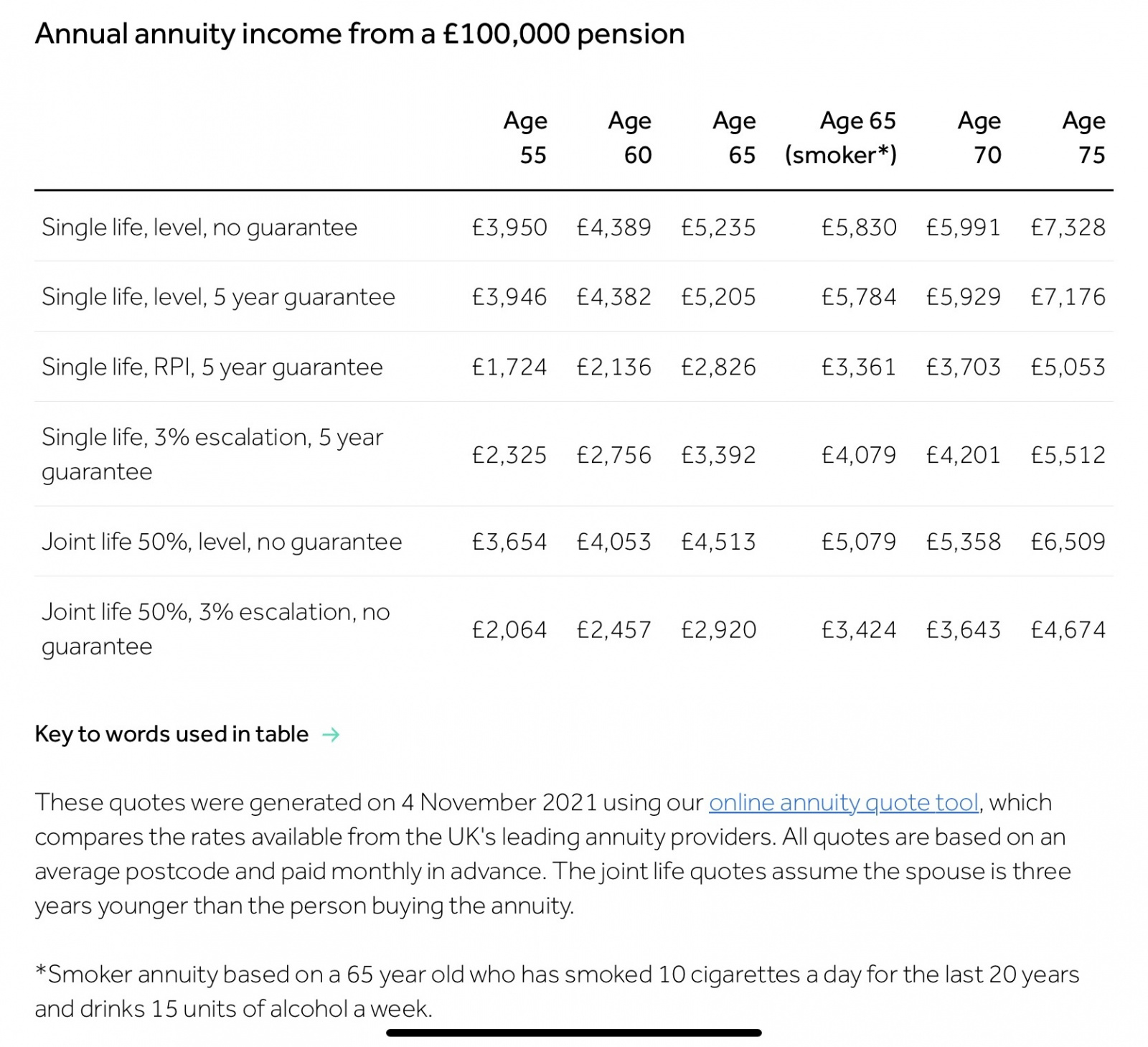

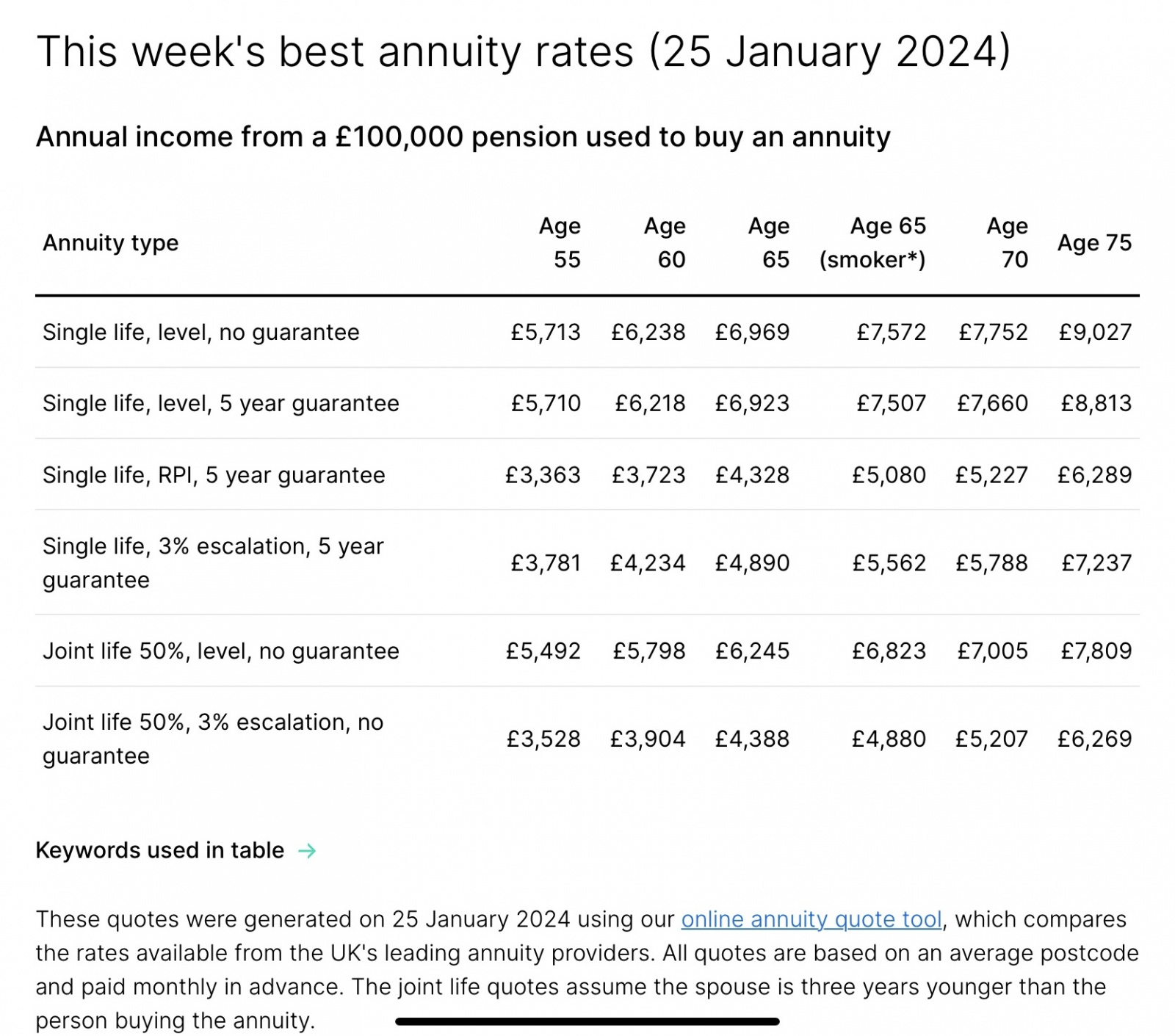

Rates have improved significantly in 2 years, for example …MarkCarnage said:From the insurers' perspective, as their existing index linked gilts (their hedging asset) will have their RPI coupons aligned to CPIH (effectively the new definition of RPI) without any compensation, I don't see that they can 'improve' current pricing to take account of this reduction as suggested above.

Inflation linked annuity pricing has and may continue to improve but it won't be for this reason, nor should it be expected to. It has improved because of the significant shift in real yields. Not sure how much it's improved, but based on some numbers I did to assist a friend, level annuity pricing for 65 year old with 50% spouse income improved by 47% between Nov 20 and now, and 3% escalation annuity pricing by over 65% over the same time period.

I am surprised that it took so long to amend RPI as it was a statistically flawed calculation which systematically overstated inflation. Whether CPIH understates it is another matter.....everyone's basket of goods is different so their inflation rate will be different.

NOVEMBER 2021 JANUARY 2024

JANUARY 2024 This is a significant improvement, especially if you had no bond investments that took a similar hit in the opposite direction!1

This is a significant improvement, especially if you had no bond investments that took a similar hit in the opposite direction!1 -

Yes, they have also improved a fair bit over 2 years but not quite as much as over 3 years (which was close to the low point). However, they have improved because of the general shift in bond pricing and yields.

Indeed, if you had an equity based portfolio, or even cash, you would have benefited from that, but holding bonds would have given some certainty of the (admittedly poor!) outcome throughout. Anyone who took a TV from DB and put it in equities/cash might want to think now about whether an annuity could be appropriate at least in part.0 -

Indeed, but I would point people to the Kitces article about the use of annuities in a retirement portfolio and how they compare with a cash and bond allocation. There is no one right answer here and every decision has trade offs which is one of the burdens associated with the choice people have today.MarkCarnage said:Yes, they have also improved a fair bit over 2 years but not quite as much as over 3 years (which was close to the low point). However, they have improved because of the general shift in bond pricing and yields.

Indeed, if you had an equity based portfolio, or even cash, you would have benefited from that, but holding bonds would have given some certainty of the (admittedly poor!) outcome throughout. Anyone who took a TV from DB and put it in equities/cash might want to think now about whether an annuity could be appropriate at least in part.

And so we beat on, boats against the current, borne back ceaselessly into the past.0 -

Your last sentence summarises it. However, I think the decision is currently more balanced than it has been for some years as the guaranteed income stream is commensurately higher. The price of certainty of outcome may still be worth paying for some, and having a foot in both camps has more attractions now than it has done for some years.Bostonerimus1 said:

Indeed, but I would point people to the Kitces article about the use of annuities in a retirement portfolio and how they compare with a cash and bond allocation. There is no one right answer here and every decision has trade offs which is one of the burdens associated with the choice people have today.MarkCarnage said:Yes, they have also improved a fair bit over 2 years but not quite as much as over 3 years (which was close to the low point). However, they have improved because of the general shift in bond pricing and yields.

Indeed, if you had an equity based portfolio, or even cash, you would have benefited from that, but holding bonds would have given some certainty of the (admittedly poor!) outcome throughout. Anyone who took a TV from DB and put it in equities/cash might want to think now about whether an annuity could be appropriate at least in part.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards