We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Annuity Purchase Cost

Comments

-

Thank you.dunstonh said:

Yes. Each annuity purchase is standalone.FIREDreamer said:

Could an IFA do this for an existing Just customer if I wanted to buy another annuity at some point?dunstonh said:In that scenario can the IFA fee come from the pension fund, or is it billed separately?Either. It can also be taken after TFC taken in many cases.Its a bit like 4x5 and 5x4.

I assume in HL's case the 0.8% comes from the fund indirectly in some way, noting that 0.8% of £645k is over twice as much.

If both the commission and the fee are the same then the end annuity rate will be virtually the same.

With a fee, the fund value is reduced by the fee but the nil commission annuity rate is applied.

With commission, the fund value is not reduced by the commission but a lower annuity rate is applied.

On a £645k fund, it is an absolute no-brainer to use an IFA. Plus, with Just, the IFA would have got the computer rate further enhanced by speaking to their Just account manager (never once have they failed to increase it. Sometimes just a little. Sometimes surprisingly a lot)0 -

What website are you using to give you those estimates please?0

-

https://annuitysupermarket.hl.co.uk/PersonalClient.aspx?MetaPhysical said:What website are you using to give you those estimates please?

0 -

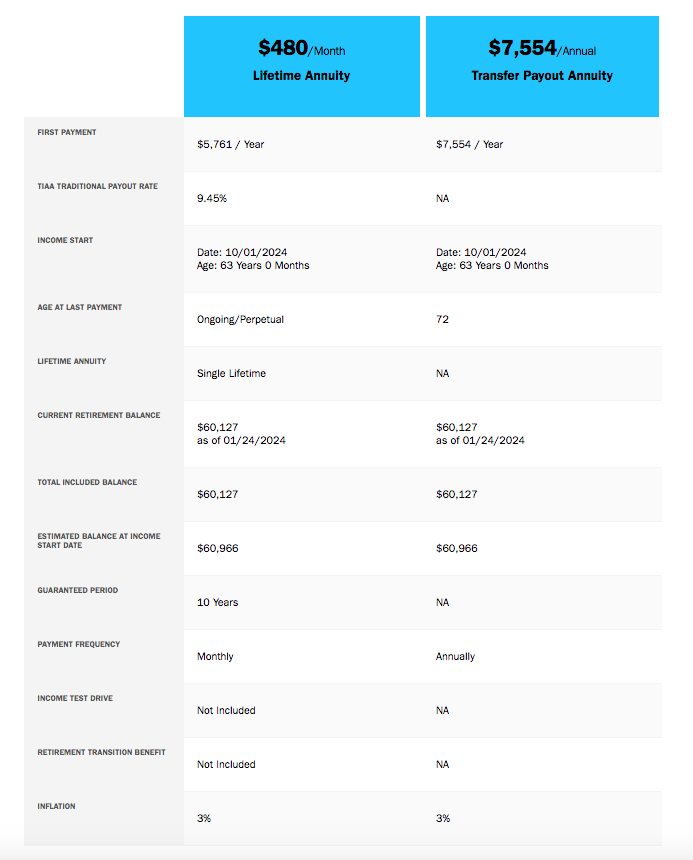

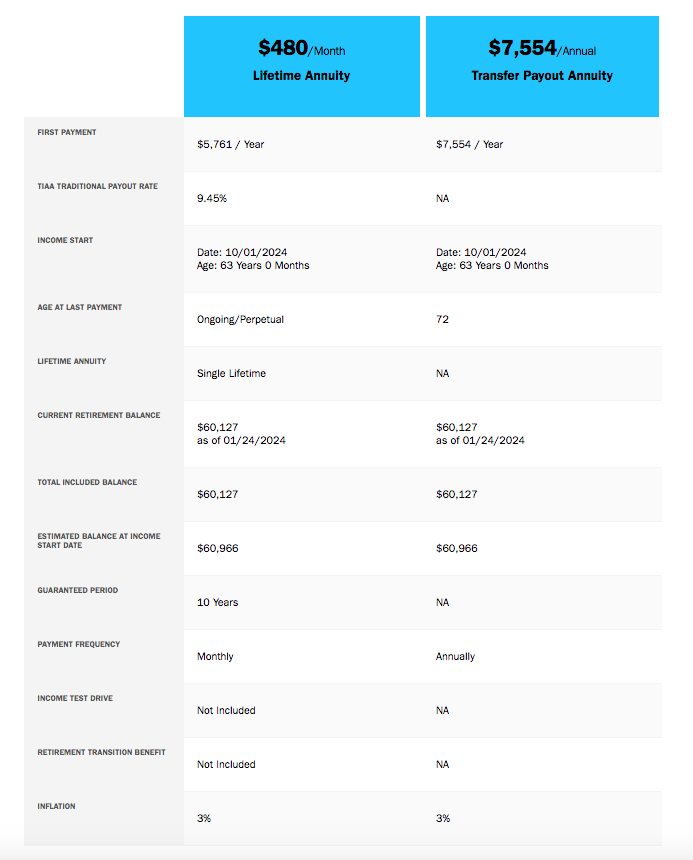

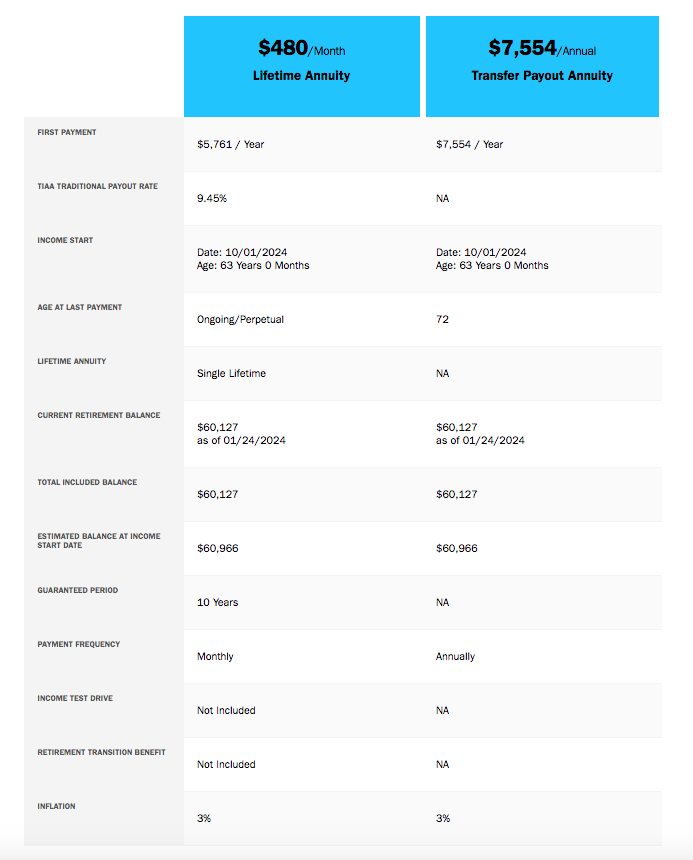

This is a bit academic, but I just got an annuity quote from an insurance company in the US that I've had funds with for many years. They were the default retirement administrator for my first job and my employer put in a percentage of my salary and the amount was quite small as I left after 3 years, but it has compounded over the years. Anyway, I get the annuity by just filling in an online form on the insurance company website so no intermediaries or extra fees. They have a number of options and I'm showing the Single Life Annuity with 3% inflation and also a Transfer Payout Annuity that takes my principal and interest and just pays it out over 10 years, both starting at age 63. The payout rate of 9.45% makes it quite attractive.

And so we beat on, boats against the current, borne back ceaselessly into the past.0 -

I read somewhere that “annuity” means something totally different in the USA. Is this correct?Bostonerimus1 said:This is a bit academic, but I just got an annuity quote from an insurance company in the US that I've had funds with for many years. They were the default retirement administrator for my first job and my employer put in a percentage of my salary and the amount was quite small as I left after 3 years, but it has compounded over the years. Anyway, I get the annuity by just filling in an online form on the insurance company website so no intermediaries or extra fees. They have a number of options and I'm showing the Single Life Annuity with 3% inflation and also a Transfer Payout Annuity that takes my principal and interest and just pays it out over 10 years, both starting at age 63. The payout rate of 9.45% makes it quite attractive. 0

0 -

I'm sure there are some differences in the Ts&Cs, but the general idea is the same..."a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future. You buy an annuity by making either a single payment or a series of payments". You bought what would be called a Single Premium Immediate Annuity (SPIA) in the US and that's what I was quoted on. Age, sex, death benefits etc will all change the quote. Because the money was placed in a "deferred annuity", compounding at about 5%, 35 years ago I think I get a preferential payout rate.FIREDreamer said:

I read somewhere that “annuity” means something totally different in the USA. Is this correct?Bostonerimus1 said:This is a bit academic, but I just got an annuity quote from an insurance company in the US that I've had funds with for many years. They were the default retirement administrator for my first job and my employer put in a percentage of my salary and the amount was quite small as I left after 3 years, but it has compounded over the years. Anyway, I get the annuity by just filling in an online form on the insurance company website so no intermediaries or extra fees. They have a number of options and I'm showing the Single Life Annuity with 3% inflation and also a Transfer Payout Annuity that takes my principal and interest and just pays it out over 10 years, both starting at age 63. The payout rate of 9.45% makes it quite attractive. And so we beat on, boats against the current, borne back ceaselessly into the past.1

And so we beat on, boats against the current, borne back ceaselessly into the past.1 -

I'm generally against annuities for anything other than providing a bare minimum of income you need to survive as they are expensive and will probably reduce the amount you can leave to heirs. They do offer longevity insurance and the certainty of a lifetime cheque and with rates higher than they have been for a while people will start to consider them again, but make sure you understand the fees and costs and I'd keep most of your money liquid in stocks, bonds, cash etc and do drawdown for it's low cost, flexibility, potential investment returns and to pass money onto children and charities etc.FIREDreamer said:

The computer rate off the website was something like £24,100 which I was happy with. It took ages for the funds to go to Just as it kept bouncing back (return date matched the send date so no interest lost) as Hargreaves got the reference number wrong twice. When it did go through I found that the annuity had gone up a bit so I was happy with that.dunstonh said:Using an IFA might have taken longer and mean that my annuity would have been lower due to rates going down.Although, it may have been higher? Did you get the computer rate or did HL ring Just to get the uplifted rate?

As rates have come down since then I think the timing was good and if I had gone with an IFA it could have taken longer and the rate might more likely to been lower as a result.

I was able to answer health questions on the web site but whilst it did impact all the other providers it made no difference with Just (same rate with or without health questions - i have a login with health declaration and another without to do a comparison) who were higher anyway.

I might use an IFA if I buy an annuity with the rest of the pot in the future though. Annuity rates might have stabilised by then and we would also be older.And so we beat on, boats against the current, borne back ceaselessly into the past.0 -

I used approx 70% of my drawdown pot to buy an annuity. This leaves £300k in drawdown plus another maybe £50k to crystallise once I retire in June.Bostonerimus1 said:

I'm generally against annuities for anything other than providing a bare minimum of income you need to survive as they are expensive and will probably reduce the amount you can leave to heirs. They do offer longevity insurance and the certainty of a lifetime cheque and with rates higher than they have been for a while people will start to consider them again, but make sure you understand the fees and costs and I'd keep most of your money liquid in stocks, bonds, cash etc and do drawdown for it's low cost, flexibility, potential investment returns and to pass money onto children and charities etc.FIREDreamer said:

The computer rate off the website was something like £24,100 which I was happy with. It took ages for the funds to go to Just as it kept bouncing back (return date matched the send date so no interest lost) as Hargreaves got the reference number wrong twice. When it did go through I found that the annuity had gone up a bit so I was happy with that.dunstonh said:Using an IFA might have taken longer and mean that my annuity would have been lower due to rates going down.Although, it may have been higher? Did you get the computer rate or did HL ring Just to get the uplifted rate?

As rates have come down since then I think the timing was good and if I had gone with an IFA it could have taken longer and the rate might more likely to been lower as a result.

I was able to answer health questions on the web site but whilst it did impact all the other providers it made no difference with Just (same rate with or without health questions - i have a login with health declaration and another without to do a comparison) who were higher anyway.

I might use an IFA if I buy an annuity with the rest of the pot in the future though. Annuity rates might have stabilised by then and we would also be older.

Also have over £600k in an ISA fully invested in a portfolio of investment trusts yielding over 4%. The dividends plus £20k subscriptions are just reinvested. I might tidy this up this year and just go for global trackers like HMWO / VWRL for simplicity.

That’s enough in investments so I was happy to take an annuity.

I got a rate of about 3.8% joint life RPI with a 10 year guarantee for ages 59/58.

That purchase money (the post crystallisation gain anyway) has also been removed from any potential LTA charge should that be reintroduced in the future.

My wife isn’t going to be interested in investments so again the “needs and requirements” are covered. The drawdown can go to luxuries. Unless the tax thresholds move soon, the annuity plus db plus state pension will use up my basic rate tax and I will not drawdown at 40% tax! That can be inherited.0 -

You've made choices applicable to your circumstances. I think the hostility to annuities comes from a purely financial return perspective and with the attitude that markets will always deliver robust returns. The "absolutely never" folks don't consider the psychology or personal circumstances of many retirees. Of course annuities also rely on market returns, but the buyer is insulated from market fluctuations by their policy. I'm a big advocate for diversity in income generation and how much annuity/DB/SP vs drawdown is a very personal decision, but my inclination is to cover essentials with guaranteed income and as I'm single I don't need to consider a spouse which is a big factor.FIREDreamer said:

I used approx 70% of my drawdown pot to buy an annuity. This leaves £300k in drawdown plus another maybe £50k to crystallise once I retire in June.Bostonerimus1 said:

I'm generally against annuities for anything other than providing a bare minimum of income you need to survive as they are expensive and will probably reduce the amount you can leave to heirs. They do offer longevity insurance and the certainty of a lifetime cheque and with rates higher than they have been for a while people will start to consider them again, but make sure you understand the fees and costs and I'd keep most of your money liquid in stocks, bonds, cash etc and do drawdown for it's low cost, flexibility, potential investment returns and to pass money onto children and charities etc.FIREDreamer said:

The computer rate off the website was something like £24,100 which I was happy with. It took ages for the funds to go to Just as it kept bouncing back (return date matched the send date so no interest lost) as Hargreaves got the reference number wrong twice. When it did go through I found that the annuity had gone up a bit so I was happy with that.dunstonh said:Using an IFA might have taken longer and mean that my annuity would have been lower due to rates going down.Although, it may have been higher? Did you get the computer rate or did HL ring Just to get the uplifted rate?

As rates have come down since then I think the timing was good and if I had gone with an IFA it could have taken longer and the rate might more likely to been lower as a result.

I was able to answer health questions on the web site but whilst it did impact all the other providers it made no difference with Just (same rate with or without health questions - i have a login with health declaration and another without to do a comparison) who were higher anyway.

I might use an IFA if I buy an annuity with the rest of the pot in the future though. Annuity rates might have stabilised by then and we would also be older.

Also have over £600k in an ISA fully invested in a portfolio of investment trusts yielding over 4%. The dividends plus £20k subscriptions are just reinvested. I might tidy this up this year and just go for global trackers like HMWO / VWRL for simplicity.

That’s enough in investments so I was happy to take an annuity.

I got a rate of about 3.8% joint life RPI with a 10 year guarantee for ages 59/58.

That purchase money (the post crystallisation gain anyway) has also been removed from any potential LTA charge should that be reintroduced in the future.

My wife isn’t going to be interested in investments so again the “needs and requirements” are covered. The drawdown can go to luxuries. Unless the tax thresholds move soon, the annuity plus db plus state pension will use up my basic rate tax and I will not drawdown at 40% tax! That can be inherited.And so we beat on, boats against the current, borne back ceaselessly into the past.0 -

I had to buy an annuity because if I just relied on drawdown plus 2 db then I would have been stuck in one more year syndrome and being to afraid to retire. Buying the annuity has given me the confidence to hand in my notice and retire in June. That, to me, is priceless. 😀Bostonerimus1 said:

You've made choices applicable to your circumstances. I think the hostility to annuities comes from a purely financial return perspective and with the attitude that markets will always deliver robust returns. The "absolutely never" folks don't consider the psychology or personal circumstances of many retirees. Of course annuities also rely on market returns, but the buyer is insulated from market fluctuations by their policy. I'm a big advocate for diversity in income generation and how much annuity/DB/SP vs drawdown is a very personal decision, but my inclination is to cover essentials with guaranteed income and as I'm single I don't need to consider a spouse which is a big factor.FIREDreamer said:

I used approx 70% of my drawdown pot to buy an annuity. This leaves £300k in drawdown plus another maybe £50k to crystallise once I retire in June.Bostonerimus1 said:

I'm generally against annuities for anything other than providing a bare minimum of income you need to survive as they are expensive and will probably reduce the amount you can leave to heirs. They do offer longevity insurance and the certainty of a lifetime cheque and with rates higher than they have been for a while people will start to consider them again, but make sure you understand the fees and costs and I'd keep most of your money liquid in stocks, bonds, cash etc and do drawdown for it's low cost, flexibility, potential investment returns and to pass money onto children and charities etc.FIREDreamer said:

The computer rate off the website was something like £24,100 which I was happy with. It took ages for the funds to go to Just as it kept bouncing back (return date matched the send date so no interest lost) as Hargreaves got the reference number wrong twice. When it did go through I found that the annuity had gone up a bit so I was happy with that.dunstonh said:Using an IFA might have taken longer and mean that my annuity would have been lower due to rates going down.Although, it may have been higher? Did you get the computer rate or did HL ring Just to get the uplifted rate?

As rates have come down since then I think the timing was good and if I had gone with an IFA it could have taken longer and the rate might more likely to been lower as a result.

I was able to answer health questions on the web site but whilst it did impact all the other providers it made no difference with Just (same rate with or without health questions - i have a login with health declaration and another without to do a comparison) who were higher anyway.

I might use an IFA if I buy an annuity with the rest of the pot in the future though. Annuity rates might have stabilised by then and we would also be older.

Also have over £600k in an ISA fully invested in a portfolio of investment trusts yielding over 4%. The dividends plus £20k subscriptions are just reinvested. I might tidy this up this year and just go for global trackers like HMWO / VWRL for simplicity.

That’s enough in investments so I was happy to take an annuity.

I got a rate of about 3.8% joint life RPI with a 10 year guarantee for ages 59/58.

That purchase money (the post crystallisation gain anyway) has also been removed from any potential LTA charge should that be reintroduced in the future.

My wife isn’t going to be interested in investments so again the “needs and requirements” are covered. The drawdown can go to luxuries. Unless the tax thresholds move soon, the annuity plus db plus state pension will use up my basic rate tax and I will not drawdown at 40% tax! That can be inherited.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards