We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Same debt on Credit Report

jackjones01

Posts: 554 Forumite

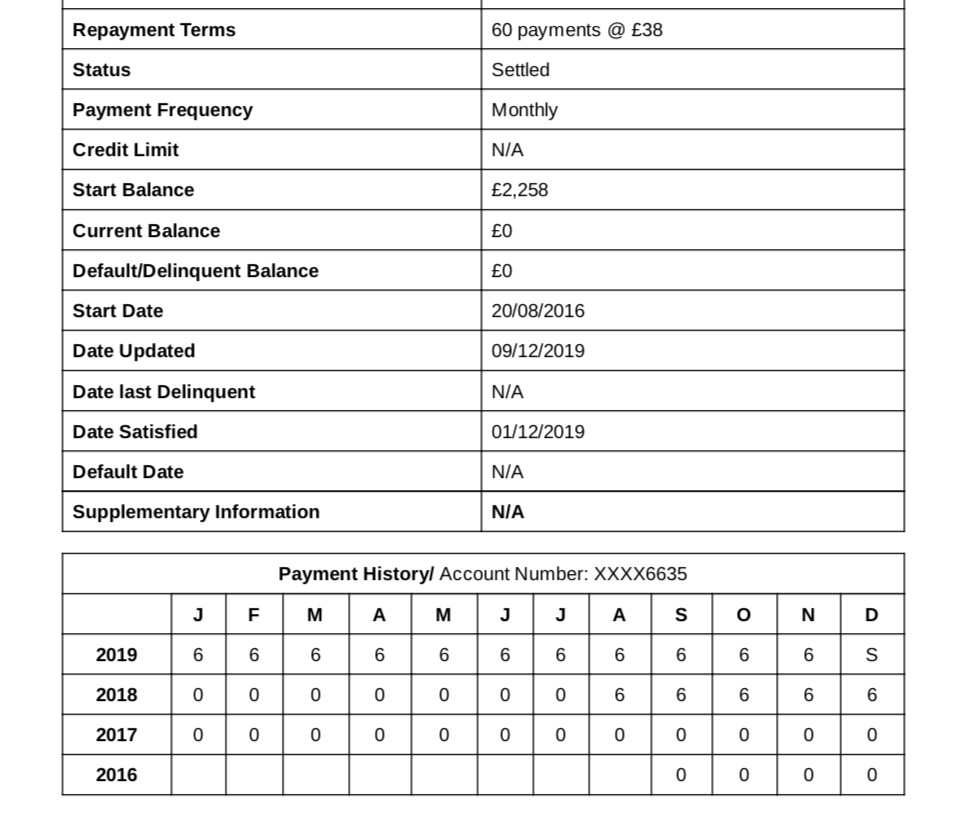

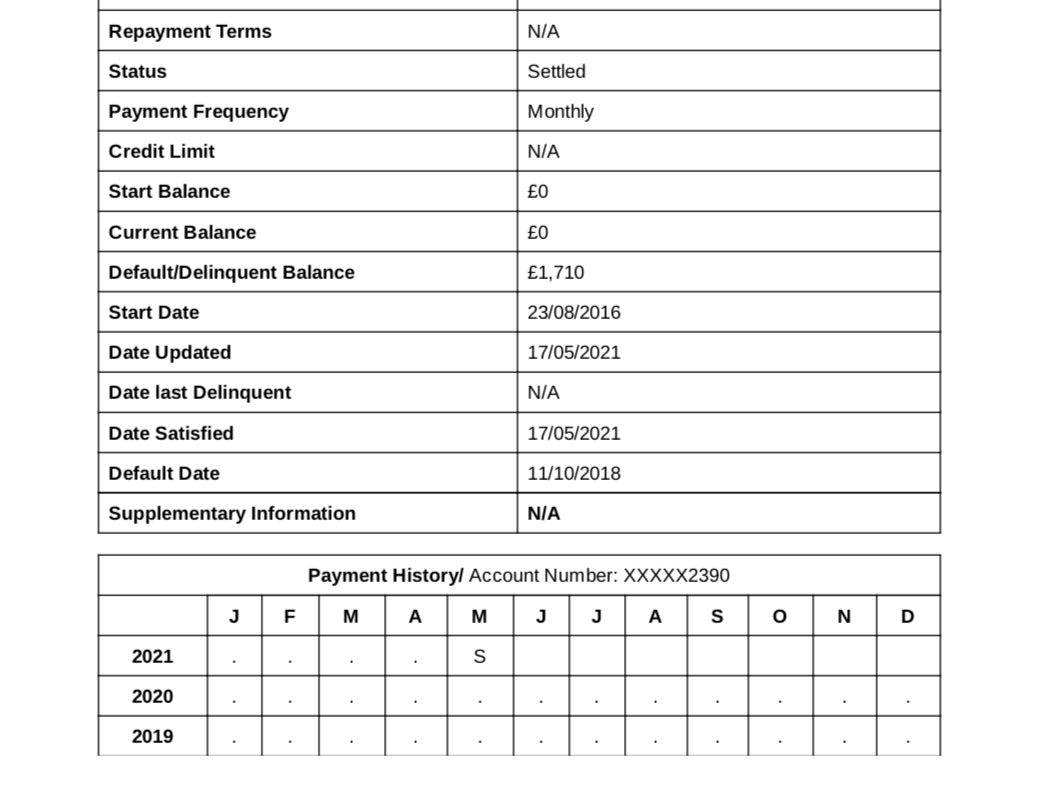

I defaulted on a loan in 2018 however the debt is showing on my credit report twice once with the actual lender and then again with the DCA is this right or should it only show once. In addition the original entry is not showing as defaulted it just says it’s closed.

0

Comments

-

Your debt has been sold, and your file shows entries from the original and the new owner.

Original entry should show the date of default and a zero balance.

New owner entry should show same date of default and the outstanding balance.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter1 -

Yes that's quite common.

So say you owe £100 to Vodafone but never paid it. Eventually they will close their file and sell the debt along to a debt collection agency for a fraction of the price. The DCA will then log that you owe them the full £100 and try to collect.

Some reports will have it showing that £100 is owed to both but anyone reading it will know that Vodafone is no longer interested but rather is just the source. Other times the original creditor will have registered that the debt went from £100 to zero with the £100 showing up on the DCA at about the same time or perhaps a month later.I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇🏅🏅🏅1 -

sourcrates said:Your debt has been sold, and your file shows entries from the original and the new owner.

Original entry should show the date of default and a zero balance.

New owner entry should show same date of default and the outstanding balance.This is how they both show on my Equifax report - I have only ever had one loan and the info don’t seem to tally the original debt don’t show as being defaulted.

0

0 -

Yes - precisely as expected.

The loan for £2258 shows as having defaulted in 2018 and settled in 2019 (so balance became zero) when it was passed to the DCA.

The second bit shows the default amount of £1710 in 2018 with the DCA which presumably you paid off so that it was marked as settled in May 2021 with a zero balance.

I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇🏅🏅🏅1 -

Great thanks - should I be concerned the original lender does not have a default date on the entry,Brie said:Yes - precisely as expected.

The loan for £2258 shows as having defaulted in 2018 and settled in 2019 (so balance became zero) when it was passed to the DCA.

The second bit shows the default amount of £1710 in 2018 with the DCA which presumably you paid off so that it was marked as settled in May 2021 with a zero balance.0 -

No, the whole lot will drop off your credit file on the 6th anniversary of the default date next year.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards