We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Hargreaves Pension Cashback

Law_man

Posts: 9 Forumite

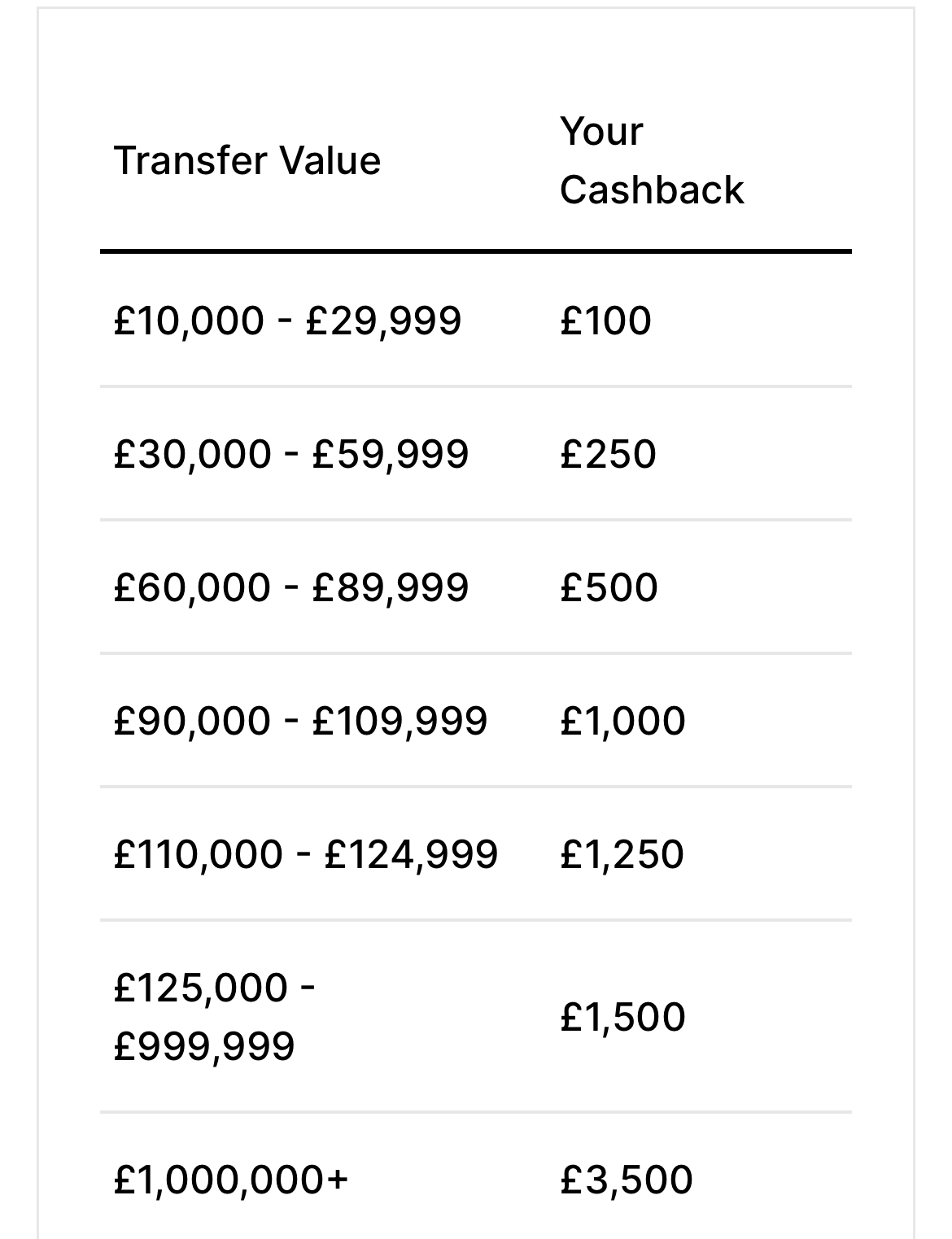

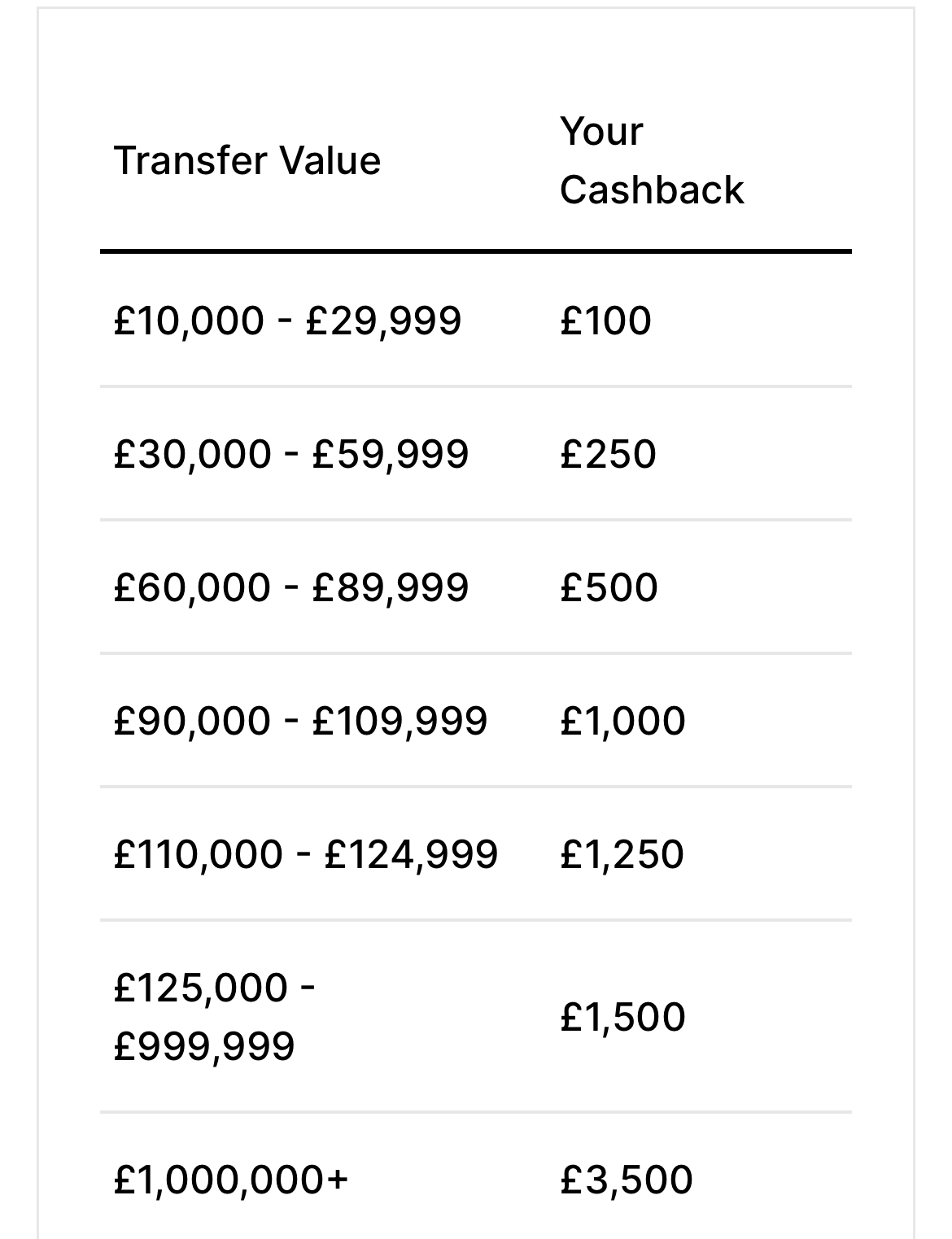

HL currently offering a cashback incentive to move my SIPP.

Does anyone have any advice on whether it is worthwhile moving to HL.

We have three SIPPs each worth over £125K. So it’s potentially worth £4500.

https://www.hl.co.uk/features/cashback

Does anyone have any advice on whether it is worthwhile moving to HL.

We have three SIPPs each worth over £125K. So it’s potentially worth £4500.

https://www.hl.co.uk/features/cashback

0

Comments

-

I've been with HL for a couple of years now, using their app and managing my investments is easy IMHO. When I've needed to seek advice the phone is picked up quickly and the staff knowledgeable.

You'll need to choose which funds to invest in but each has a detailed report on it, including performance data over several years and what the fees are. You can choose a portfolio they've chosen based on risk profile or choose your own which tends to be cheaper in terms of fees.

I'm guessing the cashback offer is paid into your SIPPs and not paid back as cash to your bank account, either way it's a pretty good incentive if you're looking for a new home for your investments.0 -

It's not £1,500 for each pension if you transfer them all together - they would use the total of the transfers which if they are £125k each would be £375k so within the same band.

I have got around this by transferring separately during different offers. I did one a year ago to get £1,500 and one just a couple of weeks ago in the new promotion to gain another £500 (was a much smaller pension).

However the investments I made with the first transfer increased 10% while the other pension (where I had no say in the investments) languished at around 2% in the same time period so in pure cash terms I should have transferred both together! But that is a risk I took.

You can in fact withdraw the money into your bank account and it isn't treated as pension money so is untaxed.0 -

I have SIPPs with both HL and AJB and I far prefer the interface of AJB. I like the daily variance column which instantly shows the daily movement. For someone like me, who holds a lot of individual shares, this is important.

I have just made the decision to transfer away from HL due to their higher fees. I'm just trying to decide whether to do it as a cash transfer or have the funds moved over.

Thant having been said, if you can get £4,500 across 3 accounts, that's not to be sniffed at and might be worth doing, but do check what it's going to cost you in ongoing fees0 -

The only real issue is that the platform fee with HL is one of the highest at 0.45%.

It drops to 0.25% if you have £250K on the platform ( but only for funds above £250K)

If you hold shares /investment trusts/ETF's as opposed to OEIC funds, there is a cap on the platform fee.

Many platforms offer cashback for transfers, but this HL one ( and the one before this one) are particularly high, and you can transfer out again 12 months later if you want.

They must be pretty desperate to increase market share !

I'm guessing the cashback offer is paid into your SIPPs and not paid back as cash to your bank account, either way it's a pretty good incentive if you're looking for a new home for your investments.

It is paid into a separate bonus account.0 -

I’ve been with HL for years and never had any major issues. The website and app do what they are supposed to do and on the rare occasion I’ve had to contact them, they have usually responded the same day or the next day at the latest.

yes their platform fee is higher than some others but I find their charging structure easy to understand, unlike other firms where they charge for regular contributions or charge for changing funds, all of which can increase the cost without you realising it.1 -

With HL it depends whether you want to use stocks and shares (including investment trusts and ETFs) or want to use funds. With funds the charges are 0.45% which is high. With stocks the charges are limited to £200, which is low for a reasonable sum.Their portfolio display is easily adjustable to include a daily gain-loss column (value and/or percentage).0

-

Yep I'll be doing this again (made £1500 from their last promotion), plus an ISA as well this time. In fact Mrs Arty will be doing the same, together that will make us £5k, which in the scheme of things is very easy money.It will all be held in ETFs to keep the fees down...

Fair to say I'm becoming a bit of an old pro at this game 1

1 -

When do you get the cash back credit?0

-

You can change the columns to show daily change. Although shame it doesn’t show yearly increase like fidelity does.Roger175 said:I have SIPPs with both HL and AJB and I far prefer the interface of AJB. I like the daily variance column which instantly shows the daily movement. For someone like me, who holds a lot of individual shares, this is important.

I have just made the decision to transfer away from HL due to their higher fees. I'm just trying to decide whether to do it as a cash transfer or have the funds moved over.

Thant having been said, if you can get £4,500 across 3 accounts, that's not to be sniffed at and might be worth doing, but do check what it's going to cost you in ongoing fees

My experience is that the platform works well and has low fees when using etf’s. moved from fidelity but don’t have experience of many other platforms though. Good luck1 -

Thanks Nightowl - didn't realise you could do that!NlghtOwl said:

You can change the columns to show daily change. Although shame it doesn’t show yearly increase like fidelity does.Roger175 said:I have SIPPs with both HL and AJB and I far prefer the interface of AJB. I like the daily variance column which instantly shows the daily movement. For someone like me, who holds a lot of individual shares, this is important.

I have just made the decision to transfer away from HL due to their higher fees. I'm just trying to decide whether to do it as a cash transfer or have the funds moved over.

Thant having been said, if you can get £4,500 across 3 accounts, that's not to be sniffed at and might be worth doing, but do check what it's going to cost you in ongoing fees

My experience is that the platform works well and has low fees when using etf’s. moved from fidelity but don’t have experience of many other platforms though. Good luck0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.6K Banking & Borrowing

- 253.4K Reduce Debt & Boost Income

- 454K Spending & Discounts

- 244.6K Work, Benefits & Business

- 600K Mortgages, Homes & Bills

- 177.3K Life & Family

- 258.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards