We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Metro Bank Misleading Customers ( maybe breaching advertising standards )

Comments

-

I don't think twenty four extra words that sum up THE BIG QUESTION IN PLAIN ENGLISH is going to destroy the rainforests. AmityNeon gets lots of thumbs up from me.k12479 said:

Better transparency needs to be balanced against too much information, otherwise the so-called small print gets longer and longer and people don't read it, whining "There's too much small print! Everything's hidden in the small print!".AmityNeon said:It’s an imperfect system; there is nothing wrong with desiring better transparency. Even a single line would be sufficient: “As this account only allows interest to be paid to an external account, monthly interest will result in lower total interest from this account.” This explicit statement would likely invite further query from anyone who didn’t fully understand its meaning, before they decide to apply.1 -

I realise that your mind is made up and you're convinced that something inappropriate is a foot. I agree however, that branch staff really should know better.

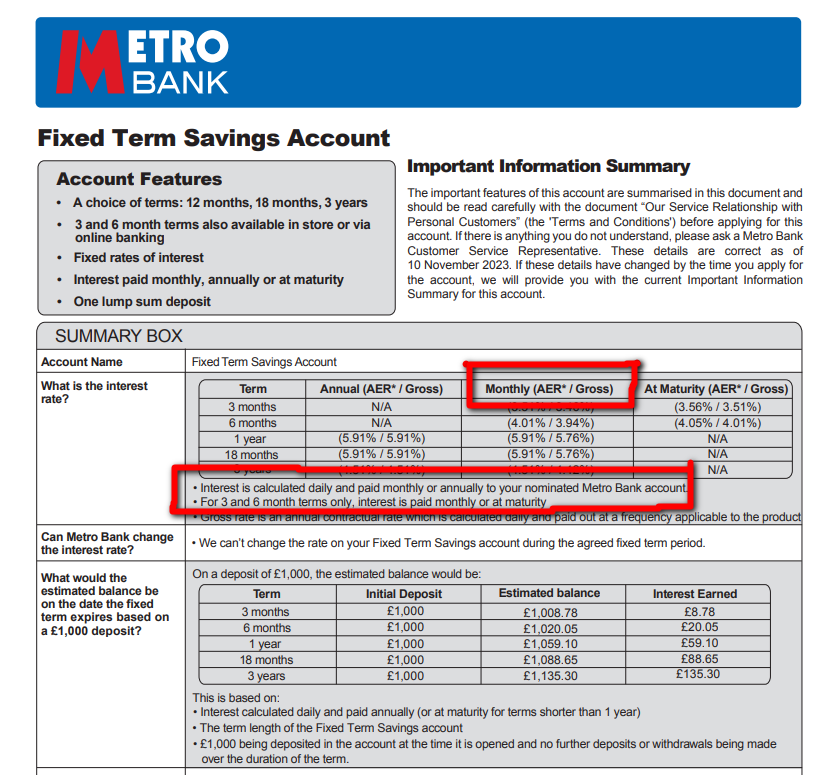

As mentioned more than once - is this the 'account flyer' you have - as this is the Metro 'Important Information Summary' document and it both has as asterisk adjacent to AER with an explanation lower down (which you've never included in your posts about the interest rate) and the fact that interest is paid into a nominated account also features clearly. It also explains that the expected interest is only earned if paid annually, thus:

This how the AER and interest is explained on their web page in respect of the asterisk - which seems pretty clear and isn't even in small print, it's the same size text as the rest of the page content:*AER stands for annual equivalent rate. It shows what the interest rate would be if interest was paid and compounded once each year.

Gross rate is an annual contractual rate which is calculated daily and paid out at a frequency applicable to the product.

AER and gross rate for annual interest is the same as interest is compounded annually. The monthly AER and gross rate is different, as interest is paid away and the gross rate does not take into account compounding. When comparing different savings accounts, use the same rate for each. E.g. compare AER with AER, and gross rate with gross rate.

1 -

That's not a flyer I have

Go to Merto Banks homepageMake sure "Personal" is underlined red at the top left.Hover mouse over "Savings" just underneath and a big white box opensIn the white box click "Fixed Term Savings"Scroll the next page down a bit to a graphic of a moneybag on the right.Look to the left of that moneybag - there is a link to download a PDF of "Fixed Term Account Details"Look at that flyer - it has one single worked example of "what you could earn in interest if you invested £1000" in the 1 year fixed term saver. It adds on the AER of 5.91% so it says you would have made £59.10It makes no mention that you would make less interest with the pay-way monthly interest.The only clue is the difference in Gross % in the section it states Gross and AER for both versions of the acct:monthly interest = Gross 5.76% / AER 5.91%yearly interest = Gross 5.91% / AER 5.91%In my newbieness of thinking AER was the be all and end all of how to work out how much interest an account gives you I assumed the accounts paid the same interest ( i.e. the 12 monthly instalments would add up to the one yearly instalment )I saw two versions of the account with the same AER. And one worked interest example ( that would only actually work for the yearly paid interest account ) but assumed it worked for both.Is it any wonder I was confused ? I feel the flyer is being deceptive by omission myself and it should have AmityNeon's proposed sentence in it.1 -

I don't think the bank is "pulling a fast one" or someone is shafting me. What I think needs doing is Metro Bank just need to put better flyers and staff in place that say in plain English the yearly interest account will give you more than the "pay away" monthly one.

Not to just rely on putting:monthly interest = Gross 5.76% / AER 5.91%yearly interest = Gross 5.91% / AER 5.91%

On a flyer.

And hoping that all their customers can then just infer the rest from that.1 -

You'll see it's a theme about staff at banks not knowing key details.[Deleted User] said:

As I have said further up - the longer the conversation went on the more suspicious I got of how competent any of these people were. I mean - the branch manager couldn't explain it !auser99 said:

Have read all your posts and it seems you've been unlucky that you've seemingly had a supposed banking professional unable to give you the 1 line explanation of why things works like they do, that randoms on a forum can give you in seconds[Deleted User] said:It all hinges on the fact you think Joe Average reads ( and I stress READS ) on the account flyer:

monthly interest = 5.76% Gross / 5.91 AER

yearly interest = 5.91% Gross / 5.91% AER

I had a family member told that she had to declare interest herself to HMRC and that banks don't do it. Which isn't true on the latter part at all, and would only be true on the former if she was self assessing.

And another staff member was telling me they didn't offer a certain account, even though when I queried it and told him the name of it, he brought it up on his computer in seconds!

But a branch manager not knowing sounds ridiculous. Either you or he must have got the wrong end of the conversational stick.

But you've been told now, so you take your choice. And 0.15% is only £1.50 every £1,000 so not a huge gamechanger.0 -

I followed the instructions above and get to exactly the same document I posted a screen grab of above. It does illustrate that you'd receive £59.10 in interest on £1,000, but explains below the table that it's based on the interest being paid annually - you can see it above. I'm pretty sure that it will be a document you have to download and agree that you've read it as part of the account opening process. And I can't say that it's any different from others I've seen on my account opening travels. Whilst financial institutions have responsibilities to customers - customers also have to take responsibility for undertaking due diligence in ensuring that a product meets their needs.[Deleted User] said:That's not a flyer I have

Go to Merto Banks homepageMake sure "Personal" is underlined red at the top left.Hover mouse over "Savings" just underneath and a big white box opensIn the white box click "Fixed Term Savings"Scroll the next page down a bit to a graphic of a moneybag on the right.Look to the left of that moneybag - there is a link to download a PDF of "Fixed Term Account Details"Look at that flyer - it has one single worked example of "what you could earn in interest if you invested £1000" in the 1 year fixed term saver. It adds on the AER of 5.91% so it says you would have made £59.10It makes no mention that you would make less interest with the pay-way monthly interest.The only clue is the difference in Gross % in the section it states Gross and AER for both versions of the acct:monthly interest = Gross 5.76% / AER 5.91%yearly interest = Gross 5.91% / AER 5.91%In my newbieness of thinking AER was the be all and end all of how to work out how much interest an account gives you I assumed the accounts paid the same interest ( i.e. the 12 monthly instalments would add up to the one yearly instalment )I saw two versions of the account with the same AER. And one worked interest example ( that would only actually work for the yearly paid interest account ) but assumed it worked for both.Is it any wonder I was confused ? I feel the flyer is being deceptive by omission myself and it should have AmityNeon's proposed sentence in it.

I'm sorry that you've had an unsatisfactory experience with this. If in future you don't understand a product details, ask here and someone will be happy to explain it to you before you commit. People here are very knowledgeable and willing to assist.0 -

I certainly do understand now. AER is not the be all and end all - and watch out where the interest is being paid into !

As to the wrong conversational stick it literally was me asking "How can both accounts have the same AER if the grosses are different and the lower gross isn't being compounded ?"

Neither the teller nor manager could answer and both went off to make a huddled phone call. They told me someone in central offices would call and answer my question. I'm still waiting...1 -

EthicsGradient said:Metro has exactly the same choices as Atom, for a 1 year fixed rate account (not "only allows interest to be paid away").

Are you sure about that? That's obviously not the impression @[Deleted User] had when they opened the account in branch:

[Deleted User] said:

Instead Metro Bank pay the monthly interest amounts into either your Metro Current Account, if you have one, or they open an Instant Access Saver Account of rate 2.22 AER to pay them into.

...

He was going to sell me the monthly "pay away" account and I brought up the fact the flyer said the interest will go into a different account.As already shown via screenshot earlier in the thread, the Important Information Summary for Metro's Fixed Term Savings accounts states the following with regards to the payment of interest:

Interest is calculated daily and paid monthly or annually to your nominated Metro Bank account.

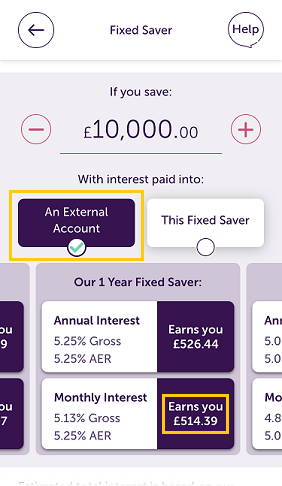

EthicsGradient said:Both allow you to choose either interest at the end of the year, or monthly interest. Both show this as Gross and AER figures - Atom is currently "Annual interest: Gross 5.25%, AER 5.25% ; Monthly interest: Gross 5.13%, AER 5.25%".Fixed Saver Accounts - Fixed Rate Savings | Atom bank

Now, oddly, Atom's website does not "clearly show a lower total estimated interest figure (despite the unchanging AER)".I browsed their product offerings in-app (as they're an app-only bank), and this is the result:

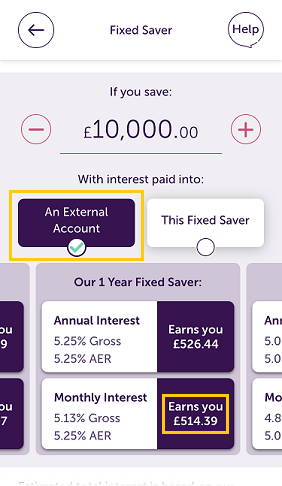

EthicsGradient said:They put an "earns you around" figure next to each option, but they strangely say, for a £10,000 deposit, "£526.44" for the annual interest, and "£526.71" for the monthly interest. So they have somehow calculated that they'll give you more money if you take the interest out earlier! Their footnote does not explain how this happened, and I would contend that, on the face of it, it's Atom who are being confusing, and potentially misleading.

EthicsGradient said:They put an "earns you around" figure next to each option, but they strangely say, for a £10,000 deposit, "£526.44" for the annual interest, and "£526.71" for the monthly interest. So they have somehow calculated that they'll give you more money if you take the interest out earlier! Their footnote does not explain how this happened, and I would contend that, on the face of it, it's Atom who are being confusing, and potentially misleading.£526.71 is only shown when choosing for interest to be paid into "This Fixed Saver" and the illustrated figures dynamically change to reflect accordingly.

EthicsGradient said:The difference between what you might expect of £525 interest over a year from £10,000 in a 5.25% AER yearly interest account can be explained by Feb 2024's leap day - 1.0525 ^ (366/365) = 1.052648, so we can get within a few pence.Atom adds an extra day (1/365) of interest: 0.0525 * (366/365) = 0.0526438, rounded to 5.2644% exactly.

EthicsGradient said:How the monthly interest figure is £526.71, I can't tell.366 days of (1/365) interest in conjunction with monthly rounding:

Month Days Balance 5.13% Nov-23 30 £10,000.00 £42.16 Dec-23 31 £10,042.16 £43.75 Jan-24 31 £10,085.91 £43.94 Feb-24 29 £10,129.85 £41.29 Mar-24 31 £10,171.14 £44.32 Apr-24 30 £10,215.46 £43.07 May-24 31 £10,258.53 £44.70 Jun-24 30 £10,303.23 £43.44 Jul-24 31 £10,346.67 £45.08 Aug-24 31 £10,391.75 £45.28 Sep-24 30 £10,437.03 £44.01 Oct-24 31 £10,481.04 £45.67 £10,526.71I'm not saying Atom is perfect either (especially their website), just that Metro could be more transparent, that is all.

2 -

[Deleted User] said:

I don't think twenty four extra words that sum up THE BIG QUESTION IN PLAIN ENGLISH is going to destroy the rainforests. AmityNeon gets lots of thumbs up from me.k12479 said:

Better transparency needs to be balanced against too much information, otherwise the so-called small print gets longer and longer and people don't read it, whining "There's too much small print! Everything's hidden in the small print!".AmityNeon said:It’s an imperfect system; there is nothing wrong with desiring better transparency. Even a single line would be sufficient: “As this account only allows interest to be paid to an external account, monthly interest will result in lower total interest from this account.” This explicit statement would likely invite further query from anyone who didn’t fully understand its meaning, before they decide to apply.

But adding twenty four extra words clearly isn't going to be sufficient because you, and a chunk of the population, will still need a Metroman to waffle on further, so the document would need to be extended to cover all the basics. Would you like a definition of 'Account', of 'Interest' added? The flyer, or these Product Information sheets, tend to be 2 pages, more information for those that need it is available in general documents and websites. That branch staff are incompetent is another matter.[Deleted User] said:I say the majority of the population won't be able to work that out just from reading the flyer. Which is why I think Mertroman needs to say in spoken word: "YOU GET LESS INTEREST MONTHLY THAN IF YOU WAIT FOR THE YEARLY INTEREST"

and then, when the puzzled Joe Average says "...but...but...the AERs are the same ?" MetroMan can then waffle on about Gross rate, "paying away" interest, compounded interest, how AERs are calculated blah, blah, blah,

0 -

Yes, I am sure both types are offered by Metro; several times in what you've quoted in this one post alone we have "paid monthly or annually", or the equivalent words. groovyclam said this in the very first post of the thread; they've always known it.AmityNeon said:EthicsGradient said:Metro has exactly the same choices as Atom, for a 1 year fixed rate account (not "only allows interest to be paid away").Are you sure about that? That's obviously not the impression @[Deleted User] had when they opened the account in branch:

[Deleted User] said:

Instead Metro Bank pay the monthly interest amounts into either your Metro Current Account, if you have one, or they open an Instant Access Saver Account of rate 2.22 AER to pay them into.

...

He was going to sell me the monthly "pay away" account and I brought up the fact the flyer said the interest will go into a different account.As already shown via screenshot earlier in the thread, the Important Information Summary for Metro's Fixed Term Savings accounts states the following with regards to the payment of interest:

Interest is calculated daily and paid monthly or annually to your nominated Metro Bank account.

EthicsGradient said:Both allow you to choose either interest at the end of the year, or monthly interest. Both show this as Gross and AER figures - Atom is currently "Annual interest: Gross 5.25%, AER 5.25% ; Monthly interest: Gross 5.13%, AER 5.25%".Fixed Saver Accounts - Fixed Rate Savings | Atom bank

Now, oddly, Atom's website does not "clearly show a lower total estimated interest figure (despite the unchanging AER)".I browsed their product offerings in-app (as they're an app-only bank), and this is the result:

EthicsGradient said:They put an "earns you around" figure next to each option, but they strangely say, for a £10,000 deposit, "£526.44" for the annual interest, and "£526.71" for the monthly interest. So they have somehow calculated that they'll give you more money if you take the interest out earlier! Their footnote does not explain how this happened, and I would contend that, on the face of it, it's Atom who are being confusing, and potentially misleading.

EthicsGradient said:They put an "earns you around" figure next to each option, but they strangely say, for a £10,000 deposit, "£526.44" for the annual interest, and "£526.71" for the monthly interest. So they have somehow calculated that they'll give you more money if you take the interest out earlier! Their footnote does not explain how this happened, and I would contend that, on the face of it, it's Atom who are being confusing, and potentially misleading.£526.71 is only shown when choosing for interest to be paid into "This Fixed Saver" and the illustrated figures dynamically change to reflect accordingly.

EthicsGradient said:The difference between what you might expect of £525 interest over a year from £10,000 in a 5.25% AER yearly interest account can be explained by Feb 2024's leap day - 1.0525 ^ (366/365) = 1.052648, so we can get within a few pence.Atom adds an extra day (1/365) of interest: 0.0525 * (366/365) = 0.0526438, rounded to 5.2644% exactly.

EthicsGradient said:How the monthly interest figure is £526.71, I can't tell.366 days of (1/365) interest in conjunction with monthly rounding:

Month Days Balance 5.13% Nov-23 30 £10,000.00 £42.16 Dec-23 31 £10,042.16 £43.75 Jan-24 31 £10,085.91 £43.94 Feb-24 29 £10,129.85 £41.29 Mar-24 31 £10,171.14 £44.32 Apr-24 30 £10,215.46 £43.07 May-24 31 £10,258.53 £44.70 Jun-24 30 £10,303.23 £43.44 Jul-24 31 £10,346.67 £45.08 Aug-24 31 £10,391.75 £45.28 Sep-24 30 £10,437.03 £44.01 Oct-24 31 £10,481.04 £45.67 £10,526.71I'm not saying Atom is perfect either (especially their website), just that Metro could be more transparent, that is all.

"£526.71 is only shown when choosing for interest to be paid into "This Fixed Saver" and the illustrated figures dynamically change to reflect accordingly."

Well, the advertising/marketing is what you get before you install the app. Their web page says nothing about "asking for monthly interest, but then having the option to feed it back into the fixed term bond after all" - the page notes that after the initial 7 day funding period, you can't add anything more to the account. So the 2 options for the account, according to the web page, are "let the interest compound inside it for a year, and then get everything out", or "take the interest out each month". And they have misleadingly said the latter gets you more money, even if the app indicates that for the confusing option of "get monthly interest out, but automatically pay it back into the account which does does not allow you to pay more into".

There should anyway not be a way for interest to be "paid" and then fed back into the account and for it to end up as larger (even if only marginally) than if you'd just left it in the account. It's nonsense.

"Atom adds an extra day (1/365) of interest: 0.0525 * (366/365) = 0.0526438, rounded to 5.2644% exactly."

But that's the AER figure, for which the interest must be calculated with powers, not multiplication - that's the entire point of this thread. One day's interest is not "(1/365) of 0.0525".

" in conjunction with monthly rounding" - well, that's dubious.

It's not a question of whether Atom is perfect - they're misleading, and thus worse than Metro, who just lack the simple language some users demand.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards