We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

SIPP understanding tax

236dave

Posts: 50 Forumite

Hi,

Wondering if anyone can advise?

I am helping my wife invest into her SIPP, to take advantage of tax breaks as a low earner.

She is age 57 and opened the SIPP last January. She wants to make the most of this tax years investment.

My wife has an estimated total income of £6,393 via part time job and savings interest.

She was planning to put £3,360 net, plus the £840 tax top up (£4,200 gross) into her SIPP, which is equal to her part time job income (£4,200 / year).

I have attached her tax information, and have the following questions:

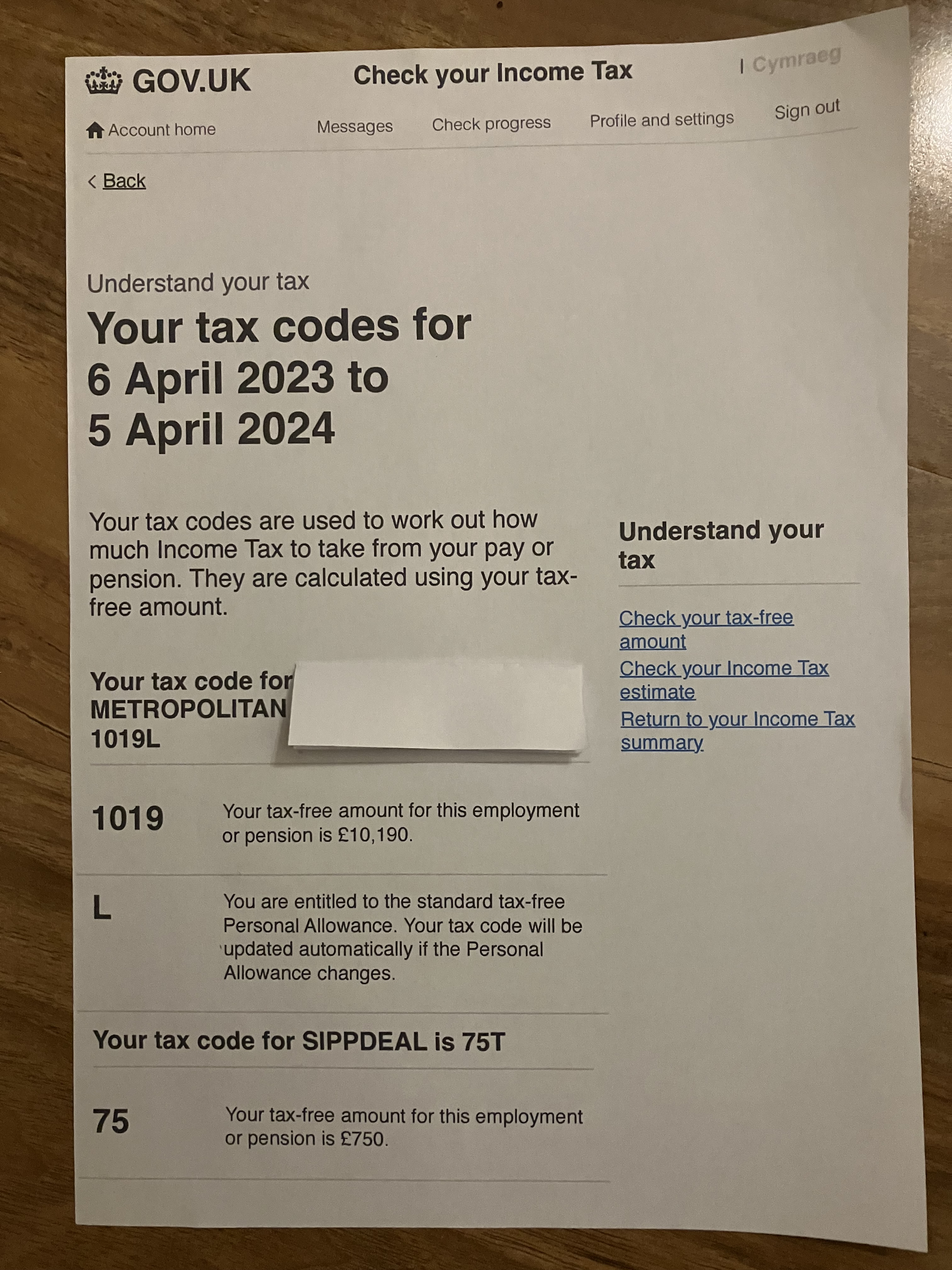

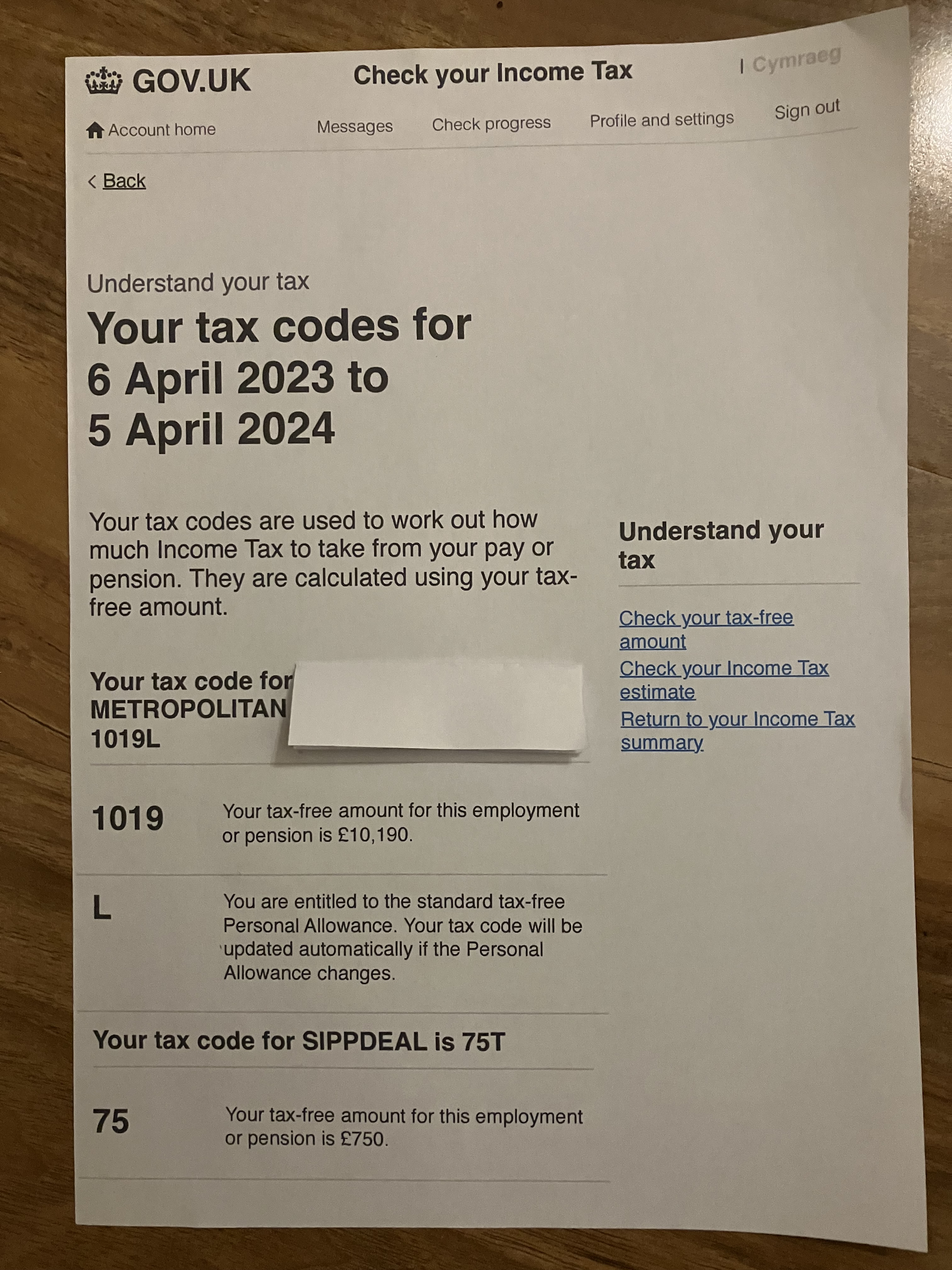

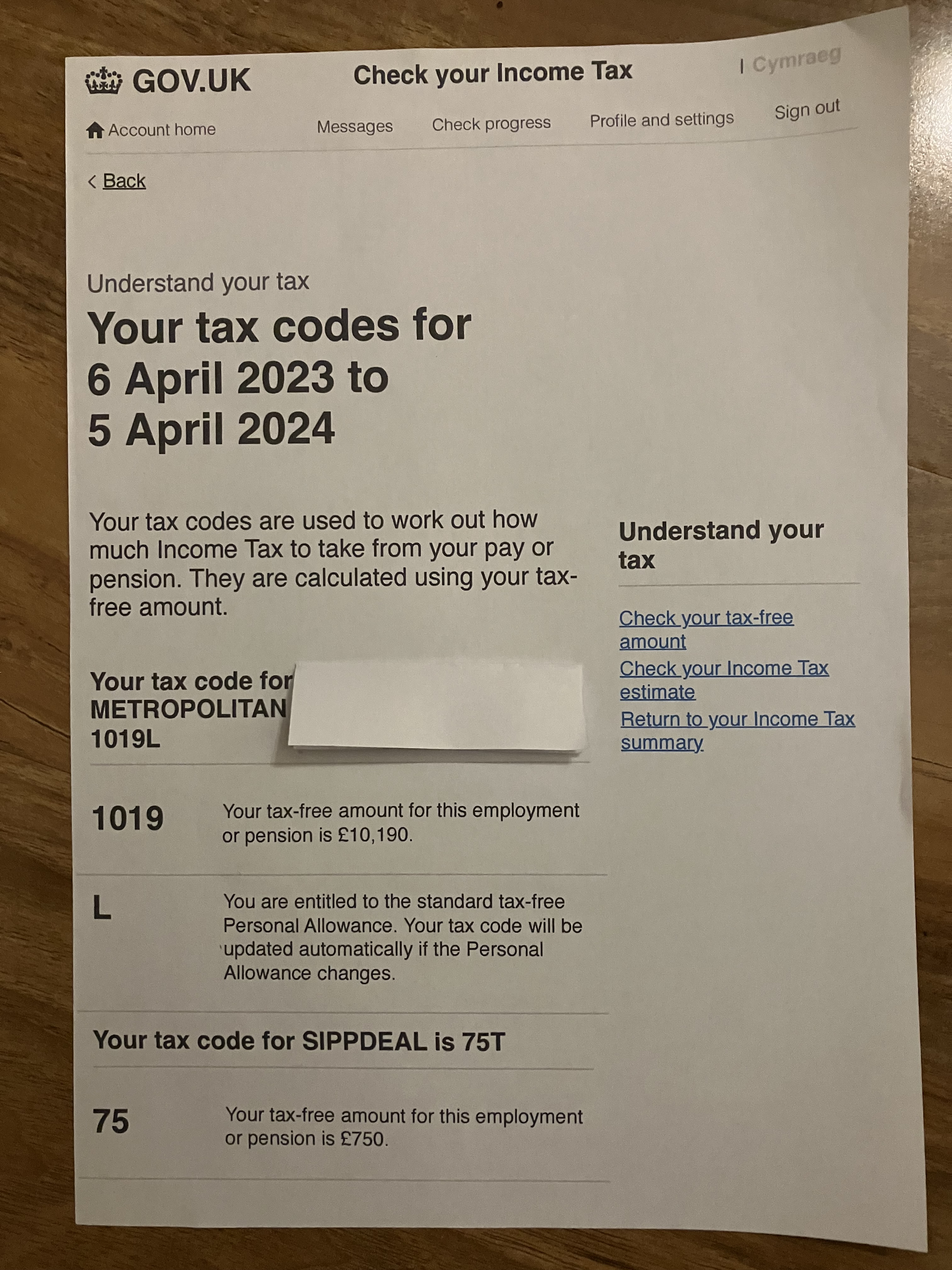

1. See attachments, she has a seperate tax code for the SIPP of 75T, why ?

Her other tax code is 1019L, and shows that she can earn a further £4,551 before being liable for tax.

2. Could she increase her SIPP investment further, ie to £6,000 gross (less than her £6,393 taxable income). or does it have to be within her part time job income of £4,200 ?

3. If she was allowed to put £6,000 into the SIPP, can this then be withdrawn without paying tax, ie, as £4,500 taxable income (within the £4,551 left on her tax threshold) + £1,500 tax free (25%) ?

Help and advice is much appreciated.

Thanks

Wondering if anyone can advise?

I am helping my wife invest into her SIPP, to take advantage of tax breaks as a low earner.

She is age 57 and opened the SIPP last January. She wants to make the most of this tax years investment.

My wife has an estimated total income of £6,393 via part time job and savings interest.

She was planning to put £3,360 net, plus the £840 tax top up (£4,200 gross) into her SIPP, which is equal to her part time job income (£4,200 / year).

I have attached her tax information, and have the following questions:

1. See attachments, she has a seperate tax code for the SIPP of 75T, why ?

Her other tax code is 1019L, and shows that she can earn a further £4,551 before being liable for tax.

2. Could she increase her SIPP investment further, ie to £6,000 gross (less than her £6,393 taxable income). or does it have to be within her part time job income of £4,200 ?

3. If she was allowed to put £6,000 into the SIPP, can this then be withdrawn without paying tax, ie, as £4,500 taxable income (within the £4,551 left on her tax threshold) + £1,500 tax free (25%) ?

Help and advice is much appreciated.

Thanks

0

Comments

-

She can only add the £4200 gross.Interest from savings isn’t ‘earnings’ when it comes to pension contributions.1

-

1) Each income stream has its own tax code which should add up to het total tax allowance.The SIPP tax code has been set at the minimum such that she does not pay any tax on £750/year income from the SIPP. This will mean that all tax is taken out of her employment income. Why they decided she would take £750 taxable income from her SIPP I dont know, perhaps based on the previous tax year.236dave said:Hi,

Wondering if anyone can advise?

I am helping my wife invest into her SIPP, to take advantage of tax breaks as a low earner.

She is age 57 and opened the SIPP last January. She wants to make the most of this tax years investment.

My wife has an estimated total income of £6,393 via part time job and savings interest.

She was planning to put £3,360 net, plus the £840 tax top up (£4,200 gross) into her SIPP, which is equal to her part time job income (£4,200 / year).

I have attached her tax information, and have the following questions:

1. See attachments, she has a seperate tax code for the SIPP of 75T, why ?

Her other tax code is 1019L, and shows that she can earn a further £4,551 before being liable for tax.

2. Could she increase her SIPP investment further, ie to £6,000 gross (less than her £6,393 taxable income). or does it have to be within her part time job income of £4,200 ?

3. If she was allowed to put £6,000 into the SIPP, can this then be withdrawn without paying tax, ie, as £4,500 taxable income (within the £4,551 left on her tax threshold) + £1,500 tax free (25%) ?

Help and advice is much appreciated.

Thanks

2) Pension contributons can only be made against earned income, in your wife's case £4200. Savings interest is not "earned" income.

3) She cannot pay £6K into her pension because of (2) but if she cound it could be taken as £1500 tax free and the rest covered by her tax alllowance.

1 -

I would be a little surprised if the op's wife hadn't triggered MPAA.

To have a tax code for the SIPP indicates a taxable payment has been taken.

Although now that MPAA has been increased to £10k it isn't going to cause any problems for the ops wife. Unless her earnings increase significantly.2 -

-

Remember that tax codes are only basically an attempt to collect the right amount of tax from a person.

After the tax year ends then a calculation is made to see if you have in the end paid the correct amount of tax or not.

So even if a tax code is wrong, and you pay too much or too little tax, it all comes out in the wash later.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards