We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Who is liable to pay underpaid tax?

Options

Kashdown

Posts: 8 Forumite

in Cutting tax

Hi!

When I started with an ex-employer, I was on emergency tax for a few months. Once I had this discussion with accounts, they paid me the extra amount I should have been paid. Now HMRC are asking me to pay back the £1500 in underpaid tax. Do I need to pay this or is it my ex-employers fault?

Many thanks

0

Comments

-

You need to pay it back, assuming the calculation is accurate.1

-

Thank you. The other issue I have is I’m on maternity leave and don’t have an income. I can’t afford it

Having a bit of a panic! 0

Having a bit of a panic! 0 -

Contact HMRC then and come to a payment plan with them.

Your story is confusing tbh, AFAIK if you are emergency taxed and then the correct code is finally sorted out, payroll systems should sort everything out cumulatively throughout the year.

How did they pay you this extra amount?1 -

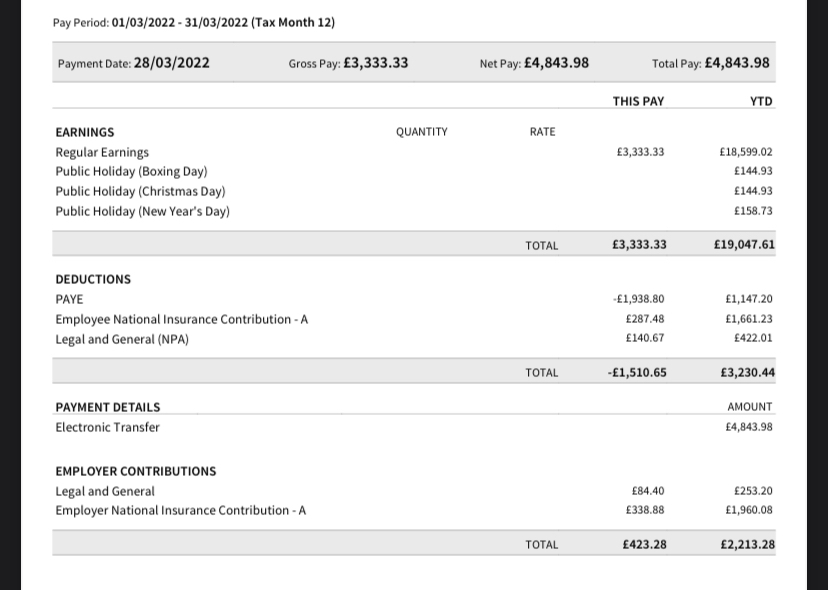

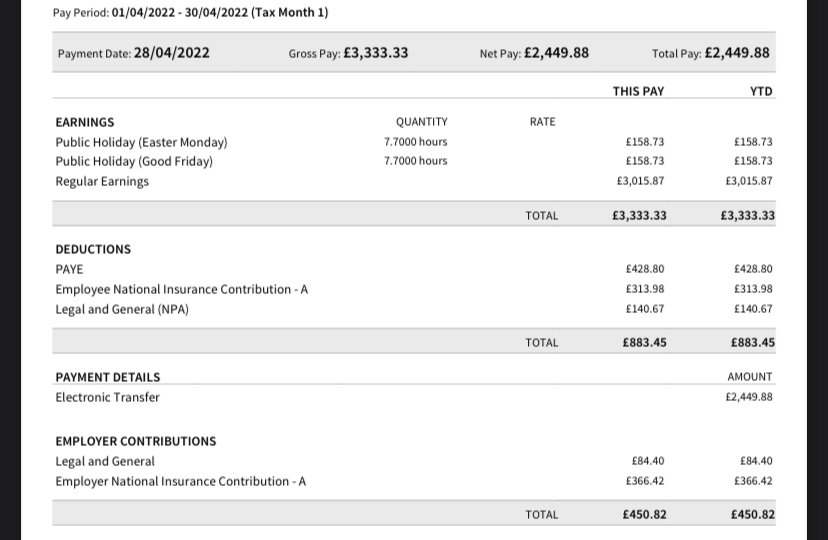

I must admit, I’m very confused about it all. I can’t make sense of my payslips. My tax code then changed from 1288L (March payslip) to 1257L.

0

0 -

1288 was the old Covid work from home tax code which gave you the extra few quid a month, this was discontinued for the 22/23 tax year and will have gone back to 1257L as a result. This won't have caused the issue though.

Which tax year are they saying you owe for.? 21/22 I assume?

How much did you earn in your previous employment that year and what was the final tax amount on your final slip with them?1 -

You are always responsible for paying the correct amount of tax you are due to pay.Kashdown said:Hi!When I started with an ex-employer, I was on emergency tax for a few months. Once I had this discussion with accounts, they paid me the extra amount I should have been paid. Now HMRC are asking me to pay back the £1500 in underpaid tax. Do I need to pay this or is it my ex-employers fault?Many thanks

Have you checked your personal tax account to see what information HMRC hold for the year that has the underpayment?1 -

Looking at the amount of tax paid YTD on that March 22 payslip, I'm wondering if her new job has wrongly given her the full whack of tax free allowance for the year and the refund was too much as a result.

1147 tax on a 19000 annual wage may be right if the Pension is deducted before tax. 1147 tax on 19000 earned in 6 months probably not right.

Edit - indeed I was only a quid away from 1147 when I tried to work it out myself for someone earning 19k a year with a 400 quid or so pension deduction.

The OPs new employer has, in essence, royally messed up. The refund should have been much smaller than the one actually given. Of course this is assuming there was another job with another employer for the first part of the 21/22 year.1 -

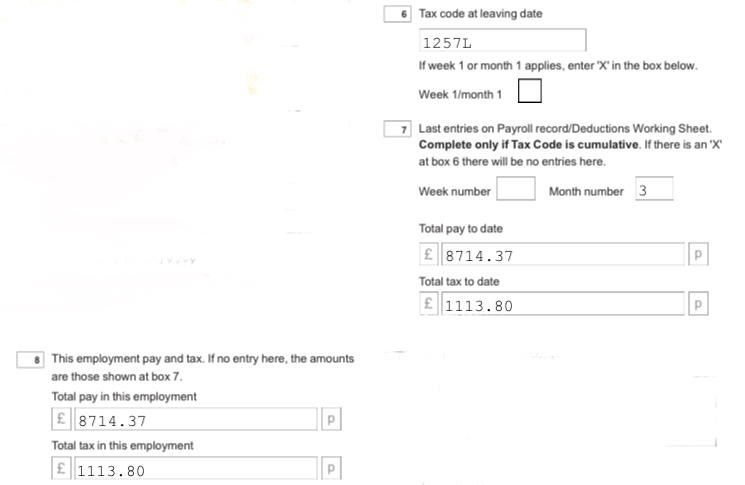

As above the tax code of 1288L appears to have been used but with no account of previous earnings.la531983 said:Looking at the amount of tax paid YTD on that March 22 payslip, I'm wondering if her new job has wrongly given her the full whack of tax free allowance for the year and the refund was too much as a result.

1147 tax on a 19000 annual wage may be right if the Pension is deducted before tax. 1147 tax on 19000 earned in 6 months probably not right.

Edit - indeed I was only a quid away from 1147 when I tried to work it out myself for someone earning 19k a year with a 400 quid or so pension deduction.

The OPs new employer has, in essence, royally messed up. The refund should have been much smaller than the one actually given. Of course this is assuming there was another job with another employer for the first part of the 21/22 year.

Was there a P45 given to new employer and if so what were the details on part1A

If so what were the details in boxes 6 7 and 8

1 -

Thank you so much for all your help!

Thank you so much for all your help!

0 -

Someone else can check the numbers but from a quick look thats total taxable pay of 27339, so should be tax of about 2890 if on the 1288L coding.

From the above you have been taxed 2261 (based on a 1288L tax code) so around £630 shy and not £1500, unless I am missing something.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.2K Banking & Borrowing

- 253.2K Reduce Debt & Boost Income

- 453.7K Spending & Discounts

- 244.2K Work, Benefits & Business

- 599.2K Mortgages, Homes & Bills

- 177K Life & Family

- 257.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards