We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Interest taxed at maturity unfair

Comments

-

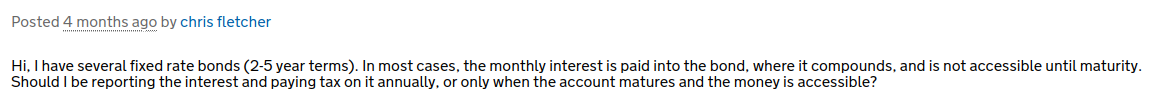

For this purpose, it does, according to HMRC Admin 19 on their forum:masonic said:

Exercising a choice to have it credited the account doesn't mean it wasn't made available to you.VNX said:Even if interest is paid or credited annually HMRC guidance is that any tax is owned in the tax year in which the interest becomes available to youIf you opt for the interest to be paid to an account that you can access and make withdrawals, this must be declared on an annual basis. If you keep it in the same account that generates it, that is, the fixed bond, then you will declare it on maturity.

Tax on interest on long term fixed rate bond - Community Forum - GOV.UK (hmrc.gov.uk)

1 -

We can plan our future investments accordingly to legally avoid the tax if we know one way or the other.Swipe said:There's nothing you can do about it anyway as it always comes down to how it's reported to HMRC, so it's not really an issue unless you do self assessment. In that case, you may face penalties for any wrong assumptions. That's why I tend to avoid them.0 -

EthicsGradient said:

For this purpose, it does, according to HMRC Admin 19 on their forum:masonic said:

Exercising a choice to have it credited the account doesn't mean it wasn't made available to you.VNX said:Even if interest is paid or credited annually HMRC guidance is that any tax is owned in the tax year in which the interest becomes available to youIf you opt for the interest to be paid to an account that you can access and make withdrawals, this must be declared on an annual basis. If you keep it in the same account that generates it, that is, the fixed bond, then you will declare it on maturity.

Tax on interest on long term fixed rate bond - Community Forum - GOV.UK (hmrc.gov.uk)

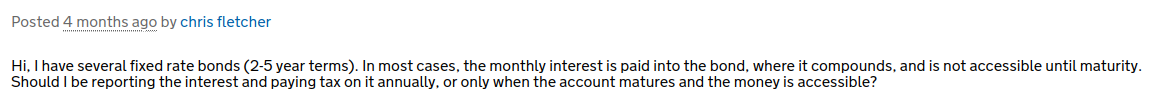

It seems HMRC Admin 32 has got in on the act too, with this Q and A:

There seems to be a shift in sentiment on those forums vs the past. I see you have a question queued up.1

There seems to be a shift in sentiment on those forums vs the past. I see you have a question queued up.1 -

I'm not feeling particularly inclined to register and post to the above quoted forum, but if anyone wants a straw-man worked example to use, feel free to pinch the below...Example 4

Chris applies for a 2 year fixed term savings account paying 5% interest, which does not permit any access to funds during the term. He decides to invest £20,000. During the application, he is given the choice to either have his interest paid out to an external account or reinvested in the fixed term account. Either way, interest is credited annually on the anniversary of opening the account. Chris chooses to have interest reinvested in the fixed term account. He is credited with £1000 and £1050 on 15th September 2024 and 15th September 2025 respectively. This is his only interest income and he is a basic rate taxpayer. Chris does not complete a tax return, and the provider declares interest to HMRC on an annual basis. Chris will therefore underpay tax in the 2024/25 tax year unless he contacts HMRC to inform them the £1000 interest received on 15th September 2024 was not made available to him until 15th September 2025 when the account matured. He is required to take this action.2 -

Yes, I agree, but my point is we don't know one way or the other.metrobus said:

We can plan our future investments accordingly to legally avoid the tax if we know one way or the other.Swipe said:There's nothing you can do about it anyway as it always comes down to how it's reported to HMRC, so it's not really an issue unless you do self assessment. In that case, you may face penalties for any wrong assumptions. That's why I tend to avoid them.0 -

Not knowing whether or not you have underpaid tax is an unsatisfactory situation to be in, because if at any time HMRC takes an interest in your tax affairs, perhaps for a completely unrelated reason, they could identify the underpayment, and while it is unlikely they'd fine someone for a genuine mistake, you'd likely be billed for the tax owed plus interest at some eye watering rate.Swipe said:

Yes, I agree, but my point is we don't know one way or the other.metrobus said:

We can plan our future investments accordingly to legally avoid the tax if we know one way or the other.Swipe said:There's nothing you can do about it anyway as it always comes down to how it's reported to HMRC, so it's not really an issue unless you do self assessment. In that case, you may face penalties for any wrong assumptions. That's why I tend to avoid them.

0 -

Hence, why I avoid anything longer than a 1 year fix and opt for interest paid at maturity. At least that way I know my tax return is correct.masonic said:

Not knowing whether or not you have underpaid tax is an unsatisfactory situation to be in, because if at any time HMRC takes an interest in your tax affairs, perhaps for a completely unrelated reason, they could identify the underpayment, and while it is unlikely they'd fine someone for a genuine mistake, you'd likely be billed for the tax owed plus interest at some eye watering rate.Swipe said:

Yes, I agree, but my point is we don't know one way or the other.metrobus said:

We can plan our future investments accordingly to legally avoid the tax if we know one way or the other.Swipe said:There's nothing you can do about it anyway as it always comes down to how it's reported to HMRC, so it's not really an issue unless you do self assessment. In that case, you may face penalties for any wrong assumptions. That's why I tend to avoid them.0 -

Currently 7.5% but that only seems to apply under Self Assessment, outside that they don't seem to charge interest.masonic said:

Not knowing whether or not you have underpaid tax is an unsatisfactory situation to be in, because if at any time HMRC takes an interest in your tax affairs, perhaps for a completely unrelated reason, they could identify the underpayment, and while it is unlikely they'd fine someone for a genuine mistake, you'd likely be billed for the tax owed plus interest at some eye watering rate.Swipe said:

Yes, I agree, but my point is we don't know one way or the other.metrobus said:

We can plan our future investments accordingly to legally avoid the tax if we know one way or the other.Swipe said:There's nothing you can do about it anyway as it always comes down to how it's reported to HMRC, so it's not really an issue unless you do self assessment. In that case, you may face penalties for any wrong assumptions. That's why I tend to avoid them.1 -

Swipe said:

Hence, why I avoid anything longer than a 1 year fix and opt for interest paid at maturity. At least that way I know my tax return is correct.masonic said:

Not knowing whether or not you have underpaid tax is an unsatisfactory situation to be in, because if at any time HMRC takes an interest in your tax affairs, perhaps for a completely unrelated reason, they could identify the underpayment, and while it is unlikely they'd fine someone for a genuine mistake, you'd likely be billed for the tax owed plus interest at some eye watering rate.Swipe said:

Yes, I agree, but my point is we don't know one way or the other.metrobus said:

We can plan our future investments accordingly to legally avoid the tax if we know one way or the other.Swipe said:There's nothing you can do about it anyway as it always comes down to how it's reported to HMRC, so it's not really an issue unless you do self assessment. In that case, you may face penalties for any wrong assumptions. That's why I tend to avoid them.The other way to sidestep the issue is to have interest paid out to a linked account, which is my favoured approach. Makes it easier to add up too.But there is going to be a large number of savers filling their boots on long term fixes in anticipation of interest rates peaking. It seems like an issue that should be pushed for clarity.

2 -

Is this why many fixed term accounts say access only by closure as that would presumably cover them to file annually. I had my simple assessment (not that it is simple) through last week & my interest adds up to what they say apart from my NS&I interest. That includes fixes of 2 yrs & over with access by closure.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards