We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Should I pay into a cash ISA, or carry on in S&S ISA?

Comments

-

Although if you contribute more to your pension with the aid of 40% tax relief, you can most likely retire earlier than if you just saved it/invested it without the tax relief.DietIrnBru said:Does it have to be an either / or? What is the destination for the S&S fund? Time frame and target amount. If you're wanting more short to medium term cash to be available then by all means open a Cash ISA and build up your target amount - be it for an emergency fund, pending purchases etc. While the pension is tax efficient given your 40% bracket - remember there is living to be done in the here and now - retirement comfort is important - but arriving there not broken is also important - invest in yourself. Once cash is in the pension - its out of reach for many decades.

So you are less likely to be 'broken' if you stop work in your late Fifties, than having to work on until your late Sixties.2 -

You could always drop it in as a regular monthly investment over the rest of the tax year, if that makes you feel a bit safer about doing it.

Or just stick it in Natwest, probably the better choice to be fair...1 -

Sorry, this is wildly off topic, but I notice that the MSE forums have been updated. I now dont get updates when someone replies to my post. Does anyone know how to turn the notification setting back on?0

-

Hi ... I would suggest posting that question here ...@dllive said:Sorry, this is wildly off topic, but I notice that the MSE forums have been updated. I now dont get updates when someone replies to my post. Does anyone know how to turn the notification setting back on?

https://forums.moneysavingexpert.com/discussion/6459216/welcome-to-the-new-forum-look-give-us-your-feedback#latest

1 -

I'm not regulated to give advice, but my personal view is that interest rates on cash will fall as inflation comes down, while investment returns will likely beat cash over a longer time horizon. So for me, I'd chose investing over cash deposits for longer-term holdings. Hope that helps somewhat.3

-

So how much would I need to pay into my pension each year so I dont pay any higher rate? If my salary was £100k (to make it simple), how much would I need to contribute so I didnt pay any 40% tax?Doctor_Who said:

I was a '40%' tax payer for the last ~15 years of my working career.....however, by making strategic annual contributions to my SIPP I never actually paid any 40% tax! HMRC increased the basic rate tax band by the gross SIPP contribution in my SA calculation and the revised band was always more than my taxable income.dllive said:

Yes, youre probably right. Its taken me years to come to this conclusion. Last year was the first year I made a load of contributions to my pension, effectively taking me down to almost a basic rate payer. I cant believe I spent so many years paying so much at the higher rate!thegentleway said:Prioritising pension is usually the right answer at 40% tax bracket.0 -

Can you expand? So I can make amends to earlier tax years and get a tax rebate if I contribute more to my pension?ColdIron said:dllive said:

I cant believe I spent so many years paying so much at the higher rate!thegentleway said:Prioritising pension is usually the right answer at 40% tax bracket.You can make amends. The Annual Allowance is now £60,000 (gross) and if that isn't enough and you have the earnings to support it you can go back 3 years with Carry Forward0 -

Yes with Carry Forward but there are some rulesFirst you must exhaust your current years annual allowance, £60,000 2023/24 (gross) or your relevant income for the current year (basically earnings), whichever is the lower. So if you earn £40,000 that's all you can contribute (gross so £32k from you and £8,000 tax relief) and you can't use CFIt sounds like you earn more than £60,000 pa so after that you can 'carry forward' unused annual allowance from previous years but you are still bound by the limit on current years earnings. So if you earn £80,000 this year you can use £60,000 (gross) from the current year and carry forward £20,000 (gross) from 2020/21So theoretically you could contribute up to £180,000 this year, £60,000 from this year and £120,000 from the previous 3 years (if you have the earnings to support it and you had made no contributions)There's lots on the internet about this and this is a simple guide

https://www.pensionbee.com/pensions-explained/pension-contributions/pension-carry-forward-ruleNB Don't fall into the trap which many do. You can carry forward unused annual allowance from previous years but you cannot carry forward earnings from previous years2 -

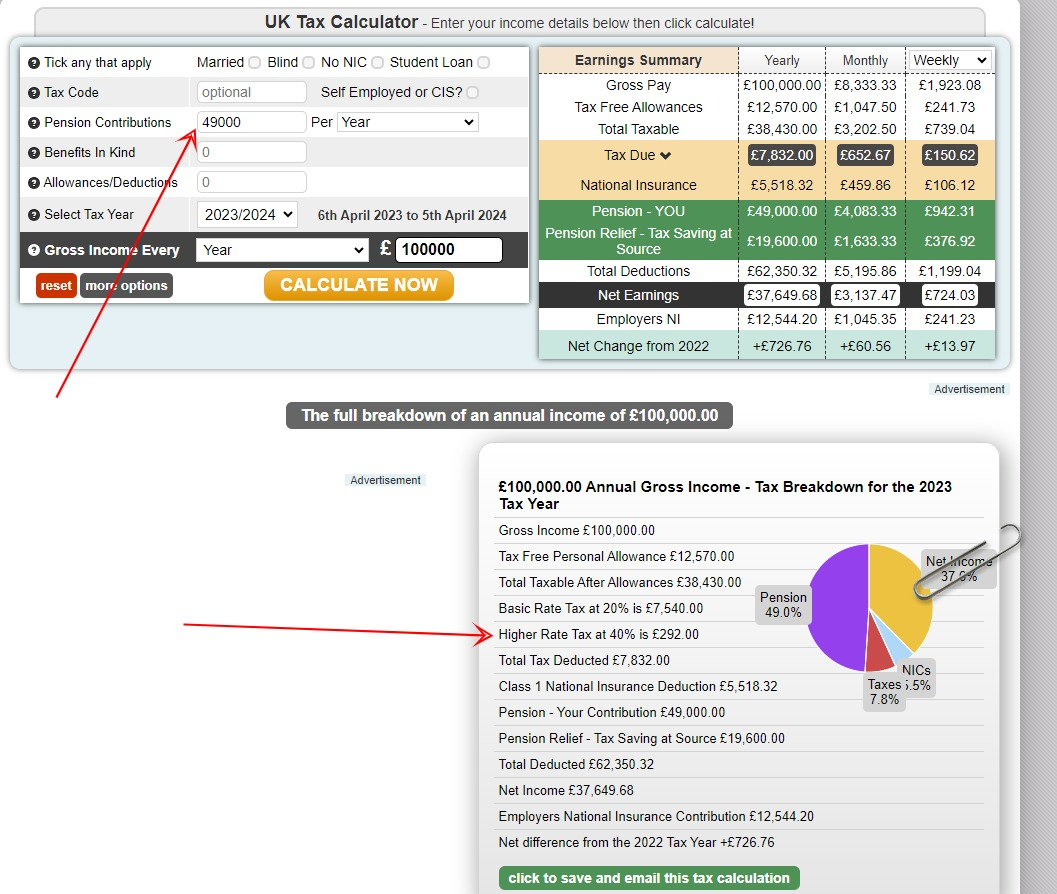

Ive just found this useful calculator: https://www.uktaxcalculators.co.uk/

So if Im reading this correctly, if I earn £100k, i would need to contribute £49k to only pay £292 tax at the higher rate.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards