We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Getting a Credit Card With No Credit History?

Comments

-

Yes I'm a student and I'm self-employed/working in my company. Is that supposed to help or hinder?MrFrugalFever said:

So are you still a full time student AND working self-employed at the same time?gh148 said:

I do have overdraft on my student current account. I've used it (since it's completely free arranged overdraft with no fees) but fully paid it off quickly.elasto said:Getting your name onto the utility bills is a good suggestion. Both my broadband provider and my water company report to the CRAs.

Maybe try to get an overdraft with your current bank, no matter how small (but don't dip into it).

There are credit cards that evaluate you if you let them link to your bank account to see all your income and outgoings for themselves. One of those might offer you a low limit card to get you going.

Gaining a decent rewards or cashback credit card shouldn’t take that long to do with a little perseverance and patience, however, you do not seem to be forthcoming in putting the legwork in to benefit from it so perhaps it’s not for you anyway?0 -

gh148 said:

Yes I'm a student and I'm self-employed/working in my company. Is that supposed to help or hinder?MrFrugalFever said:

So are you still a full time student AND working self-employed at the same time?gh148 said:

I do have overdraft on my student current account. I've used it (since it's completely free arranged overdraft with no fees) but fully paid it off quickly.elasto said:Getting your name onto the utility bills is a good suggestion. Both my broadband provider and my water company report to the CRAs.

Maybe try to get an overdraft with your current bank, no matter how small (but don't dip into it).

There are credit cards that evaluate you if you let them link to your bank account to see all your income and outgoings for themselves. One of those might offer you a low limit card to get you going.

Gaining a decent rewards or cashback credit card shouldn’t take that long to do with a little perseverance and patience, however, you do not seem to be forthcoming in putting the legwork in to benefit from it so perhaps it’s not for you anyway?Hinder x 2.HSBC and TSB offer specialist student credit cards. Perhaps you could look in opening an account with one of them (they both need you to have a student current account with them).0 -

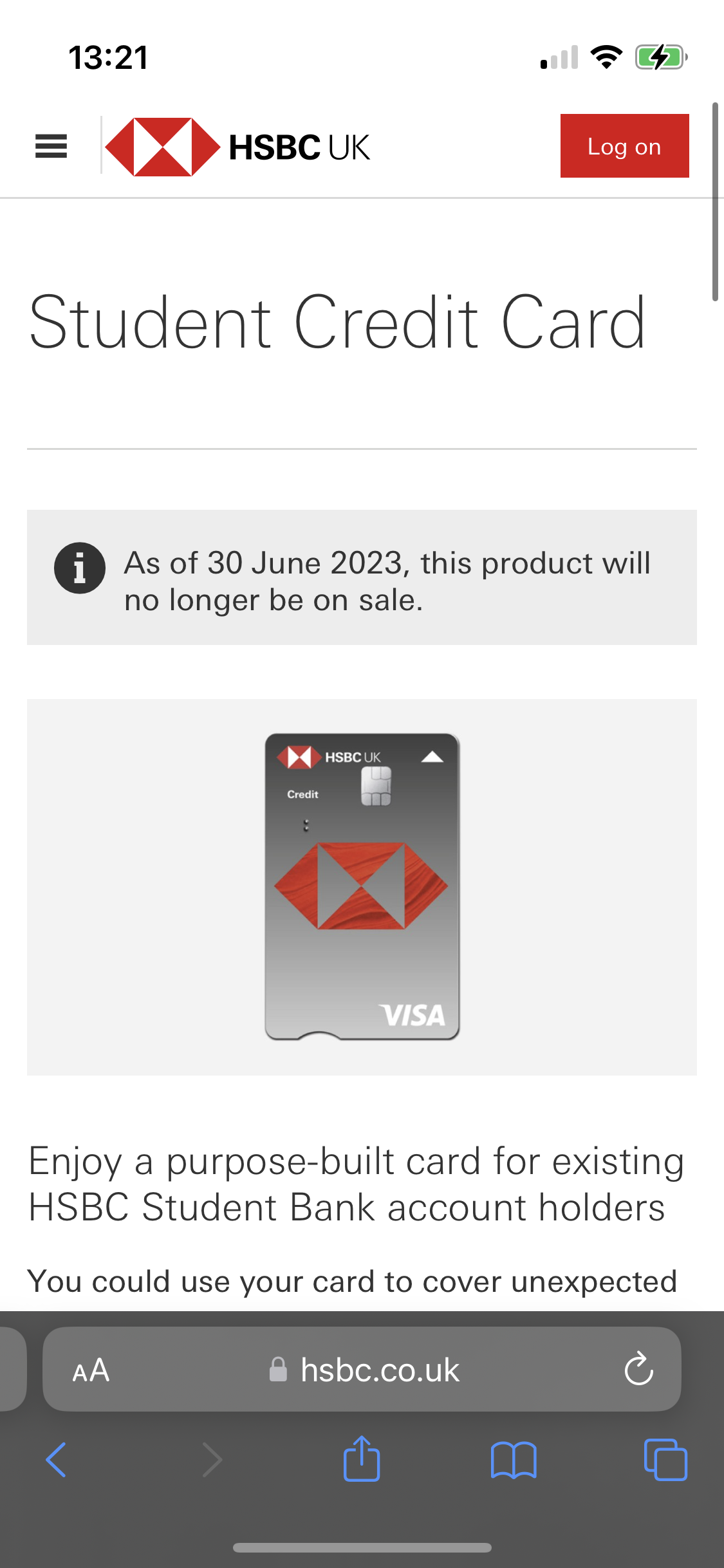

So I looked into HSBC first as I already have a student account with them, however it seems they discontinued they student card or something in June. For the TSB card, I would've needed to have an account with them for at least 3 months anyway.WillPS said:gh148 said:

Yes I'm a student and I'm self-employed/working in my company. Is that supposed to help or hinder?MrFrugalFever said:

So are you still a full time student AND working self-employed at the same time?gh148 said:

I do have overdraft on my student current account. I've used it (since it's completely free arranged overdraft with no fees) but fully paid it off quickly.elasto said:Getting your name onto the utility bills is a good suggestion. Both my broadband provider and my water company report to the CRAs.

Maybe try to get an overdraft with your current bank, no matter how small (but don't dip into it).

There are credit cards that evaluate you if you let them link to your bank account to see all your income and outgoings for themselves. One of those might offer you a low limit card to get you going.

Gaining a decent rewards or cashback credit card shouldn’t take that long to do with a little perseverance and patience, however, you do not seem to be forthcoming in putting the legwork in to benefit from it so perhaps it’s not for you anyway?Hinder x 2.HSBC and TSB offer specialist student credit cards. Perhaps you could look in opening an account with one of them (they both need you to have a student current account with them).1 -

Oh no - @bridlington1 it’s gone before I was eligible for their accountgh148 said:

So I looked into HSBC first as I already have a student account with them, however it seems they discontinued they student card or something in June. For the TSB card, I would've needed to have an account with them for at least 3 months anyway.WillPS said:gh148 said:

Yes I'm a student and I'm self-employed/working in my company. Is that supposed to help or hinder?MrFrugalFever said:

So are you still a full time student AND working self-employed at the same time?gh148 said:

I do have overdraft on my student current account. I've used it (since it's completely free arranged overdraft with no fees) but fully paid it off quickly.elasto said:Getting your name onto the utility bills is a good suggestion. Both my broadband provider and my water company report to the CRAs.

Maybe try to get an overdraft with your current bank, no matter how small (but don't dip into it).

There are credit cards that evaluate you if you let them link to your bank account to see all your income and outgoings for themselves. One of those might offer you a low limit card to get you going.

Gaining a decent rewards or cashback credit card shouldn’t take that long to do with a little perseverance and patience, however, you do not seem to be forthcoming in putting the legwork in to benefit from it so perhaps it’s not for you anyway?Hinder x 2.HSBC and TSB offer specialist student credit cards. Perhaps you could look in opening an account with one of them (they both need you to have a student current account with them).

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

I never have one or know anything about (apart from the blurb) it but would the Luma card help OP?

Let's Be Careful Out There0 -

HillStreetBlues said:I never have one or know anything about (apart from the blurb) it but would the Luma card help OP?

That's a capital one card at heart - and they've already said no...

0 -

gh148 said:

So I looked into HSBC first as I already have a student account with them, however it seems they discontinued they student card or something in June. For the TSB card, I would've needed to have an account with them for at least 3 months anyway.WillPS said:gh148 said:

Yes I'm a student and I'm self-employed/working in my company. Is that supposed to help or hinder?MrFrugalFever said:

So are you still a full time student AND working self-employed at the same time?gh148 said:

I do have overdraft on my student current account. I've used it (since it's completely free arranged overdraft with no fees) but fully paid it off quickly.elasto said:Getting your name onto the utility bills is a good suggestion. Both my broadband provider and my water company report to the CRAs.

Maybe try to get an overdraft with your current bank, no matter how small (but don't dip into it).

There are credit cards that evaluate you if you let them link to your bank account to see all your income and outgoings for themselves. One of those might offer you a low limit card to get you going.

Gaining a decent rewards or cashback credit card shouldn’t take that long to do with a little perseverance and patience, however, you do not seem to be forthcoming in putting the legwork in to benefit from it so perhaps it’s not for you anyway?Hinder x 2.HSBC and TSB offer specialist student credit cards. Perhaps you could look in opening an account with one of them (they both need you to have a student current account with them).3 months isn't exactly a long time in the grand scheme of the world.You could start a loqbox tomorrow, open a TSB account this week, and by the time you get to 3 months down the line or so, you'd likely get your first card.Not everything can be done by this time tomorrow.0 -

Thing is, what is most likely to be more of a factor here, income or the complete lack of a credit history? When I applied for an American Express card for example, even though their eligibility checker gave me good chances, I still got automatically rejected, and the rejection email clearly stated that it was my income that is the issue.cymruchris said:gh148 said:

So I looked into HSBC first as I already have a student account with them, however it seems they discontinued they student card or something in June. For the TSB card, I would've needed to have an account with them for at least 3 months anyway.WillPS said:gh148 said:

Yes I'm a student and I'm self-employed/working in my company. Is that supposed to help or hinder?MrFrugalFever said:

So are you still a full time student AND working self-employed at the same time?gh148 said:

I do have overdraft on my student current account. I've used it (since it's completely free arranged overdraft with no fees) but fully paid it off quickly.elasto said:Getting your name onto the utility bills is a good suggestion. Both my broadband provider and my water company report to the CRAs.

Maybe try to get an overdraft with your current bank, no matter how small (but don't dip into it).

There are credit cards that evaluate you if you let them link to your bank account to see all your income and outgoings for themselves. One of those might offer you a low limit card to get you going.

Gaining a decent rewards or cashback credit card shouldn’t take that long to do with a little perseverance and patience, however, you do not seem to be forthcoming in putting the legwork in to benefit from it so perhaps it’s not for you anyway?Hinder x 2.HSBC and TSB offer specialist student credit cards. Perhaps you could look in opening an account with one of them (they both need you to have a student current account with them).3 months isn't exactly a long time in the grand scheme of the world.You could start a loqbox tomorrow, open a TSB account this week, and by the time you get to 3 months down the line or so, you'd likely get your first card.Not everything can be done by this time tomorrow.

0 -

gh148 said:

Thing is, what is most likely to be more of a factor here, income or the complete lack of a credit history? When I applied for an American Express card for example, even though their eligibility checker gave me good chances, I still got automatically rejected, and the rejection email clearly stated that it was my income that is the issue.cymruchris said:gh148 said:

So I looked into HSBC first as I already have a student account with them, however it seems they discontinued they student card or something in June. For the TSB card, I would've needed to have an account with them for at least 3 months anyway.WillPS said:gh148 said:

Yes I'm a student and I'm self-employed/working in my company. Is that supposed to help or hinder?MrFrugalFever said:

So are you still a full time student AND working self-employed at the same time?gh148 said:

I do have overdraft on my student current account. I've used it (since it's completely free arranged overdraft with no fees) but fully paid it off quickly.elasto said:Getting your name onto the utility bills is a good suggestion. Both my broadband provider and my water company report to the CRAs.

Maybe try to get an overdraft with your current bank, no matter how small (but don't dip into it).

There are credit cards that evaluate you if you let them link to your bank account to see all your income and outgoings for themselves. One of those might offer you a low limit card to get you going.

Gaining a decent rewards or cashback credit card shouldn’t take that long to do with a little perseverance and patience, however, you do not seem to be forthcoming in putting the legwork in to benefit from it so perhaps it’s not for you anyway?Hinder x 2.HSBC and TSB offer specialist student credit cards. Perhaps you could look in opening an account with one of them (they both need you to have a student current account with them).3 months isn't exactly a long time in the grand scheme of the world.You could start a loqbox tomorrow, open a TSB account this week, and by the time you get to 3 months down the line or so, you'd likely get your first card.Not everything can be done by this time tomorrow.

You likely won't get an Amex in 3 months.Additionally if you completed a FULL application, a 'Hard search' will now have appeared on your credit file history. Every time you complete a FULL application (go beyond eligibility checkers) you will get a hard search.Lots of hard searches and no new accounts shows future lenders that you've not been successful in your applications.So if you're applying left, right and centre - stop - otherwise you're digging yourself a hole that will take some time to get out of.It'll be a combination of lack of history and lack of income that will impact your application with many providers.You can do something about the former, but for the moment you can't do anything about the latter.I would have thought by now you'd have got the picture that obtaining credit is a journey, not an overnight guarantee that you'll get a £100k limit on a card with cashback, rewards and a big fat welcome bonus.Small steps towards building is what it needs. As time goes on and you finish your study no doubt your income will increase. If you take some of the steps now that have been outlined, by the time you get to that point, you'll be in a far better position to get better/bigger offers.1 -

I'm obviously not expecting wonders, but as it is right now I can't get any credit card, not matter how low the credit limit is. Even got denied by my own bank as they said their minimum credit limit of £500 is too much for me.. Even if I did somehow get an amazing credit history somehow, would it even be enough though or will income also win out? In terms of full-on applications, the only full one I've done is really with Amex, where again it didn't even go through to a human, rather I got an instant denial anyway based on income.cymruchris said:gh148 said:

Thing is, what is most likely to be more of a factor here, income or the complete lack of a credit history? When I applied for an American Express card for example, even though their eligibility checker gave me good chances, I still got automatically rejected, and the rejection email clearly stated that it was my income that is the issue.cymruchris said:gh148 said:

So I looked into HSBC first as I already have a student account with them, however it seems they discontinued they student card or something in June. For the TSB card, I would've needed to have an account with them for at least 3 months anyway.WillPS said:gh148 said:

Yes I'm a student and I'm self-employed/working in my company. Is that supposed to help or hinder?MrFrugalFever said:

So are you still a full time student AND working self-employed at the same time?gh148 said:

I do have overdraft on my student current account. I've used it (since it's completely free arranged overdraft with no fees) but fully paid it off quickly.elasto said:Getting your name onto the utility bills is a good suggestion. Both my broadband provider and my water company report to the CRAs.

Maybe try to get an overdraft with your current bank, no matter how small (but don't dip into it).

There are credit cards that evaluate you if you let them link to your bank account to see all your income and outgoings for themselves. One of those might offer you a low limit card to get you going.

Gaining a decent rewards or cashback credit card shouldn’t take that long to do with a little perseverance and patience, however, you do not seem to be forthcoming in putting the legwork in to benefit from it so perhaps it’s not for you anyway?Hinder x 2.HSBC and TSB offer specialist student credit cards. Perhaps you could look in opening an account with one of them (they both need you to have a student current account with them).3 months isn't exactly a long time in the grand scheme of the world.You could start a loqbox tomorrow, open a TSB account this week, and by the time you get to 3 months down the line or so, you'd likely get your first card.Not everything can be done by this time tomorrow.

You likely won't get an Amex in 3 months.Additionally if you completed a FULL application, a 'Hard search' will now have appeared on your credit file history. Every time you complete a FULL application (go beyond eligibility checkers) you will get a hard search.Lots of hard searches and no new accounts shows future lenders that you've not been successful in your applications.So if you're applying left, right and centre - stop - otherwise you're digging yourself a hole that will take some time to get out of.It'll be a combination of lack of history and lack of income that will impact your application with many providers.You can do something about the former, but for the moment you can't do anything about the latter.I would have thought by now you'd have got the picture that obtaining credit is a journey, not an overnight guarantee that you'll get a £100k limit on a card with cashback, rewards and a big fat welcome bonus.Small steps towards building is what it needs. As time goes on and you finish your study no doubt your income will increase. If you take some of the steps now that have been outlined, by the time you get to that point, you'll be in a far better position to get better/bigger offers.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards