We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Car insurance - conflict of interest - company represents both drivers

Comments

-

So I wasn't far off the mark with "inept" .....along with understaffed.DullGreyGuy said:

Got to love job title inflation, unless it was like our letters which were all signed by the system as coming from the Claims Director (until he left, a year later had an accident with one of our policyholders and received a letter from us still being signed by him... we then went to a squiggle and a job title rather than an identifiable person). Our lot call them Claims Underwriters which is an odd title but intended to avoid Claims being second class employees -v- Underwriting.Clive_Woody said:

This was multiple calls over several weeks with various photos and statements provided before the letter arrived stating 50:50. This was not a frontline call handler, but supposedly a claims manager who had had chance to review all information provided and speak with the independent witnesses before making a decision.

Having time probably should be in "", even in the technical teams its a fairly high pressure/volume job. Before starting to deal with injury claims used to have between 1,000 and 1,500 open claims with disputed liability per experienced technician. Telephone calls are taken by whoever is free but you have to deal with all the inbound letters/email and diaries so the amount of time you get for actioning each item isnt significant esp if a non-letter requires you to find the paper file."We act as though comfort and luxury are the chief requirements of life, when all that we need to make us happy is something to be enthusiastic about” – Albert Einstein0 -

Downside of a highly commoditised distress purchase... price is king. You can go for a Hiscox type insurer but then their minimum premium was 4x the uk average premium and so you are paying for them having much higher staffing levels etc.Clive_Woody said:

So I wasn't far off the mark with "inept" .....along with understaffed.DullGreyGuy said:

Got to love job title inflation, unless it was like our letters which were all signed by the system as coming from the Claims Director (until he left, a year later had an accident with one of our policyholders and received a letter from us still being signed by him... we then went to a squiggle and a job title rather than an identifiable person). Our lot call them Claims Underwriters which is an odd title but intended to avoid Claims being second class employees -v- Underwriting.Clive_Woody said:

This was multiple calls over several weeks with various photos and statements provided before the letter arrived stating 50:50. This was not a frontline call handler, but supposedly a claims manager who had had chance to review all information provided and speak with the independent witnesses before making a decision.

Having time probably should be in "", even in the technical teams its a fairly high pressure/volume job. Before starting to deal with injury claims used to have between 1,000 and 1,500 open claims with disputed liability per experienced technician. Telephone calls are taken by whoever is free but you have to deal with all the inbound letters/email and diaries so the amount of time you get for actioning each item isnt significant esp if a non-letter requires you to find the paper file.0 -

Indeed, pay peanuts get monkeys. I don't recall Aviva being the cheapest, but they certainly tick the second box.DullGreyGuy said:

Downside of a highly commoditised distress purchase... price is king. You can go for a Hiscox type insurer but then their minimum premium was 4x the uk average premium and so you are paying for them having much higher staffing levels etc.Clive_Woody said:

So I wasn't far off the mark with "inept" .....along with understaffed.DullGreyGuy said:

Got to love job title inflation, unless it was like our letters which were all signed by the system as coming from the Claims Director (until he left, a year later had an accident with one of our policyholders and received a letter from us still being signed by him... we then went to a squiggle and a job title rather than an identifiable person). Our lot call them Claims Underwriters which is an odd title but intended to avoid Claims being second class employees -v- Underwriting.Clive_Woody said:

This was multiple calls over several weeks with various photos and statements provided before the letter arrived stating 50:50. This was not a frontline call handler, but supposedly a claims manager who had had chance to review all information provided and speak with the independent witnesses before making a decision.

Having time probably should be in "", even in the technical teams its a fairly high pressure/volume job. Before starting to deal with injury claims used to have between 1,000 and 1,500 open claims with disputed liability per experienced technician. Telephone calls are taken by whoever is free but you have to deal with all the inbound letters/email and diaries so the amount of time you get for actioning each item isnt significant esp if a non-letter requires you to find the paper file."We act as though comfort and luxury are the chief requirements of life, when all that we need to make us happy is something to be enthusiastic about” – Albert Einstein0 -

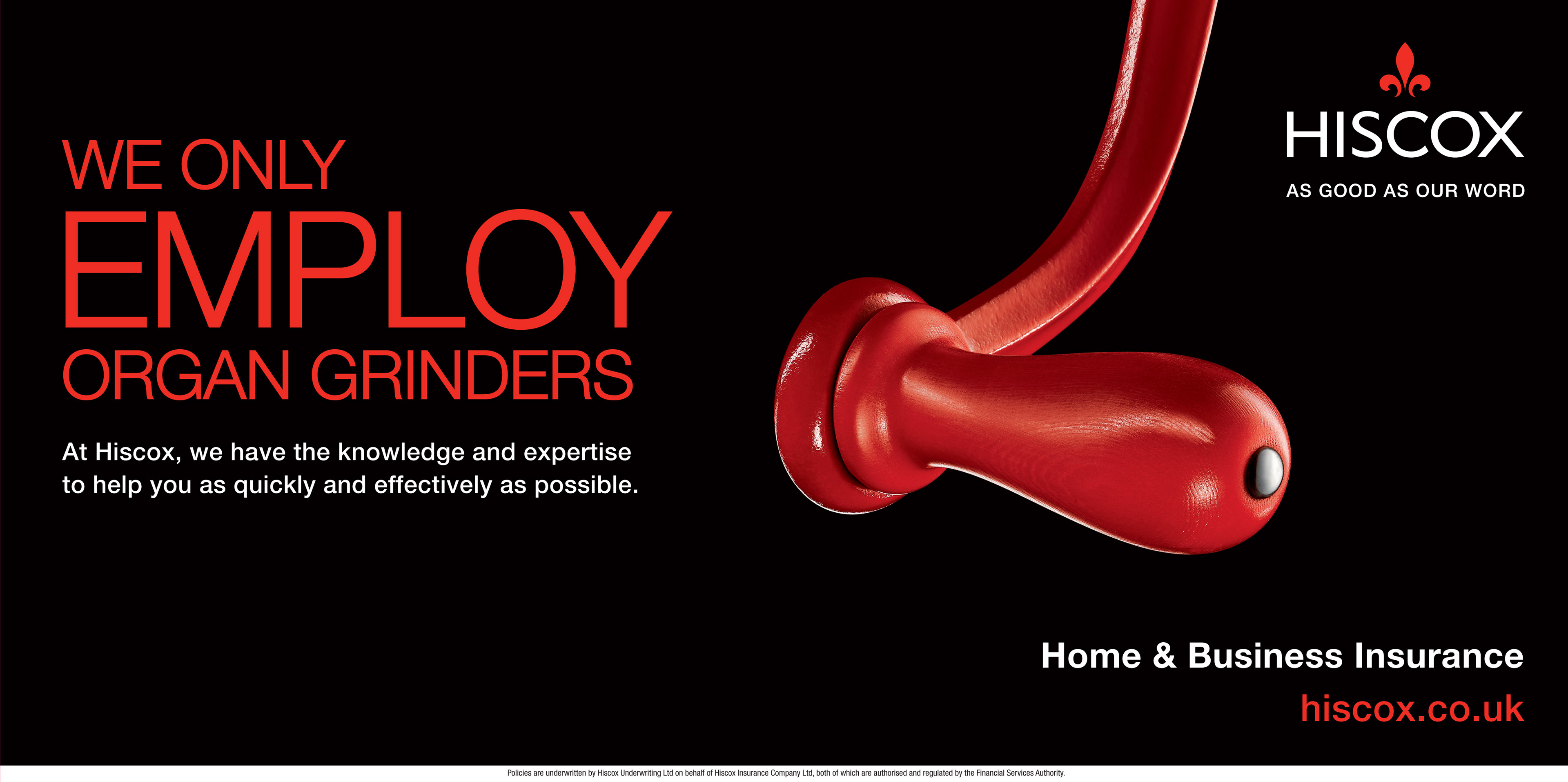

Amusingly, given Hiscox's old advert:Clive_Woody said:

Indeed, pay peanuts get monkeys. I don't recall Aviva being the cheapest, but they certainly tick the second box.DullGreyGuy said:

Downside of a highly commoditised distress purchase... price is king. You can go for a Hiscox type insurer but then their minimum premium was 4x the uk average premium and so you are paying for them having much higher staffing levels etc.Clive_Woody said:

So I wasn't far off the mark with "inept" .....along with understaffed.DullGreyGuy said:

Got to love job title inflation, unless it was like our letters which were all signed by the system as coming from the Claims Director (until he left, a year later had an accident with one of our policyholders and received a letter from us still being signed by him... we then went to a squiggle and a job title rather than an identifiable person). Our lot call them Claims Underwriters which is an odd title but intended to avoid Claims being second class employees -v- Underwriting.Clive_Woody said:

This was multiple calls over several weeks with various photos and statements provided before the letter arrived stating 50:50. This was not a frontline call handler, but supposedly a claims manager who had had chance to review all information provided and speak with the independent witnesses before making a decision.

Having time probably should be in "", even in the technical teams its a fairly high pressure/volume job. Before starting to deal with injury claims used to have between 1,000 and 1,500 open claims with disputed liability per experienced technician. Telephone calls are taken by whoever is free but you have to deal with all the inbound letters/email and diaries so the amount of time you get for actioning each item isnt significant esp if a non-letter requires you to find the paper file.

Aviva are full spectrum, they have cheap and cheerful policies and full fat. Maybe avoid the absolute bottom of the barrel on direct business but most likely on the panel of some real bottom feeding intermediaries.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards