We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Santander ‘Edge Up’ launching today

Comments

-

Because, as I said before, Santander are only going to talk about their own accounts. They are not going to suggest holding three accounts in parallel. If you compare Edge Up with a Santander Everyday Account, then it will leave you feeling good if you have big enough bills/eligible card spending for the cashback to cover the fee. If you compare it with the standard current account offering from most of the other banks, it is a good proposition.where_are_we said:"Our new current account will leave you feeling good"

Really! Compared to our 123lite where we get much superior cashback averaging £8 a month with a £2 a month fee, keep a minimum balance and get at least 4% with whatever easy access account is "flavour"of the week and get 1% cashback on most purchases (Chase). How does that make us feel good? The cat with the sunglasses in their promotion looks like a "spiv" if ever I saw one!The worry is that the days of the 123 lite are numbered.

I think you're right about the 123 Lite days being numbered, although it's interesting that Santander didn't automatically convert these to Edge accounts (giving appropriate notice as per the T&Cs), and their online calculator allows you to compare 123 and 123 Lite with the two Edge accounts, so it doesn't look like they're trying to encourage existing customers to move at the moment unless there's a financial benefit to the customer. (If you have low bills but a high balance and spend a lot in supermarkets/on travel, the new Edge accounts could be beneficial compared to the 123 accounts).

The thing that surprises me is the removal of the 1% cashback on Santander mortgage payments and Santander branded Aviva insurance policies (compared to the 123 products). I would have thought this was a good way to encourage loyalty, i.e. to encourage Santander's mortgage customer base (which is huge) to open current accounts, and the current account customers to consider a Santander mortgage/insurance.

0 -

Perphaps Santander have consulted their crystal ball on future mortgage payments and calculated that 1% cashback will cost them appreciably more for a few years at least?....................

The thing that surprises me is the removal of the 1% cashback on Santander mortgage payments ............

0 -

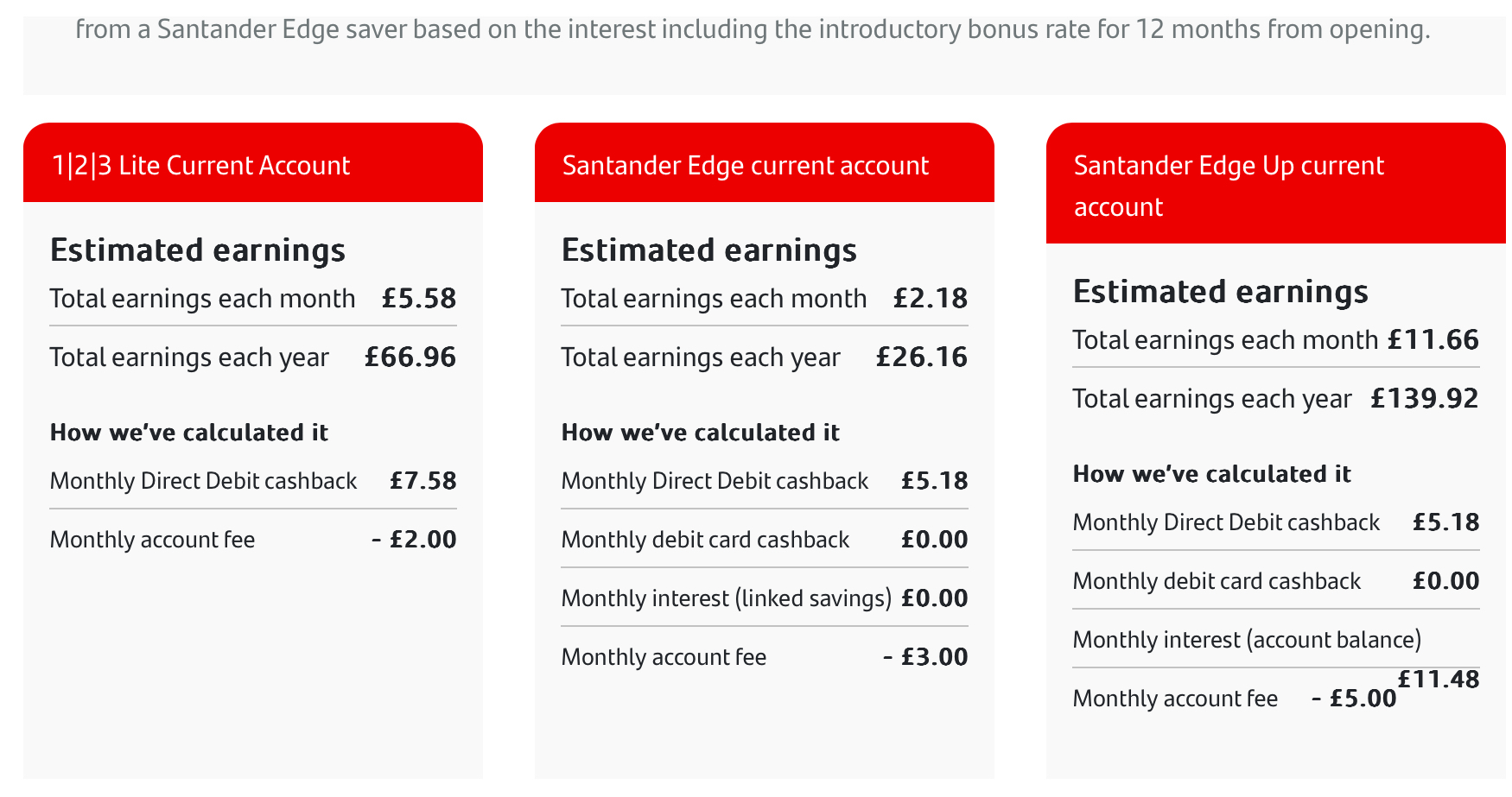

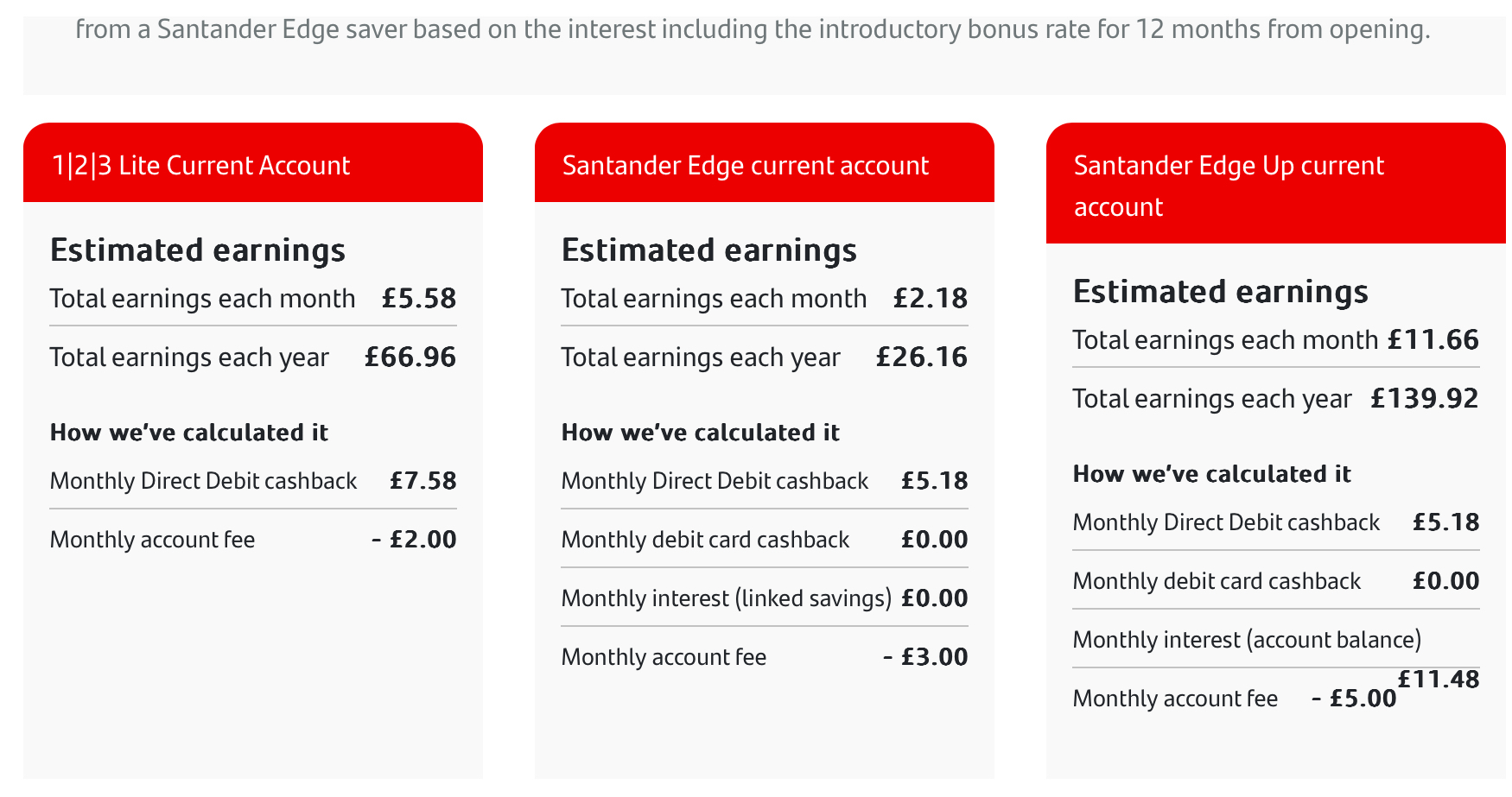

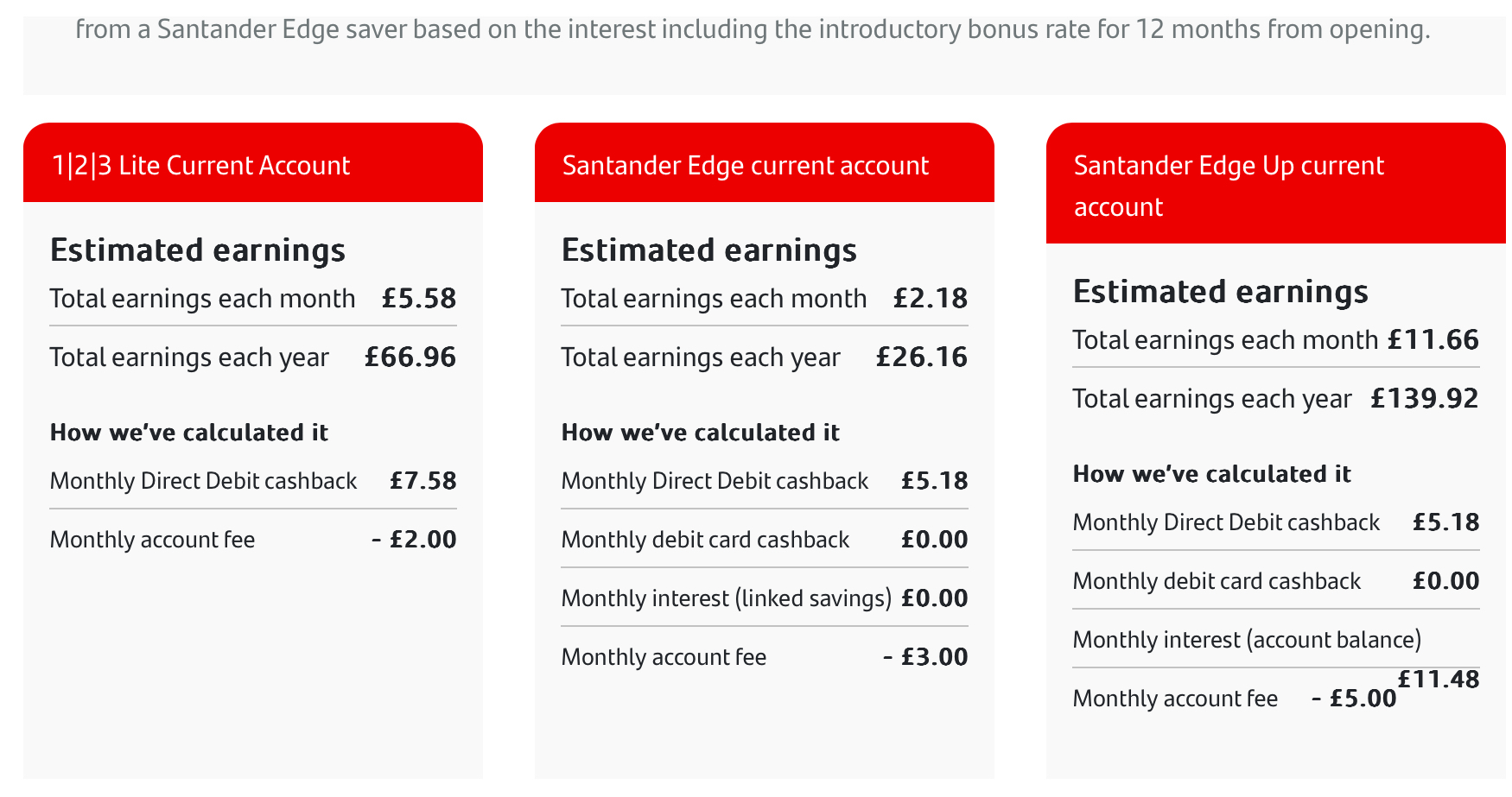

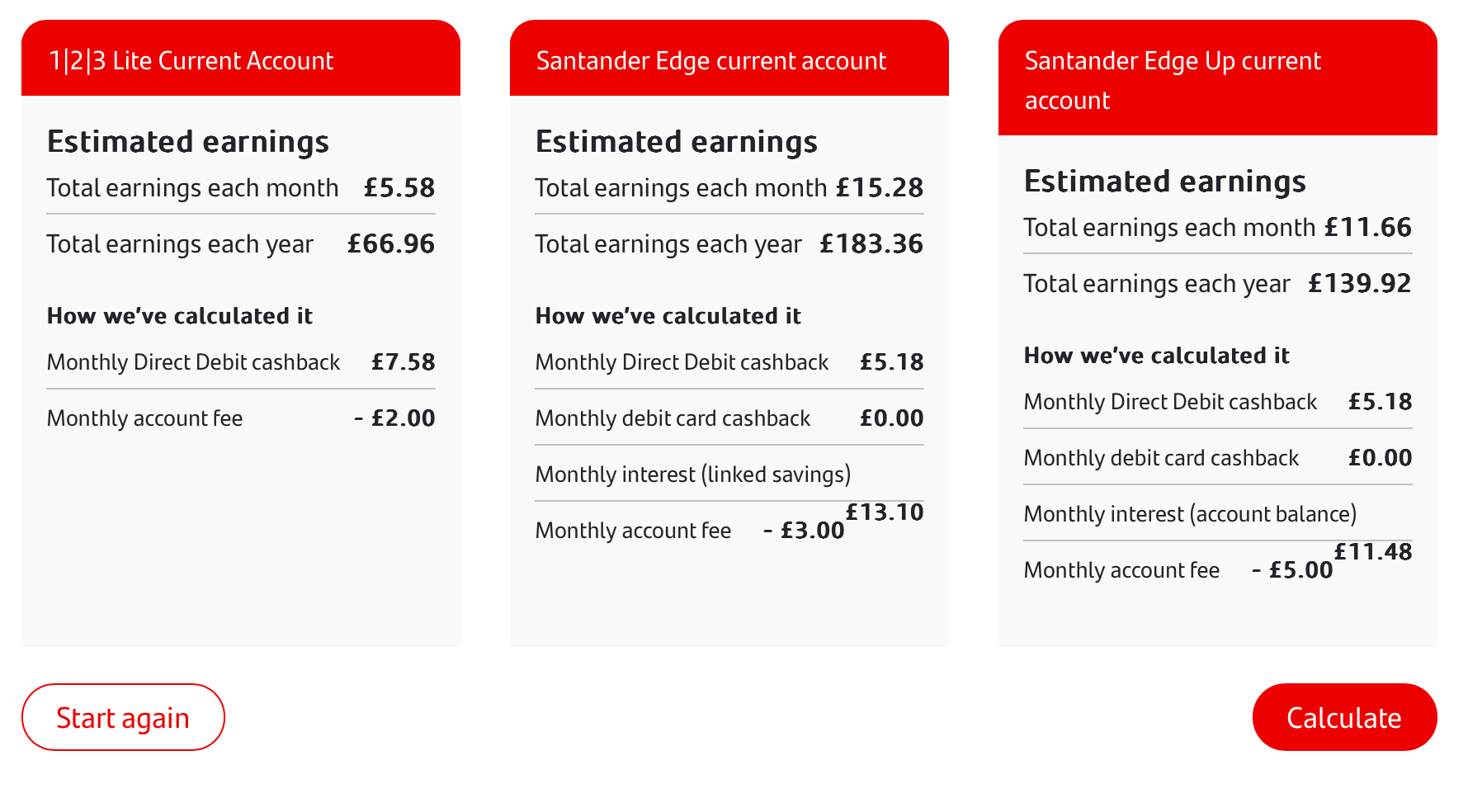

So currently a 123 Lite account holder, at the moment I earn just over £5 after the £2 fee.

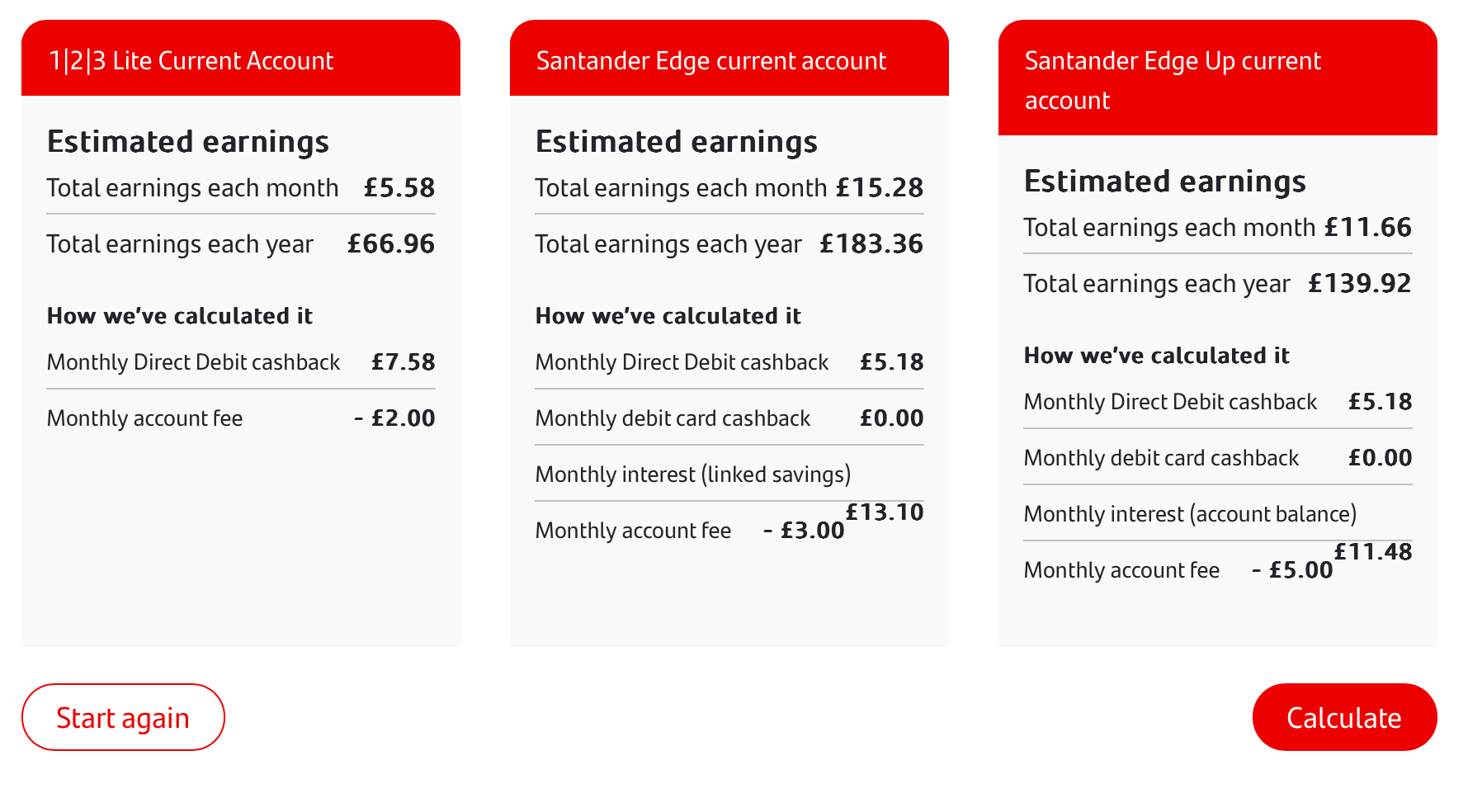

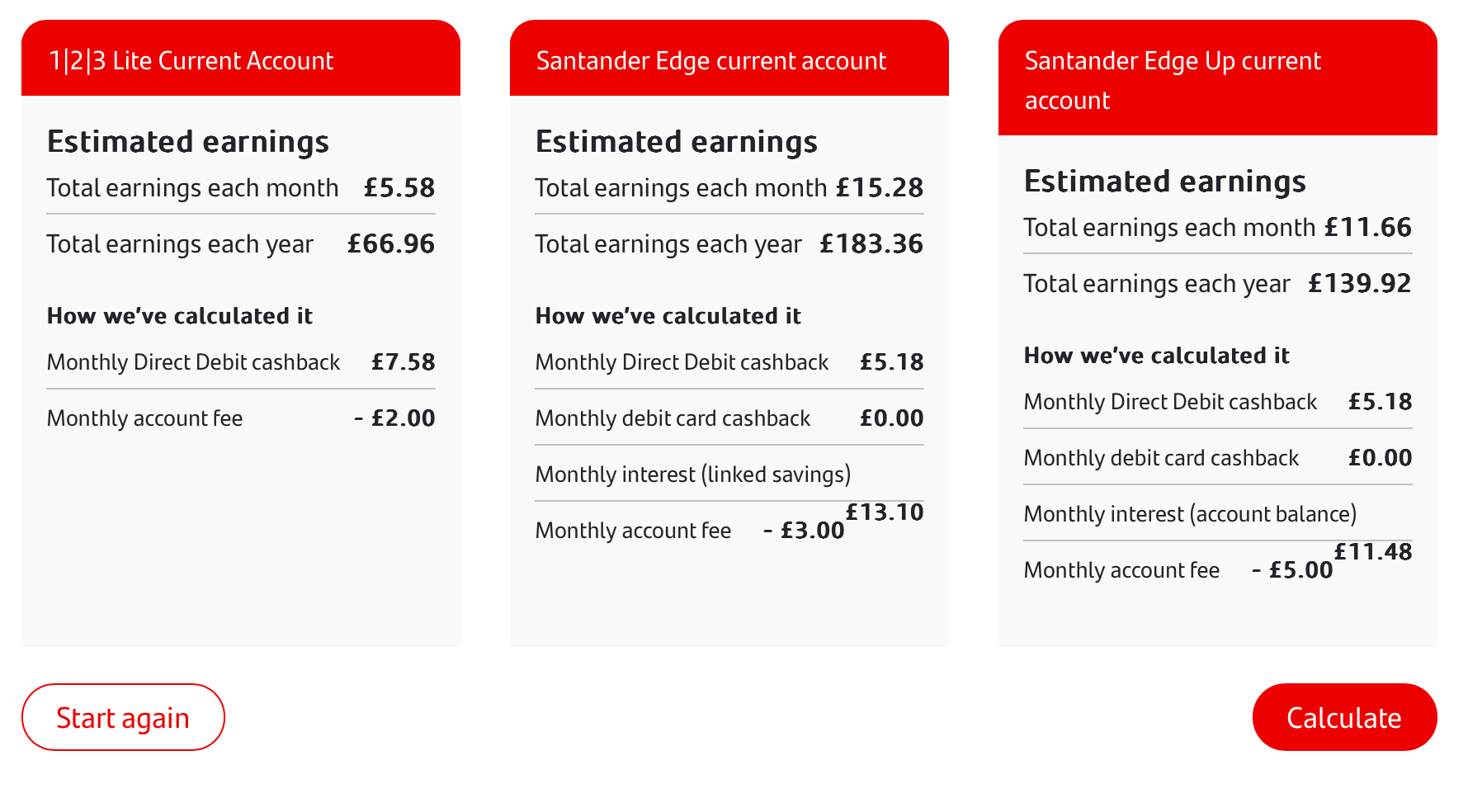

I usually average a balance of 4k in the account, I have used the calculator, first one is without moving 4k to the Edge saver, second one is with. My reading is I’d be better moving to Edge for a year using linked saver, then transferring to Edge Up…or seeing what they do after introductory bonus rate. I say average balance is 4k, currently has 7k prior to shuffling / payments coming out on or shortly after 1st of month. I know I could move some to Kroo or Chip which I also have.

Anything else I should consider before making the move?

0 -

Since your Edge earnings are driven mainly by interest rather than cashback, I'd personally leave it for a couple of weeks. After yesterday's base rate rise the 4% Edge Saver and 3.5% Edge Up account don't look as attractive as they did a few days ago. I'd see what Santander and others do with their rates before making any decisions.Catplan said:So currently a 123 Lite account holder, at the moment I earn just over £5 after the £2 fee.

I usually average a balance of 4k in the account, I have used the calculator, first one is without moving 4k to the Edge saver, second one is with. My reading is I’d be better moving to Edge for a year using linked saver, then transferring to Edge Up…or seeing what they do after introductory bonus rate. I say average balance is 4k, currently has 7k prior to shuffling / payments coming out on or shortly after 1st of month. I know I could move some to Kroo or Chip which I also have.

Anything else I should consider before making the move?

3

3 -

Either open an Edge Up additionally to earn the interest (leave your DDs with 123 Lite) or better still move your cash balance to a savings account where it'll earn more anyway and there'll be no fee to pay.Catplan said:So currently a 123 Lite account holder, at the moment I earn just over £5 after the £2 fee.

I usually average a balance of 4k in the account, I have used the calculator, first one is without moving 4k to the Edge saver, second one is with. My reading is I’d be better moving to Edge for a year using linked saver, then transferring to Edge Up…or seeing what they do after introductory bonus rate. I say average balance is 4k, currently has 7k prior to shuffling / payments coming out on or shortly after 1st of month. I know I could move some to Kroo or Chip which I also have.

Anything else I should consider before making the move?

0

0 -

I am a current 123 Lite customer. Is it true that if I swirched to Edge Up I could just pay in £1,500 a month, then withdraw it a few days later and repeat the process ad nauseum?

Regards to all.0 -

Yes that is true. Although if you're just paying in £1,500 then withdrawing it I'm not sure how you'd benefit from the Edge Up account. You'd need to leave some of it to cover the direct debits that generate cashback... otherwise what's the point?BeauJ38 said:I am a current 123 Lite customer. Is it true that if I swirched to Edge Up I could just pay in £1,500 a month, then withdraw it a few days later and repeat the process ad nauseum?

Regards to all.0 -

I should of given more detail. I'll have £10k sitting in the account at all times and just pay in and withdraw £1,500 each month from another account.TheBanker said:

Yes that is true. Although if you're just paying in £1,500 then withdrawing it I'm not sure how you'd benefit from the Edge Up account. You'd need to leave some of it to cover the direct debits that generate cashback... otherwise what's the point?BeauJ38 said:I am a current 123 Lite customer. Is it true that if I swirched to Edge Up I could just pay in £1,500 a month, then withdraw it a few days later and repeat the process ad nauseum?

Regards to all.0 -

I think you need to have the two Direct Debits to qualify for the 3.5% interest. Although if you use two household bills you'll get 1% cashback on the DDs. You'd also be charged the £5 per month fee.BeauJ38 said:

I should of given more detail. I'll have £10k sitting in the account at all times and just pay in and withdraw £1,500 each month from another account.TheBanker said:

Yes that is true. Although if you're just paying in £1,500 then withdrawing it I'm not sure how you'd benefit from the Edge Up account. You'd need to leave some of it to cover the direct debits that generate cashback... otherwise what's the point?BeauJ38 said:I am a current 123 Lite customer. Is it true that if I swirched to Edge Up I could just pay in £1,500 a month, then withdraw it a few days later and repeat the process ad nauseum?

Regards to all.

So I don't think it's worth trying to use this as a savings account - there are better homes for £10k. It's been designed to be used as a current account - without the DD/card cashback it's not really worth it due to the fee.0 -

The fact you have to pay for the interest and fee-free withdrawals which Virgin Money provides for free, and the NatWest Reward with £3 a month just for having 2 direct debits and mobile app makes the new Santander accounts feel line they aren’t spectacular and just going for the larger spenders. If Nationwide continue with the Fairer Share payments like they said they were, you’d get £100/£200 a year, great savings, and a possible free overdraft/5% makes it feel more rewarding than Santander with no effort or ties, as long as you meet simple criteria which you would with your main bank account and as an addition, great service. Plus, I like having the security of 2 accounts.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards