We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Emerging markets ex China

LHW99

Posts: 5,597 Forumite

I believe from reading around, that there have been an increasing number of management companies who have started emerging markets ex China funds.

However, from research, most of these have Taiwan and South Korea in the top three countries geographically, and therefore include Taiwan semi-conductor and Samsung electronics in their top 10 investments.

One / both those companies are also included in MSCI trackers as well as other more general global funds / trusts.

There is a Morgan Stanley fund (MFMPX) which has Poland / Vietnam / Indonesia as the top three countries, but that is institutional, and seems to be a USD fund which not all platforms list.

Blackrock Frontiers IT is the only fund / trust I have located whose top three

countries geographically don't include Taiwan and S. Korea, and is fairly widely available.

Are there

any others I could research?

0

Comments

-

So are you looking for specifically small cap emerging markets then, if you're excluding companies that might also be covered by global trackers?

Something like ishares emerging markets smallcap etf or SPDR Emerging markets small cap UCTIS etf?

1 -

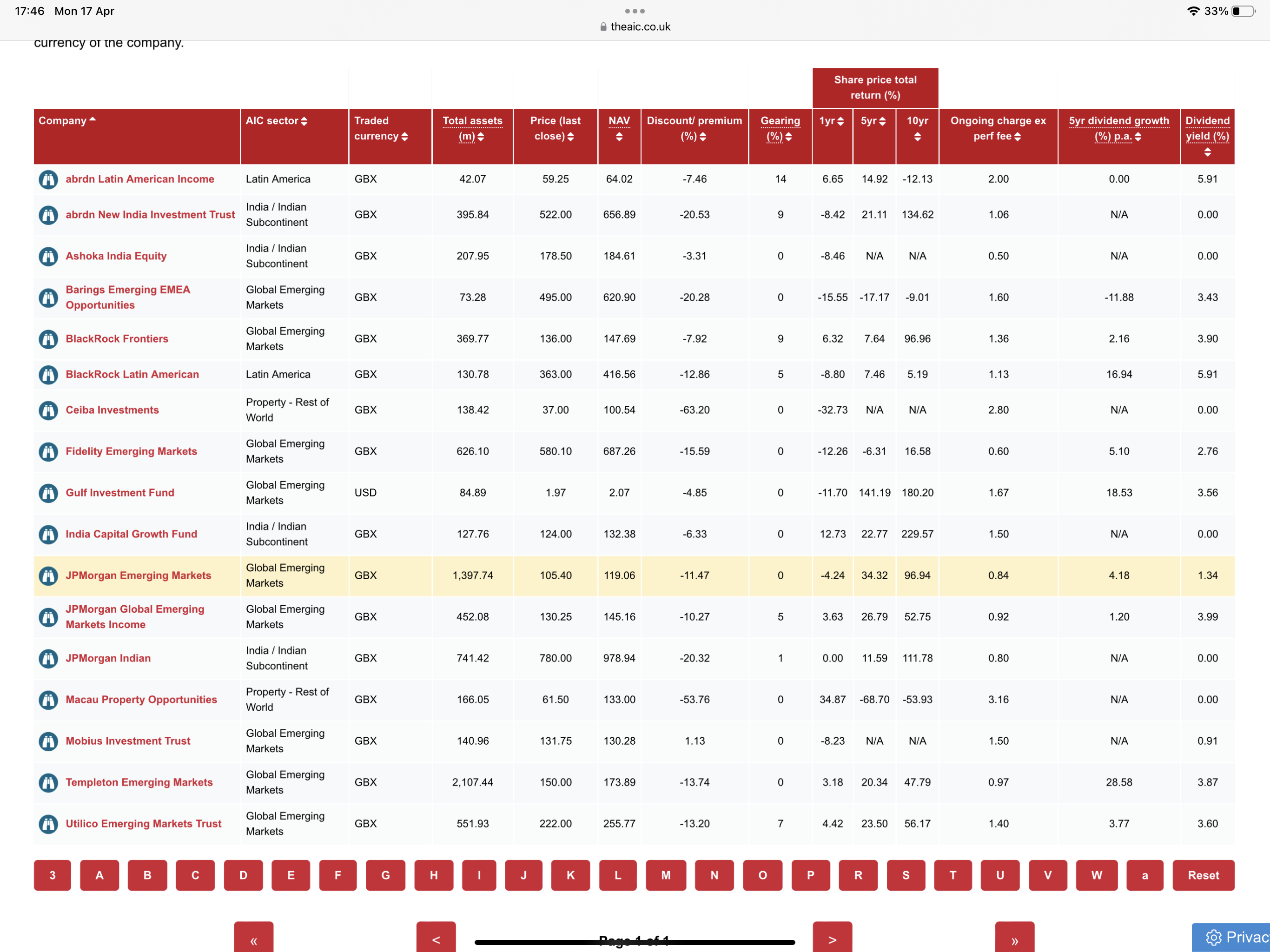

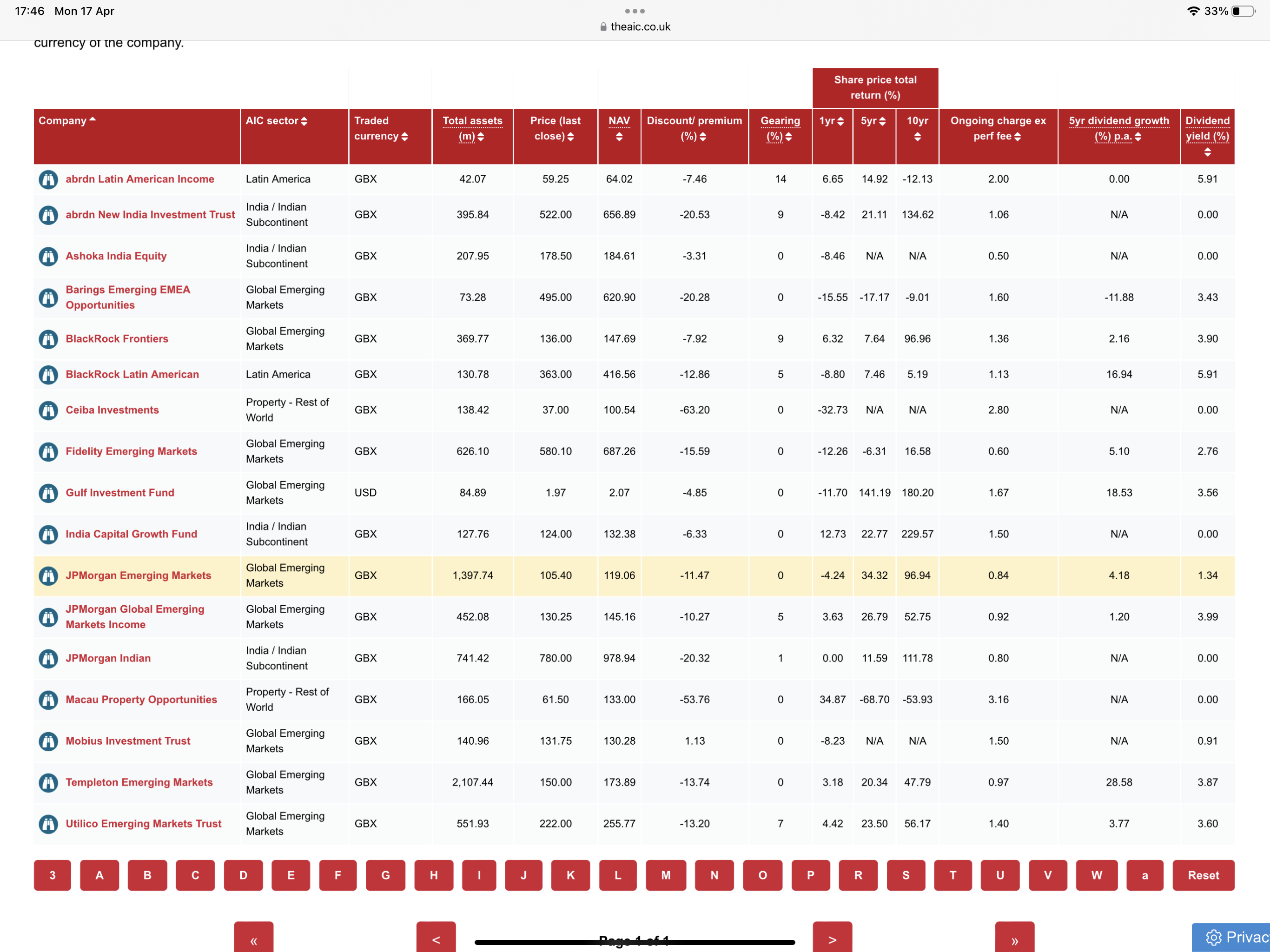

There are other ITs e.g., Aberdeen Latin America* LSE:ALAI), BlackRock Latin America (LSE:BRLA), there are some India focused ones. You can find them listed on the AIC's website.LHW99 said:I believe from reading around, that there have been an increasing number of management companies who have started emerging markets ex China funds.However, from research, most of these have Taiwan and South Korea in the top three countries geographically, and therefore include Taiwan semi-conductor and Samsung electronics in their top 10 investments.One / both those companies are also included in MSCI trackers as well as other more general global funds / trusts.There is a Morgan Stanley fund (MFMPX) which has Poland / Vietnam / Indonesia as the top three countries, but that is institutional, and seems to be a USD fund which not all platforms list.Blackrock Frontiers IT is the only fund / trust I have located whose top three countries geographically don't include Taiwan and S. Korea, and is fairly widely available.Are there any others I could research?

https://www.theaic.co.uk/aic/find-compare-investment-companies?geo=EMG&sortid=Name&desc=false *A week or two ago it announced that it's going to wind itself up, though.0

*A week or two ago it announced that it's going to wind itself up, though.0 -

InvesterJones said:So are you looking for specifically small cap emerging markets then, if you're excluding companies that might also be covered by global trackers?

Something like ishares emerging markets smallcap etf or SPDR Emerging markets small cap UCTIS etf?The iShares ETF has Taiwan / India / S. Korea as its three top geographies, the SPDR ETF has the same three (different order). Both have China at 4th, so neither are truly an ex-China fund.Ex-China is my main criterion, small / large cap is secondary (at present).0 -

wmb194 said:

There are other ITs e.g., Aberdeen Latin America* LSE:ALAI), BlackRock Latin America (LSE:BRLA), there are some India focused ones. You can find them listed on the AIC's website.LHW99 said:I believe from reading around, that there have been an increasing number of management companies who have started emerging markets ex China funds.However, from research, most of these have Taiwan and South Korea in the top three countries geographically, and therefore include Taiwan semi-conductor and Samsung electronics in their top 10 investments.One / both those companies are also included in MSCI trackers as well as other more general global funds / trusts.There is a Morgan Stanley fund (MFMPX) which has Poland / Vietnam / Indonesia as the top three countries, but that is institutional, and seems to be a USD fund which not all platforms list.Blackrock Frontiers IT is the only fund / trust I have located whose top three countries geographically don't include Taiwan and S. Korea, and is fairly widely available.Are there any others I could research?

https://www.theaic.co.uk/aic/find-compare-investment-companies?geo=EMG&sortid=Name&desc=false *A week or two ago it announced that it's going to wind itself up, though.I appreciate I could go country specific, although I had hoped not to. The Blackrock Frontiers, for example, includes Chile, Mexico, Peru and Columbia from Latin America, a number of Asian / Oceania emerging countries, plus Hungary / Poland and a few others.The Barings EMEA Opportunities could be an alternative, but doesn't have any Asian geography according to Morningstar. Its Ongoing is also a little higher than the Frontiers fund.I may be looking for a unicorn, but wondered if I had missed something obvious.0

*A week or two ago it announced that it's going to wind itself up, though.I appreciate I could go country specific, although I had hoped not to. The Blackrock Frontiers, for example, includes Chile, Mexico, Peru and Columbia from Latin America, a number of Asian / Oceania emerging countries, plus Hungary / Poland and a few others.The Barings EMEA Opportunities could be an alternative, but doesn't have any Asian geography according to Morningstar. Its Ongoing is also a little higher than the Frontiers fund.I may be looking for a unicorn, but wondered if I had missed something obvious.0 -

ISHARES VII PLC MSCI EM EX CHINA UCITS ETF USD ACC (EXCS) is probably your best bet...

"If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)0 -

george4064 said:ISHARES VII PLC MSCI EM EX CHINA UCITS ETF USD ACC (EXCS) is probably your best bet...

Thanks george4064, but this appears to be the USD version of EMXC, and includes Taiwan semiconductor and Samsung at nos. 1 and 2 (according to Morningstar). Certainly ex-China, but still with realtively large % in those two companies. This I believe is the issue with using a tracker.

0 -

It's not the issue with a tracker it's the point of a tracker.LHW99 said:george4064 said:ISHARES VII PLC MSCI EM EX CHINA UCITS ETF USD ACC (EXCS) is probably your best bet...

Thanks george4064, but this appears to be the USD version of EMXC, and includes Taiwan semiconductor and Samsung at nos. 1 and 2 (according to Morningstar). Certainly ex-China, but still with realtively large % in those two companies. This I believe is the issue with using a tracker.

You get cap weighted investments in the universe of qualifying companies.

It can be a disadvantage if you are trying to build a specific allocation however1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards