We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Are we expecting BOE to remain at 4.75% on 8th February 2025?

Comments

-

That’s only 1 or 2% above what a lot of people will have been paying on average over the last 10-15 years.IAMIAM said:So BOE rates are predicted to be 5.5% and some by year end/early 2024.

Whether you rent or have a mortgage you are screwed. They both are on a parr at the moment.0 -

But on how much?weddingringman said:

That’s only 1 or 2% above what a lot of people will have been paying on average over the last 10-15 years.IAMIAM said:So BOE rates are predicted to be 5.5% and some by year end/early 2024.

Whether you rent or have a mortgage you are screwed. They both are on a parr at the moment.

I was paying 5/6% 13 years ago, then 4% for a few years (stupidly). However, I only had to borrow £97k on a purchase price of £111k. The house in front of mine, (same size as mine was but without a garage, but similar condition), has just sold for £300k. Two flipped houses sold for £325k in the last couple of years.

My payment was around £565 a month. A 2% rise would have seen me paying £688.

If I had to buy the same house today, based on £300k, with the same deposit and the same rate as I had when I bought, it would cost me c£1650. (A 2% rise takes that to £2036 for comparison).

The people who will be most affected by the rate increases aren't likely to be the ones who have been paying lower rates for the last 10-15 years.0 -

Here we go again.weddingringman said:

That’s only 1 or 2% above what a lot of people will have been paying on average over the last 10-15 years.IAMIAM said:So BOE rates are predicted to be 5.5% and some by year end/early 2024.

Whether you rent or have a mortgage you are screwed. They both are on a parr at the moment.1 -

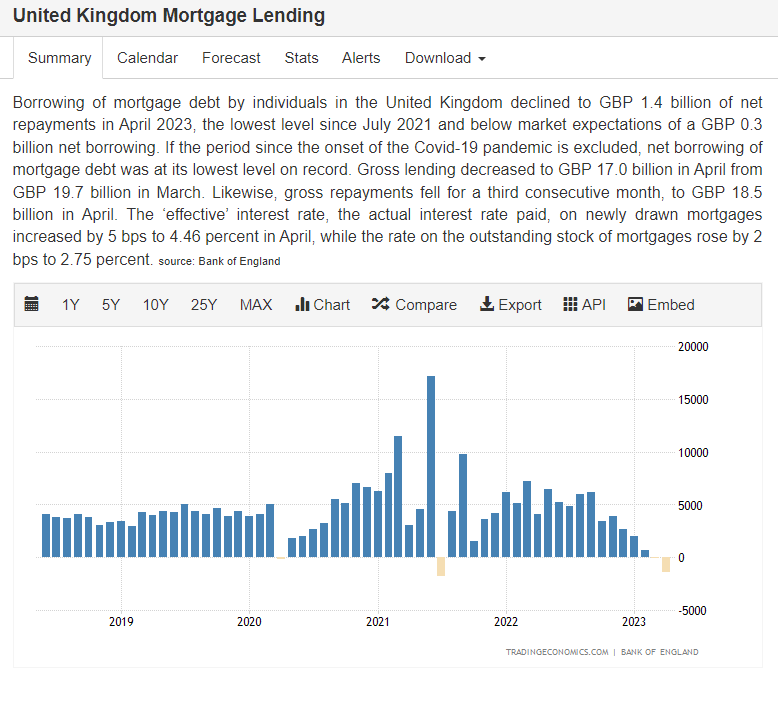

Data release today from BoE showing net mortgage borrowing fell and mortgagees are now actually making net repayments on mortgages - a very rare instance.

And with base rates predicted to go higher and house prices already falling YoY, estate agents must be questioning when this will all turn around.

At least with falling mortgage debt outstanding and money supply falling, it takes more pressure off inflation.

Flippers and BTL landlords are more likely to keep their money safe in gilts.

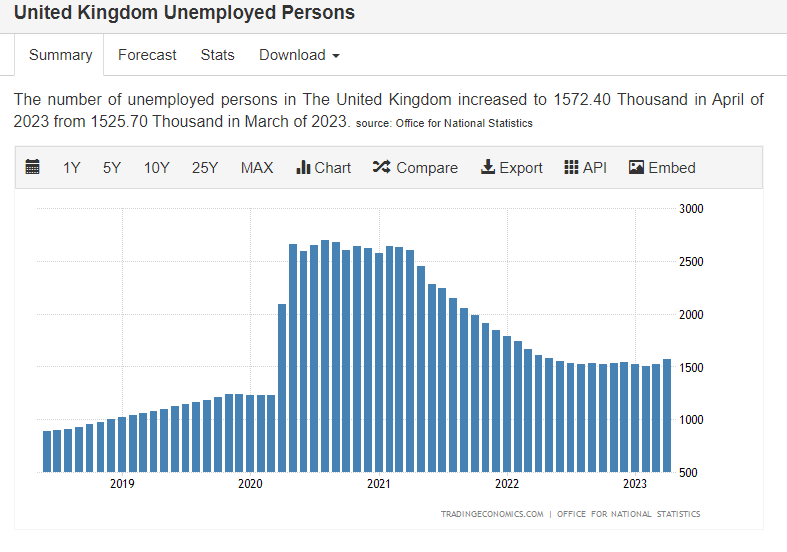

Whilst unemployment remains subdued, a recession is less likely to take hold. But there are worrying early signs the fall in unemployment has bottomed.

To solve inequality and failing productivity, cap leverage allowed to be used in property transactions. This lowers the ROI on housing, reduces monetary demand for housing, reduces house prices bringing them more into line with wage growth as opposed to debt expansion.

Reduce stamp duty on new builds and increase stamp duty on pre-existing property.

No-one should have control of setting interest rates since it only adds to uncertainty. Let the markets price yields, credit and labour.0 -

And there in lies the problem…Beetroot_24 said:

The people who will be most affected by the rate increases aren't likely to be the ones who have been paying lower rates for the last 10-15 years.weddingringman said:

That’s only 1 or 2% above what a lot of people will have been paying on average over the last 10-15 years.IAMIAM said:So BOE rates are predicted to be 5.5% and some by year end/early 2024.

Whether you rent or have a mortgage you are screwed. They both are on a parr at the moment.In 2021, I was viewing houses with my wife and kids that were 350-400k. Properties that we’d of brought 150k of equity to, and had a modest mortgage of about 3x our income.

Viewings were invariably dominated by people 15-20 years younger than us. Many people that looked like they were fresh out of school or uni and about to bid on a house 5x what I spent on my first place, a mere 15 years ago.

Hoe did things go so wrong?! Interest rates and a failure to recognise that the slashing of the base rate to 0.1% during covid was temporary and sparked an enormous rise in house prices.

So while I have no regrets about staying put, I have a decent house for my kids, I have zero concern for anyone that fears interest rates rising 2 or 3%. These are the very people that outbid me in recent years with stupid offers at rates most new were unsustainable.2 -

The truth hurts. I’m not talking about rates 10-15 years ago…. I’m talking about average rates, or those that you’d of got a mere 4 or 5 years ago.IAMIAM said:

Here we go again.weddingringman said:

That’s only 1 or 2% above what a lot of people will have been paying on average over the last 10-15 years.IAMIAM said:So BOE rates are predicted to be 5.5% and some by year end/early 2024.

Whether you rent or have a mortgage you are screwed. They both are on a parr at the moment.Our economy is destroyed because we can’t raise rates high enough, literally due to millions of people taking out ridiculous, unaffordable mortgages.The base rate should’ve been 5% for the last 10 years. Then we wouldn’t be in this mess.1 -

You sound really bitter.weddingringman said:

And there in lies the problem…Beetroot_24 said:

The people who will be most affected by the rate increases aren't likely to be the ones who have been paying lower rates for the last 10-15 years.weddingringman said:

That’s only 1 or 2% above what a lot of people will have been paying on average over the last 10-15 years.IAMIAM said:So BOE rates are predicted to be 5.5% and some by year end/early 2024.

Whether you rent or have a mortgage you are screwed. They both are on a parr at the moment.In 2021, I was viewing houses with my wife and kids that were 350-400k. Properties that we’d of brought 150k of equity to, and had a modest mortgage of about 3x our income.

Viewings were invariably dominated by people 15-20 years younger than us. Many people that looked like they were fresh out of school or uni and about to bid on a house 5x what I spent on my first place, a mere 15 years ago.

Hoe did things go so wrong?! Interest rates and a failure to recognise that the slashing of the base rate to 0.1% during covid was temporary and sparked an enormous rise in house prices.

So while I have no regrets about staying put, I have a decent house for my kids, I have zero concern for anyone that fears interest rates rising 2 or 3%. These are the very people that outbid me in recent years with stupid offers at rates most new were unsustainable.

It may be the problem but it was not caused by the younger people who outbid you.

What was their alternative? Pay dead money in rent? Buy somewhere cheaper and/or smaller meaning they would have to fork out thousands in fees and stamp duty in order to get on the second step?

And how do you know they didn't have larger deposits than you? I have 350k equity and I'm in my 30s.

Interest rate rises don't really affect me. I'll be mortgage free by the end of my 1.39% fix in 18 months (I'd have been mortgage free by now but we had an extension 4.5 years ago). However, many people will be affected, many of those through no fault of their own.2 -

I have a really nice home and my mortgage is low enough that I regularly overpay it by £1000-2000 a month. But yes, I do find it frustrating that the UKs housing crisis is entirely self-inflicted. It’s been a conscious strategy of governments and central bank governors to inflating house prices artificially.Beetroot_24 said:

You sound really bitter.weddingringman said:

And there in lies the problem…Beetroot_24 said:

The people who will be most affected by the rate increases aren't likely to be the ones who have been paying lower rates for the last 10-15 years.weddingringman said:

That’s only 1 or 2% above what a lot of people will have been paying on average over the last 10-15 years.IAMIAM said:So BOE rates are predicted to be 5.5% and some by year end/early 2024.

Whether you rent or have a mortgage you are screwed. They both are on a parr at the moment.In 2021, I was viewing houses with my wife and kids that were 350-400k. Properties that we’d of brought 150k of equity to, and had a modest mortgage of about 3x our income.

Viewings were invariably dominated by people 15-20 years younger than us. Many people that looked like they were fresh out of school or uni and about to bid on a house 5x what I spent on my first place, a mere 15 years ago.

Hoe did things go so wrong?! Interest rates and a failure to recognise that the slashing of the base rate to 0.1% during covid was temporary and sparked an enormous rise in house prices.

So while I have no regrets about staying put, I have a decent house for my kids, I have zero concern for anyone that fears interest rates rising 2 or 3%. These are the very people that outbid me in recent years with stupid offers at rates most new were unsustainable.

It may be the problem but it was not caused by the younger people who outbid you.

What was their alternative? Pay dead money in rent? Buy somewhere cheaper and/or smaller meaning they would have to fork out thousands in fees and stamp duty in order to get on the second step?

And how do you know they didn't have larger deposits than you? I have 350k equity and I'm in my 30s.

Interest rate rises don't really affect me. I'll be mortgage free by the end of my 1.39% fix in 18 months (I'd have been mortgage free by now but we had an extension 4.5 years ago). However, many people will be affected, many of those through no fault of their own.

How do I know they didn’t have larger deposits? Well not many folk in their early 20s in Scotland have 100-150k in the bank. Not many at all. I can also recall what it was like to be a FTB in my town 15 years ago and by all accounts the average amount of borrowing for first homes has trebled since then. There are still plenty of good small houses and flats for prices akin to what I paid years ago, but it seems they’ve fallen out of favour as people skip 3 rungs of the property ladder and just borrow 6x their income as if it’s nothing.

Artificially low interest rates, 100-120% / BTL mortgages, and relaxed borrowing criteria have destroyed our economy and spawned 3 million landlords. Prices have went mental and it’s the next generation that’ll suffer.Boomers blame the position young folk are in on designer clothes and Netflix. While they sit in homes that’ve increased in value 500% in 25-30 years through no doing of their own - just corrupt governments that have multimillion £££ property portfolios themselves.Watch this space. The government can’t have a housing crash. I expect to see government backed, discounted/subsidised mortgage rates next!!! Can’t have folk living within their means!! They must be a slave to a mortgage 6x their salary!1 -

I’m not hearing about any repossessions yet, so we certainly aren’t anywhere near peak BOE base rate.

I fully expect the banks to come out with 40 year and inter-generational mortgages.

0 -

I thought mortgages were all stress tested up to about 6%+ so whilst people are no doubt having to cut back elsewhere I suspect there are few cases of not being able to pay when push comes to shove. Plus with unemployment remaining low there will also not be too many unemployed forced sellers. Plus equity cushions are probably generally good right now due to all the recent HPI. So I am not seeing a spike in repossessions any time soon.ader42 said:I’m not hearing about any repossessions yet, so we certainly aren’t anywhere near peak BOE base rate.

I fully expect the banks to come out with 40 year and inter-generational mortgages.

Rates are more likely to impact through reducing demand elsewhere in the economy than sending the housing market into a downward spiral. He supply and demand imbalance will (sadly) support prices.I think....1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards