We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

SVB collapse

Comments

-

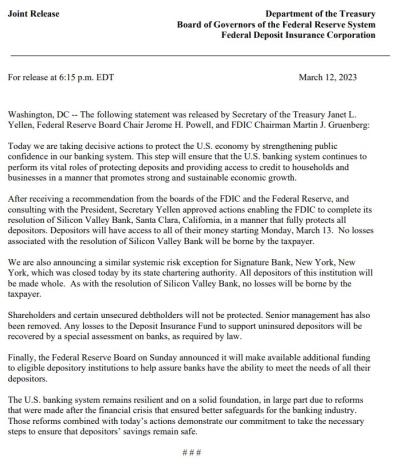

Crisis averted

3 -

The US futures markets have just opened and the S&P, Dow and Nasdaq are all up between 1% and 1.4%I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1

-

'No losses will be borne by the taxpayer'. Of course not, they'll just get charged more or earn less depending on how the banks handle the depositor bailout.Wonder how long they'll extend this for if the regionals start going under. Does this signal the depositor insurance is effectively unlimited?2

-

Glad to see that the Fed is taking again the familiar but safe route of bailing out all depositors regardless of amount or type of depositor (individual or corporate), in time before markets open in Asia. Watching Fed tonight better than watching the Oscar!lon_don said:

The article mentioned FDIC, but didn't touch on the one important point post-failure: what is FDIC going to do with the 93% uninsured deposits ? If by Monday morning FDIC hasn't organised some sort of rescue to make whole ALL depositors (similar to JPM being asked to buy the part of Washington Mutual holding all the deposits, in 2008), then the immediate read-across shall be that the FDIC (and by extension, our own FSCS) guarantee's cap is real and rigidly enforced, that in 2023 governments (not short of cash) won't accept to bail out depositors under any circumstance. Otoh if all uninsured depositors are made whole by FDIC, then the message is the cap is meaningless.Bravepants said:

The new BTFP program looks similar to our TLTRO...? QE creeping back..1 -

I’m pretty sure my knowledge of the financial markets is a fair bit better than yours, but even were it not, what you posted was wrong.darren232002 said:The casual user of this forum probably couldn't explain what T-Bill is. So, yes, it stands to reason that they aren't aware of accounting practices around long duration assets.

No sums involved, big or small, regardless by the way.0 -

Is it a bit like bear Stearns in that it has more assets than liabilities. But has liquidity problem, mortgage debt it can't liquidate fast enough?

Or is it more bankrupt than this?0 -

Hi

I was the first to post on this thread the other day and said not to worry. Now that is offical.

As I said in my intial post here, when things went wrong in 2008/9 and a few years before that and black wednday i think it was called, it happens quick and there is not a lot one can do about it. You do get warnings the markets will crash but it does not materialise and often blips. When it does happen, not a lot more needs to happen and then, bang, its a crash

The markets will make money going down and up and down and up - its thouse people that cash in when going down and or on a 'dead-cat-bounce' and those with private pensions that will be accessing them soon that lose out big time.

Markets can never go up in a straight line.

What is incredible is all of the hype about banking integrity tests and so on, so much so for that.

Thnaks0 -

diystarter7 said:Hi

I was the first to post on this thread the other day and said not to worry. Now that is offical.

As I said in my intial post here, when things went wrong in 2008/9 and a few years before that and black wednday i think it was called, it happens quick and there is not a lot one can do about it. You do get warnings the markets will crash but it does not materialise and often blips. When it does happen, not a lot more needs to happen and then, bang, its a crash

The markets will make money going down and up and down and up - its thouse people that cash in when going down and or on a 'dead-cat-bounce' and those with private pensions that will be accessing them soon that lose out big time.

Markets can never go up in a straight line.

What is incredible is all of the hype about banking integrity tests and so on, so much so for that.

Thnaks

Did you? This thread?

I must have missed it.How's it going, AKA, Nutwatch? - 12 month spends to date = 3.24% of current retirement "pot" (as at end December 2025)4 -

It must have grown very quick . The deposit amount being quoted in the news is nearly £7 Billion.wmb194 said:

SVB UK appears to be minuscule : "Silicon Valley Bank’s branch in the U.K. became a separate bank subsidiary requiring its own capital and more intensive local regulation in August last after it reached 100 million British pounds, equivalent to $120.3 million, of insured small business deposits, according to the parent company’s 2022 annual report."Shedman said:I see on BBC news website that Bank of London have submitted a bid for the UK part of SVB

and that Barclays may be considering a bid as are (per Sky News) OakNorth Bank and a ME bank.Hopefully this will help sentiment on stock market tomorrow

https://www.wsj.com/articles/bank-of-england-shuts-silicon-valley-banks-u-k-subsidiary-5a2e5b94

Edit: This makes it smaller than the smallest building society, the one branch Penrith with a balance sheet of £127m at the end of 2021.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards