We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Filling out the class 3 national ins form.

jimnew

Posts: 15 Forumite

I have worked out I need to start making extra class3 contributions I am in no rush to make up the short before this years deadline,

I have the form CA5603.

I can't find any help online to help me fill out the form ,

3 HMRC help lines are hopeless ,

Qu.9 Asks what date do I want to start?

Is that the date I wish to start paying ie sometime in 2023 or the start of the tax year I want to start making up ie year 2021-22 so i put April 6th 2021

Qu.10 asks about my employment status before I wish to pay extra contributions.

For the employed dates and un employed can I use the start and end of tax years .As I don't know the exact dates ?

Thanks in advance

I have the form CA5603.

I can't find any help online to help me fill out the form ,

3 HMRC help lines are hopeless ,

Qu.9 Asks what date do I want to start?

Is that the date I wish to start paying ie sometime in 2023 or the start of the tax year I want to start making up ie year 2021-22 so i put April 6th 2021

Qu.10 asks about my employment status before I wish to pay extra contributions.

For the employed dates and un employed can I use the start and end of tax years .As I don't know the exact dates ?

Thanks in advance

0

Comments

-

The problem you are having is that CA5603 form is for a direct debit payment, and you can only use that to pay for the current year - it says that hereYou can only use Direct Debit to make voluntary Class 3 National Insurance contributions for the current tax year (6 April 2022 to 5 April 2023).Given how late in the tax year it is now, I suspect that in fact HMRC would only apply a direct debit request now to start in the 2023-24 tax year.To pay for past years you need to make a one-off payment by contacting HMRC NI Enquiries.The good news for you is that 2021-22 will still be available to buy after April, and I believe at the same price.So I'd suggest leaving it until the new tax year, when hopefully the current rush on the phones will have died down, and give them a call then - in my experience they'll be able to both give you the reference to make a on-off payment for past years and/or set up a direct debit for the current year.Be aware that they'll probably ask if you;ve checked with the Future Pension Centre / Pension Service that buying the years will boost your state pension forecast.

1 -

Thanks for above advice.

DO you know if I set up the direct debit for future years does the DD run until I cancel it or would I have to renew every year?0 -

jimnew said:Thanks for above advice.

DO you know if I set up the direct debit for future years does the DD run until I cancel it or would I have to renew every year?It runs until you cancel it (or presumably until you reach State Pension Age).You'll get a letter just before the start of each year to tell you what the payments are going to be and when they'll be taken (I received mine last week).Note that although they take the DD monthly, the amount varies from month to month as they only take whole weeks - so four weeks for the first month, four for the second month and then five for the third (or the other way round, I can;t recall which).0 -

Hello

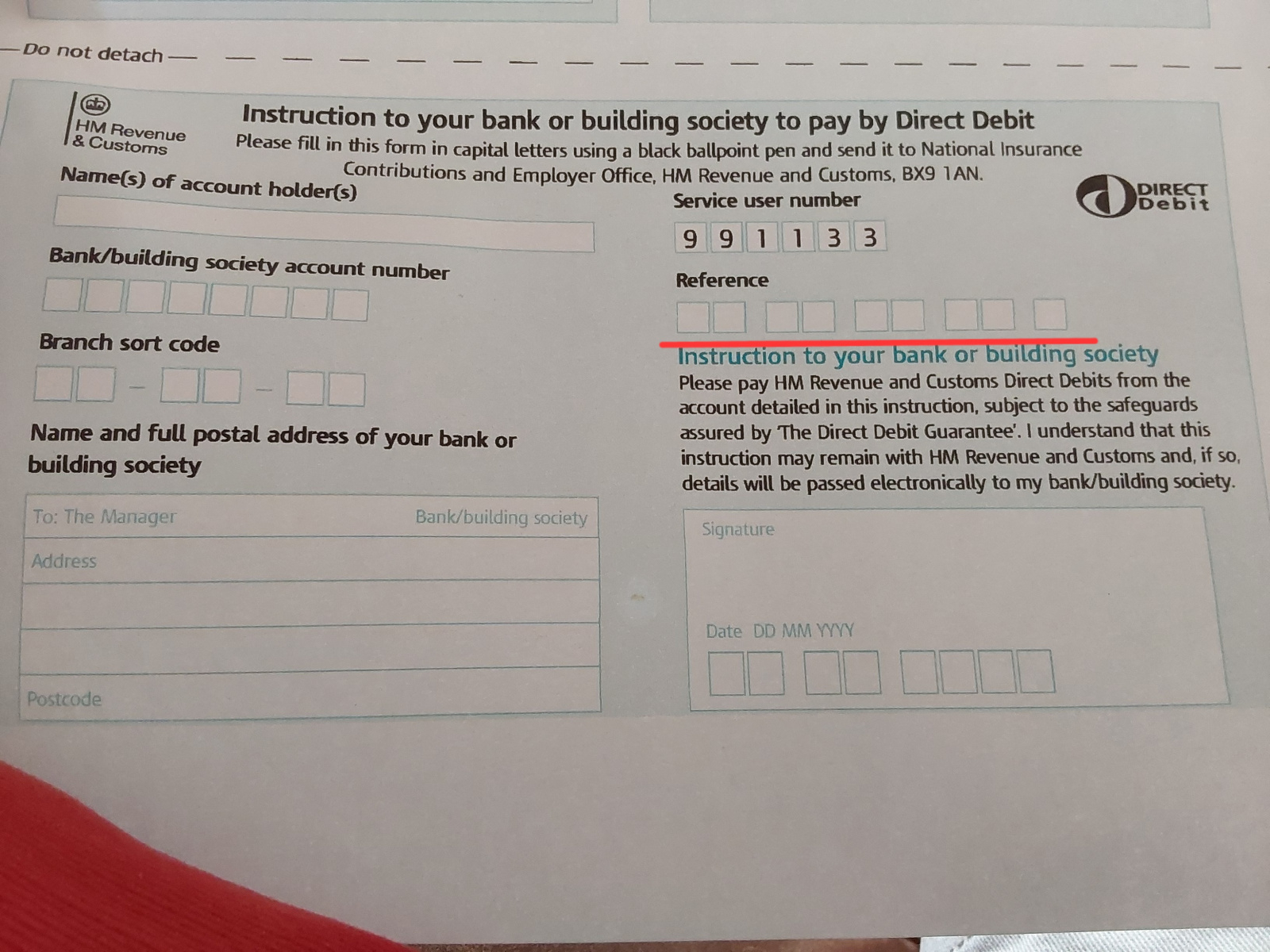

I have the form CA5603. But I want to know what is the reference number need to feel up on the instructions

to the bank to pay by direct debit,

Is the national insurance number? or something else? There are 9 boxes need to fill up.

Thanks 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards