We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Small Business - Understanding Costs

Keeling1985

Posts: 3 Newbie

Hello,

I have recently started my own business and after countless hours on You tube and the web I am just not understanding how this works in terms of margin and VAT. I have a supplier that is giving me a 60% discount off their list price.

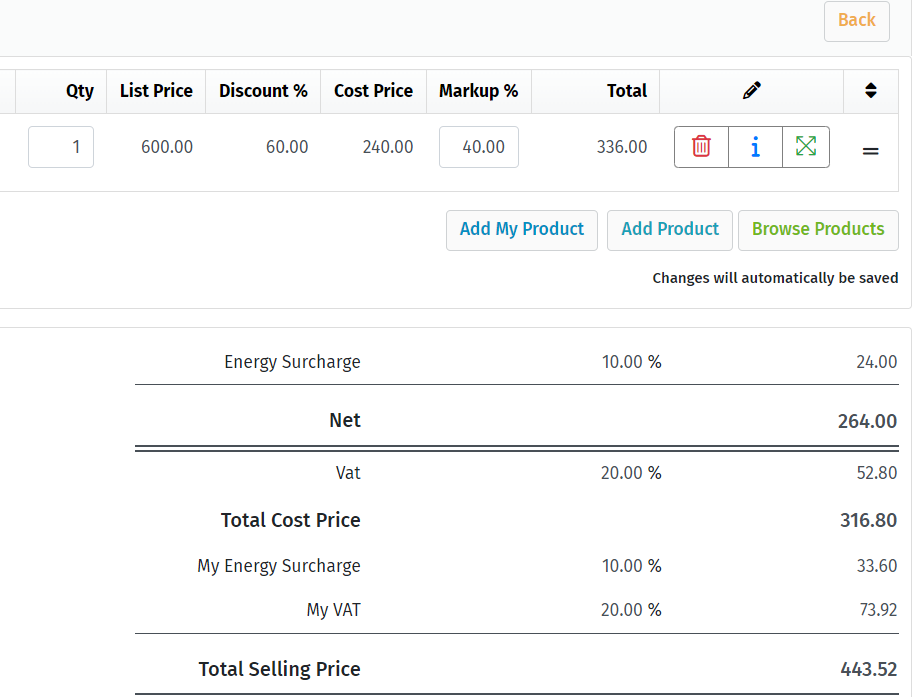

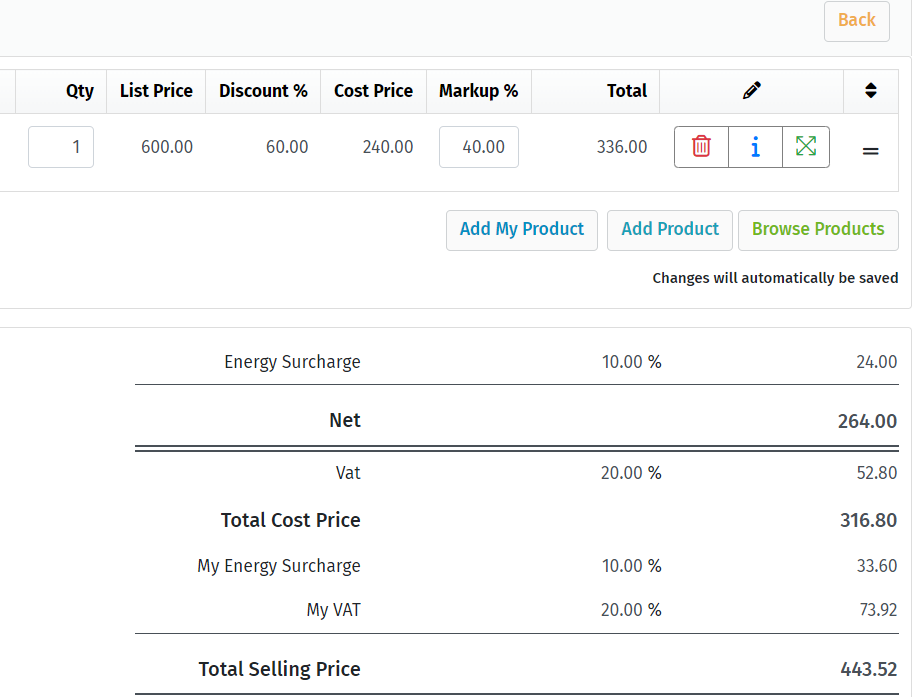

This is a sample of the costings that I see -

So I get the first 3 lines - the energy surcharge, the NET and the VAT they are charging. So my total cost is 316.80 to pay. So then it adds on the energy surcharge and then the VAT on the customers price which is £336+£33.60= 369.60 + VAT = £443.52.

So if someone can correct me if this next bit is wrong that would be great as this is where my headache starts.

How do I work out my PROFIT MARGIN?

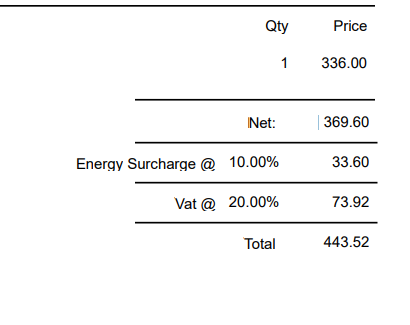

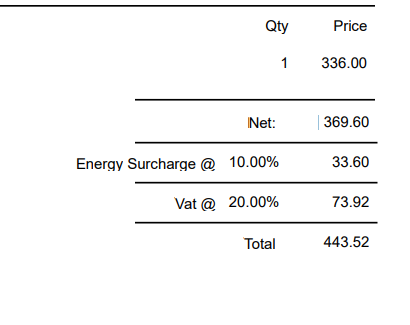

This is the costing that the customers see -

The confusion comes from the customers price as their NET is my total costings including VAT and Energy. Do I take into account that the VAT coming back is part of my margin?

My VAT is £52.80. Customers VAT is £73.92. So £21.12 difference to be paid to HMRC VAT? As you can't charge more VAT than I have paid.

If someone could clear this up for me that would be great. We aren't really in a position yet to get an accountant so the first few orders will need to go through before that happens. But I just want to make sure I am doing the calculations right

Thanks

Lee

I have recently started my own business and after countless hours on You tube and the web I am just not understanding how this works in terms of margin and VAT. I have a supplier that is giving me a 60% discount off their list price.

This is a sample of the costings that I see -

So I get the first 3 lines - the energy surcharge, the NET and the VAT they are charging. So my total cost is 316.80 to pay. So then it adds on the energy surcharge and then the VAT on the customers price which is £336+£33.60= 369.60 + VAT = £443.52.

So if someone can correct me if this next bit is wrong that would be great as this is where my headache starts.

How do I work out my PROFIT MARGIN?

This is the costing that the customers see -

The confusion comes from the customers price as their NET is my total costings including VAT and Energy. Do I take into account that the VAT coming back is part of my margin?

My VAT is £52.80. Customers VAT is £73.92. So £21.12 difference to be paid to HMRC VAT? As you can't charge more VAT than I have paid.

If someone could clear this up for me that would be great. We aren't really in a position yet to get an accountant so the first few orders will need to go through before that happens. But I just want to make sure I am doing the calculations right

Thanks

Lee

0

Comments

-

As you are VAT registered, you pay any difference in VAT to HMRC, so ignore it. You pay £264, you charge £369.60. Your gross profit is £105.80, which is 40%.1

-

Are you VAT registered if you dont have any customers yet?

If you are then you pay the VAT to the supplier and dont charge your customers and so use the gross wholesale price as the basis of your calculations.1 -

Your gross profit margin is your sales - costs divided by your sales. Ignore the VAT because that's a wash in the end so use ex-VAT figures.

Your costs are £264

Your sales are £369.60

Your profit is £105.60

Your margin is about 28.5%

Your markup is (as it says in the box) 40%

1 -

Thanks for all of the replies.

0 -

We registered for VAT as we had quite a lot of outgoings to get setup and was advised that by registering we can get the VAT back on things business related. I am under the impression that by registering and claiming VAT back we are in a position regardless of the 85k threshold to charge VAT when selling? Is this correct?DullGreyGuy said:Are you VAT registered if you dont have any customers yet?

If you are then you pay the VAT to the supplier and dont charge your customers and so use the gross wholesale price as the basis of your calculations.0 -

Yes, once registered for VAT you charge VAT whatever the level of your taxable supplies.3

-

Keeling1985 said:

We registered for VAT as we had quite a lot of outgoings to get setup and was advised that by registering we can get the VAT back on things business related. I am under the impression that by registering and claiming VAT back we are in a position regardless of the 85k threshold to charge VAT when selling? Is this correct?DullGreyGuy said:Are you VAT registered if you dont have any customers yet?

If you are then you pay the VAT to the supplier and dont charge your customers and so use the gross wholesale price as the basis of your calculations.As @Jeremy535897 says, regardless of whether you are above or below the £85k threshold, if you are VAT registered then you have to charge VAT on everything you sell and you can claim back any VAT you pay on valid business purchases. Every time you do a VAT return you then pay or reclaim to/from HMRC the difference between the total VAT you have charged and the total VAT you have paid.So essentially the VAT part of what you charge customers is never really your money, you are just collecting and holding on to it on behalf of HMRC. This is why you ignore VAT for profit purposes as it is a separate line in your accounts on your balance sheet and has nothing to do with your profit and loss account.So, as said, when working out your profit margin simply ignore the VAT and pretend it is zero.

Every generation blames the one before...

Mike + The Mechanics - The Living Years0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards