We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Marcus Savings Account, still worthwhile?

Comments

-

Yes, and they were instantly beaten by Al RayanRG2015 said:

Didn’t they only launch in the UK in September 2018?Band7 said:Goldman Sachs are not having a brilliant time at the moment. I reckon Marcus will now remain an also-run for quite some time to come. I have not kept more than £1 in Marcus since September 2018, when they lost their market leadership.

https://www.cnbc.com/2023/01/20/goldman-sachs-slips-on-report-that-the-fed-is-investigating-its-marcus-business.html

https://www.pymnts.com/news/banking/2021/goldman-planning-2022-uk-launch-of-marcus-app-robo-adviser/

https://www.ft.com/content/9a8e7bde-a6b4-11e8-926a-7342fe5e173f1 -

Fair dos. Market leading and also rans in a matter of days.Band7 said:

Yes, and they were instantly beaten by Al RayanRG2015 said:

Didn’t they only launch in the UK in September 2018?Band7 said:Goldman Sachs are not having a brilliant time at the moment. I reckon Marcus will now remain an also-run for quite some time to come. I have not kept more than £1 in Marcus since September 2018, when they lost their market leadership.

https://www.cnbc.com/2023/01/20/goldman-sachs-slips-on-report-that-the-fed-is-investigating-its-marcus-business.html

https://www.pymnts.com/news/banking/2021/goldman-planning-2022-uk-launch-of-marcus-app-robo-adviser/

https://www.ft.com/content/9a8e7bde-a6b4-11e8-926a-7342fe5e173f0 -

Per the other response, keep £1 in to hold your account open,. then move to a higher rate. I have done the same taking my monies to Cynergy. I did like Marcus as a straight forward access account but end of the day there is no loyalty when it comes to financial services. If Marcus ever becomes market leader again I will move back. Until then that £1 will keep the door open for me.0

-

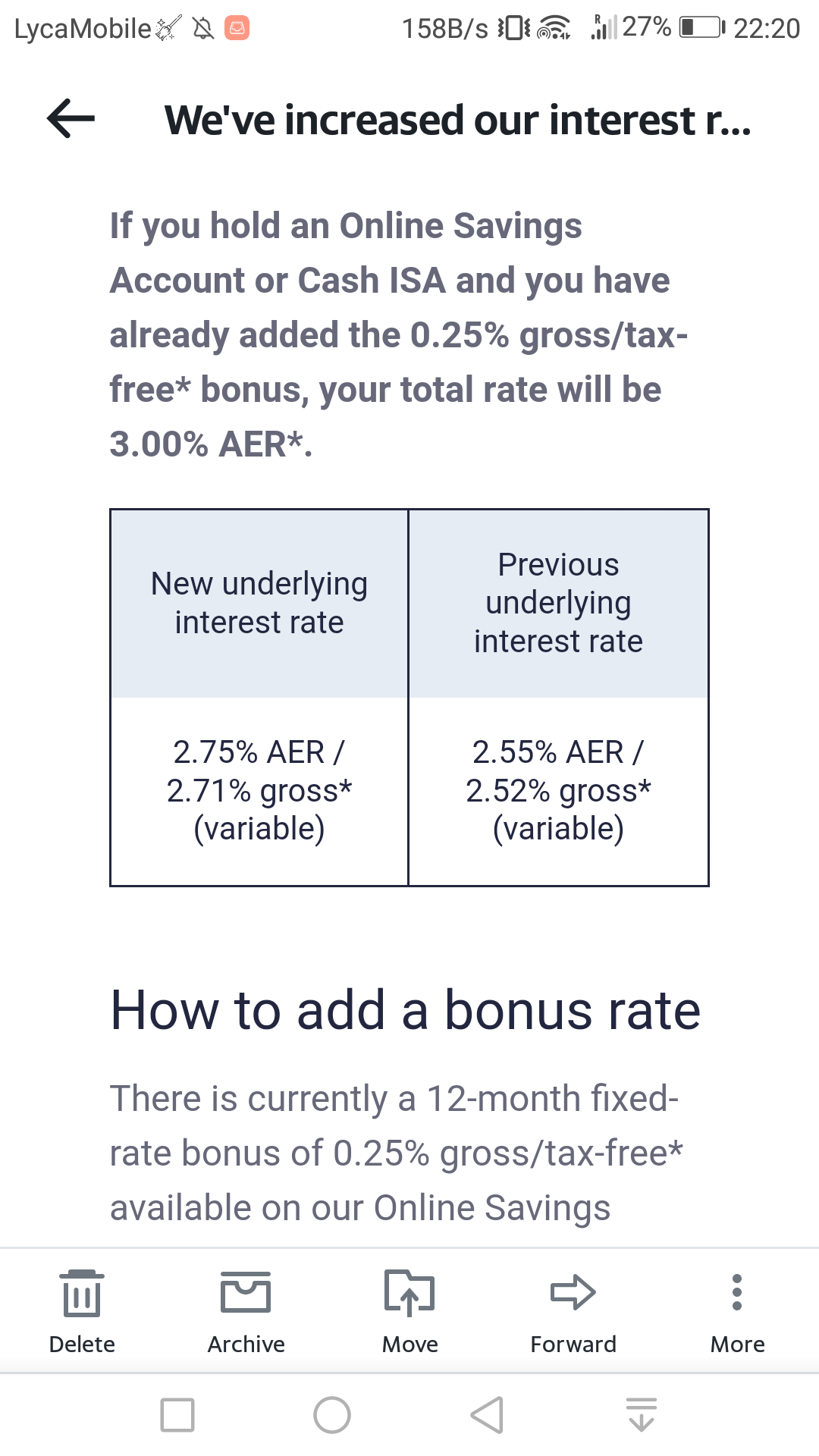

Marcus have a habit of increasing rates 0-2 days before the Bank of England raises rates.

Seems tactical, as they often go to top of best buys (briefly) and get "Marcus raised rates" headlines around time of Bk of England decision. last few changes were 3Aug, 22Sep, 18Oct, 1st Nov, two of those (Aug and Oct) were 1-2 days before widely predicted BoE rate hikes, the September increase was a week after the BoE raised rates.

I would maybe wait, but I honestly don't expect them to be best and I'd personally move my savings to Zopa.0 -

As others have said, I would move your money elsewhere but leave a pound in it just in case.WhoisDannie said:I have a Marcus savings account with a balance of £30,000 with an interest rate of 2.5%.

Is it worthwhile moving it elsewhere or do you think Marcus will increase the interest rate?

Of those currently at the top of the easy access table, my preferences would be for Shawbrook @ 2.92% (if you're happy with 'next-day' withdrawals) or Zopa @ 2.86% (if you're comfortable with app-only banking and would prefer an account that operates much more quickly).0 -

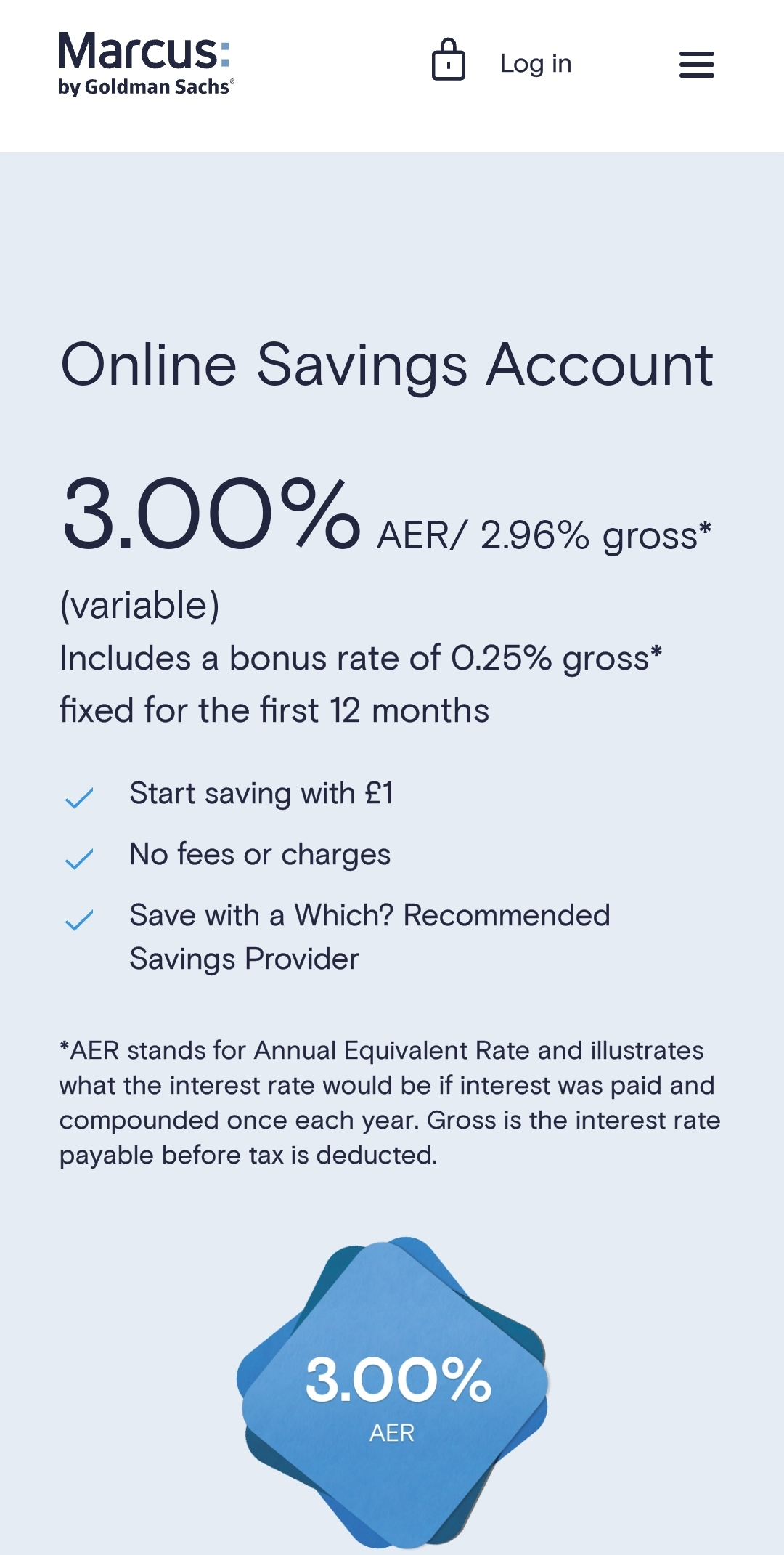

They've just done so again yesterday and are now at 3% including the bonus. That's now 0.25% above Santander's eSaver and the account is starting to look attractive again for those needing to transfer large sums instantly (although these are then subject to the limitations of the linked current account.)cwep2 said:Marcus have a habit of increasing rates 0-2 days before the Bank of England raises rates.

Well it's attractive to me, especially as Santander blocked my internet access for trying to withdraw sums totalling less than £25,000 yesterday (I'm now forced to visit a branch). Does anyone know what the daily withdrawal limit is nowadays for Marcus?

0 -

Unless you want/need a web based provider rather than app only, I’m struggling to see much going for Marcus any more. They have been incredibly slow to raise their rates and still behind many others.1

-

As well as other accounts, I've had a large sum in Marcus for 3 years and I'm glad I left it there.

0 -

I’ve mentioned before that Marcus works well for us because it’s pretty much true instant access, allows joint accounts, and has online banking as well as the app - which works better for MrEH for various reasons. For our Emergency Fund this makes it a decent option - the ability of both of us to get at the money instantly if needed (and more importantly, if something happens to one of us) is vital. For various reasons I also don’t want to risk further hard searches on my file at the moment, so trying to keep to institutions we already have accounts with.Yes - I could get slightly more interest elsewhere, but it’s little enough that we’re happy to stick where we are for the moment.🎉 MORTGAGE FREE (First time!) 30/09/2016 🎉 And now we go again…New mortgage taken 01/09/23 🏡

Balance as at 01/09/23 = £115,000.00 Balance as at 31/12/23 = £112,000.00

Balance as at 31/08/24 = £105,400.00 Balance as at 31/12/24 = £102,500.00

£100k barrier broken 1/4/25

Balance as at 31/08/25 = £ 95,450.00. Balance as at 31/12/25 = £ 91,100.00

SOA CALCULATOR (for DFW newbies): SOA Calculatorshe/her2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards