We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Proposed £100k ISA lifetime limit

Comments

-

That is always the fearmongering that goes along with this. Imagine you could choose to do whatever job you wanted without worrying about money?Their assets stripped and handed out to people who don't want to work? Until nobody still living in the country has that kind of theoretical wealth? It would be problematic for those owning properties that are valued over a few million. I guess the state could always confiscate them.

That would bring more people into the workforce, not less.3 -

Like most, I can't afford to put 20k p.a. of new money into an ISA, earned in the previous 12 months, but every year I do put 20k from expiring fixed rate bonds into ISAs to shelter it from tax.Qyburn said:I wonder what percentage of the adult population are able to make £20K contributions into their ISAs, after living costs and pension contributions. I can't see how that is not disproportionately beneficial to the better off....I wouldn't argue against reducing the annual contribution limit.0 -

The quote expressly mentions focussing to top few percent income individuals and redistribution to those at the bottom. Do you think those at the bottom are in full time work?Anonymous101 said:

Absolutely not. I’m not quite sure why some people always have to bring these types of discussions back to “handouts for the workshy”?Altior said:mebu60 said:

I got told off for calling it a proposal / being proposed rather than a suggestion / being suggested!masonic said:jimjames said:

I agree but it's something the government have in place for pensions with the lifetime allowance and the annual contribution limits so it is technically possible to put something in place. Not suggesting that it is a good idea at all but the limit of £20k per year does seem pretty generous in comparison to other countries.masonic said:In practice this would be a complete nightmare to implement. ISA allowance is effectively dependent on the total you have saved and invested across the ISAs you hold, which for many people will fluctuate from one day to the next.While I wouldn't describe the pension LTA as an elegant solution, it works quite differently than what is being suggested here, and the product is more amenable to such meddling. ISAs are designed to be easy access and don't benefit from tax relief (which conceptually is what is being clawed back by the pensions LTA). All that is being proposed (if I am reading correctly) is to stop people from contributing more cash while they are above £100k across their ISAs, not pierce the tax free wrapper. As part of a major overhaul, where ISA managers moved to live reporting and the annual allowance was centrally controlled in real time, this could be workable, remove the possibility of people making mistakes and oversubscribing, and remove the need for a one ISA of each type rule. Though I doubt there would be a net saving after all of that infrastructure was paid for.Agree that the annual allowance is high and if the lost tax revenue is a concern, it would be better to set this at an appropriate level rather than retaining a situation whereby someone could hit the cap within 5 years.

Agree with what you're saying. Also what Anonymous101 said:

I don't disagree that wealth inequality is a huge issue and requires some careful thought to address. I do feel as though taxing savings or introducing wealth taxes in other ways not only try to treat the symptom rather than the cause but they overly punish those in middle classes which have chosen to save / invest rather than spend. Its as much a lifestyle choice tax as a wealth tax for me which the truly wealthy will avoid - agreed spoke as a relatively comfortable middle class saver.

The focus has to be on taxation of top few percent income individuals and redistribution to those at the bottom. I'm thinking those with nett worth's in the tens of millions and above rather than those with a few hundred grand in an ISA.

It's quite a curious outlook. There will always be individuals at the top with tens of millions of wealth (on paper). So what do people actually want? Their assets stripped and handed out to people who don't want to work? Until nobody still living in the country has that kind of theoretical wealth? It would be problematic for those owning properties that are valued over a few million. I guess the state could always confiscate them.

Its pretty clear to most people that’s there’s a big issue with public service funding in this country. Added to that we’re in a situation where hardworking people on average salaries are struggling to make ends meet. Surely they would be better areas to focus on?

Its really odd to me that you’d think it it unfair that those spending tens of millions on properties they never live in, hundreds of thousands on watches or tens of thousands on a night in a hotel can’t afford to pay more tax somewhere along the line. In fact they probably paid much less tax on that income in the first place.

Perhaps one possible solution would be a tiered taxation system on dividends much like income tax but with higher thresholds?

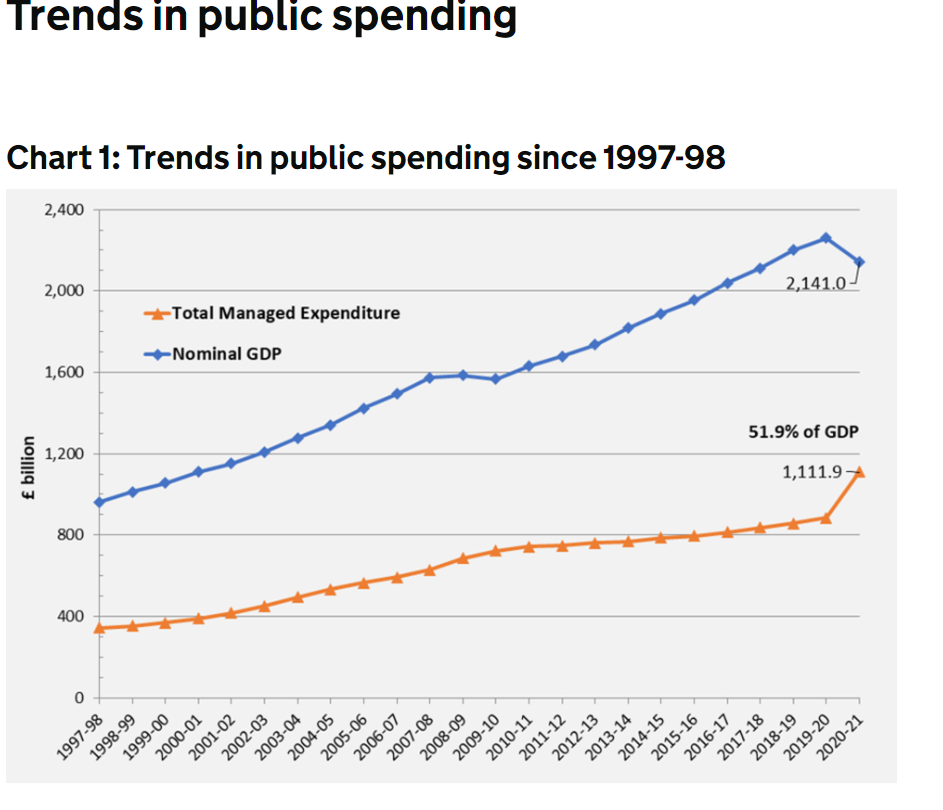

There's a big issue with public spending.

1 -

Just because people can pay more tax, doesn't mean they should. Taxation isn't a punishment. Wealthier people pay far more tax, as the system should encourage success and not penalise it. The Coates family paid an estimated £481.7m in tax for a single year, announced in 2022. Of course, Denise Coates is a very wealthy and successful woman, predominately self made. So she should pay a lot of tax, and does.

I'm not sure I would want to give the government half a billion in just a year, though the opportunity would be quite nice!3 -

I'm not convinced that Denise Coates is a particularly representative example, in that she pays herself a vast salary, in the knowledge that this will attract a correspondingly massive tax bill, whereas most in her shoes would employ accountants and advisers to use more tax-efficient remuneration methods - it's noble of her to willingly pay her full whack but for every one Denise Coates there'll be hundreds or thousands of Jimmy Carrs!Altior said:Just because people can pay more tax, doesn't mean they should. Taxation isn't a punishment. Wealthier people pay far more tax, as the system should encourage success and not penalise it. The Coates family paid an estimated £481.7m in tax for a single year, announced in 2022. Of course, Denise Coates is a very wealthy and successful woman, predominately self made. So she should pay a lot of tax, and does.

I'm not sure I would want to give the government half a billion in just a year, though the opportunity would be quite nice!7 -

A lifetime cap on ISAs isn't the worst idea in principle but £100k across both Cash and S&S ISAs is far too low.1

-

I suspect the annual allowance will reduce at some point (probably by a considerable amount to circa £5k). However I can't see the total amount in an ISA being capped for the reasons already given in this thread.0

-

Or they may come up with something like no new contributions once your ISAs exceed a certain figure. So it's not capped but restricted. But I agree the most likely action, if any, will be a reduction in the annual allowance.khanny09 said:I suspect the annual allowance will reduce at some point (probably by a considerable amount to circa £5k). However I can't see the total amount in an ISA being capped for the reasons already given in this thread.1 -

I'm not saying this is likely, but they could just close ISAs to future contributions. And then replace them with a less advantageous product. One for which you could build in a lifetime limit from the start (which would be impractical to retrofit to existing ISAs).

Even better, from the Treasury's perspective, would be a tax-free savings account that allows you to invest only in UK gilts 0

0 -

NS&I used to offer tax free fixed interest and index linked certificates. They have not been offered for over a decade so the chance of this is minimal.kuratowski said:

Even better, from the Treasury's perspective, would be a tax-free savings account that allows you to invest only in UK gilts 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.6K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.7K Work, Benefits & Business

- 601.6K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards