We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

£23.7K Debt - SOA - Plan Needed

lixhul

Posts: 110 Forumite

It wouldn't let me remove old post. I wanted to start a new one with all the facts.

I'm 32, live alone with mortgage and have a child of 5, whom lives with their mum and I pay CSA. I have a full-time job as a data analyst and have a great opportunity next week to get a major promotion if it works out, and that suggests to be a substantial pay rise. My full energy is on making sure that works out and within 7 days I will know.

Very long and painful story short; I have always been a financially sensible person, saved up over £20,000 in 2019 and purchased a house, followed by a car without any finance. I got hit by the cryto bug, tried a short-cut, and lost over £50,000, £28,000 of borrowed cash within a matter of months. I have paid £0 towards any of these loans for 5 months now, and owe £23,700 overall.

My question is, what's next? I originally had a strong mindset of waiting til the loans are 1 year old to start an IVA (my previous IVA application failed from StepChange for this fact). However, having been on these forums, I have been advised to begin a DMP. Problem I have with a DMP right now is the length and scale of the task, I won't be able to pay much off per month at all and this will last over a decade. Bills are going up fast, and my outgoings will change by around £300 a month soon. My mortgage fixed-rate ends in September, 2025. There is no chance I will get a new fixed-rate with my shot credit rating, so I am looking at paying another £200 extra a month on this alone.

I have had no default notice for any of the loans as of yet. I think the best course of action is to wait til they all default, then start paying off something, somehow.

Please see below my SOA. I have tried to be as honest as possible. What are my options? Mentally I am okay, this is my problem and I plan to fix it, although it has been a huge burden. Even without these debts I'd be struggling with managing my finances.

Slight rant. I am using an income tax calculator, and essentially for every extra £10K I earn from where I am now, I pocket only £5,800. That's just ridiculous and annoying, but I know everyone goes through that.

I'm 32, live alone with mortgage and have a child of 5, whom lives with their mum and I pay CSA. I have a full-time job as a data analyst and have a great opportunity next week to get a major promotion if it works out, and that suggests to be a substantial pay rise. My full energy is on making sure that works out and within 7 days I will know.

Very long and painful story short; I have always been a financially sensible person, saved up over £20,000 in 2019 and purchased a house, followed by a car without any finance. I got hit by the cryto bug, tried a short-cut, and lost over £50,000, £28,000 of borrowed cash within a matter of months. I have paid £0 towards any of these loans for 5 months now, and owe £23,700 overall.

My question is, what's next? I originally had a strong mindset of waiting til the loans are 1 year old to start an IVA (my previous IVA application failed from StepChange for this fact). However, having been on these forums, I have been advised to begin a DMP. Problem I have with a DMP right now is the length and scale of the task, I won't be able to pay much off per month at all and this will last over a decade. Bills are going up fast, and my outgoings will change by around £300 a month soon. My mortgage fixed-rate ends in September, 2025. There is no chance I will get a new fixed-rate with my shot credit rating, so I am looking at paying another £200 extra a month on this alone.

I have had no default notice for any of the loans as of yet. I think the best course of action is to wait til they all default, then start paying off something, somehow.

Please see below my SOA. I have tried to be as honest as possible. What are my options? Mentally I am okay, this is my problem and I plan to fix it, although it has been a huge burden. Even without these debts I'd be struggling with managing my finances.

Slight rant. I am using an income tax calculator, and essentially for every extra £10K I earn from where I am now, I pocket only £5,800. That's just ridiculous and annoying, but I know everyone goes through that.

[tt][b]Statement of Affairs and Personal Balance Sheet[/b][b]

Household Information[/b]

Number of adults in household........... 1

Number of children in household......... 0

Number of cars owned.................... 1[b]

Monthly Income Details[/b]

Monthly income after tax................ 1605.46

Partners monthly income after tax....... 0

Benefits................................ 0

Other income............................ 0[b]

Total monthly income.................... 1605.46[/b][b]

Monthly Expense Details[/b]

Mortgage................................ 350.4

Secured/HP loan repayments.............. 0

Rent.................................... 0

Management charge (leasehold property).. 0

Council tax............................. 86

Electricity............................. 50

Gas..................................... 50

Oil..................................... 0

Water rates............................. 18

Telephone (land line)................... 0

Mobile phone............................ 7

TV Licence.............................. 0

Satellite/Cable TV...................... 0

Internet Services....................... 28

Groceries etc. ......................... 220

Clothing................................ 10

Petrol/diesel........................... 120

Road tax................................ 2

Car Insurance........................... 29

Car maintenance (including MOT)......... 20

Car parking............................. 0

Other travel............................ 0

Childcare/nursery....................... 0

Other child related expenses............ 210

Medical (prescriptions, dentist etc).... 0

Pet insurance/vet bills................. 0

Buildings insurance..................... 13

Contents insurance...................... 0

Life assurance ......................... 0

Other insurance......................... 0

Presents (birthday, christmas etc)...... 15

Haircuts................................ 15

Entertainment........................... 0

Holiday................................. 0

Emergency fund.......................... 0

Gym..................................... 16[b]

Total monthly expenses.................. 1259.4[/b]

[b]

Assets[/b]

Cash.................................... 1400

House value (Gross)..................... 140000

Shares and bonds........................ 0

Car(s).................................. 7000

Other assets............................ 3000[b]

Total Assets............................ 151400[/b]

[b]

Secured & HP Debts[/b]

Description....................Debt......Monthly...APR

Mortgage...................... 98361....(350.4)....0[b]

Total secured & HP debts...... 98361.....-.........- [/b]

[b]Unsecured Debts[/b]

Description....................Debt......Monthly...APR

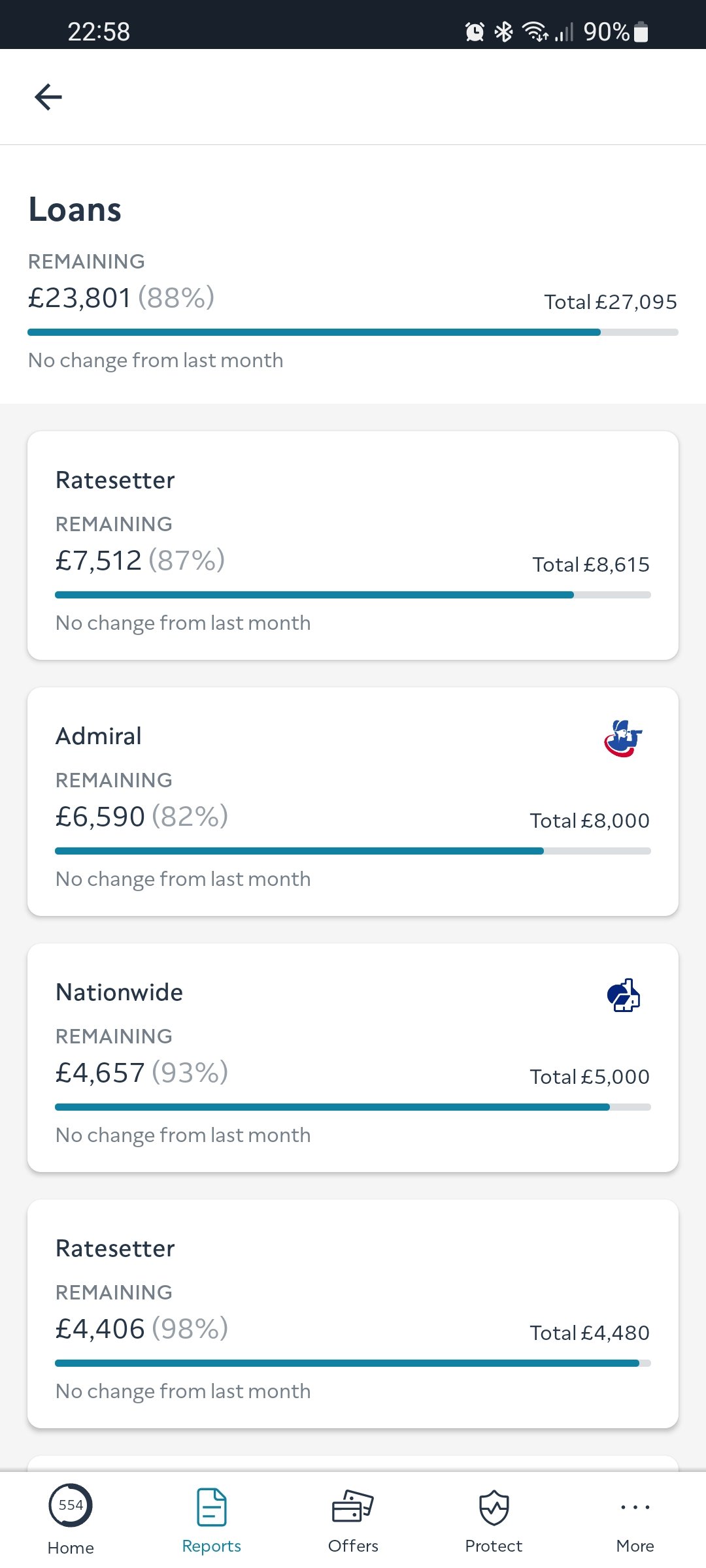

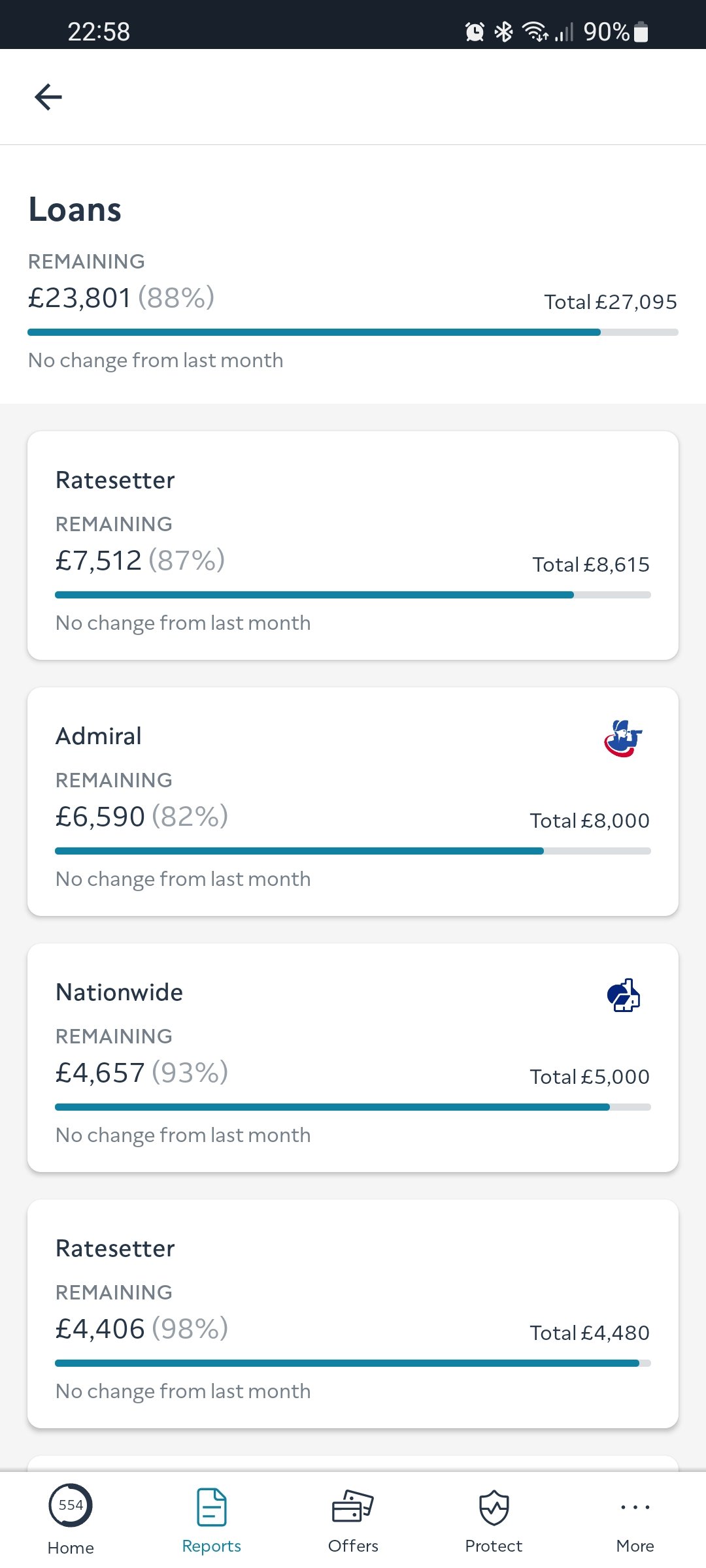

Ratesetter 1...................7512......0.........0

Ratesetter 2...................4406......0.........0

Admiral Loan...................6590......0.........0

Nationwide 2...................636.......0.........0

Nationwide 1...................4657......0.........0[b]

Total unsecured debts..........23801.....0.........- [/b]

[b]

Monthly Budget Summary[/b]

Total monthly income.................... 1,605.46

Expenses (including HP & secured debts). 1,259.4

Available for debt repayments........... 346.06

Monthly UNsecured debt repayments....... 0[b]

Amount left after debt repayments....... 346.06[/b]

[b]Personal Balance Sheet Summary[/b]

Total assets (things you own)........... 151,400

Total HP & Secured debt................. -98,361

Total Unsecured debt.................... -23,801[b]

Net Assets.............................. 29,238[/b]

[i][/i][/tt]

0

Comments

-

Until you are on roughly £50k, you'll gain £6,800 for every £10k. In theory, at least, the other £3,200 goes towards your healthcare, the roads you drive on, your state pension etc. As you are at the lower end of earnings, it would probably be a lot more expensive if you had to pay for those by yourself, without pooling your money with those who pay more tax and NI.

In terms of your SOA, your food bill is high, have you tried the downshift challenge?Statement of Affairs (SOA) link: https://www.lemonfool.co.uk/financecalculators/soa.phpFor free, non-judgemental debt advice, try: Stepchange or National Debtline. Beware fee charging companies with similar names.3 -

Right what is happening to the £300 plus surplus you are showing?

My guess is it disappears.

Food you need to work on many people on here live on much less than that.

Look on this board. Old style MoneySaving — MoneySavingExpert Forum

I guess you buy food out, sandwiches, coffee etc. That has to stop, that is where money disappears.

£23.000 is not a huge amount of debt, with careful budgeting and determination you will find you can clear it.

Don't panic and get your head down and set yourself small goals, you will get there.If you go down to the woods today you better not go alone.2 -

[tt][b]Statement of Affairs and Personal Balance Sheet[/b][b]Household Information[/b]Number of adults in household........... 1Number of children in household......... 0Number of cars owned.................... 1[b]Monthly Income Details[/b]Monthly income after tax................ 1605.46Partners monthly income after tax....... 0Benefits................................ 0Other income............................ 0[b]Total monthly income.................... 1605.46[/b][b]Monthly Expense Details[/b]Mortgage................................ 350.4 Compared to your earnings this is at a really good level.Secured/HP loan repayments.............. 0Rent.................................... 0Management charge (leasehold property).. 0Council tax............................. 86 This allows for the single person's discount? Do you pay over 10 months, or 12?Electricity............................. 50 Check that this and the gas are correct - I assume you pay a straight £100 a month to a single provider? It appears a little low. Make sure you give regular meter readings if you're not on smart meter, and check what the SM is sending if you are. Also budget for an extra £20 per month from April, just in case.Gas..................................... 50Oil..................................... 0Water rates............................. 18 clearly metered - so consider whether there are any savings to be had here.Telephone (land line)................... 0Mobile phone............................ 7 Great stuff - well done!TV Licence.............................. 0 You never watch live TV, or record it? Or use iPlayer?Satellite/Cable TV...................... 0Internet Services....................... 28 Depending on your area this is possibly a little high - might be worth shopping aroundGroceries etc. ......................... 220 Probably a little high for a single person, the Old Style board might be useful for ideas of how to bring this down.Clothing................................ 10Petrol/diesel........................... 120Road tax................................ 2 Just to check - you're not paying this monthly are you? There is a premium for doing so, which is why I ask.Car Insurance........................... 29Car maintenance (including MOT)......... 20Car parking............................. 0Other travel............................ 0Childcare/nursery....................... 0Other child related expenses............ 210Medical (prescriptions, dentist etc).... 0Pet insurance/vet bills................. 0Buildings insurance..................... 13 Does this include contents too? If not then you need to sort that out fast.Contents insurance...................... 0 See above - this is important.Life assurance ......................... 0Other insurance......................... 0Presents (birthday, christmas etc)...... 15 Does this actually cover what you spend, for your child, close family, any friends you buy for? It seems on the low side.Haircuts................................ 15Entertainment........................... 0 Nope - not realistic. You never grab a coffee, buy a magazine, meet a friend for drinks or a meal?Holiday................................. 0 No weekends away even, visits to family, that sort of thing?Emergency fund.......................... 0 You need to start budgeting for savings here. (And actually MAKE those savings!)Gym..................................... 16 Extract every last penny of value out of this - for example, always shower while there to save water and energy at home.[b]Total monthly expenses.................. 1259.4[/b][b]Assets[/b]Cash.................................... 1400House value (Gross)..................... 140000Shares and bonds........................ 0Car(s).................................. 7000Other assets............................ 3000[b]Total Assets............................ 151400[/b][b]Secured & HP Debts[/b]Description....................Debt......Monthly...APRMortgage...................... 98361....(350.4)....0[b]Total secured & HP debts...... 98361.....-.........- [/b][b]Unsecured Debts[/b]Description....................Debt......Monthly...APRRatesetter 1...................7512......0.........0Ratesetter 2...................4406......0.........0Admiral Loan...................6590......0.........0Nationwide 2...................636.......0.........0Nationwide 1...................4657......0.........0[b]Total unsecured debts..........23801.....0.........- [/b] So to check, you're paying nothing to any of these at the moment, so they should default soon?[b]Monthly Budget Summary[/b]Total monthly income.................... 1,605.46Expenses (including HP & secured debts). 1,259.4Available for debt repayments........... 346.06Monthly UNsecured debt repayments....... 0[b]Amount left after debt repayments....... 346.06[/b][b]Personal Balance Sheet Summary[/b]Total assets (things you own)........... 151,400Total HP & Secured debt................. -98,361Total Unsecured debt.................... -23,801[b]Net Assets.............................. 29,238[/b][i][/i][/tt]

Right - let's take a look at the SOA then. Comments in bold as usual.

Things not to worry about right now -

Your "shot credit rating" - just ignore it - the only person who sees the number is you, and the only thing it has any relevance for is a new mortgage. I'll come on to why that's less of an issue than you think.

Your mortgage deal ending in 2025. Park that one for now - that's two whole years away, and right now none of us know where rates will be then. You have our permission to start worrying about that again in a year ...however...

...however...

Not being able to get a new fixed deal when your current mortgage deal ends. What on earth makes you think that? It just means your choice is limited to products offered by your existing lender - and presumably you chose them because they suited your profile, so hopefully they still will. You MIGHT have increased costs, sure, but then again a) you might not, and b) you might be earning more by then.

How long a DMP might take - sure, it might, but then again it might not. the main thing is that you are tackling your debts without making further huge impacts on your credit file, and without putting your home at risk in any way.

Things not to do:

Gamble any more - at all. Not a lottery ticket, not a cheeky £5 each way on the grand national, nothing. You need to accept that you have the sort of mindset that means you will always be tempted to chase one more more chance - and the only way of avoiding that risk it to never put yourself in that position. It's easy to think that "Oh but I'm not like the poor fools who lose thousands on the horses, or in casinos" but actually there's not so much difference, when you think about it. Learn that lesson now, before things get worse.

Be tempted to consolidate. You need to go through this process I think - as that is the only way you will come out of the other side most likely to never find yourself there again. You can't borrow your way out of debt.

Rush into an insolvency "solution" like an IVA - it might seem easier, but it very likely won't be.

Next thing then - do you have that £346 a month surplus each month? If not then you need to find out why - and it will be because there is something - or things - not included on that SOA, or that you are overspending in one area or another. A spending diary might well help as it will let you track everything you really do spend.

If you do have that surplus, then target £50 of it to building your emergency fund - this is vital. The balance gets split between the debts.

I'm going to assume that there is a chance that you might have a bank account with Nationwide? If so - then you need to open a basic account with a different bank - one you have no debts with - although the SOA suggests that the only bank (building society) that you DO owe money to is Nationwide anyway.

That's some starting points - others will be able to offer more structured advice specifically in the area of the DMP, and may well spot things in the SOA that I've missed too.

Hopefully starting to take some positive action on this will enable another "thing not to do" - namely being up at 3am worrying about your debts.

🎉 MORTGAGE FREE (First time!) 30/09/2016 🎉 And now we go again…New mortgage taken 01/09/23 🏡

Balance as at 01/09/23 = £115,000.00 Balance as at 31/12/23 = £112,000.00

Balance as at 31/08/24 = £105,400.00 Balance as at 31/12/24 = £102,500.00

£100k barrier broken 1/4/25

Balance as at 31/08/25 = £ 95,450.00. Balance as at 31/12/25 = £ 91,100.00

SOA CALCULATOR (for DFW newbies): SOA Calculatorshe/her4 -

It sounds like you have been through a difficult financial situation. It's understandable that you want to start fresh with a new post and all the facts.Based on the information you provided, it seems like you are in a challenging financial situation. You have a significant amount of debt, and your expenses are about to increase. You also mention that your credit rating has been affected, which could make it difficult to secure a new fixed-rate mortgage.One option you have is to wait until the loans default, and then start paying off something, somehow. However, this strategy could result in a negative impact on your credit rating and legal action from the creditors.Another option is to consider a debt management plan (DMP). A DMP is a repayment plan where you make affordable monthly payments to your creditors, over a period of time, usually between 3 to 5 years. However, you mention that the length and scale of this task could be a burden, and that your income will change soon.You also mention an IVA(Individual Voluntary Arrangement) as an option, but it seems that your previous application failed. An IVA is a legally binding agreement between you and your creditors, which allows you to make reduced payments over a period of time, usually 5 to 6 years. However, it's important to note that an IVA can have a negative impact on your credit rating, and it may not be suitable for everyone.It's important that you seek professional advice from a qualified financial advisor or a debt charity like StepChange, National Debtline, or Citizens Advice, to help you understand your options and find a solution that works for you. They can help you to evaluate your current financial situation, and provide you with the guidance and support you need to move forward.It's important to remember that this is a difficult situation, but there are ways to move forward, and you have the determination to fix it. You have a great opportunity for a major promotion and substantial pay rise. It may be a good idea to focus on that and use that opportunity to improve your financial situation.-1

-

EssexHebridean said:[tt][b]Statement of Affairs and Personal Balance Sheet[/b][b]Household Information[/b]Number of adults in household........... 1Number of children in household......... 0Number of cars owned.................... 1[b]Monthly Income Details[/b]Monthly income after tax................ 1605.46Partners monthly income after tax....... 0Benefits................................ 0Other income............................ 0[b]Total monthly income.................... 1605.46[/b][b]Monthly Expense Details[/b]Mortgage................................ 350.4 Compared to your earnings this is at a really good level.Secured/HP loan repayments.............. 0Rent.................................... 0Management charge (leasehold property).. 0Council tax............................. 86 This allows for the single person's discount? Do you pay over 10 months, or 12?Electricity............................. 50 Check that this and the gas are correct - I assume you pay a straight £100 a month to a single provider? It appears a little low. Make sure you give regular meter readings if you're not on smart meter, and check what the SM is sending if you are. Also budget for an extra £20 per month from April, just in case.Gas..................................... 50Oil..................................... 0Water rates............................. 18 clearly metered - so consider whether there are any savings to be had here.Telephone (land line)................... 0Mobile phone............................ 7 Great stuff - well done!TV Licence.............................. 0 You never watch live TV, or record it? Or use iPlayer?Satellite/Cable TV...................... 0Internet Services....................... 28 Depending on your area this is possibly a little high - might be worth shopping aroundGroceries etc. ......................... 220 Probably a little high for a single person, the Old Style board might be useful for ideas of how to bring this down.Clothing................................ 10Petrol/diesel........................... 120Road tax................................ 2 Just to check - you're not paying this monthly are you? There is a premium for doing so, which is why I ask.Car Insurance........................... 29Car maintenance (including MOT)......... 20Car parking............................. 0Other travel............................ 0Childcare/nursery....................... 0Other child related expenses............ 210Medical (prescriptions, dentist etc).... 0Pet insurance/vet bills................. 0Buildings insurance..................... 13 Does this include contents too? If not then you need to sort that out fast.Contents insurance...................... 0 See above - this is important.Life assurance ......................... 0Other insurance......................... 0Presents (birthday, christmas etc)...... 15 Does this actually cover what you spend, for your child, close family, any friends you buy for? It seems on the low side.Haircuts................................ 15Entertainment........................... 0 Nope - not realistic. You never grab a coffee, buy a magazine, meet a friend for drinks or a meal?Holiday................................. 0 No weekends away even, visits to family, that sort of thing?Emergency fund.......................... 0 You need to start budgeting for savings here. (And actually MAKE those savings!)Gym..................................... 16 Extract every last penny of value out of this - for example, always shower while there to save water and energy at home.[b]Total monthly expenses.................. 1259.4[/b][b]Assets[/b]Cash.................................... 1400House value (Gross)..................... 140000Shares and bonds........................ 0Car(s).................................. 7000Other assets............................ 3000[b]Total Assets............................ 151400[/b][b]Secured & HP Debts[/b]Description....................Debt......Monthly...APRMortgage...................... 98361....(350.4)....0[b]Total secured & HP debts...... 98361.....-.........- [/b][b]Unsecured Debts[/b]Description....................Debt......Monthly...APRRatesetter 1...................7512......0.........0Ratesetter 2...................4406......0.........0Admiral Loan...................6590......0.........0Nationwide 2...................636.......0.........0Nationwide 1...................4657......0.........0[b]Total unsecured debts..........23801.....0.........- [/b] So to check, you're paying nothing to any of these at the moment, so they should default soon?[b]Monthly Budget Summary[/b]Total monthly income.................... 1,605.46Expenses (including HP & secured debts). 1,259.4Available for debt repayments........... 346.06Monthly UNsecured debt repayments....... 0[b]Amount left after debt repayments....... 346.06[/b][b]Personal Balance Sheet Summary[/b]Total assets (things you own)........... 151,400Total HP & Secured debt................. -98,361Total Unsecured debt.................... -23,801[b]Net Assets.............................. 29,238[/b][i][/i][/tt]

Right - let's take a look at the SOA then. Comments in bold as usual.

Things not to worry about right now -

Your "shot credit rating" - just ignore it - the only person who sees the number is you, and the only thing it has any relevance for is a new mortgage. I'll come on to why that's less of an issue than you think.

Your mortgage deal ending in 2025. Park that one for now - that's two whole years away, and right now none of us know where rates will be then. You have our permission to start worrying about that again in a year ...however...

...however...

Not being able to get a new fixed deal when your current mortgage deal ends. What on earth makes you think that? It just means your choice is limited to products offered by your existing lender - and presumably you chose them because they suited your profile, so hopefully they still will. You MIGHT have increased costs, sure, but then again a) you might not, and b) you might be earning more by then.

How long a DMP might take - sure, it might, but then again it might not. the main thing is that you are tackling your debts without making further huge impacts on your credit file, and without putting your home at risk in any way.

Things not to do:

Gamble any more - at all. Not a lottery ticket, not a cheeky £5 each way on the grand national, nothing. You need to accept that you have the sort of mindset that means you will always be tempted to chase one more more chance - and the only way of avoiding that risk it to never put yourself in that position. It's easy to think that "Oh but I'm not like the poor fools who lose thousands on the horses, or in casinos" but actually there's not so much difference, when you think about it. Learn that lesson now, before things get worse.

Be tempted to consolidate. You need to go through this process I think - as that is the only way you will come out of the other side most likely to never find yourself there again. You can't borrow your way out of debt.

Rush into an insolvency "solution" like an IVA - it might seem easier, but it very likely won't be.

Next thing then - do you have that £346 a month surplus each month? If not then you need to find out why - and it will be because there is something - or things - not included on that SOA, or that you are overspending in one area or another. A spending diary might well help as it will let you track everything you really do spend.

If you do have that surplus, then target £50 of it to building your emergency fund - this is vital. The balance gets split between the debts.

I'm going to assume that there is a chance that you might have a bank account with Nationwide? If so - then you need to open a basic account with a different bank - one you have no debts with - although the SOA suggests that the only bank (building society) that you DO owe money to is Nationwide anyway.

That's some starting points - others will be able to offer more structured advice specifically in the area of the DMP, and may well spot things in the SOA that I've missed too.

Hopefully starting to take some positive action on this will enable another "thing not to do" - namely being up at 3am worrying about your debts. While you have offered some useful suggestions, it's important to note that seeking professional advice from a qualified financial advisor or a debt charity is crucial in order to fully understand all options available and find a solution that is tailored to his specific financial situation.A financial advisor can provide a comprehensive analysis of his finances, including his income, expenses, assets and debts. They can help him understand the pros and cons of different debt solutions, such as a debt management plan (DMP) or an Individual Voluntary Arrangement (IVA), and provide guidance on which option is most suitable for him. They can also provide support and advice on budgeting, saving, and managing his money to help him avoid future financial difficulties.It's also important to keep in mind that the credit rating is not something to be taken lightly, as it can affect his ability to secure new credit or loans in the future. A financial advisor can help him understand how his credit rating is affected by different debt solutions and provide guidance on how to improve it over time.Additionally, consolidating debt can be a viable option for some individuals, and should be evaluated by a professional.In summary, while your suggestions are helpful, it's important to seek professional advice to fully understand all options available and find a solution that is tailored to his specific financial situation.-2

While you have offered some useful suggestions, it's important to note that seeking professional advice from a qualified financial advisor or a debt charity is crucial in order to fully understand all options available and find a solution that is tailored to his specific financial situation.A financial advisor can provide a comprehensive analysis of his finances, including his income, expenses, assets and debts. They can help him understand the pros and cons of different debt solutions, such as a debt management plan (DMP) or an Individual Voluntary Arrangement (IVA), and provide guidance on which option is most suitable for him. They can also provide support and advice on budgeting, saving, and managing his money to help him avoid future financial difficulties.It's also important to keep in mind that the credit rating is not something to be taken lightly, as it can affect his ability to secure new credit or loans in the future. A financial advisor can help him understand how his credit rating is affected by different debt solutions and provide guidance on how to improve it over time.Additionally, consolidating debt can be a viable option for some individuals, and should be evaluated by a professional.In summary, while your suggestions are helpful, it's important to seek professional advice to fully understand all options available and find a solution that is tailored to his specific financial situation.-2 -

You're slightly missing the point of this forum.easyeconomicmaster said:In summary, while your suggestions are helpful, it's important to seek professional advice to fully understand all options available and find a solution that is tailored to his specific financial situation.

Hang around and keep reading and let's see you get to 16000 posts19 -

From the top of the forum....We're a friendly community of MoneySavers sharing our experiences and tips to help each other outeasyeconomicmaster said:EssexHebridean said:[tt][b]Statement of Affairs and Personal Balance Sheet[/b][b]Household Information[/b]Number of adults in household........... 1Number of children in household......... 0Number of cars owned.................... 1[b]Monthly Income Details[/b]Monthly income after tax................ 1605.46Partners monthly income after tax....... 0Benefits................................ 0Other income............................ 0[b]Total monthly income.................... 1605.46[/b][b]Monthly Expense Details[/b]Mortgage................................ 350.4 Compared to your earnings this is at a really good level.Secured/HP loan repayments.............. 0Rent.................................... 0Management charge (leasehold property).. 0Council tax............................. 86 This allows for the single person's discount? Do you pay over 10 months, or 12?Electricity............................. 50 Check that this and the gas are correct - I assume you pay a straight £100 a month to a single provider? It appears a little low. Make sure you give regular meter readings if you're not on smart meter, and check what the SM is sending if you are. Also budget for an extra £20 per month from April, just in case.Gas..................................... 50Oil..................................... 0Water rates............................. 18 clearly metered - so consider whether there are any savings to be had here.Telephone (land line)................... 0Mobile phone............................ 7 Great stuff - well done!TV Licence.............................. 0 You never watch live TV, or record it? Or use iPlayer?Satellite/Cable TV...................... 0Internet Services....................... 28 Depending on your area this is possibly a little high - might be worth shopping aroundGroceries etc. ......................... 220 Probably a little high for a single person, the Old Style board might be useful for ideas of how to bring this down.Clothing................................ 10Petrol/diesel........................... 120Road tax................................ 2 Just to check - you're not paying this monthly are you? There is a premium for doing so, which is why I ask.Car Insurance........................... 29Car maintenance (including MOT)......... 20Car parking............................. 0Other travel............................ 0Childcare/nursery....................... 0Other child related expenses............ 210Medical (prescriptions, dentist etc).... 0Pet insurance/vet bills................. 0Buildings insurance..................... 13 Does this include contents too? If not then you need to sort that out fast.Contents insurance...................... 0 See above - this is important.Life assurance ......................... 0Other insurance......................... 0Presents (birthday, christmas etc)...... 15 Does this actually cover what you spend, for your child, close family, any friends you buy for? It seems on the low side.Haircuts................................ 15Entertainment........................... 0 Nope - not realistic. You never grab a coffee, buy a magazine, meet a friend for drinks or a meal?Holiday................................. 0 No weekends away even, visits to family, that sort of thing?Emergency fund.......................... 0 You need to start budgeting for savings here. (And actually MAKE those savings!)Gym..................................... 16 Extract every last penny of value out of this - for example, always shower while there to save water and energy at home.[b]Total monthly expenses.................. 1259.4[/b][b]Assets[/b]Cash.................................... 1400House value (Gross)..................... 140000Shares and bonds........................ 0Car(s).................................. 7000Other assets............................ 3000[b]Total Assets............................ 151400[/b][b]Secured & HP Debts[/b]Description....................Debt......Monthly...APRMortgage...................... 98361....(350.4)....0[b]Total secured & HP debts...... 98361.....-.........- [/b][b]Unsecured Debts[/b]Description....................Debt......Monthly...APRRatesetter 1...................7512......0.........0Ratesetter 2...................4406......0.........0Admiral Loan...................6590......0.........0Nationwide 2...................636.......0.........0Nationwide 1...................4657......0.........0[b]Total unsecured debts..........23801.....0.........- [/b] So to check, you're paying nothing to any of these at the moment, so they should default soon?[b]Monthly Budget Summary[/b]Total monthly income.................... 1,605.46Expenses (including HP & secured debts). 1,259.4Available for debt repayments........... 346.06Monthly UNsecured debt repayments....... 0[b]Amount left after debt repayments....... 346.06[/b][b]Personal Balance Sheet Summary[/b]Total assets (things you own)........... 151,400Total HP & Secured debt................. -98,361Total Unsecured debt.................... -23,801[b]Net Assets.............................. 29,238[/b][i][/i][/tt]

Right - let's take a look at the SOA then. Comments in bold as usual.

Things not to worry about right now -

Your "shot credit rating" - just ignore it - the only person who sees the number is you, and the only thing it has any relevance for is a new mortgage. I'll come on to why that's less of an issue than you think.

Your mortgage deal ending in 2025. Park that one for now - that's two whole years away, and right now none of us know where rates will be then. You have our permission to start worrying about that again in a year ...however...

...however...

Not being able to get a new fixed deal when your current mortgage deal ends. What on earth makes you think that? It just means your choice is limited to products offered by your existing lender - and presumably you chose them because they suited your profile, so hopefully they still will. You MIGHT have increased costs, sure, but then again a) you might not, and b) you might be earning more by then.

How long a DMP might take - sure, it might, but then again it might not. the main thing is that you are tackling your debts without making further huge impacts on your credit file, and without putting your home at risk in any way.

Things not to do:

Gamble any more - at all. Not a lottery ticket, not a cheeky £5 each way on the grand national, nothing. You need to accept that you have the sort of mindset that means you will always be tempted to chase one more more chance - and the only way of avoiding that risk it to never put yourself in that position. It's easy to think that "Oh but I'm not like the poor fools who lose thousands on the horses, or in casinos" but actually there's not so much difference, when you think about it. Learn that lesson now, before things get worse.

Be tempted to consolidate. You need to go through this process I think - as that is the only way you will come out of the other side most likely to never find yourself there again. You can't borrow your way out of debt.

Rush into an insolvency "solution" like an IVA - it might seem easier, but it very likely won't be.

Next thing then - do you have that £346 a month surplus each month? If not then you need to find out why - and it will be because there is something - or things - not included on that SOA, or that you are overspending in one area or another. A spending diary might well help as it will let you track everything you really do spend.

If you do have that surplus, then target £50 of it to building your emergency fund - this is vital. The balance gets split between the debts.

I'm going to assume that there is a chance that you might have a bank account with Nationwide? If so - then you need to open a basic account with a different bank - one you have no debts with - although the SOA suggests that the only bank (building society) that you DO owe money to is Nationwide anyway.

That's some starting points - others will be able to offer more structured advice specifically in the area of the DMP, and may well spot things in the SOA that I've missed too.

Hopefully starting to take some positive action on this will enable another "thing not to do" - namely being up at 3am worrying about your debts. While you have offered some useful suggestions, it's important to note that seeking professional advice from a qualified financial advisor or a debt charity is crucial in order to fully understand all options available and find a solution that is tailored to his specific financial situation.A financial advisor can provide a comprehensive analysis of his finances, including his income, expenses, assets and debts. They can help him understand the pros and cons of different debt solutions, such as a debt management plan (DMP) or an Individual Voluntary Arrangement (IVA), and provide guidance on which option is most suitable for him. They can also provide support and advice on budgeting, saving, and managing his money to help him avoid future financial difficulties.It's also important to keep in mind that the credit rating is not something to be taken lightly, as it can affect his ability to secure new credit or loans in the future. A financial advisor can help him understand how his credit rating is affected by different debt solutions and provide guidance on how to improve it over time.Additionally, consolidating debt can be a viable option for some individuals, and should be evaluated by a professional.In summary, while your suggestions are helpful, it's important to seek professional advice to fully understand all options available and find a solution that is tailored to his specific financial situation.

While you have offered some useful suggestions, it's important to note that seeking professional advice from a qualified financial advisor or a debt charity is crucial in order to fully understand all options available and find a solution that is tailored to his specific financial situation.A financial advisor can provide a comprehensive analysis of his finances, including his income, expenses, assets and debts. They can help him understand the pros and cons of different debt solutions, such as a debt management plan (DMP) or an Individual Voluntary Arrangement (IVA), and provide guidance on which option is most suitable for him. They can also provide support and advice on budgeting, saving, and managing his money to help him avoid future financial difficulties.It's also important to keep in mind that the credit rating is not something to be taken lightly, as it can affect his ability to secure new credit or loans in the future. A financial advisor can help him understand how his credit rating is affected by different debt solutions and provide guidance on how to improve it over time.Additionally, consolidating debt can be a viable option for some individuals, and should be evaluated by a professional.In summary, while your suggestions are helpful, it's important to seek professional advice to fully understand all options available and find a solution that is tailored to his specific financial situation.

Also, we advise people to only seek free debt advice.1 -

Goodness me, that’s quite an entrance to the forum you’ve made! Regardless, welcome aboard - perhaps take some time to familiarise yourself with the purpose of the forum, and perhaps read through some of the diaries from those who’ve been here a while - who almost without exception will say that the support they have received here has made a huge difference to not only the progress they’ve made on clearing their debts but also - and probably more importantly, on their peace of mind and ability to sleep at night.easyeconomicmaster said:EssexHebridean said:[tt][b]Statement of Affairs and Personal Balance Sheet[/b][b]Household Information[/b]Number of adults in household........... 1Number of children in household......... 0Number of cars owned.................... 1[b]Monthly Income Details[/b]Monthly income after tax................ 1605.46Partners monthly income after tax....... 0Benefits................................ 0Other income............................ 0[b]Total monthly income.................... 1605.46[/b][b]Monthly Expense Details[/b]Mortgage................................ 350.4 Compared to your earnings this is at a really good level.Secured/HP loan repayments.............. 0Rent.................................... 0Management charge (leasehold property).. 0Council tax............................. 86 This allows for the single person's discount? Do you pay over 10 months, or 12?Electricity............................. 50 Check that this and the gas are correct - I assume you pay a straight £100 a month to a single provider? It appears a little low. Make sure you give regular meter readings if you're not on smart meter, and check what the SM is sending if you are. Also budget for an extra £20 per month from April, just in case.Gas..................................... 50Oil..................................... 0Water rates............................. 18 clearly metered - so consider whether there are any savings to be had here.Telephone (land line)................... 0Mobile phone............................ 7 Great stuff - well done!TV Licence.............................. 0 You never watch live TV, or record it? Or use iPlayer?Satellite/Cable TV...................... 0Internet Services....................... 28 Depending on your area this is possibly a little high - might be worth shopping aroundGroceries etc. ......................... 220 Probably a little high for a single person, the Old Style board might be useful for ideas of how to bring this down.Clothing................................ 10Petrol/diesel........................... 120Road tax................................ 2 Just to check - you're not paying this monthly are you? There is a premium for doing so, which is why I ask.Car Insurance........................... 29Car maintenance (including MOT)......... 20Car parking............................. 0Other travel............................ 0Childcare/nursery....................... 0Other child related expenses............ 210Medical (prescriptions, dentist etc).... 0Pet insurance/vet bills................. 0Buildings insurance..................... 13 Does this include contents too? If not then you need to sort that out fast.Contents insurance...................... 0 See above - this is important.Life assurance ......................... 0Other insurance......................... 0Presents (birthday, christmas etc)...... 15 Does this actually cover what you spend, for your child, close family, any friends you buy for? It seems on the low side.Haircuts................................ 15Entertainment........................... 0 Nope - not realistic. You never grab a coffee, buy a magazine, meet a friend for drinks or a meal?Holiday................................. 0 No weekends away even, visits to family, that sort of thing?Emergency fund.......................... 0 You need to start budgeting for savings here. (And actually MAKE those savings!)Gym..................................... 16 Extract every last penny of value out of this - for example, always shower while there to save water and energy at home.[b]Total monthly expenses.................. 1259.4[/b][b]Assets[/b]Cash.................................... 1400House value (Gross)..................... 140000Shares and bonds........................ 0Car(s).................................. 7000Other assets............................ 3000[b]Total Assets............................ 151400[/b][b]Secured & HP Debts[/b]Description....................Debt......Monthly...APRMortgage...................... 98361....(350.4)....0[b]Total secured & HP debts...... 98361.....-.........- [/b][b]Unsecured Debts[/b]Description....................Debt......Monthly...APRRatesetter 1...................7512......0.........0Ratesetter 2...................4406......0.........0Admiral Loan...................6590......0.........0Nationwide 2...................636.......0.........0Nationwide 1...................4657......0.........0[b]Total unsecured debts..........23801.....0.........- [/b] So to check, you're paying nothing to any of these at the moment, so they should default soon?[b]Monthly Budget Summary[/b]Total monthly income.................... 1,605.46Expenses (including HP & secured debts). 1,259.4Available for debt repayments........... 346.06Monthly UNsecured debt repayments....... 0[b]Amount left after debt repayments....... 346.06[/b][b]Personal Balance Sheet Summary[/b]Total assets (things you own)........... 151,400Total HP & Secured debt................. -98,361Total Unsecured debt.................... -23,801[b]Net Assets.............................. 29,238[/b][i][/i][/tt]

Right - let's take a look at the SOA then. Comments in bold as usual.

Things not to worry about right now -

Your "shot credit rating" - just ignore it - the only person who sees the number is you, and the only thing it has any relevance for is a new mortgage. I'll come on to why that's less of an issue than you think.

Your mortgage deal ending in 2025. Park that one for now - that's two whole years away, and right now none of us know where rates will be then. You have our permission to start worrying about that again in a year ...however...

...however...

Not being able to get a new fixed deal when your current mortgage deal ends. What on earth makes you think that? It just means your choice is limited to products offered by your existing lender - and presumably you chose them because they suited your profile, so hopefully they still will. You MIGHT have increased costs, sure, but then again a) you might not, and b) you might be earning more by then.

How long a DMP might take - sure, it might, but then again it might not. the main thing is that you are tackling your debts without making further huge impacts on your credit file, and without putting your home at risk in any way.

Things not to do:

Gamble any more - at all. Not a lottery ticket, not a cheeky £5 each way on the grand national, nothing. You need to accept that you have the sort of mindset that means you will always be tempted to chase one more more chance - and the only way of avoiding that risk it to never put yourself in that position. It's easy to think that "Oh but I'm not like the poor fools who lose thousands on the horses, or in casinos" but actually there's not so much difference, when you think about it. Learn that lesson now, before things get worse.

Be tempted to consolidate. You need to go through this process I think - as that is the only way you will come out of the other side most likely to never find yourself there again. You can't borrow your way out of debt.

Rush into an insolvency "solution" like an IVA - it might seem easier, but it very likely won't be.

Next thing then - do you have that £346 a month surplus each month? If not then you need to find out why - and it will be because there is something - or things - not included on that SOA, or that you are overspending in one area or another. A spending diary might well help as it will let you track everything you really do spend.

If you do have that surplus, then target £50 of it to building your emergency fund - this is vital. The balance gets split between the debts.

I'm going to assume that there is a chance that you might have a bank account with Nationwide? If so - then you need to open a basic account with a different bank - one you have no debts with - although the SOA suggests that the only bank (building society) that you DO owe money to is Nationwide anyway.

That's some starting points - others will be able to offer more structured advice specifically in the area of the DMP, and may well spot things in the SOA that I've missed too.

Hopefully starting to take some positive action on this will enable another "thing not to do" - namely being up at 3am worrying about your debts. While you have offered some useful suggestions, it's important to note that seeking professional advice from a qualified financial advisor or a debt charity is crucial in order to fully understand all options available and find a solution that is tailored to his specific financial situation.A financial advisor can provide a comprehensive analysis of his finances, including his income, expenses, assets and debts. They can help him understand the pros and cons of different debt solutions, such as a debt management plan (DMP) or an Individual Voluntary Arrangement (IVA), and provide guidance on which option is most suitable for him. They can also provide support and advice on budgeting, saving, and managing his money to help him avoid future financial difficulties.It's also important to keep in mind that the credit rating is not something to be taken lightly, as it can affect his ability to secure new credit or loans in the future. A financial advisor can help him understand how his credit rating is affected by different debt solutions and provide guidance on how to improve it over time.Additionally, consolidating debt can be a viable option for some individuals, and should be evaluated by a professional.In summary, while your suggestions are helpful, it's important to seek professional advice to fully understand all options available and find a solution that is tailored to his specific financial situation.There are various reasons I’ve made suggestions in this case.The OP has had issues with a form of gambling, and has already confirmed that they have a good time to run on their current mortgage deals. Being unable to get credit or new loans would - in my opinion - be by far the best position they could find themselves in for a while, certainly until they’ve broken the habit and compulsion to risk heading back down the crypto route.

While you have offered some useful suggestions, it's important to note that seeking professional advice from a qualified financial advisor or a debt charity is crucial in order to fully understand all options available and find a solution that is tailored to his specific financial situation.A financial advisor can provide a comprehensive analysis of his finances, including his income, expenses, assets and debts. They can help him understand the pros and cons of different debt solutions, such as a debt management plan (DMP) or an Individual Voluntary Arrangement (IVA), and provide guidance on which option is most suitable for him. They can also provide support and advice on budgeting, saving, and managing his money to help him avoid future financial difficulties.It's also important to keep in mind that the credit rating is not something to be taken lightly, as it can affect his ability to secure new credit or loans in the future. A financial advisor can help him understand how his credit rating is affected by different debt solutions and provide guidance on how to improve it over time.Additionally, consolidating debt can be a viable option for some individuals, and should be evaluated by a professional.In summary, while your suggestions are helpful, it's important to seek professional advice to fully understand all options available and find a solution that is tailored to his specific financial situation.There are various reasons I’ve made suggestions in this case.The OP has had issues with a form of gambling, and has already confirmed that they have a good time to run on their current mortgage deals. Being unable to get credit or new loans would - in my opinion - be by far the best position they could find themselves in for a while, certainly until they’ve broken the habit and compulsion to risk heading back down the crypto route.

We advise against consolidation unless there are compelling reasons to support it - and right now those compelling reasons aren’t there for the OP - their debt is already heading towards defaulting, when no interest will be payable going forwards, so consolidating won’t save them any money, and once a DMP, either managed or self managed, is in place the monthly payments will be manageable. Importantly, consolidation isn’t something that should even be suggested without a considerable amount more information than we have here so far, I’d suggest.As a general rule “Financial advisors” don’t give their advice for nothing, and similarly they often aren’t experts in debt solutions either. Pointing people at “Financial advisors” (you are by any chance one yourself, are you?) can often lead to them ending up in a fee-charging arrangement, which is rarely, if ever, the best thing for the debtor.

As already said, the constant and consistent advice here is that people should only seek advice from one of the free debt charities in the first instance - that doesn’t get written in every post offering support to a poster, as it would get remarkably repetitive if it was!

Perhaps take a bit of time to familiarise yourself with the way the forum worsk, and it’s strengths - I’m sure you’ll soon come to see that while many of us (not all) aren’t professionals, that doesn’t mean that we’re not capable of providing help and support. What’s more, we do it for free, too, and gladly so. 🙂🎉 MORTGAGE FREE (First time!) 30/09/2016 🎉 And now we go again…New mortgage taken 01/09/23 🏡

Balance as at 01/09/23 = £115,000.00 Balance as at 31/12/23 = £112,000.00

Balance as at 31/08/24 = £105,400.00 Balance as at 31/12/24 = £102,500.00

£100k barrier broken 1/4/25

Balance as at 31/08/25 = £ 95,450.00. Balance as at 31/12/25 = £ 91,100.00

SOA CALCULATOR (for DFW newbies): SOA Calculatorshe/her8 -

lixhul said:It wouldn't let me remove old post. I wanted to start a new one with all the facts.

I'm 32, live alone with mortgage and have a child of 5, whom lives with their mum and I pay CSA.[b]Statement of Affairs and Personal Balance Sheet[/b][b]Household Information[/b]Number of adults in household........... 1Number of children in household......... 0Number of cars owned.................... 1[b]Monthly Income Details[/b]Monthly income after tax................ 1605.46Partners monthly income after tax....... 0Benefits................................ 0Other income............................ 0[b]Total monthly income.................... 1605.46[/b][b]Monthly Expense Details[/b]Mortgage................................ 350.4Secured/HP loan repayments.............. 0Rent.................................... 0Management charge (leasehold property).. 0Council tax............................. 86Electricity............................. 50Gas..................................... 50Oil..................................... 0Water rates............................. 18Telephone (land line)................... 0Mobile phone............................ 7TV Licence.............................. 0Satellite/Cable TV...................... 0Internet Services....................... 28Groceries etc. ......................... 220 you could cut this. Even if you don't want to regularly, learning how to have a really cheap month might be worth it, so you can ride the rough times.Clothing................................ 10 - not viable longer term. By all means hit the chazzers but you also need some decent work clothesPetrol/diesel........................... 120Road tax................................ 2Car Insurance........................... 29Car maintenance (including MOT).... 20 might be OK now but longer term needs to be higherCar parking............................. 0 never?Other travel............................ 0Childcare/nursery....................... 0Other child related expenses............ 210Medical (prescriptions, dentist etc).... 0 you need to budget for at least one dental visit a year and a minor procedure, even if you don't need it every yearPet insurance/vet bills................. 0Buildings insurance..................... 13Contents insurance...................... 0 you really need thisLife assurance ......................... 0 Try declining term insurance to cover the mortgage at least, and write a will.Other insurance......................... 0Presents (birthday, christmas etc)...... 15Haircuts................................ 15Entertainment........................... 0 do you never take your daughter out anywhere, have a pint or a coffee with friendsHoliday................................. 0Emergency fund.......................... 0 you need at least £30 in here and as a house owner probably more. Enough to cover one replacement of white goods and basic house maintenance. Even if you've become good at DIY.Gym..................................... 16[b]Total monthly expenses.................. 1259.4[/b][b]Assets[/b]Cash.................................... 1400House value (Gross)..................... 140000Shares and bonds........................ 0Car(s).................................. 7000Other assets............................ 3000[b]Total Assets............................ 151400[/b][b]Secured & HP Debts[/b]Description....................Debt......Monthly...APRMortgage...................... 98361....(350.4)....0[b]Total secured & HP debts...... 98361.....-.........- [/b][b]Unsecured Debts[/b]Description....................Debt......Monthly...APRRatesetter 1...................7512......0.........0Ratesetter 2...................4406......0.........0Admiral Loan...................6590......0.........0Nationwide 2...................636.......0.........0Nationwide 1...................4657......0.........0[b]Total unsecured debts..........23801.....0.........- [/b][b]Monthly Budget Summary[/b]Total monthly income.................... 1,605.46Expenses (including HP & secured debts). 1,259.4Available for debt repayments........... 346.06Monthly UNsecured debt repayments....... 0[b]Amount left after debt repayments....... 346.06[/b] Where is this going? You need a spending diary to identify the leaks in your budget[b]Personal Balance Sheet Summary[/b]Total assets (things you own)........... 151,400Total HP & Secured debt................. -98,361Total Unsecured debt.................... -23,801[b]Net Assets.............................. 29,238[/b]

Starter for ten. If you take out an IVA expect the majority of the £5,800 pa to be taken in enhanced payments towards your debt. With a DMP, you will at least have the flexibility to stop your payments for a month or two if you need a new car, for example.

Although, ideally you'd be budgeting for a new car.

In addition to the notes above, do you have one bedroom or two? Or could you reconfigure your house/flat to provide a spare bedroom?

Taking a lodger you can "earn" £7k tax free using the rent a room scheme. Possibly Monday-Friday if you need the room for access visits? Obviously there will be costs but it might be worth it. Maybe talk to FreeBear on the Housing forum?

If you've have not made a mistake, you've made nothing2 -

Christians against Poverty is another one to speak to, they apparently run free budgeting courses, they were just on Stephs packed lunch on Channel 4, thry mentioned debts.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards