We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

ARROWHEAD PHARMA

Comments

-

Is that annualised, 22% per year? Or cumulative, current value 22% higher than value in November 2017?Richard1212 said:

Last 5 years (within a couple of months ) net returns = +22% ( as at November 2022).1 -

That is "annualised", Qyburn. I hope that also answers certain other posters questions as none of them thought to ask your question at all.Qyburn said:

Is that annualised, 22% per year? Or cumulative, current value 22% higher than value in November 2017?Richard1212 said:

Last 5 years (within a couple of months ) net returns = +22% ( as at November 2022).0 -

..concept that is complex but made simple by your way of setting it out in your original way,Good wasn’t it, but shamelessly lifted from a couple of Canadians: https://rationalreminder.ca/podcast/231. The explanation starts at 19:00 min, where there’s more detail and explanation than mine, as there is at the related discussion at: https://rationalreminder.ca/podcast/227 at 7:00 min. And interestingly some reasons that you might deviate from a market portfolio which perhaps gets to Linton’s ‘value’ preference.1

-

That's certainly an impressive figure, although of course that also demonstrates the inherent risk.Richard1212 said:

That is "annualised", Qyburn. I hope that also answers certain other posters questions as none of them thought to ask your question at all.Qyburn said:

Is that annualised, 22% per year? Or cumulative, current value 22% higher than value in November 2017?Richard1212 said:

Last 5 years (within a couple of months ) net returns = +22% ( as at November 2022).

I must say, though, it makes your disregard of ISAs rather baffing - you must be setting up a hefty liability for CGT, especially in the light of the reducing allowance.I am one of the Dogs of the Index.0 -

An honest rascalJohnWinder said:..concept that is complex but made simple by your way of setting it out in your original way,Good wasn’t it, but shamelessly lifted from a couple of Canadians: https://rationalreminder.ca/podcast/231. The explanation starts at 19:00 min, where there’s more detail and explanation than mine, as there is at the related discussion at: https://rationalreminder.ca/podcast/227 at 7:00 min. And interestingly some reasons that you might deviate from a market portfolio which perhaps gets to Linton’s ‘value’ preference. ----in all your posts from now on you'll have to have a copyright logo if it's your own work, otherwise I'll assume it's someone else's work of art LOL LOL. Thx. Merry Xmas. 0

----in all your posts from now on you'll have to have a copyright logo if it's your own work, otherwise I'll assume it's someone else's work of art LOL LOL. Thx. Merry Xmas. 0 -

Richard1212 said:

Coach ? I don't understand, sorry. But I was told that you were THE main man concerning Arrowhead, a company which burned me and make me scared stiff of the biotechs sectorBrockStoker said:Hello Coach and all, hope you are well.I still have very high confidence in Arrowhead. I must admit I was probably a bit naive at first, not having much experience with stocks, and I was expecting Arrowhead to "take off" sooner than it has. They did make the decision to pull their CF therapy, but that is because they know they have a better/upgraded CF therapy. While this is a setback, and it means going back to square one with CF, it also means that they will have a stronger therapy which will have a better chance of keeping it's top spot (assuming it gets there) as best in class therapy, which is good for the long term.Arrowhead's competitor Alnylam is an excellent comparison that shows what RNAi can achieve, and suggests where Arrowhead can be in a few years time once it has an approval or two. Although Arrowhead is playing catch-up at this point, it's approvals, when they come, will be much more aggressive/lucrative than Alnylam's.This is a long term story, and I think buying at current prices will eventually pay off in a big way. First approvals should be around 2023/2024, so it could still be a while before Arrowhead becomes profitable, but when it does, I'm confident it will do in a big way.This is a very basic analysis, skipping over many positives that Arrowhead will benefit from, eventually, but as usual, Wall Street is stuck in it's old ways, and will not see it coming till the last minute. My opinion of course! . Although I have sold all my shares at a modest loss, I was interested to know why such positivity about the company turned so sour. Your post shows continuing positivity but it just does not tally with how the markets have reacted over the past few years to the company and its wannabe drugs. I'm all for being " in for the long term" but Arrowhead looked to me after a couple of years as though it was always promising a lot but never delivering. There is still no drug on the market and yet the company disingenuously calls itself Arrowhead Pharmaceuticals.

. Although I have sold all my shares at a modest loss, I was interested to know why such positivity about the company turned so sour. Your post shows continuing positivity but it just does not tally with how the markets have reacted over the past few years to the company and its wannabe drugs. I'm all for being " in for the long term" but Arrowhead looked to me after a couple of years as though it was always promising a lot but never delivering. There is still no drug on the market and yet the company disingenuously calls itself Arrowhead Pharmaceuticals.

You do not actually mention why there is absolutely no sign, after years, of an uplift in the company's fortunes. Even its TRiM platform doesn't attract interest anymore.

I'm glad I sold, even with a noticeable loss, but I sincerely wish your optimism results in your share holdings bringing you joy. Thank you very much for your post which gives food for thought : anything can happen in the dreaded biotechs sector. Best wishes.OK, here's what I think is going on:Firstly, I think it's important to point out that Arrowhead's early data is very impressive, STRONGLY suggesting that Arrowhead's therapies do work, but more importantly they are very efficient and safe, with only very minor side effects. RNAi, I believe will replace the current standard of care for many conditions. There is not much, if anything, that can compete with it at this time, and this therapy can translate to hundreds of different conditions/ailments.The main problem is that Wall Street is dumb, and impatient. WS is not interested in "potential", and that is even more the case in the current climate, where any company that is not currently profitable is being punished (in terms of share price).When the CF therapy was withdrawn, I think that was seen as a sign that there are problems with TRiM, but that is not the case. It was withdrawn because they have "CF Mk2", which will work even better, and help Arrowhead to hang on to very lucrative therapy better than they could if they left it as the earlier, inferior iteration. Of course, this also sets back the whole CF program, and WS/investors don't like delays!It also did not help that the share price got ahead of itself, a bit too soon.I think share prices, especially in this sector, can be extremely misleading, and can effectively be ignored (at least as an indicator of quality). It's the science that dictates what will be the final outcome. With good science (providing of course management is also up to the job, and can leverage that science to it's maximum potential), a biotech will thrive. Arrowhead has it all IMHO - not only is the science good, it's great. Management know how to leverage it to the maximum potential too. However, it won't happen over night, so WS is MUCH less interested.Of course, once it DOES become clear that Arrowhead IS on to something, the share price will jump. Here in lies the opportunity - the disconnect. This is where the big bucks are made - by investing when the general view is that there is not much hope.As I mentioned before, Alnylam platform can be looked at for comparison, since the tech is very similar (only difference is Arrowhead have tweaked the platform so that it works better than Alnylam's). Alnylam's indications are much less lucrative than Arrowhead's. Arrowhead will be in a similar position to Alnylam in a few years, but with more revenue.So my advice would be to start nibbling now while the share price is close to $30. It may well drop a bit lower, but the floor at around $30 looks like it will mostly hold up, so any dip below I'd take as a buying opportunity.Of course, as always, this is just my own opinion. If you decide to invest in a single stock like Arrowhead, risks abound, and nothing is guaranteed, so anyone contemplating investing should keep that in mind.

2 -

The main problem is that Wall Street is dumb, ……. WS is not interested in "potential",The market price of a stock reflects all knowledge about that stock, in an open easily tradable market. The price can move with new knowledge, but does that mean the old knowledge was ‘dumb’?

’potential’? How often are we told the market is forward looking?early data is …Arrowhead's therapies……safe, with only very minor side effectsKeep in mind that longer term side effects don’t show up in early data, not only when you’re investing but when offered the latest, greatest therapy.3 -

JohnWinder said:The main problem is that Wall Street is dumb, ……. WS is not interested in "potential",The market price of a stock reflects all knowledge about that stock, in an open easily tradable market. The price can move with new knowledge, but does that mean the old knowledge was ‘dumb’?

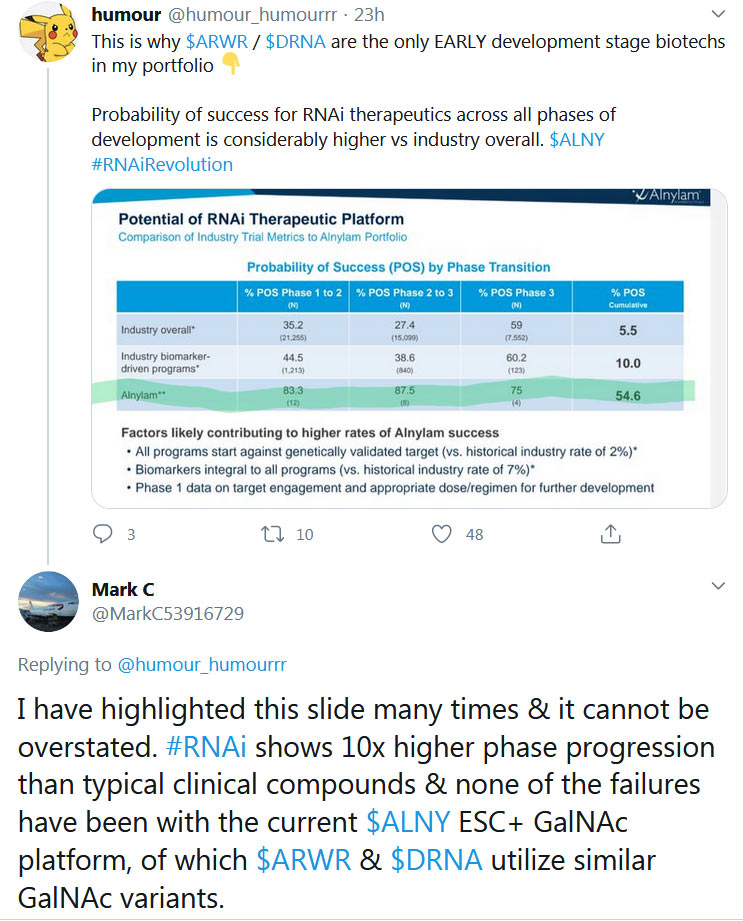

’potential’? How often are we told the market is forward looking?For technical stocks, in biotech sector for example, Wall Street relies on analysts for the "low down". Some analysts get it right, and others do not - in my opinion, but by definition one side will not get it right. So the market essentially is a voting machine, and in times of panic, people vote out of fear, which can easily skew a valuation that is already tenuous at best. This is why young stocks have wild swings in price, till one side wins out (once the cards are on the table and we can all see them), and the stock progresses or declines.JohnWinder said:early data is …Arrowhead's therapies……safe, with only very minor side effectsKeep in mind that longer term side effects don’t show up in early data, not only when you’re investing but when offered the latest, greatest therapy.The beauty of investing in RNAi is that it is different to conventional drugs in a few major ways.One of these is that an RNAi treatment is delivered in the form of a designer molecule of synthetic protein. It's a complex molecule consisting basically of two main parts (it's actually a bit more complex than that), the part that targets the particular tissue, and the other part which is the pay load, which is basically a section of genetic code that acts as a switch to turn off a gene(or genes) that are malfunctioning and causing problems. The point is, its an organic protein molecule, that is basically innocuous, and is much like any other bit of protein which might be found "floating around" in an animal. Like any other protein, the body quickly breaks it down, and recycles the useful components/excretes the useless ones. This means there won't be any long term effects. In fact, one of the challenges with RNAi has been that the body breaks down the "drug" very quickly, not giving the therapy a chance to work, so part of the design of the molecule is there to try to prevent it from being broken down so easily.The only problem is when the "targeting" part of the molecule is not right, and the switch is turned off in the wrong tissue. This can sometimes cause very serious problems, but it's going to be easy to spot since similar pathways exist in other animals (monkeys, rats, and mice for example).The size of the molecule plays a crucial role. Old drugs were small molecules that easily pass through barriers (between blood and organs), and into all parts of the body. Akin to trying to crack a nut with a sledge hammer. Lot's of side effects, and the drug can accumulate in far away corners of the body only to cause problems later. RNAi on the other hand is a large molecule which presents challenges getting in to parts of the body that have been hard to overcome, but because of this it is a much safer option.Because RNAi molecules are effectively innocuous, companies like Alnylam have already done the human trials for us, and proved that RNAi is safe, providing it is accurately targeted. This is not to say that each individual therapy should not be thoroughly trialed before hand, but it does mean that when done properly, every one should work without problems or serious side effects if any.Due to this, and highly precise targeting, RNAi therapeutics have an intrinsically higher chance of approval, even with Alnylam's moderately good platform (Arrowhead's is significantly better tuned IMHO) who provided the following data: So, the chances are heavily slewed in favor of RNAi compared to other types of therapy/drugs, and much of the market (analysts included) seem oblivious to this, and other important benefits that come with RNAi. I think this is partly because, in the past, there have been many new treatments, that were touted as game changers, but that never really happened in the end due to one issue or another. That does not seem to be the case here, but once bitten, twice shy.. I'll take advantage of that disconnect, thank you very much Mr market!All of that said, there have been signs that some analysts are twigging on. GS for example has for some time now had a higher price target on ARWR after noting that their therapies should not be modeled in the same way as other therapies have been in the past.

So, the chances are heavily slewed in favor of RNAi compared to other types of therapy/drugs, and much of the market (analysts included) seem oblivious to this, and other important benefits that come with RNAi. I think this is partly because, in the past, there have been many new treatments, that were touted as game changers, but that never really happened in the end due to one issue or another. That does not seem to be the case here, but once bitten, twice shy.. I'll take advantage of that disconnect, thank you very much Mr market!All of that said, there have been signs that some analysts are twigging on. GS for example has for some time now had a higher price target on ARWR after noting that their therapies should not be modeled in the same way as other therapies have been in the past.

0 -

Your description of how RNAi works is wrong. The API is RNA, not a protein.

Futhermore, there is no inherent targeting mechanism with RNAi.

And side effects are possible both from the API and other ingredients in the formulation."Real knowledge is to know the extent of one's ignorance" - Confucius1 -

Agreed, but careful with the acronyms. API in this context presumably means Advanced Pharmaceutical Ingredient, but I have heard some people on the "computer science" side of molecular biology describe RNA/DNA as being like an API (Advanced Programing Language) that instructs genes on how to make proteins. RNAi interferes with the manufacturing of proteins. To do that it must get into the cell and that is facilitated by attaching the RNA to a ligand that allows the whole molecule to cross the cell membrane. Investing in small companies in technical fields is dangerous for the regular investor as they don't have the technical expertise to really critique the company and it's assertions. Theranous is an extreme example, but working at the edge of a scientific field has many other risks both technical and regulatory. It's a field where specialized venture capital likes to work, but they will often get it wrong as well.kinger101 said:Your description of how RNAi works is wrong. The API is RNA, not a protein.

Futhermore, there is no inherent targeting mechanism with RNAi.

And side effects are possible both from the API and other ingredients in the formulation.“So we beat on, boats against the current, borne back ceaselessly into the past.”2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards