We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

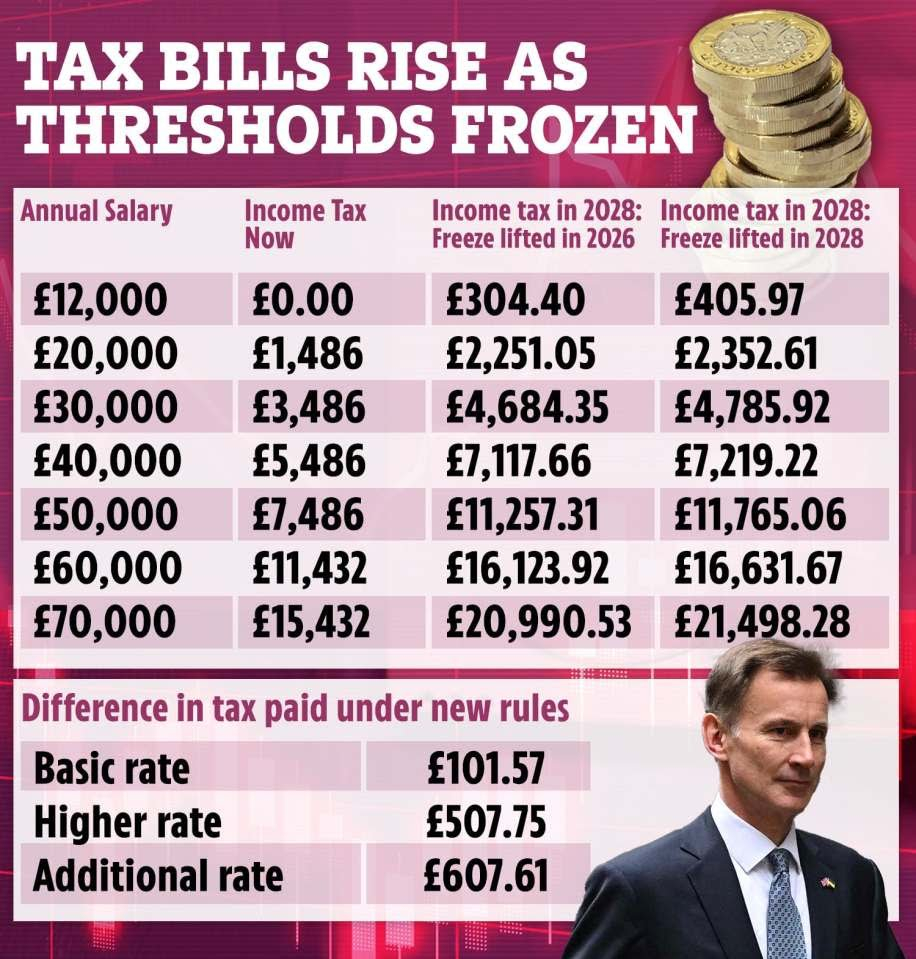

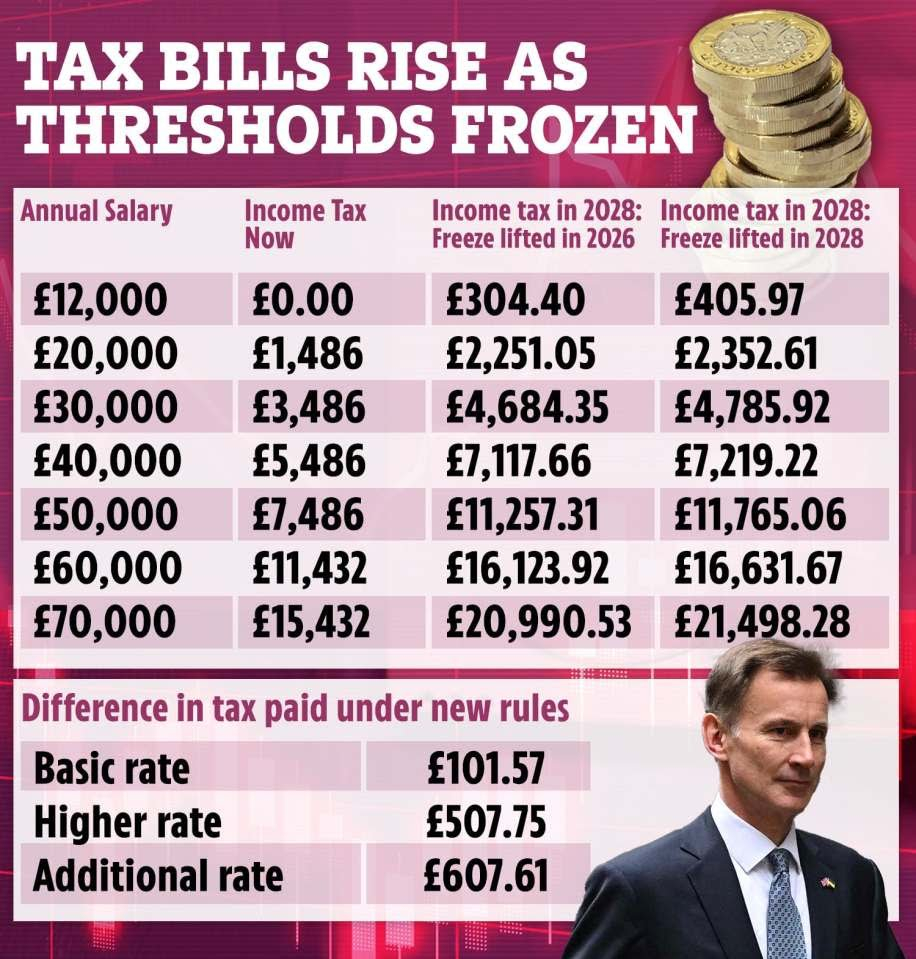

Extra tax infographic

sultan123

Posts: 446 Forumite

in Cutting tax

Thought this deserved its own thread. Is this an accurate reflection of extra tax being paid with the PA freeze?

0

Comments

-

No, not one single aspect of that infographic is correct.

As an example if you earn £12,000 in the current tax year you will pay no tax (assuming you haven't applied for Marriage Allowance).

If you earn £12,000 next year you will also pay no tax.

If you earn £12,000 in 2025:26 you will again pay no tax.

If you earn £12,000 in 2028:29 you will yet again pay no tax.

1 -

There's obviously some assumption about wage growth, eg with inflation. Without that, how is anyone supposed to tell whether it's correct?

3 -

Exactly so why is it that people are saying we are going to be paying much more tax due to recent autumn statement?Dazed_and_C0nfused said:No, not one single aspect of that infographic is correct.

As an example if you earn £12,000 in the current tax year you will pay no tax (assuming you haven't applied for Marriage Allowance).

If you earn £12,000 next year you will also pay no tax.

If you earn £12,000 in 2025:26 you will again pay no tax.

If you earn £12,000 in 2028:29 you will yet again pay no tax.

Is it simply due to inflation as money is worth less?0 -

No, it's because in reality someone earning £12,000 is likely to get several pay rises over the next few years.sultan123 said:

Exactly so why is it that people are saying we are going to be paying much more tax due to recent autumn statement?Dazed_and_C0nfused said:No, not one single aspect of that infographic is correct.

As an example if you earn £12,000 in the current tax year you will pay no tax (assuming you haven't applied for Marriage Allowance).

If you earn £12,000 next year you will also pay no tax.

If you earn £12,000 in 2025:26 you will again pay no tax.

If you earn £12,000 in 2028:29 you will yet again pay no tax.

Is it simply due to inflation as money is worth less?

So in say 2028:29 their pay might be £15,000 not £12,000. So they will pay some tax. But if their pay remains £12,000 they will pay the same tax (£0).

You might find this useful.

https://www.ftadviser.com/your-industry/2022/11/17/income-tax-bands-frozen-until-2028/

I think this will be my last comment on this, enough is enough.2 -

It's taken from that renowned bastion of insightful financial analysis, The Sun! No further questions, your honour....zagfles said:There's obviously some assumption about wage growth, eg with inflation. Without that, how is anyone supposed to tell whether it's correct?

https://www.thesun.co.uk/money/20450299/millions-wages-cut-autumn-statement-tax-change/

2 -

eskbanker said:

It's taken from that renowned bastion of insightful financial analysis, The Sun! No further questions, your honour....zagfles said:There's obviously some assumption about wage growth, eg with inflation. Without that, how is anyone supposed to tell whether it's correct?

https://www.thesun.co.uk/money/20450299/millions-wages-cut-autumn-statement-tax-change/And it's explained several times in the article..."That is because inflation and rising wages will mean more workers will go over the thresholds for paying higher tax"....But it's guesswork because it depends on assumptions on future inflation, wage growth etc.0 -

If my maths is correct it seems to be assuming 20% wage growth between now and 2026, but hardly any wage growth for the following two years. Seems like a big assumption.1

-

but if you are on 12k PA you never pay any tax no matter what tax year?Albermarle said:If my maths is correct it seems to be assuming 20% wage growth between now and 2026, but hardly any wage growth for the following two years. Seems like a big assumption.0 -

Unless the PA is reduced rather than frozen, which is not on the cards.sultan123 said:

but if you are on 12k PA you never pay any tax no matter what tax year?Albermarle said:If my maths is correct it seems to be assuming 20% wage growth between now and 2026, but hardly any wage growth for the following two years. Seems like a big assumption.

0 -

Sky news have the following:

The Resolution Foundation provided a stark illustration of the issue here: If you earn £62,000 you'll end up paying an extra £1,600 in taxes.

The same goes for someone earning £124,000 - they pay an extra £1,600.

Any accuracy to these numbers?

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards