We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Transfer shares directly into Stocks & Shares ISA?

On-the-coast

Posts: 719 Forumite

I have some shares in an international company (in US-dollars - my employer).

I will easily have enough space in my existing (Lloyds) Stocks/Shares ISA in this financial year to be able to place them all there before the end of March.

With the recent announced reductions in Capital Gains Tax to £6k next tax year, and £3k the following year, I am thinking it would be better to move these shares into my ISA to avoid the chance of paying CGT in the future. It's unlikely this would have been a problem if the allowance had stayed at £12+k

note - i also have shares in my company through UK share-save-as you earn (£150pm). The shares above are over and above what I've saved tax efficiently.

My company share-save broker allows me to "Sell" or "Transfer". I'd like to transfer as that avoids currency charges (i assume), but i can't see an obvious way of feeding my Lloyds ISA by transferring in Shares (rather than cash). Before i research that further, is there a general block on transferring in shares to a stocks and shares ISA? Whether direct from my company provider, or via an intermediate like my standard Lloyds share dealing account?

I know i can sell my holding and transfer in the funds, and that may be more straightforward, but then i will have to carefully calculate my Capital Gains (even though i know they will be no more than £6k), and i will also lose 1% on the sale and currency conversion, 1% on re-buying the shares as i convert back to dollars, and 1% when i come to sell them... (i know... i might choose to buy something that's sterling denominated instead, but I enjoy tracking this small bunch of shares).

Responses gratefully received.

I will easily have enough space in my existing (Lloyds) Stocks/Shares ISA in this financial year to be able to place them all there before the end of March.

With the recent announced reductions in Capital Gains Tax to £6k next tax year, and £3k the following year, I am thinking it would be better to move these shares into my ISA to avoid the chance of paying CGT in the future. It's unlikely this would have been a problem if the allowance had stayed at £12+k

note - i also have shares in my company through UK share-save-as you earn (£150pm). The shares above are over and above what I've saved tax efficiently.

My company share-save broker allows me to "Sell" or "Transfer". I'd like to transfer as that avoids currency charges (i assume), but i can't see an obvious way of feeding my Lloyds ISA by transferring in Shares (rather than cash). Before i research that further, is there a general block on transferring in shares to a stocks and shares ISA? Whether direct from my company provider, or via an intermediate like my standard Lloyds share dealing account?

I know i can sell my holding and transfer in the funds, and that may be more straightforward, but then i will have to carefully calculate my Capital Gains (even though i know they will be no more than £6k), and i will also lose 1% on the sale and currency conversion, 1% on re-buying the shares as i convert back to dollars, and 1% when i come to sell them... (i know... i might choose to buy something that's sterling denominated instead, but I enjoy tracking this small bunch of shares).

Responses gratefully received.

0

Comments

-

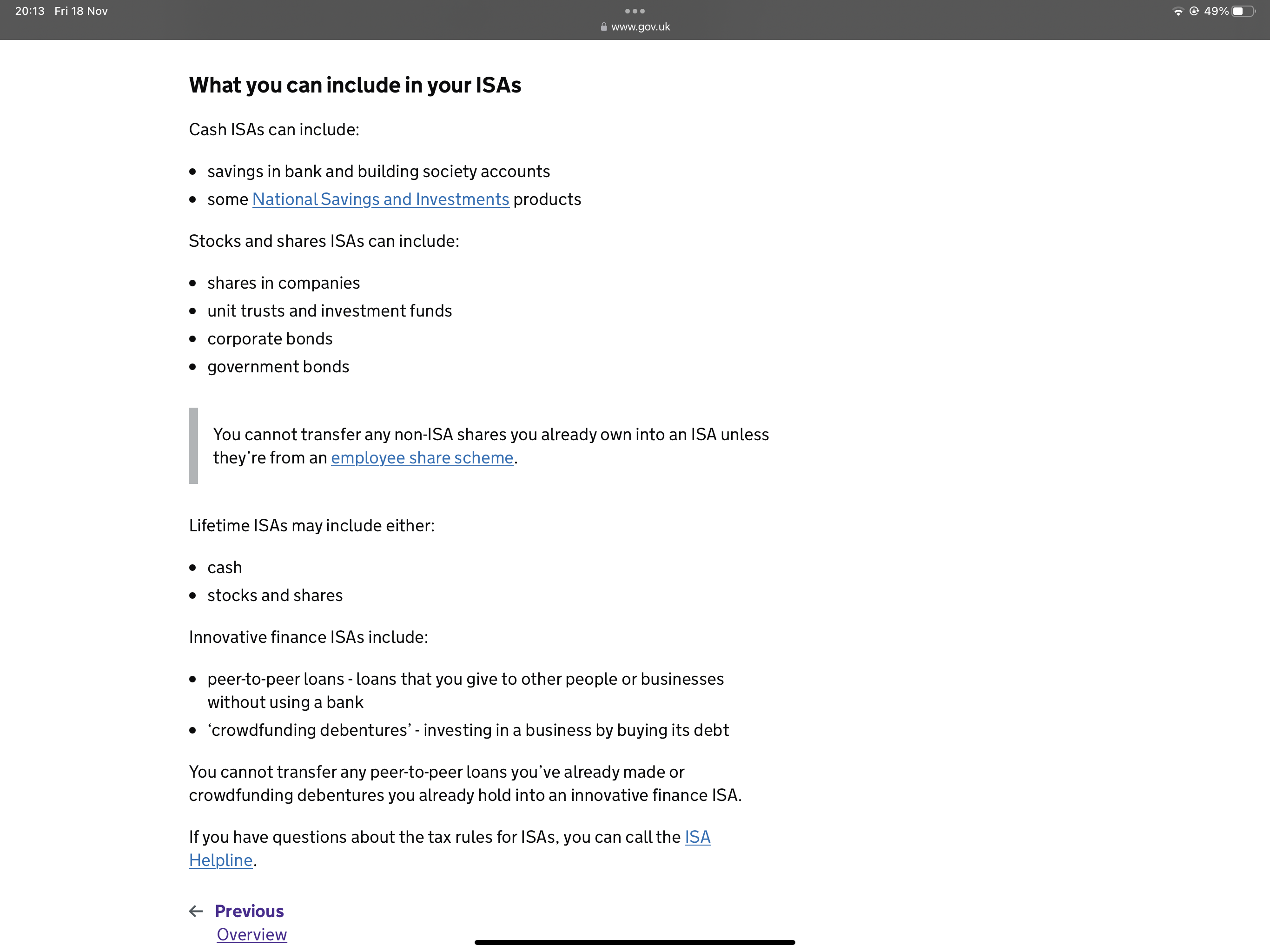

No. With the exception of employee share schemes, shares held outside an Isa wrapper have to be sold and then repurchased within the Isa. This is often referred to as 'bed and Isa.'On-the-coast said:I have some shares in an international company (in US-dollars - my employer).

I will easily have enough space in my existing (Lloyds) Stocks/Shares ISA in this financial year to be able to place them all there before the end of March.

With the recent announced reductions in Capital Gains Tax to £6k next tax year, and £3k the following year, I am thinking it would be better to move these shares into my ISA to avoid the chance of paying CGT in the future. It's unlikely this would have been a problem if the allowance had stayed at £12+k

note - i also have shares in my company through UK share-save-as you earn (£150pm). The shares above are over and above what I've saved tax efficiently.

My company share-save broker allows me to "Sell" or "Transfer". I'd like to transfer as that avoids currency charges (i assume), but i can't see an obvious way of feeding my Lloyds ISA by transferring in Shares (rather than cash). Before i research that further, is there a general block on transferring in shares to a stocks and shares ISA? Whether direct from my company provider, or via an intermediate like my standard Lloyds share dealing account?

I know i can sell my holding and transfer in the funds, and that may be more straightforward, but then i will have to carefully calculate my Capital Gains (even though i know they will be no more than £6k), and i will also lose 1% on the sale and currency conversion, 1% on re-buying the shares as i convert back to dollars, and 1% when i come to sell them... (i know... i might choose to buy something that's sterling denominated instead, but I enjoy tracking this small bunch of shares).

Responses gratefully received.

https://www.gov.uk/individual-savings-accounts/how-isas-work

3 -

that’s very comprehensive.Thanks.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards