We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

We're aware that some users are experiencing technical issues which the team are working to resolve. See the Community Noticeboard for more info. Thank you for your patience.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Mind Boggling…..Fund names minefield….Help please

Options

Moneymac06

Posts: 14 Forumite

Hi all

Going through my OH workplace pension with Standard Life (it’s easy to access online), it says on there you can switch funds whenever you like, this is where the mind boggling bit comes in.

OH is 58 and it says his pension is a Lifestyle one which I understand lowers the risk in the last 10 years of your pension.

Going through my OH workplace pension with Standard Life (it’s easy to access online), it says on there you can switch funds whenever you like, this is where the mind boggling bit comes in.

OH is 58 and it says his pension is a Lifestyle one which I understand lowers the risk in the last 10 years of your pension.

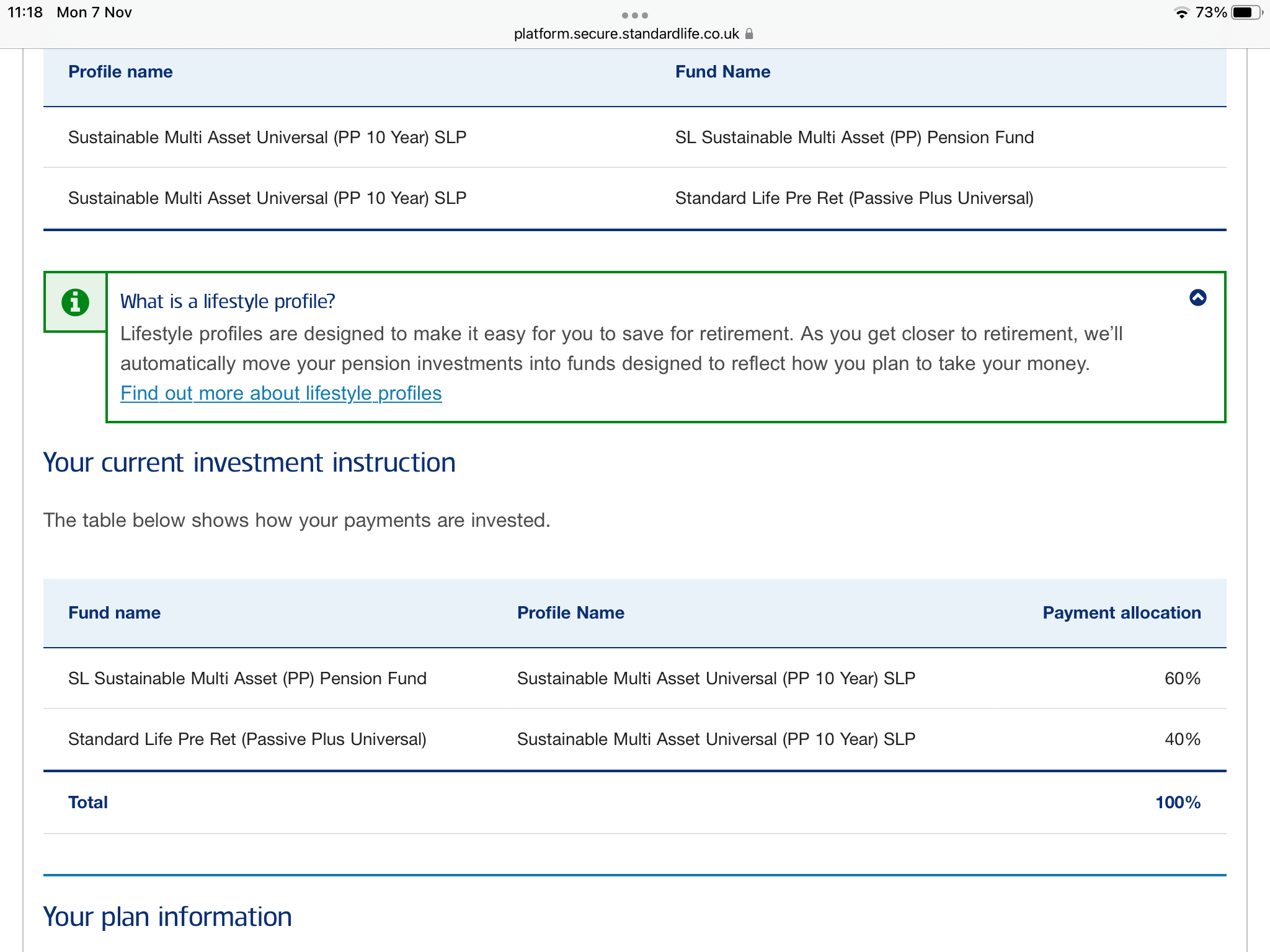

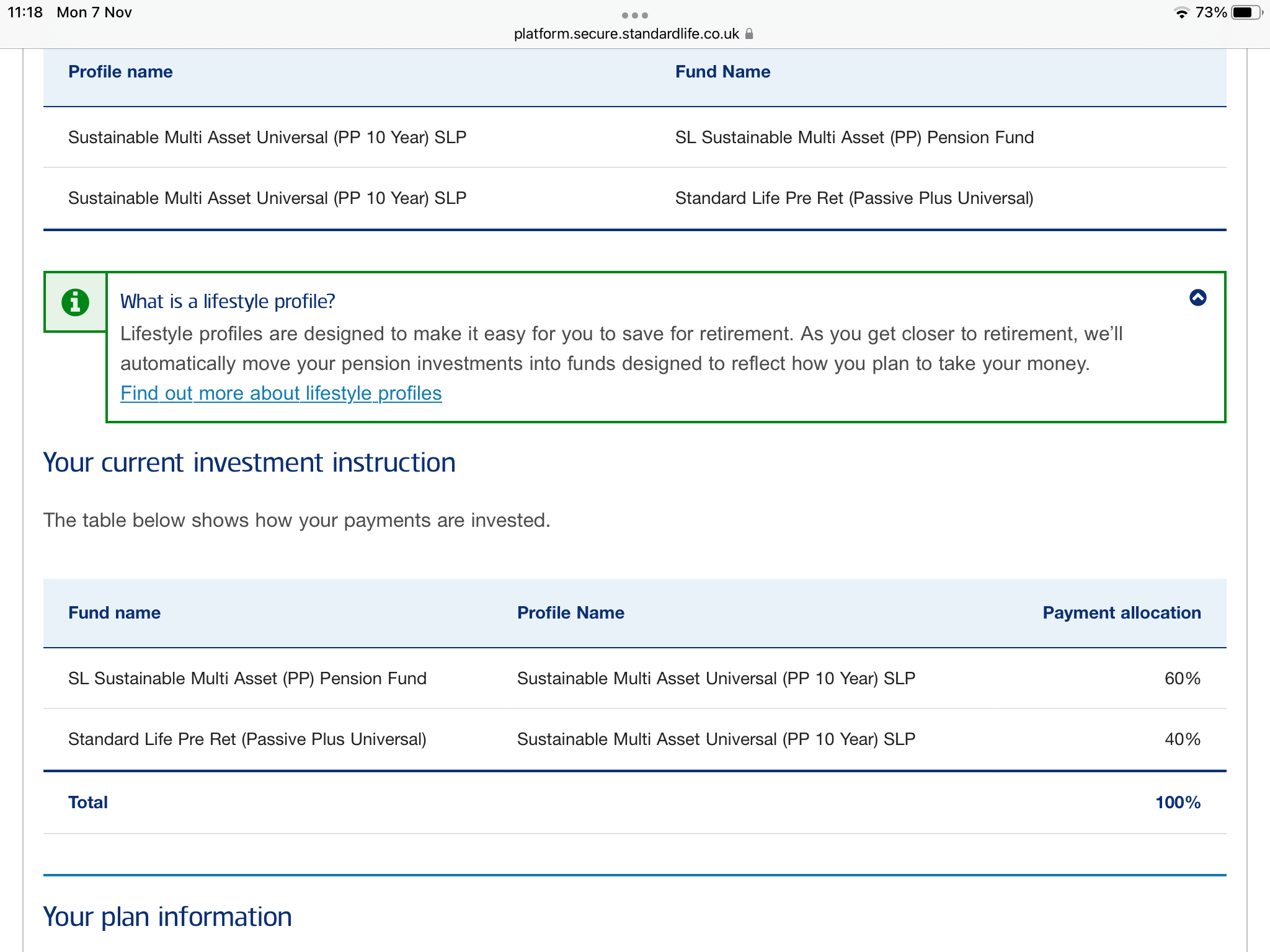

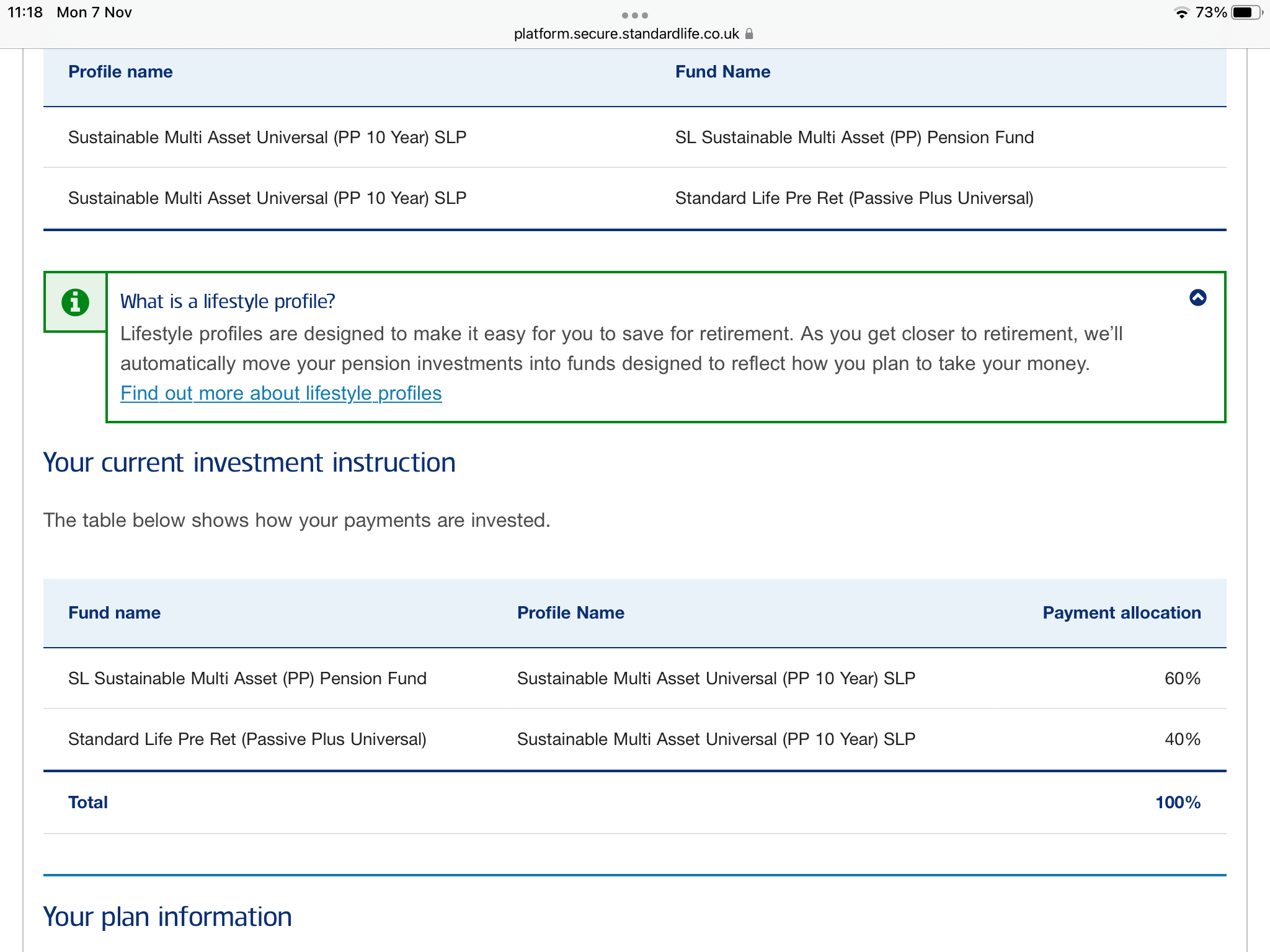

The 2 funds they are in are SL Sustainable Multi Asset (PP) Pension Fund - 60%

and Standard Life Pre Ret (Passive Plus Universal) - 40%.

Is this any good and if not how do we navigate round Funds, there are plenty listed on the account but where do you start?

Would appreciate any input.

Many thanks in advance

and Standard Life Pre Ret (Passive Plus Universal) - 40%.

Is this any good and if not how do we navigate round Funds, there are plenty listed on the account but where do you start?

Would appreciate any input.

Many thanks in advance

0

Comments

-

Yes even when there are 'only' 200 or 300 funds available it can still be a bit mind boggling even when you know a bit about investing.

Lifestyling in itself is not a bad idea, but there are different ones, and some (most?) tend to dial down the risk too much (in my opinion)

In simple terms his portfolio will be a mix of equity ( shares) and bonds. The theory is that equity is volatile (linked to stock markets) but grows over the long term. Bonds are more stable. So you should have high equity when young, and reduce this as you get older.

How much you should do this depends on how he is planning to take his pension. If he will buy an annuity then better that the risk is lowered a lot approaching retirement. However if he intends to drawdown, then he will be invested for many years, so the equity % should not reduce too much. So how he will draw his pension and how many years before this is likely to happen, needs to be known, before any investment decisions can be thought about in detail.1 -

Thank you for your reply, at the moment his plan is to drawdown but as we know from the current market things change quite a lot, as has proved with the bond issue in recent weeks (not that I am an expert in economics, I just watch too much news I think), so where bonds were considered stable as is viewed with lifestyle pensions, is that not more risky now?Albermarle said:Yes even when there are 'only' 200 or 300 funds available it can still be a bit mind boggling even when you know a bit about investing.

Lifestyling in itself is not a bad idea, but there are different ones, and some (most?) tend to dial down the risk too much (in my opinion)

In simple terms his portfolio will be a mix of equity ( shares) and bonds. The theory is that equity is volatile (linked to stock markets) but grows over the long term. Bonds are more stable. So you should have high equity when young, and reduce this as you get older.

How much you should do this depends on how he is planning to take his pension. If he will buy an annuity then better that the risk is lowered a lot approaching retirement. However if he intends to drawdown, then he will be invested for many years, so the equity % should not reduce too much. So how he will draw his pension and how many years before this is likely to happen, needs to be known, before any investment decisions can be thought about in detail.

0 -

so where bonds were considered stable as is viewed with lifestyle pensions, is that not more risky now?No. In fact it is probably less risky as they have unwound the effects of Quantitative Easing (QE) due to the credit crunch. There were hopes that the impact of QE could be unwound slowly over decades but because of other events (such as the invasion of Ukraine causing energy costs of sky rocket which led to high inflation, amongst other things) it has all come tumbling down this year. So, that particular risk event has been and gone.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Thanks for the reply, so the lifestyling on his pension fund at 58 is a good thing, but are the 2 funds I listed above a good investment or should we maybe start looking through the (minefield) other funds available through Standard Life?dunstonh said:so where bonds were considered stable as is viewed with lifestyle pensions, is that not more risky now?No. In fact it is probably less risky as they have unwound the effects of Quantitative Easing (QE) due to the credit crunch. There were hopes that the impact of QE could be unwound slowly over decades but because of other events (such as the invasion of Ukraine causing energy costs of sky rocket which led to high inflation, amongst other things) it has all come tumbling down this year. So, that particular risk event has been and gone.0 -

so the lifestyling on his pension fund at 58 is a good thing,Depends on the degree of lifestyling and his plans.

If he intends to use drawdown in retirement with phased UFPLS (e.g. monthly income where its paid 25%/75%) then lifestyling shouldnt be used.

If he intends to use drawdown but take the 25% up front, then lifestyling for 25% should be used.but are the 2 funds I listed above a good investmentOne is sustainable and I wouldnt use that. I suspect he shouldnt as he clearly doesnt have an ESG point of view otherwise both funds would be ESG. ESG investing generally results in lower returns.

I don't know about the other.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

You need to delve into how this particular lifestyling works. Does it have a specific name ? How quickly does it derisk ?, at what age points? and what would be the profile at the indicated retirement age( They will have an age in their system that will default to 65 unless you change it) Presume the info will be somewhere on their website.1

-

The age on the plan says 65 and these I have done a screen shot from the account pageAlbermarle said:You need to delve into how this particular lifestyling works. Does it have a specific name ? How quickly does it derisk ?, at what age points? and what would be the profile at the indicated retirement age( They will have an age in their system that will default to 65 unless you change it) Presume the info will be somewhere on their website.

0

0 -

That particular glide path to de-risking seems more appropriate for someone buying an annuity. Not for someone using drawdown. Since the pension freedoms were introduced, many providers have offered multiple lifestyle reduction methods to match the intended method. So, you dont want to be on an annuity lifestyle risk reduction if you are not buying an annuity.Moneymac06 said:

The age on the plan says 65 and these I have done a screen shot from the account pageAlbermarle said:You need to delve into how this particular lifestyling works. Does it have a specific name ? How quickly does it derisk ?, at what age points? and what would be the profile at the indicated retirement age( They will have an age in their system that will default to 65 unless you change it) Presume the info will be somewhere on their website.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Ok, so instead of trying to change funds we need to be looking at actually changing the lifestyle plan, is that possible do you think? Are we able to do it on the Standard Life Pension Account? Or do you think this is the only Lifestyle default plan?dunstonh said:

That particular glide path to de-risking seems more appropriate for someone buying an annuity. Not for someone using drawdown. Since the pension freedoms were introduced, many providers have offered multiple lifestyle reduction methods to match the intended method. So, you dont want to be on an annuity lifestyle risk reduction if you are not buying an annuity.Moneymac06 said:

The age on the plan says 65 and these I have done a screen shot from the account pageAlbermarle said:You need to delve into how this particular lifestyling works. Does it have a specific name ? How quickly does it derisk ?, at what age points? and what would be the profile at the indicated retirement age( They will have an age in their system that will default to 65 unless you change it) Presume the info will be somewhere on their website.

0

0 -

As suspected it appears to be set to derisk too much, if drawdown is the likely way of withdrawing.

This is because with drawdown, your money needs to be in funds that have a good chance of at least keeping up with inflation, and hopefully grow a bit. So pointless derisking the whole portfolio to very low risk funds as you approach drawdown/retirement. Something like 50% equity- 50% bonds would be more in the right area ( opinions vary as to the exact amount) It is useful to have some cash savings during drawdown as well, so if you took those into account , then say 50% equity ; 30% bonds + 20% cash could be another route.

Just very general info, not personal advice of course.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351K Banking & Borrowing

- 253.1K Reduce Debt & Boost Income

- 453.6K Spending & Discounts

- 244K Work, Benefits & Business

- 598.9K Mortgages, Homes & Bills

- 176.9K Life & Family

- 257.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards