We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Change to will to remove siblings of 2nd Husband

Comments

-

Crazy, if they do nothing with it! As Malthusian says, why burden the postie then? If they kept them I might have done it now as it’s a big bundle of papers, with my own copies too, that I could do with ditching!BooJewels said:

I only knew because my Dad's solicitor told me to do it when we advised her he'd passed. The funny thing is, you send it back - well, I sent the certified copy I had, with a death certificate - and a few weeks later you get it back, looking exactly the same - I thought it might be stamped across 'cancelled' or something.poppystar said:

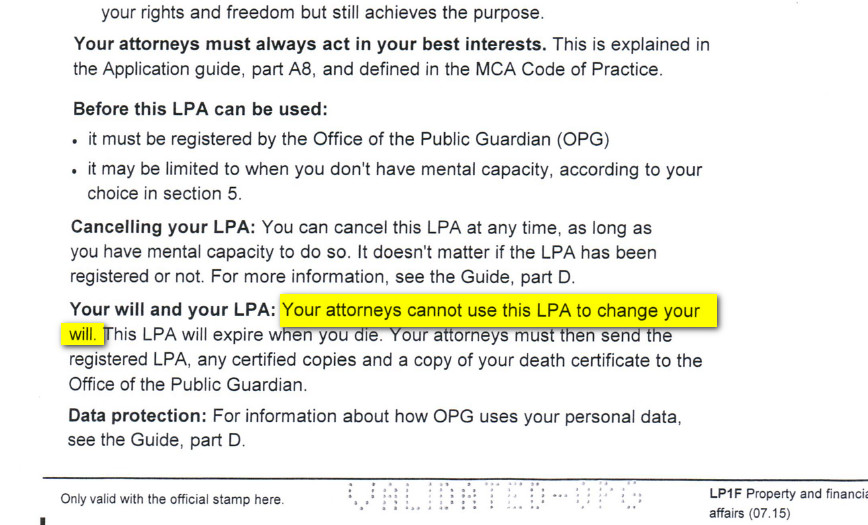

Eek! That’s worried me now reading the next bit about sending back LPA and certified copies on death. I had no idea about that and so didn’t. I didn’t see it written anywhere when I was dealing with the estate.BooJewels said:I don't think an LPA can be used to change a will - I've just been looking at one as I'm just using it for something and it specifically says "Your Attorneys cannot use this LPA to change your will" - on both the Finance and Health ones.

ETA: Screen grab, as I still have it open: 0

0 -

The 'action' they wish to take on behalf of their mother may be as simple as offering advice in response to questions.sevenhills said:The OP is seeking advice in order to act on behalf of her mother, so the mother is obviously not capable.Signature removed for peace of mind0 -

Asuming that the estate was left to her absolutely, not as a life interest, then there is nothing to stop her changing her will. Ionthemend said:My mother in law (83) has lost her second husband approximately 3 years ago, and the estate has transferred to her. We have power of attorney of her affairs and she re-wrote her will so that her 3 children will share 75% of the estate equally, and her late husbands 2 adult children would equally share the remaining 25%. Her estate comprises of a small apartment 250k and assets 150K

However, since her husbands death, her late 2nd husbands children have not kept in touch and do not deal with her day to day needs, so she keeps talking about re-writing her will to share the whole estate equally between her 3 children, and not to leave the late husbands children anything.

I'm seeking any advise on why she should not be able to re-write her will to make these changes and what position would the 2nd husband's 2 adult children have to contest these changes, our mother in law is of sound mind.

I look forward to any feedback/ suggestions

If she is not fit enough to go to a solicitors pffoice most can arrange home visits. They will probaby ask her why she wants to make the change, not to be judgemental but becasuee they would be on the alert for any indicatins that she might be losing capacity or have been put under pressure.

That said, if she is talking to you about it, it might be reasonable for you to suggest to her that it would be fairer for her to leave things as they are - her husband's childeren may not have been visiting much but presumably in leaving eveything to her, her husband did so trusting that she would be fair to both sets of children, and if a proportion of the assets were originall his rather than hers, ensuring that they return to his children rather than hers is likely what he assumed and expected would happen, and what she would have wanted to happen with her sahre of the assets, had she been the one who died first. Do you know whether husband left anything to his children, or did everything go to her on the basis that they had make mirror wills with the assumption that all the children would benefit in the end?

Of cours, iof you do have that conversation and she still wants to leace eveything to you and your siblings, that's her choice to make, but I think in your position I would feel very uncomfortable if I didn't at least raise the question. (If of course he brought nothing into the marriage then it's a little different, but your mention of the estate trnasferring to her suggests that there were assets in his name which came to her.) Were his children on good terms with him before his death?

If she does go ahead and make the change thenI would expect the solicitor to double check and perhaps to suggest thatshe also provides a side-letter setting out her reasons, to protect you/the estate if the step-children were to question the will.All posts are my personal opinion, not formal advice Always get proper, professional advice (particularly about anything legal!)3 -

If she had died first, would her children have been closely involved in their step-father's life?onthemend said:However, since her husbands death, her late 2nd husbands children have not kept in touch and do not deal with her day to day needs

While she has every legal right to change her will, it's not kind and not fair.

0 -

It doesn't look as if the OP is coming back. The question seems to have been answered though - it's perfectly legal for the person to change her will in this way, but forum members mainly disapprove.1

-

Marmaduke123 said:It doesn't look as if the OP is coming back. The question seems to have been answered though - it's perfectly legal for the person to change her will in this way, but forum members mainly disapprove.

There's also a massive conflict of interest here. The person standing to benefit is seeking to aid this coming to fruition.

It just seems murky as.5 -

If she does decide to make a new will then it will not be as easy as going to a solicitors & saying I want to make a new will. A good solicitor will do not just an ID check but also a mental ability check (re dementia) & shouldn't let anyone else connected be in the same room whilst taking instructions.

0 -

The consensus seems to be legal but morally wrong.

Whilst I have no experience or qualification to disagree, I would be incredibly surprised if it was actually legal for someone with POA to change someone's Will so the POA holder can benefit given the original Will would have be done in sound mind.

Someone with deputyship) POA for finance changing a Will is one thing.

A deputy / POA changing a Will so they benefit could be a whole different kettle of fish.

It would be very interesting to get a professionals view on that.2 -

If you go back a page @billy2shots you'll see that I posted a screengrab of the LPA document where it says that an Attorney cannot change a will under the authority of an LPA.0

-

That's very reassuring @BooJewelsBooJewels said:If you go back a page @billy2shots you'll see that I posted a screengrab of the LPA document where it says that an Attorney cannot change a will under the authority of an LPA.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards