We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Could the government raise the limit for tax free savings?

Comments

-

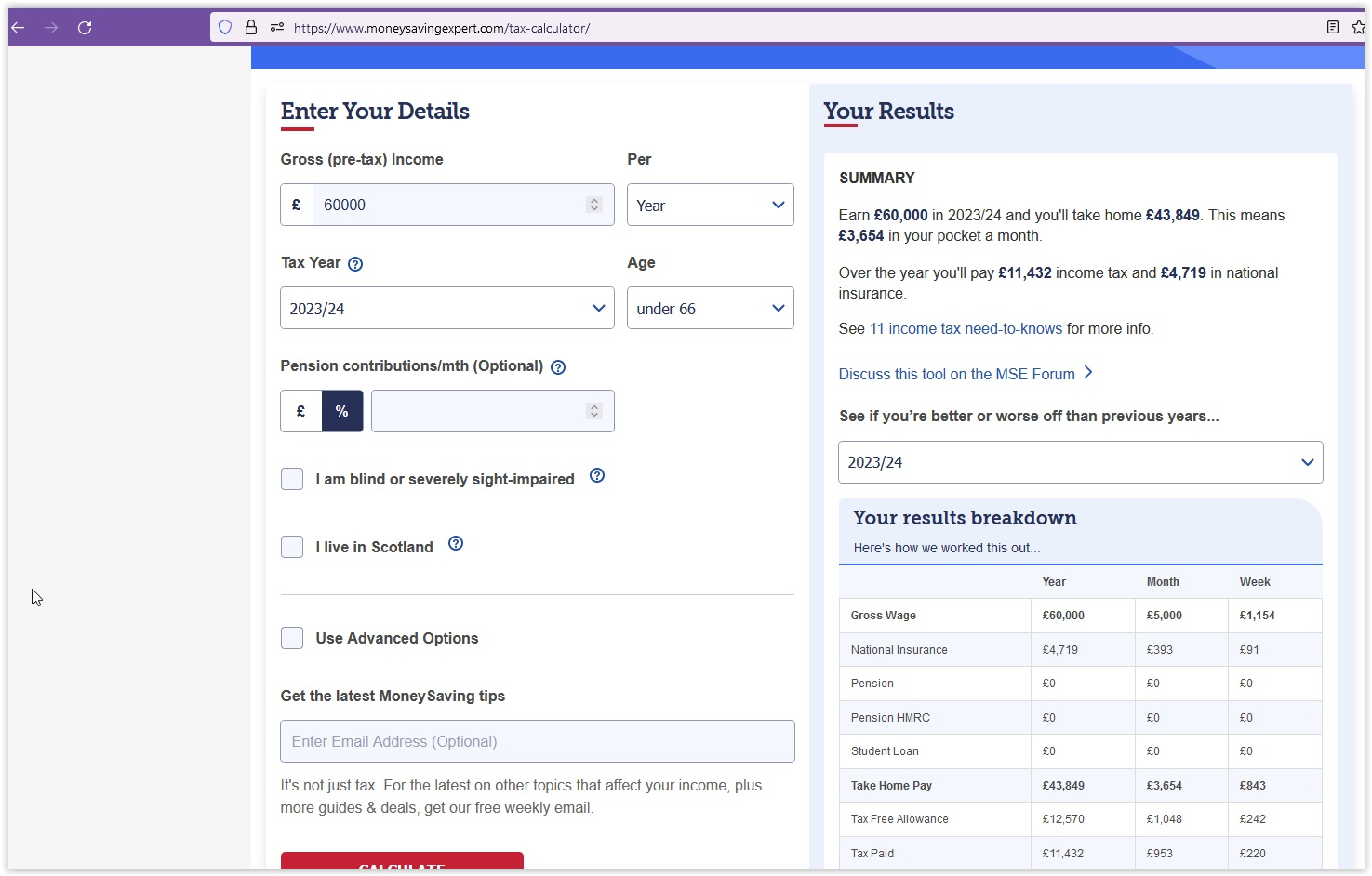

Malthusian said:A salary of about £60k would incur £12k in income tax (£61.5k, to be precise). And both of you were way off about NI, a salary of £60,000 incurs £11,743 in National Insurance.The MSE tax calculator suggests you are way off about NI

2

2 -

Citation needed. Opal Fruits was a much better name. Starburst sounds like a My Little Pony.MattMattMattUK said:No, because those would be daft.But streamlining the process would make a lot of sense.That was what Osborne did when he changed the system. It meant that the majority no longer had any tax to pay on interest, and saved non-taxpayers the bother of reclaiming the 20% tax that had previously been deducted at source.

The general principle is that the less income you have, the less hassle you should have with the taxman. If non-taxpayers have to submit a form as a result of their interest income while richer basic rate taxpayers don't, in order to pay the correct amount of tax, the system has been designed poorly.

Of course, it doesn't work so well when the amount of interest people receive goes up and the interest rate allowance goes down thanks to fiscal drag. But I would be surprised if the Tories undid their own reforms less than ten years after enacting them.

Do, do, do, another one bites the dust. You forgot employer's NI.lcooper said:The MSE tax calculator suggests you are way off about NI

60,000 - 9,100 * 0.138 = another £7,042 on top of that.

0 -

Well, if you're going to use your own unique definition of "salary", you could arrive at any figure you feel like. You'd stand a better chance of winning an argument if you stuck to what everyone else means.Malthusian said:

Citation needed. Opal Fruits was a much better name. Starburst sounds like a My Little Pony.MattMattMattUK said:No, because those would be daft.But streamlining the process would make a lot of sense.That was what Osborne did when he changed the system. It meant that the majority no longer had any tax to pay on interest, and saved non-taxpayers the bother of reclaiming the 20% tax that had previously been deducted at source.

The general principle is that the less income you have, the less hassle you should have with the taxman. If non-taxpayers have to submit a form as a result of their interest income while richer basic rate taxpayers don't, in order to pay the correct amount of tax, the system has been designed poorly.

Of course, it doesn't work so well when the amount of interest people receive goes up and the interest rate allowance goes down thanks to fiscal drag. But I would be surprised if the Tories undid their own reforms less than ten years after enacting them.

Do, do, do, another one bites the dust. You forgot employer's NI.lcooper said:The MSE tax calculator suggests you are way off about NI

60,000 - 9,100 * 0.138 = another £7,042 on top of that.2 -

My figures are correct, based on the assumption that the tax code is ‘normal’Malthusian said:

A salary of about £60k would incur £12k in income tax (£61.5k, to be precise). And both of you were way off about NI, a salary of £60,000 incurs £11,743 in National Insurance.jaypers said:Income tax on a £60k salary would be £11,432 and NI would be £4,719. I only mention this as that’s nearly £2k, which is significant to many people and your figures are exaggerated.

For someone paying graduate tax and with two kids, that's £11,432 in income tax, £2,075 child benefit tax, £2,943 graduate tax, £11,743 in NI and £3k council tax. (I'm not counting pension contributions as that's very unlikely to be a tax for someone on £60k.) Total £31,193. What's a rounding error of £2k between friends?

That said, if they have a salary of £60k and they have kids (which usually implies a partner), it's not tax that is stopping them buying a house.0 -

Might as well add Corporation tax thenMalthusian said:

Citation needed. Opal Fruits was a much better name. Starburst sounds like a My Little Pony.MattMattMattUK said:No, because those would be daft.But streamlining the process would make a lot of sense.That was what Osborne did when he changed the system. It meant that the majority no longer had any tax to pay on interest, and saved non-taxpayers the bother of reclaiming the 20% tax that had previously been deducted at source.

The general principle is that the less income you have, the less hassle you should have with the taxman. If non-taxpayers have to submit a form as a result of their interest income while richer basic rate taxpayers don't, in order to pay the correct amount of tax, the system has been designed poorly.

Of course, it doesn't work so well when the amount of interest people receive goes up and the interest rate allowance goes down thanks to fiscal drag. But I would be surprised if the Tories undid their own reforms less than ten years after enacting them.

Do, do, do, another one bites the dust. You forgot employer's NI.lcooper said:The MSE tax calculator suggests you are way off about NI

60,000 - 9,100 * 0.138 = another £7,042 on top of that.1 -

By "National Insurance" I assume people mean "National Insurance".EthicsGradient said:Well, if you're going to use your own unique definition of "salary", you could arrive at any figure you feel like. You'd stand a better chance of winning an argument if you stuck to what everyone else means.RedImp_2 said:

Might as well add Corporation tax thenHow so? Employees' salary reduces the Corporation Tax bill. Corporation Tax does constitute an income tax for limited company owners, but Arnoldy's scenario indicates a salaryman.

0 -

It seems I have landed in a strange place where some employer tax payments are somehow deducted by some people from employee gross pay. Whatever floats your boat, I suppose.

0 -

I think that the Government should replace the annual personal savings allowance with one based on the individuals annual income tax paid.This would help to mitigate the double taxation of savings made out of already taxed earnings. Individuals who have savings but haven't paid any income tax would lose out, but shouldn't everyone pay some tax for the provision of public services? A similar tax off setting principal could be applied to inheritance tax allowances.0

-

You don't get taxed on your capital/principal in savings accounts. Only the interest this balance earns counts as taxable income.Warren_Muppet said:I think that the Government should replace the annual personal savings allowance with one based on the individuals annual income tax paid.This would help to mitigate the double taxation of savings made out of already taxed earnings. Individuals who have savings but haven't paid any income tax would lose out, but shouldn't everyone pay some tax for the provision of public services? A similar tax off setting principal could be applied to inheritance tax allowances.

0 -

Warren_Muppet said:This would help to mitigate the double taxation of savings made out of already taxed earnings.There is no double taxation, your earned income is only taxed onceOnly the interest arising from the savings is taxed as it is additional income1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards