We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

HMG savings plan and BR

maxmycardagain

Posts: 5,853 Forumite

A family member was on UC but started a £50/month HMG savings (help to save?) by direct debit, she has £450 saved up, if she goes BR (or a DRO) will the OR snatch the savings? should she close the account now?

0

Comments

-

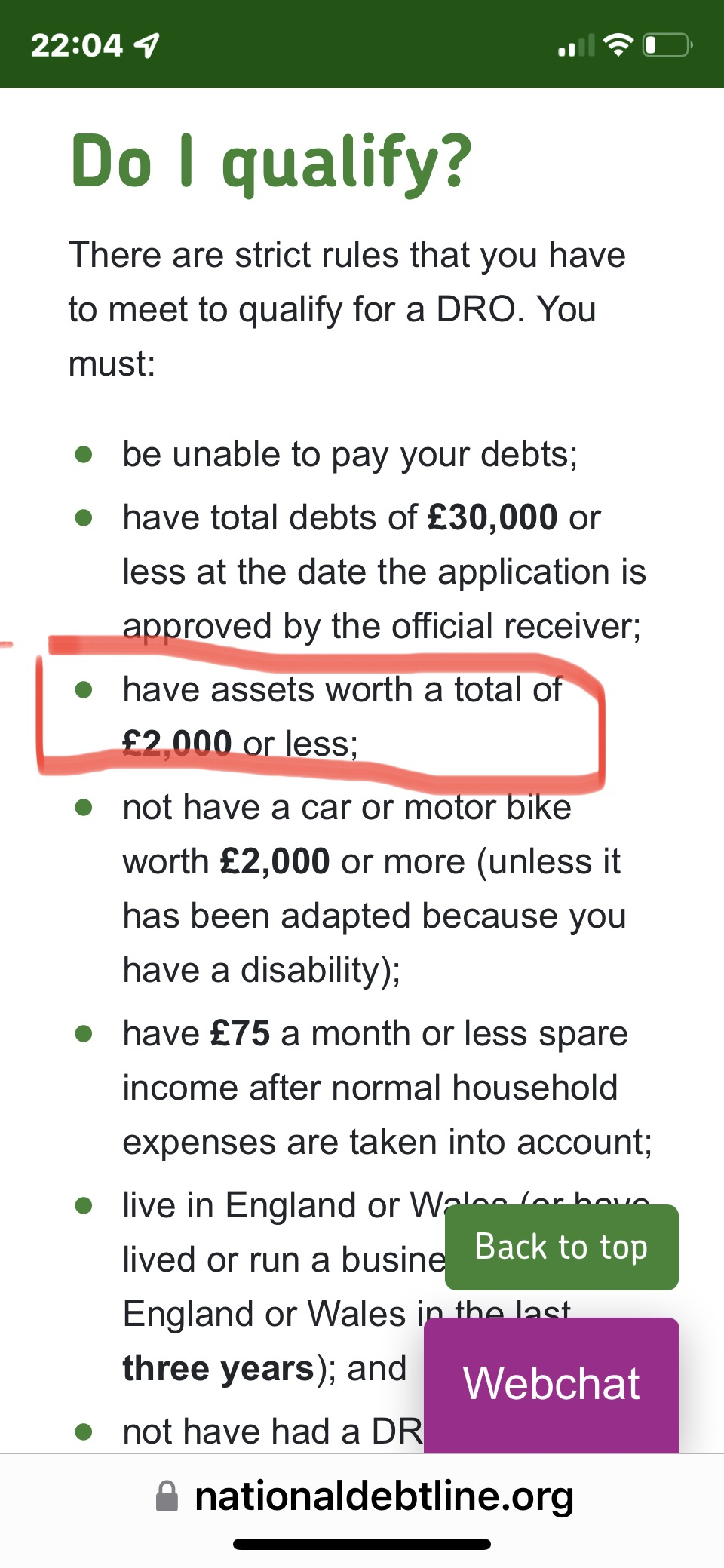

In a DRO you have to have under £2000 of assets

0 -

That doesn't mean they'd not snatch money saved though, just that over £2000 means you can't get a DRO0

-

You are allowed to have up to £2k in assets. If I’m wrong I’m sure @fatbelly will correct me.Can I just enquire who are all these friends of yours that need help that can’t ask on here for themselves or talk to StepChange or National Debtline?0

-

Some do, if they can get through, some don't do Internet or smartohonesflipflopflo said:You are allowed to have up to £2k in assets. If I’m wrong I’m sure @fatbelly will correct me.Can I just enquire who are all these friends of yours that need help that can’t ask on here for themselves or talk to StepChange or National Debtline?

Is it an issue?0 -

Under either scheme the payment is unlikely to be an allowable expense, and generally it's not recommended to be trying to save while you have high-interest debts.maxmycardagain said:A family member was on UC but started a £50/month HMG savings (help to save?) by direct debit, she has £450 saved up, if she goes BR (or a DRO) will the OR snatch the savings? should she close the account now?

In a DRO there is no seizing of assets nor any payment other than the £90 fee. You either meet the criteria, or you don't, and either get the DRO or not. You're allowed 2k of 'assets' plus a car worth up to 2k

In bankruptcy any savings can be taken though small amounts may be disregarded.

Your family member will need £680 for bankruptcy so it may make sense for them to continue until they have that sum. There is no way to avoid the fee, unfortunately. If it turns out they do a DRO then they can keep that sum (well all but £90) as an emergency fund1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards