We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

BOE and a recession.

Comments

-

There is middle ground though, between "doom-mongering" and "sticking ones head in the sand" !

We just need to try and find a balance between preparing for the things that "might" happen and those likely to happen, within our own wellbeing tolerances, and then ignoring all the other chatter.

Forewarned is forearmed

Fail to prepare, prepare to fail....and all that jazz.

Or alternatively, Ignorance is bliss How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)1

How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)1 -

The potential 1% rise is not scaremongering. Its been on the news that the markets are speculating this rise. If you want a vision of the future just look over the pond at what the Fed is doing to rates. US Mortgage rates are already over 7%. In fact they have been over 6% from back in August. What happens there makes its way here since our markets are so closely aligned.brownbagsFTB said:

Do you have a source for this info or is it just speculation on your part? I thought it was a given that there would be a steep rise in BoE rates in November, Andrew Bailey said as much last week and the markets are prepared for rises of up to 5.25% by next year. So has anything actually changed?I think we all need to start preparing for some real tough economic times as inflation keeps spiraling and interest rates are going to be much higher than a lot of people on here are anticipating.

Please be mindful of posting doomsday claims on here if there isn’t basis as there are a lot of worried people at the moment.

The fed rate is currently 3 - 3.25% so the BOE will need to raise by 1% to match. Otherwise Sterling will weaken against the US Dollar making imports - which the UK does a lot of - and especially energy which is priced in USD - more expensive adding to inflation.

It will not be great news for anyone looking to re-mortgage / purchase soon but there is ample information out there that paints a picture of where rates are heading in the UK1 -

Absolutely! I’m very interested in the counter argument to rates hitting the predicted 5% next year but only if there is context, reasoning and basis to back it up. If people have a theory as to why they think this totally expected rise in inflation will cause higher interest, I’m all ears. However I don’t think there’s foundation, it’s just personal speculation which doesn’t help anyone.Sea_Shell said:There is middle ground though, between "doom-mongering" and "sticking ones head in the sand" !

Yes inflation hit double figures today, it was expected to hit 10 so it was higher by 0.1 (neither here nor there) it’s also expected to hit 11 this month but won’t peak as high as previously forecast after the disastrous mini-budget.The catch 22 is that rising housing costs is the biggest driver of inflation this month (i.e. fuel and mortgage interest rates). The BoE and the government will have to strike a careful balance over the coming months to curb inflation (just hiking interest rates to crazy levels above inflation isn’t the magic wand that some posters on here think it is)0 -

Aberdeenangarse said:Inflation now at 10.1% It looks like the BoE will be making a fairly hefty increase in the base rate next month.

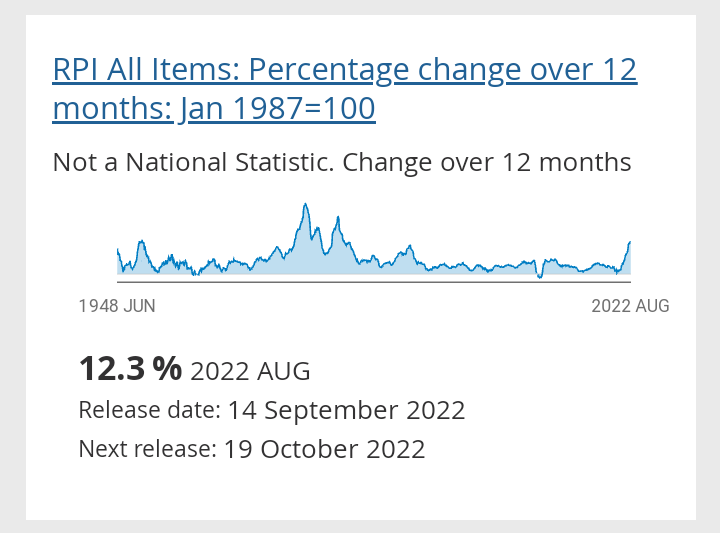

Alternatively the RPI inflation rate is 12.3%

Much more applicable to the average person as it excludes the top 4% of earners.1 -

I think you misread my comment. This is what I’m saying too, the rise is expected. What I’m asking people to be mindful of is making sweeping statements of “rates will be much, much higher” etc than projected. We already know the BoE base rate is expected to peak at 5.25% next year, so why now would rates go even higher? 🤷♀️PK_London said:

The potential 1% rise is not scaremongering. Its been on the news that the markets are speculating this rise.brownbagsFTB said:

Do you have a source for this info or is it just speculation on your part? I thought it was a given that there would be a steep rise in BoE rates in November, Andrew Bailey said as much last week and the markets are prepared for rises of up to 5.25% by next year. So has anything actually changed?I think we all need to start preparing for some real tough economic times as inflation keeps spiraling and interest rates are going to be much higher than a lot of people on here are anticipating.

Please be mindful of posting doomsday claims on here if there isn’t basis as there are a lot of worried people at the moment.1 -

As Martin said on his Moneyshow last night. Although fixed rate rises are levelling off, they’re still rising slightly.brownbagsFTB said:

I think you misread my comment. This is what I’m saying too, the rise is expected. What I’m asking people to be mindful of is making sweeping statements of “rates will be much, much higher” etc than projected. We already know the BoE base rate is expected to peak at 5.25% next year, so why now would rates go even higher? 🤷♀️PK_London said:

The potential 1% rise is not scaremongering. Its been on the news that the markets are speculating this rise.brownbagsFTB said:

Do you have a source for this info or is it just speculation on your part? I thought it was a given that there would be a steep rise in BoE rates in November, Andrew Bailey said as much last week and the markets are prepared for rises of up to 5.25% by next year. So has anything actually changed?I think we all need to start preparing for some real tough economic times as inflation keeps spiraling and interest rates are going to be much higher than a lot of people on here are anticipating.

Please be mindful of posting doomsday claims on here if there isn’t basis as there are a lot of worried people at the moment.0 -

PK_London said:

The potential 1% rise is not scaremongering. Its been on the news that the markets are speculating this rise. If you want a vision of the future just look over the pond at what the Fed is doing to rates. US Mortgage rates are already over 7%. In fact they have been over 6% from back in August. What happens there makes its way here since our markets are so closely aligned.brownbagsFTB said:

Do you have a source for this info or is it just speculation on your part? I thought it was a given that there would be a steep rise in BoE rates in November, Andrew Bailey said as much last week and the markets are prepared for rises of up to 5.25% by next year. So has anything actually changed?I think we all need to start preparing for some real tough economic times as inflation keeps spiraling and interest rates are going to be much higher than a lot of people on here are anticipating.

Please be mindful of posting doomsday claims on here if there isn’t basis as there are a lot of worried people at the moment.

The fed rate is currently 3 - 3.25% so the BOE will need to raise by 1% to match. Otherwise Sterling will weaken against the US Dollar making imports - which the UK does a lot of - and especially energy which is priced in USD - more expensive adding to inflation.It's predicted the Fed will have to increase interest rates by another 0.75 percent in November."Inflation Report Seals Case for 0.75-Point Fed Rate Rise in November

With no sign of a slowdown in price pressures, officials could revise up estimates of how high rates will rise next year"

2 -

For those that wanted a reputable news source…

Bank of England to launch record rate rise to step up fight against 40-year high inflation:

https://www.cityam.com/uk-inflation-rises-to-10-1-per-cent/

Note how the cut to the energy cap will increase inflation and that in turn will increase interest rates further.0 -

People talk of housing market crash and there will likely be some correction/slow down but nothing as drastic as the 30-50% crash bandied about.

1. There is a housing shortage

2. Cost of raw materials have increased drastically and so the cost to build a property is much higher than previous. Price of materials cannot keep increasing but then expect house prices to drop

3. If inflation is high (currently higher than interest rates), then it is inevitable that salaries have to increase overall and it then would suggest that houses will still increase - houses are not immune to inflation, in fact there is a direct correlation to house prices and inflation. Over years/decades in the UK, house prices have increased at a faster rate than inflation.

Whilst cheap borrowing may have influenced the increase in the housing market, the over-riding fact is there is a housing shortage and a desire amongst the UK public to own their own home.0 -

I'll raise your source (from BOE Deputy Governor today):ader42 said:For those that wanted a reputable news source…

Bank of England to launch record rate rise to step up fight against 40-year high inflation:

https://www.cityam.com/uk-inflation-rises-to-10-1-per-cent/

Note how the cut to the energy cap will increase inflation and that in turn will increase interest rates further.BoE's Broadbent: Interest rates may not rise as much as market expects

Just in. Bank of England deputy governor Ben Broadbent has said it ‘remains to be seen’ whether UK interest rates have to rise as much as the markets predict.

That could bring some relief to mortgage-holders, who are concerned that interest rates are currently forecast to more than double to over 5% by next summer.

Speaking at Imperial College London, Broadbent explains that the economy has been hit by severe real shocks.

The pandemic raised the global demand for goods and reduced their supply; Russia has cut back severely its supply of gas to Europe. These have had dramatic effects on relative prices.

In particular, import prices have risen significantly compared with the price of UK output. This has unavoidably depressed real incomes: the volume of output may have just about recovered to pre-Covid levels but its consumption value has not.

Broadbent also warned that the economy would suffer a hit if market bets about rising rates come to pass.

Broadbend explains that the Bank’s Monetary Policy Committee will respond promptly to news about fiscal policy (the MPC is due to set interest rates on November 3rd, three days after Jeremy Hunt is due to announce his fiscal plan).

Broadbent says the justification for tightening monetary policy is clear (inflation is five times over the Bank’s 2% target, for starters).

But much of the overshoot in inflation is due to higher import prices (such as gas, and food which has risen by over 14% in the last year). That effect should fade as prices stabilise.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.3K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards