We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Anyone use Guyton-Kinger's sustainable withdrawal rules?

GazzaBloom

Posts: 838 Forumite

Is anyone using the Guyton-Klinger rules for annual drawdown adjustments to their starting SWR? If so how is it working out?

- The withdrawal rule: Increase withdrawal in line with inflation in the previous years, unless the previous year’s portfolio total return was negative.

- The portfolio management rule: Extract the gains from an asset class that has performed best in the previous year to provide the income, and move excess portfolio gains (beyond what is needed for the withdrawal) into a cash account to fund future withdrawals.

- The capital preservation rule: If the current withdrawal rate rises above 20% of the initial rate, then current spending is reduced by 10%.

- The prosperity rule: Spending in the current year is raised by 10% if the current withdrawal rate has fallen by more than 20% below the initial withdrawal rate.

0

Comments

-

jamesd hasn't been around much lately, but have a look at this thread:

https://forums.moneysavingexpert.com/discussion/5466114/drawdown-safe-withdrawal-rates/p1

1 -

So I can increase my withdrawals 10% if my portfolio is up £1, but not if it's down £1?- The withdrawal rule: Increase withdrawal in line with inflation in the previous years, unless the previous year’s portfolio total return was negative.

0 -

Yes, as long as in doing so you do not breech the capital preservation rule, at which point you will be raising by 10% and then reducing by 10%Secret2ndAccount said:

So I can increase my withdrawals 10% if my portfolio is up £1, but not if it's down £1?- The withdrawal rule: Increase withdrawal in line with inflation in the previous years, unless the previous year’s portfolio total return was negative.

Our green credentials: 12kW Samsung ASHP for heating, 7.2kWp Solar (South facing), Tesla Powerwall 3 (13.5kWh), Net exporter0 -

It just gets better with every ruleNedS said:Yes, as long as in doing so you do not breech the capital preservation rule, at which point you will be raising by 10% and then reducing by 10% 0

0 -

Hey, wait a minute! I've just realised, if I increase my withdrawals 10%, then reduce them 10% that leaves me 1% worse off. No fair!0

-

Future you would be grateful you did…Secret2ndAccount said:Hey, wait a minute! I've just realised, if I increase my withdrawals 10%, then reduce them 10% that leaves me 1% worse off. No fair!0 -

Secret2ndAccount said:

It just gets better with every ruleNedS said:Yes, as long as in doing so you do not breech the capital preservation rule, at which point you will be raising by 10% and then reducing by 10% That's the thing with rules - you either follow them or you don't.Guyton-Klinger rules employ guard rails, the capital preservation and prosperity rules, which are aimed to essentially keep you on track over the longer term. If you start to veer off course they will correct you, like bouncing off a guard rail to keep you on course.

That's the thing with rules - you either follow them or you don't.Guyton-Klinger rules employ guard rails, the capital preservation and prosperity rules, which are aimed to essentially keep you on track over the longer term. If you start to veer off course they will correct you, like bouncing off a guard rail to keep you on course.

Don't forget, in circumstances where your portfolio may only be down by £1, the prosperity rule still allows you to apply a 10% increase if your portfolio can afford it, so the the capital preservation and prosperity rules will keep you on track at times where the withdrawal rule appears somewhat arbitrary.Secret2ndAccount said:

So I can increase my withdrawals 10% if my portfolio is up £1, but not if it's down £1?- The withdrawal rule: Increase withdrawal in line with inflation in the previous years, unless the previous year’s portfolio total return was negative.

Our green credentials: 12kW Samsung ASHP for heating, 7.2kWp Solar (South facing), Tesla Powerwall 3 (13.5kWh), Net exporter0 -

Hopefully notGazzaBloom said:Is anyone using the Guyton-Klinger rules for annual drawdown adjustments to their starting SWR? If so how is it working out?- The withdrawal rule: Increase withdrawal in line with inflation in the previous years, unless the previous year’s portfolio total return was negative.

- The portfolio management rule: Extract the gains from an asset class that has performed best in the previous year to provide the income, and move excess portfolio gains (beyond what is needed for the withdrawal) into a cash account to fund future withdrawals.

- The capital preservation rule: If the current withdrawal rate rises above 20% of the initial rate, then current spending is reduced by 10%.

- The prosperity rule: Spending in the current year is raised by 10% if the current withdrawal rate has fallen by more than 20% below the initial withdrawal rate.

1 -

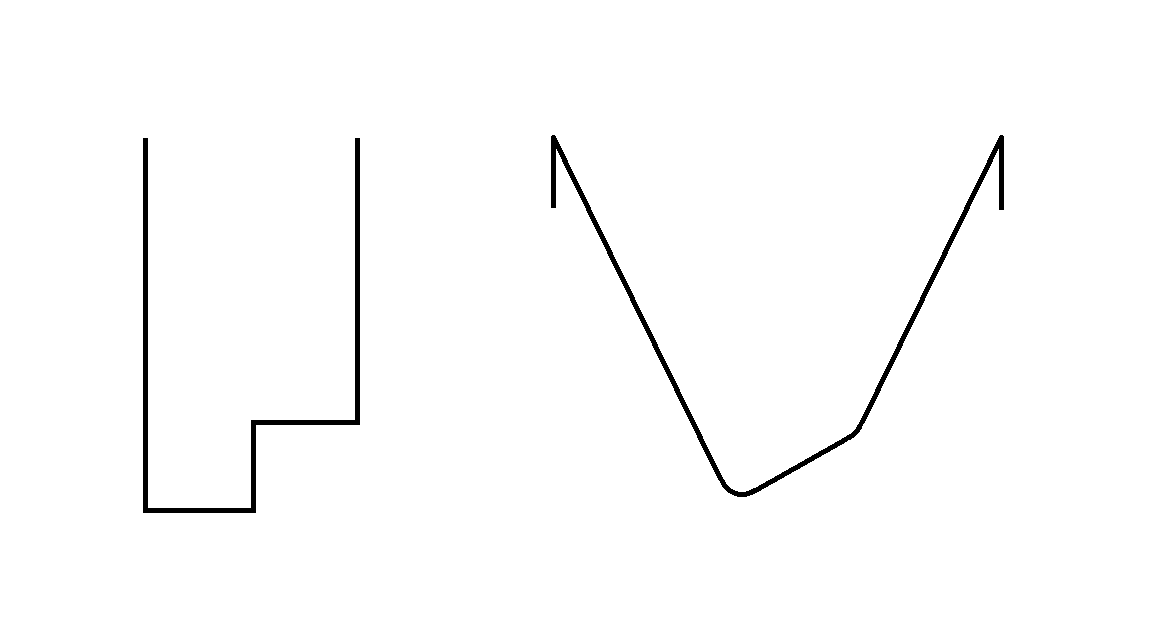

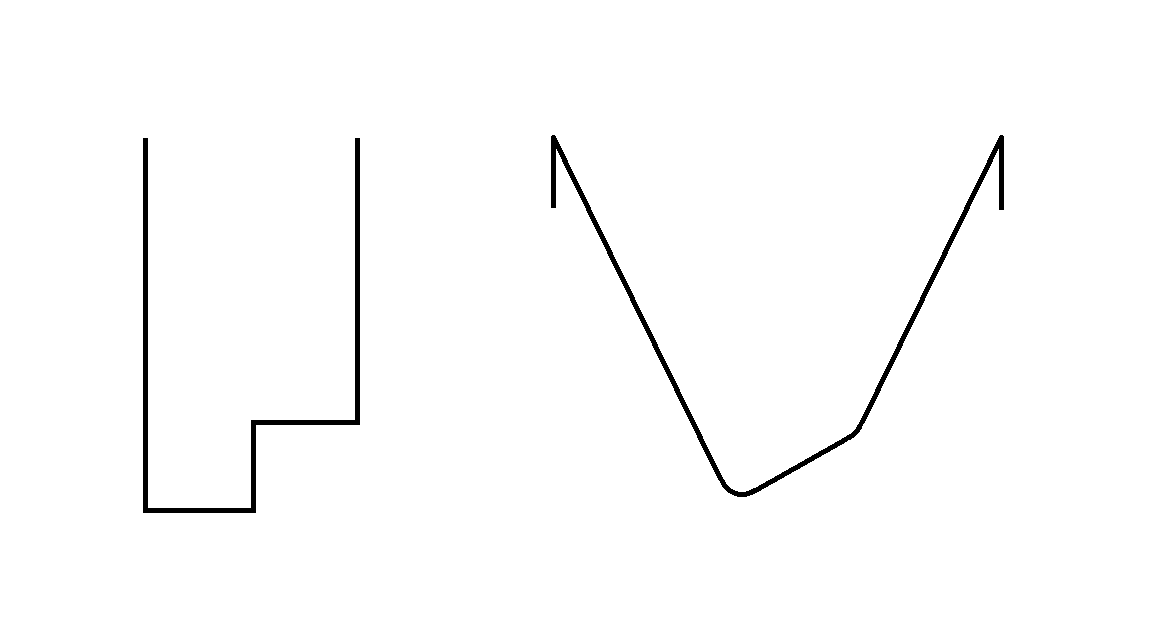

The problem I have with GK is not that it doesn't work. I think that it generates too many harsh (and arbitrary) edges. Increase 10% or don't based on one exact thing happening. Why not smooth off the edges: "Increase your drawing by 30% of the gain in your portfolio". Imagine a ball, rolling along, constrained within a channel. GK is the channel on the left. I prefer something like the channel on the right:

This doesn't change the sustainability over the long term, but it smooths out the income from year to year, and makes next year's change more predictable at a glance.

One other thing to remember. If you choose a simple SWR method of, say, 3.5% then many adopters will end up with a large pot, so they could have spent more earlier. The principle of GK is to start by spending more in the hope that the pot behaves in a somewhat average, or better manner. Maybe you never need to cut back. However, if the max SWR is 3.5% that means there was one case where 3.5% went right to the wire, and came within an inch of failure. If you started your withdrawals at 5% then some serious cutbacks would be required when that worst case hit - maybe dropping to half your original withdrawals. As long as you go in with your eyes open, and can accept this if it happens, and live on the reduced income, then GK is a viable method.0 -

I have been looking the percentage of success based on historical data and agree that a 99% success rate will mean you would have survived that 1 worst case scenario but if that didn't play out exactly as history (which it won't) then the kids are in for a treat as you would accumulate too much legacy and may not have had the retirement you could have had.Secret2ndAccount said:The problem I have with GK is not that it doesn't work. I think that it generates too many harsh (and arbitrary) edges. Increase 10% or don't based on one exact thing happening. Why not smooth off the edges: "Increase your drawing by 30% of the gain in your portfolio". Imagine a ball, rolling along, constrained within a channel. GK is the channel on the left. I prefer something like the channel on the right:

This doesn't change the sustainability over the long term, but it smooths out the income from year to year, and makes next year's change more predictable at a glance.

One other thing to remember. If you choose a simple SWR method of, say, 3.5% then many adopters will end up with a large pot, so they could have spent more earlier. The principle of GK is to start by spending more in the hope that the pot behaves in a somewhat average, or better manner. Maybe you never need to cut back. However, if the max SWR is 3.5% that means there was one case where 3.5% went right to the wire, and came within an inch of failure. If you started your withdrawals at 5% then some serious cutbacks would be required when that worst case hit - maybe dropping to half your original withdrawals. As long as you go in with your eyes open, and can accept this if it happens, and live on the reduced income, then GK is a viable method.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards