We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

New rate from Halifax 3.73%

Comments

-

I've just paid £5k to fix mine again rather than wait til Spring next year. It's a lot of money but when you do the maths it won't take much of an interest rate rise in the next 6 months to be the better option. For me, a rise of just over 1% would be more expensive over the next 5 years than taking the hit now...1

-

Based on current rates available in the market, 3.73% for a 10 year fix looks very good to me. I've had a quick look on the Halifax website myself and it is quoting me a rate of 4.48% for a 10 year fix.

Out of interest, what's the product fee?0 -

no product fee as far as I know as we are already with them - just need to pay ERC to get out of current fixed - I'm still waiting on the phone - rate might have changed by the time I get to speak to them again

0

0 -

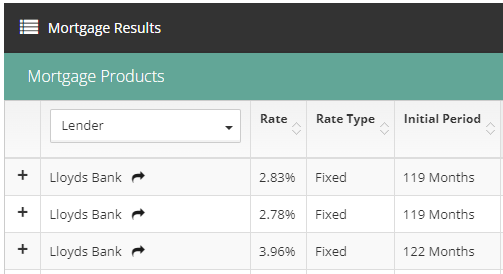

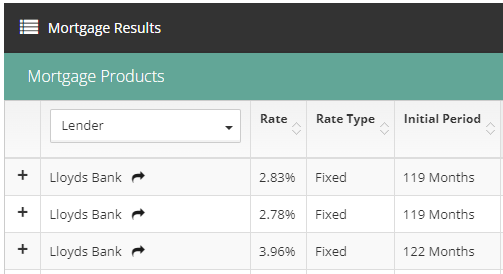

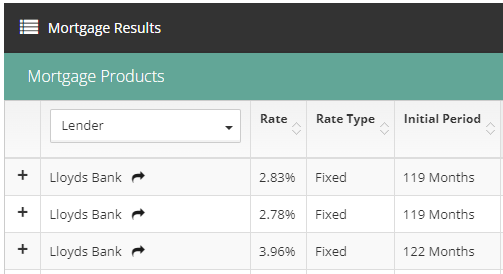

@hippydip There might be some reason you need to stick to Halifax, but if not, I can see Lloyds 60/75% remo 10yr fixes at 2.78-2.83%. Hopefully it's not been pulled.hippydip said:Along with many others I'm spending a bit of time trying to work out whether we would be better to pay an early repayment charge for current fixed deal which finishes in April 2023. Our early repayment is charge is in the region of £2000 - I'm looking to go to a 10 year fixed rate which they have offered me at 3.73% - it's a lot to pay as an early repayment charge but with £153,000 still to pay on the mortgage and bills to pay I'm really needing to know what we will be paying per month - any thoughts on the rate I've been offered? Been on hold for 2 hours waiting to confirm with mortgage advisor - I appreciate they are busy but oh my goodness

They are direct only, might be worth checking out the rates available to you on their remortgage websiteI am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1 -

We got a mortgage switch offer from Halifax (our current lender) today.

We are in a similar situation to many, currently on a 5 year fix at 2.2%, due to end June 2023 with an ERC of £1800

Today we locked in a 5year fix offer of 3.49%. The offer is valid until 28th Feb 2023.

Our plan is to wait until 1st Feb to accept it and pay the ERC. This gives us 5 more months on our current fix that we can use the savings for to water down the ERC. Plus maybe some divine intervention will fall upon us and fix the economy by then, in which case we will cancel it and reevaluate.0 -

That's what I was hoping to do, but Natwest won't allow it - would have to pay the ERC at the current rate, and switch to the new fix immediately.baguettes said:We got a mortgage switch offer from Halifax (our current lender) today.

We are in a similar situation to many, currently on a 5 year fix at 2.2%, due to end June 2023 with an ERC of £1800

Today we locked in a 5year fix offer of 3.49%. The offer is valid until 28th Feb 2023.

Our plan is to wait until 1st Feb to accept it and pay the ERC. This gives us 5 more months on our current fix that we can use the savings for to water down the ERC. Plus maybe some divine intervention will fall upon us and fix the economy by then, in which case we will cancel it and reevaluate.0 -

How do you find those rates?K_S said:

@hippydip There might be some reason you need to stick to Halifax, but if not, I can see Lloyds 60/75% remo 10yr fixes at 2.78-2.83%. Hopefully it's not been pulled.hippydip said:Along with many others I'm spending a bit of time trying to work out whether we would be better to pay an early repayment charge for current fixed deal which finishes in April 2023. Our early repayment is charge is in the region of £2000 - I'm looking to go to a 10 year fixed rate which they have offered me at 3.73% - it's a lot to pay as an early repayment charge but with £153,000 still to pay on the mortgage and bills to pay I'm really needing to know what we will be paying per month - any thoughts on the rate I've been offered? Been on hold for 2 hours waiting to confirm with mortgage advisor - I appreciate they are busy but oh my goodness

They are direct only, might be worth checking out the rates available to you on their remortgage website

I just looked and they're only offering 4.02% for years, no mention of a 10 yr fix (my LTV is 27%). If I tell it that I'm a Club Lloyds customer they do show a 10yr fix at 3.88%, but that's for existing customers only.0 -

@elwoodblues On my sourcing tool. But these are only updated once or twice a day so the products might no longer be available.ElwoodBlues said:

How do you find those rates?K_S said:

@hippydip There might be some reason you need to stick to Halifax, but if not, I can see Lloyds 60/75% remo 10yr fixes at 2.78-2.83%. Hopefully it's not been pulled.hippydip said:Along with many others I'm spending a bit of time trying to work out whether we would be better to pay an early repayment charge for current fixed deal which finishes in April 2023. Our early repayment is charge is in the region of £2000 - I'm looking to go to a 10 year fixed rate which they have offered me at 3.73% - it's a lot to pay as an early repayment charge but with £153,000 still to pay on the mortgage and bills to pay I'm really needing to know what we will be paying per month - any thoughts on the rate I've been offered? Been on hold for 2 hours waiting to confirm with mortgage advisor - I appreciate they are busy but oh my goodness

They are direct only, might be worth checking out the rates available to you on their remortgage website

I just looked and they're only offering 4.02% for years, no mention of a 10 yr fix (my LTV is 27%). If I tell it that I'm a Club Lloyds customer they do show a 10yr fix at 3.88%, but that's for existing customers only.

I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

0 -

I'm amazed those rates were available at all from Lloyds this week, thought they pulled a repriced everything on Monday?K_S said:

@elwoodblues On my sourcing tool. But these are only updated once or twice a day so the products might no longer be available.ElwoodBlues said:

How do you find those rates?K_S said:

@hippydip There might be some reason you need to stick to Halifax, but if not, I can see Lloyds 60/75% remo 10yr fixes at 2.78-2.83%. Hopefully it's not been pulled.hippydip said:Along with many others I'm spending a bit of time trying to work out whether we would be better to pay an early repayment charge for current fixed deal which finishes in April 2023. Our early repayment is charge is in the region of £2000 - I'm looking to go to a 10 year fixed rate which they have offered me at 3.73% - it's a lot to pay as an early repayment charge but with £153,000 still to pay on the mortgage and bills to pay I'm really needing to know what we will be paying per month - any thoughts on the rate I've been offered? Been on hold for 2 hours waiting to confirm with mortgage advisor - I appreciate they are busy but oh my goodness

They are direct only, might be worth checking out the rates available to you on their remortgage website

I just looked and they're only offering 4.02% for years, no mention of a 10 yr fix (my LTV is 27%). If I tell it that I'm a Club Lloyds customer they do show a 10yr fix at 3.88%, but that's for existing customers only. 0

0 -

@elwoodblues That's quite possible tbh. Since the mayhem started last Friday the system has been unreliable and has had a big disclaimer asking brokers to double-check with the lender before recommending a specific product.ElwoodBlues said:

I'm amazed those rates were available at all from Lloyds this week, thought they pulled a repriced everything on Monday?K_S said:

@elwoodblues On my sourcing tool. But these are only updated once or twice a day so the products might no longer be available.ElwoodBlues said:

How do you find those rates?K_S said:

@hippydip There might be some reason you need to stick to Halifax, but if not, I can see Lloyds 60/75% remo 10yr fixes at 2.78-2.83%. Hopefully it's not been pulled.hippydip said:Along with many others I'm spending a bit of time trying to work out whether we would be better to pay an early repayment charge for current fixed deal which finishes in April 2023. Our early repayment is charge is in the region of £2000 - I'm looking to go to a 10 year fixed rate which they have offered me at 3.73% - it's a lot to pay as an early repayment charge but with £153,000 still to pay on the mortgage and bills to pay I'm really needing to know what we will be paying per month - any thoughts on the rate I've been offered? Been on hold for 2 hours waiting to confirm with mortgage advisor - I appreciate they are busy but oh my goodness

They are direct only, might be worth checking out the rates available to you on their remortgage website

I just looked and they're only offering 4.02% for years, no mention of a 10 yr fix (my LTV is 27%). If I tell it that I'm a Club Lloyds customer they do show a 10yr fix at 3.88%, but that's for existing customers only.

Direct-only products are only on the tool FYI as we can't access them anyways, so errors don't really matter.I am a Mortgage Adviser - You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

PLEASE DO NOT SEND PMs asking for one-to-one-advice, or representation.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards