We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

A temporary haven for cash

Comments

-

I have very recently transferred a SIPP in to Vanguard (due to me holding c.75% in cash), and based on receiving a interest credit today (transfer in receipted on 26 Sept), I believe they are actually paying 2% interest (based on my calculation). Whether this means they are receiving 2.2% on the money, or whether I will receive a further deduction (platform fee, plus an entry for the 0.2%) I am unsure until all is completed (charges). But, based on the wording they use ("keep up to 0.2% of any interest they receive"), I am going to assume they are actually paying 2% net on cash balances.Albermarle said:

It was from another thread recently where the poster had actually called Vanguard to double check. I took this at face value.cloud_dog said:

Vanguard do confuse me a little as to whether they charge the platform fee on the whole account value or whether they exclude charges for cash.Albermarle said:

2% minus a fee minus platform charge, so I think about 1.65% net, which is better than their main rivals.Adyinvestment said:

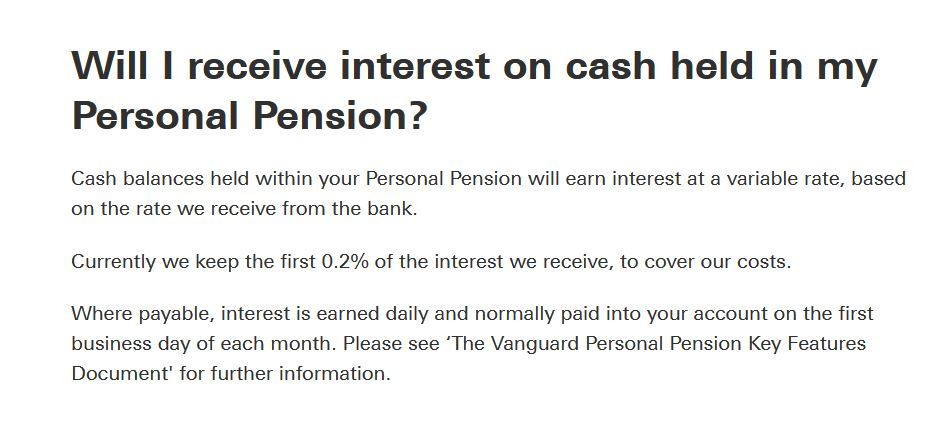

Last time I checked Vanguard do give some interest on cash balances, might be worth checking what it is at the moment.On their fees page, for Cash Balances --> Service Fee, they state:

"We don't currently charge a service fee for holding your cash - but we do keep up to 0.20% of any interest we receive on your cash. This is to cover our banking costs."

So based on this you might get 1.8% (2% minus 0.2%).

BTW @Albermarle , can you confirm where you sourced the information for them paying (currently) 2%? I've not been able to locate anything confirming a 'current rate', whenever I have tried to find it.

Personal Responsibility - Sad but True

Sometimes.... I am like a dog with a bone0 -

cloud_dog said:I have very recently transferred a SIPP in to Vanguard (due to me holding c.75% in cash), and based on receiving a interest credit today (transfer in receipted on 26 Sept), I believe they are actually paying 2% interest (based on my calculation). Whether this means they are receiving 2.2% on the money, or whether I will receive a further deduction (platform fee, plus an entry for the 0.2%) I am unsure until all is completed (charges). But, based on the wording they use ("keep up to 0.2% of any interest they receive"), I am going to assume they are actually paying 2% net on cash balances.Adyinvestment said:

Last time I checked Vanguard do give some interest on cash balances, might be worth checking what it is at the moment."Will I receive interest on cash held in my Personal Pension?Cash balances held within your Personal Pension will earn interest at a variable rate, based on the rate we receive from the bank.

Currently we keep the first 0.2% of the interest we receive, to cover our costs.

Where payable, interest is earned daily and normally paid into your account on the first business day of each month. Please see ‘The Vanguard Personal Pension Key Features Document' for further information."

0 -

Yes, but the question we have not been unable to find the answer to online is what interest rate are they currently paying? A poster has previously confirmed by speaking with Vanguard the rate, reportedly as 2% but it was unclear if this was the net or gross percentage received by account holders.adindas said:cloud_dog said:I have very recently transferred a SIPP in to Vanguard (due to me holding c.75% in cash), and based on receiving a interest credit today (transfer in receipted on 26 Sept), I believe they are actually paying 2% interest (based on my calculation). Whether this means they are receiving 2.2% on the money, or whether I will receive a further deduction (platform fee, plus an entry for the 0.2%) I am unsure until all is completed (charges). But, based on the wording they use ("keep up to 0.2% of any interest they receive"), I am going to assume they are actually paying 2% net on cash balances.Adyinvestment said:

Last time I checked Vanguard do give some interest on cash balances, might be worth checking what it is at the moment.

The only online documentation I could find from Vanguard was dated back in February and confirmed a rate of 0.25%, not unreasonable considering that was before all the raising base rates started in earnest.Personal Responsibility - Sad but True

Sometimes.... I am like a dog with a bone0 -

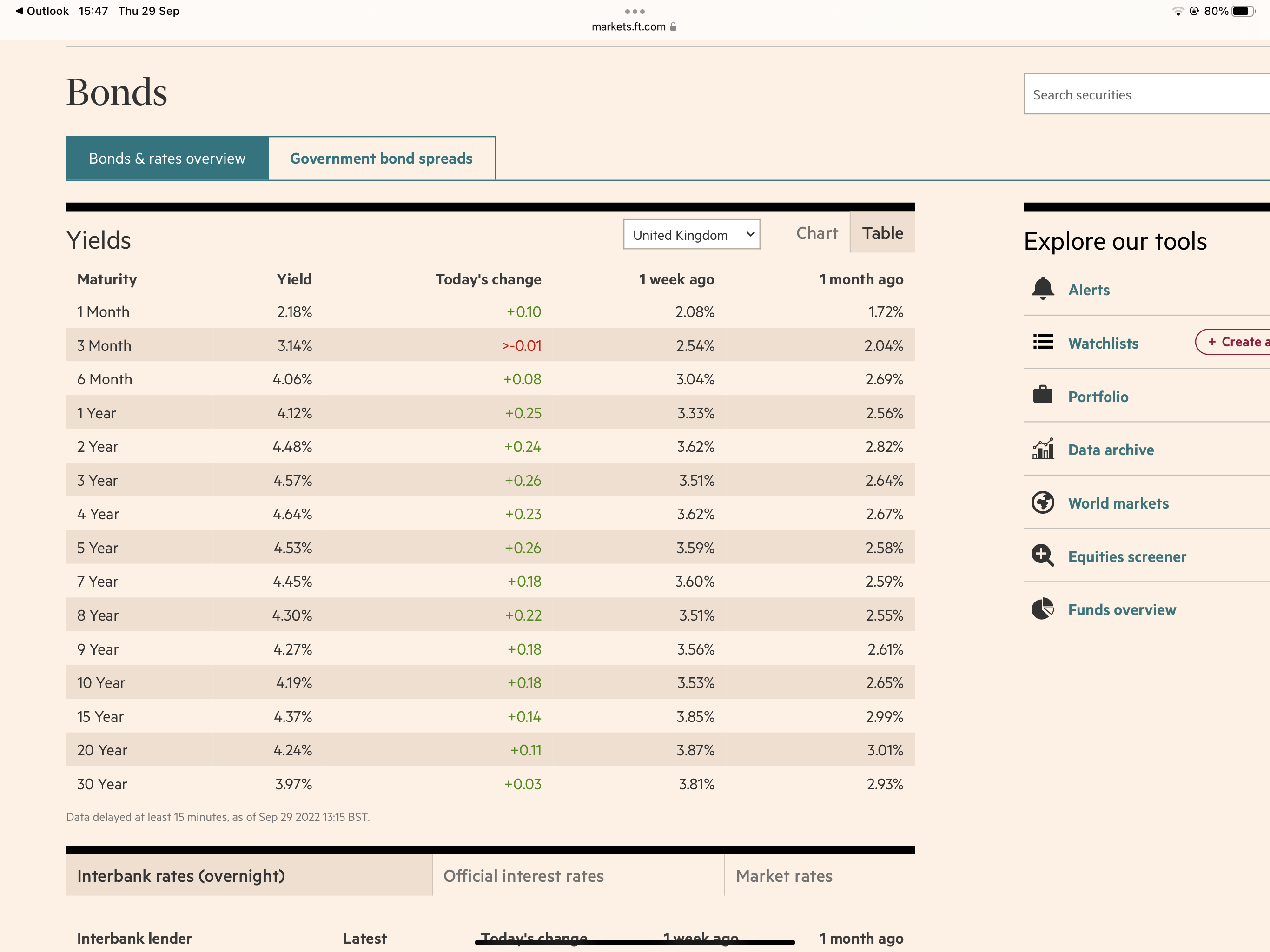

How do I buy these products? If I click 'Buy Bonds' in my SIPP, I don't see anything like these rates offered.wmb194 said:0 -

Well, it could be that your Sipp provider doesn't deal in them - which one? - but have a look through the linked. You can click through and find the tickers. They're usually TRxx or TNxx where 'xx' signifies the year in which they mature e.g., TR25, TN24.Secret2ndAccount said:

How do I buy these products? If I click 'Buy Bonds' in my SIPP, I don't see anything like these rates offered.wmb194 said:

Or perhaps you're misunderstanding yield to maturity?

https://www.hl.co.uk/shares/corporate-bonds-gilts/bond-prices/uk-gilts?column=price&order=asc

0 -

Goes into store where everything is on sale with £100K in his pocket but doesn't want to buy anything! Asks the shopkeeper if he can hold onto his cash in the till for a while and he will be back later when the prices go up. :'(

If it were my money and I had no immediate need to spend it I would drip feed into a low cost equity index fund £5-£10K a month.

Opportunities to buy into the stock market at these reduced prices don't come around too often and while trying to time the bottom is folly, a bottom will be reached eventually which is why I would drip feed in against the declining market.2 -

Nice to see a post actually about investing rather than about fixed rate savings accounts, which seem to be flavour of the month on this forum at the moment !GazzaBloom said:Goes into store where everything is on sale with £100K in his pocket but doesn't want to buy anything! Asks the shopkeeper if he can hold onto his cash in the till for a while and he will be back later when the prices go up. :'(

If it were my money and I had no immediate need to spend it I would drip feed into a low cost equity index fund £5-£10K a month.

Opportunities to buy into the stock market at these reduced prices don't come around too often and while trying to time the bottom is folly, a bottom will be reached eventually which is why I would drip feed in against the declining market.1 -

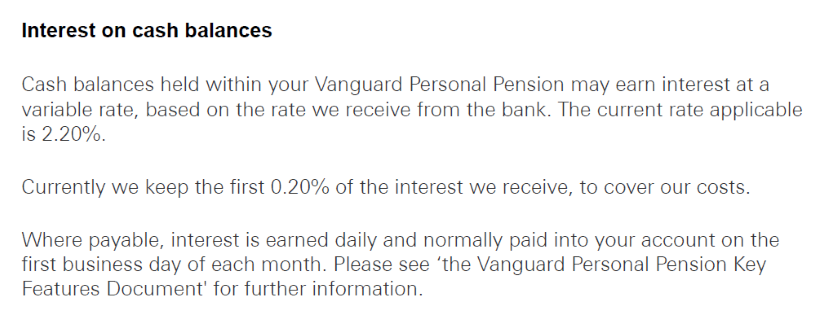

cloud_dog said:

Yes, but the question we have not been unable to find the answer to online is what interest rate are they currently paying? A poster has previously confirmed by speaking with Vanguard the rate, reportedly as 2% but it was unclear if this was the net or gross percentage received by account holders.adindas said:cloud_dog said:I have very recently transferred a SIPP in to Vanguard (due to me holding c.75% in cash), and based on receiving a interest credit today (transfer in receipted on 26 Sept), I believe they are actually paying 2% interest (based on my calculation). Whether this means they are receiving 2.2% on the money, or whether I will receive a further deduction (platform fee, plus an entry for the 0.2%) I am unsure until all is completed (charges). But, based on the wording they use ("keep up to 0.2% of any interest they receive"), I am going to assume they are actually paying 2% net on cash balances.

The only online documentation I could find from Vanguard was dated back in February and confirmed a rate of 0.25%, not unreasonable considering that was before all the raising base rates started in earnest.Ever since I opened a Vanguard account (SiPP & ISA) in March of this year, the Vanguard net interest rate has tracked the latest Bank Of Engalnd rate ---- minus 0.4%.Gross Interest of 2.2%Net Interest of 1.85% (minus 0.2% costs & 0.15% quarterly account fee).

0 -

Yes they do - but not much !valiant24 said:

The SIPP platform is AJ Bell and they don't pay interest on cash balances. So it would have to be some other provider's ETF if it's going to happen at all. In my mind Vanguard had some such in the past.Adyinvestment said:

Last time I checked Vanguard do give some interest on cash balances, might be worth checking what it is at the moment.

https://www.youinvest.co.uk/sipp/charges-and-rates

Old dog but always delighted to learn new tricks!0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

On their

On their