We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Where do Wealthy people keep their money ?

Comments

-

Most with those sorts of amounts are not cash at all but property or businesses. The likes of Bezos or Gates own significant amounts of a company that provides their wealth not cash in the bank.km1500 said:1 million is not wealthy

Where do people with 200 million 500 million, 5 billion keep their money?!Remember the saying: if it looks too good to be true it almost certainly is.0 -

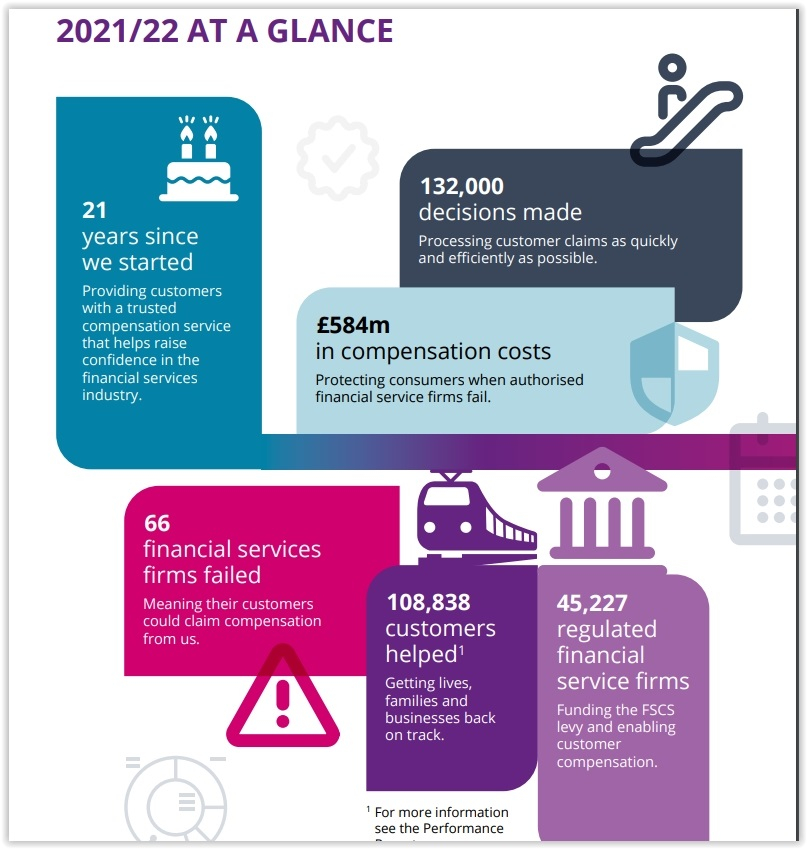

Yes, the breakdown of the FSCS compensation by protection type is shown at https://www.fscs.org.uk/globalassets/annual-reports-and-class-statements/arac-2122/fscs-class-statements-2021-22-acc-final.pdf and confirms that less than 1% related to cash deposits:jimjames said:

I suspect much of that money would have been compensation for the likes of LCF that went bust rather than retail banks. I agree that the £85k limit is something that should be considered but I don't think the FSCS data from 2021 backs it up as being needed for bank accounts.Daliah said:

You don't appear to have had money in outfits that went bust. FSCS has saved many people from losing money. £584m just alone in 2021/22, and £26.5bn since 2001. The idea that banks are as safe as houses went out of the window in 2008.MX5huggy said:Has anyone ever lost deposits in a UK bank ?Compensation paid to customers for this class totalled just under £5m – a £2m increase on the previous financial year due to more credit union failure claims during 2021/22.

Claims made for this class related to the following firm failures and resulting compensation being paid to customers:

> All Flintshire Credit Union Ltd and £2.2m in compensation;

> Strathkelvin Credit Union Ltd and £2.0m in compensation;

> Barrow & District Credit Union Ltd and £0.6m in compensation; and

> the failure of Cardenden & Kinglassie Credit Union Ltd and £0.03m in compensation.

2 -

The company I work for (small business, 30 employees, £4M turnover per year) generally has cash reserves of about £500k in the bank. This is with Barclays and I'm pretty sure FSCS is still £85k for business accounts. No doubt bigger businesses than us hold significanlty more, as you say, multiple millions.wmb194 said:If you're worried, as much as you can deposit in NS&I - looks like £3.17m per person at the moment for new accounts - then the rest in gilts. You'll probably find that many won't worry too much about the likes of Barclays, HSBC and the like going bust overnight. Plenty of larger companies have multi-millions deposited with these banks and are uninsured.

So it's funny when you see people on MSE waking up in a cold sweat because they've realised that this months interest on their savings account will put them a tenner over the £85k protection limit.Know what you don't5 -

It depends why they are holding the cash.

Someone who needs that kind of cash to fund their lifestyle isn't going to be concerned with the £85k limit. It will be a small proportion of their total assets and the convience of having it in one place is going to outweight the risk of a particular bank going bust. People like that aren't going to fanny around dealing with 12 different banks.

If it is someone who has £4m in total assets and has decided to have a sizeable cash allocation in their portfolio, perhaps they split it between a few banks or use short duration government bonds.1 -

As one who has been in three failed banks, luckily I kept under the £85k and didn’t lose, Fscs stepped in .Daliah said:

You don't appear to have had money in outfits that went bust. FSCS has saved many people from losing money. £584m just alone in 2021/22, and £26.5bn since 2001. The idea that banks are as safe as houses went out of the window in 2008.MX5huggy said:Has anyone ever lost deposits in a UK bank ?

I am in the position of looking at Ns&i I direct saver,as my assets in cash exceed £600k, in different accounts, but don’t want OH to have Agro should I peg it first, if only Ns&i

could sort their lousy bugs and allow me to do it online, not by phone , which they say they don’t know how to?

no bank is too big to fail.0 -

as my assets in cash exceed £600k

Wow that is a lot.

Whilst people with £600K in financial assets are common on this and the pensions board. Most would only have 5% to 20% in cash, due to the fact that it gets eaten away by inflation.

Unless £600K in cash is only a minority part of your portfolio, and you are a live subject of the original post ??

1 -

As I am knocking on a bit, I decided to do away with S&S etc and just stick to cash, have for several years .Albermarle said:as my assets in cash exceed £600kWow that is a lot.

Whilst people with £600K in financial assets are common on this and the pensions board. Most would only have 5% to 20% in cash, due to the fact that it gets eaten away by inflation.

Unless £600K in cash is only a minority part of your portfolio, and you are a live subject of the original post ??

umpteen accounts between me and OH.

giving money to kids all the time to reduce Iht .

house added would take me well over £1mil.

good income without the need for using savings or income from it .

just keeps growing, probably could have made more, but how much does one need !

inflation really doesn’t bother me as I have no intention of spending large amounts, I have everything I need now, if the cash stays in the bank it’s not affected by inflation, only when you spend it, ! But inflation goes up and down, so does S& S. I remember when It was 20+ % . And interest 17% .

There is no sure way of beating inflation, mixing is the best as you say, long term, which I am not bothered about now.

the way things are now, anything can happen, this is worse than the 70s .

I have IL bonds , Ns&i giving me cpi, was rpi, but for years, zilch .

no pockets in a shroud, the kids will be ok , if it doesn’t go to care home fees, etc .

best laid plans etc .

then they will have to do as we did , scrimp and do without, something some of this generation don’t do, including mine .

0 -

P.s. your health is your wealth .joesoap1264 said:

As I am knocking on a bit, I decided to do away with S&S etc and just stick to cash, have for several years .Albermarle said:as my assets in cash exceed £600kWow that is a lot.

Whilst people with £600K in financial assets are common on this and the pensions board. Most would only have 5% to 20% in cash, due to the fact that it gets eaten away by inflation.

Unless £600K in cash is only a minority part of your portfolio, and you are a live subject of the original post ??

umpteen accounts between me and OH.

giving money to kids all the time to reduce Iht .

house added would take me well over £1mil.

good income without the need for using savings or income from it .

just keeps growing, probably could have made more, but how much does one need !

inflation really doesn’t bother me as I have no intention of spending large amounts, I have everything I need now, if the cash stays in the bank it’s not affected by inflation, only when you spend it, ! But inflation goes up and down, so does S& S. I remember when It was 20+ % . And interest 17% .

There is no sure way of beating inflation, mixing is the best as you say, long term, which I am not bothered about now.

the way things are now, anything can happen, this is worse than the 70s .

I have IL bonds , Ns&i giving me cpi, was rpi, but for years, zilch .

no pockets in a shroud, the kids will be ok , if it doesn’t go to care home fees, etc .

best laid plans etc .

then they will have to do as we did , scrimp and do without, something some of this generation don’t do, including mine .0 -

If you never spend it so as "not to be affected by inflation", then you effectively don't have the money to spend, and any inheritance left behind is massively decreased over time. Seemingly the same argument as Harold Wilson's the pound in your pocket is not affected by devaluation. It is only affected when you come to spend it, but without spending it eventually that pound is not a lot of use just in your pocket.joesoap1264 said:if the cash stays in the bank it’s not affected by inflation, only when you spend it,0 -

Behave yourself.km1500 said:1 million is not wealthy0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards