We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Restricted access to own credit file, declined credit.

fringeinvestor

Posts: 1 Newbie

I am being denied credit and I can't pass ID checks anymore. Did someone / something me a flag? How to unlock that?

My actions:

A week ago I signed up for Creditkarma and checked my credit file there. I found I have quite good credit score. I proceeded to apply for a credit card from HSBC online.

HSBC application result: 'Refer; and message 'we will contact you within soon'. But zero communication from HSBC since then, no confirmation email even so I don't have any reference number.

Today, I tried to apply for another card, Zable, thinking HSBC application is probably cancelled as I haven't heard from them for a week.

Application was pre-approved on Creditkarma card comparison, then I downloaded the Zable app, confirmed my number and email, and then my application got DECLINED.

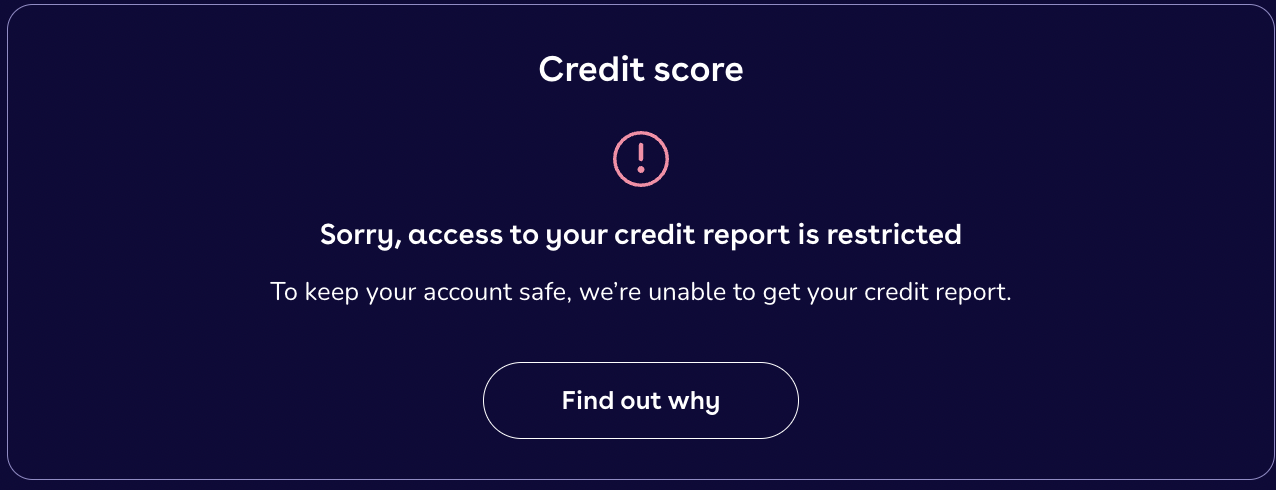

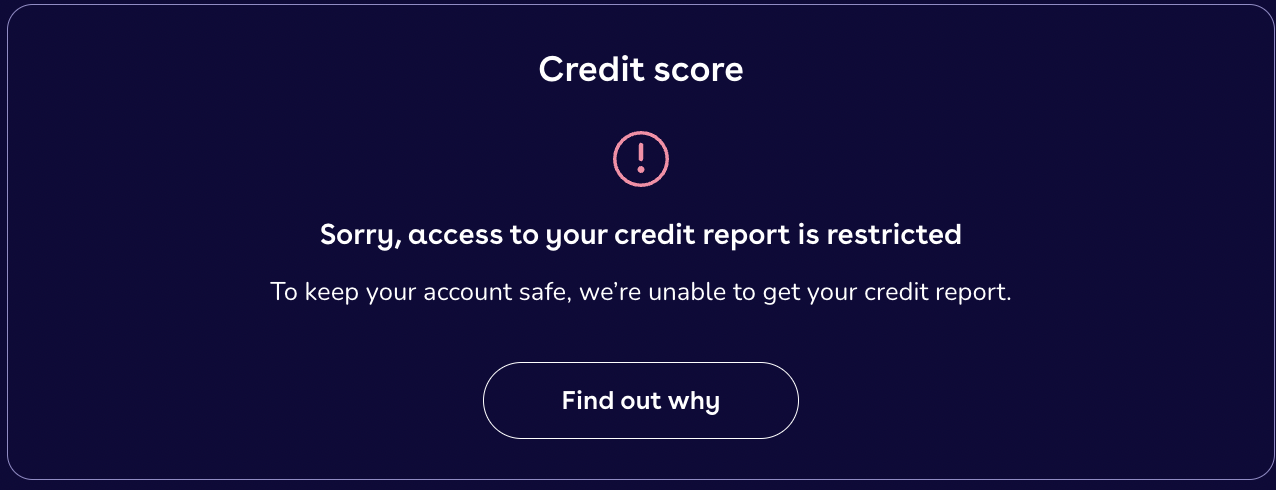

It was strage. I was pre-approved earlier already, had a good score, and Zable is a credit building card. I went back to Creditkarma to see my report again if there is anything new. But, access was denied - I was asked to upload an ID, selfie, and after doing so they restricted access to my Creditkarma account. When I am trying to log in, I get "error, try again later" message), as below:

I went over to TotallyMoney, created an account and the same result:

I did check "Find out why" but none of the reasons are applicable to me, as my score was not restricted just last week!

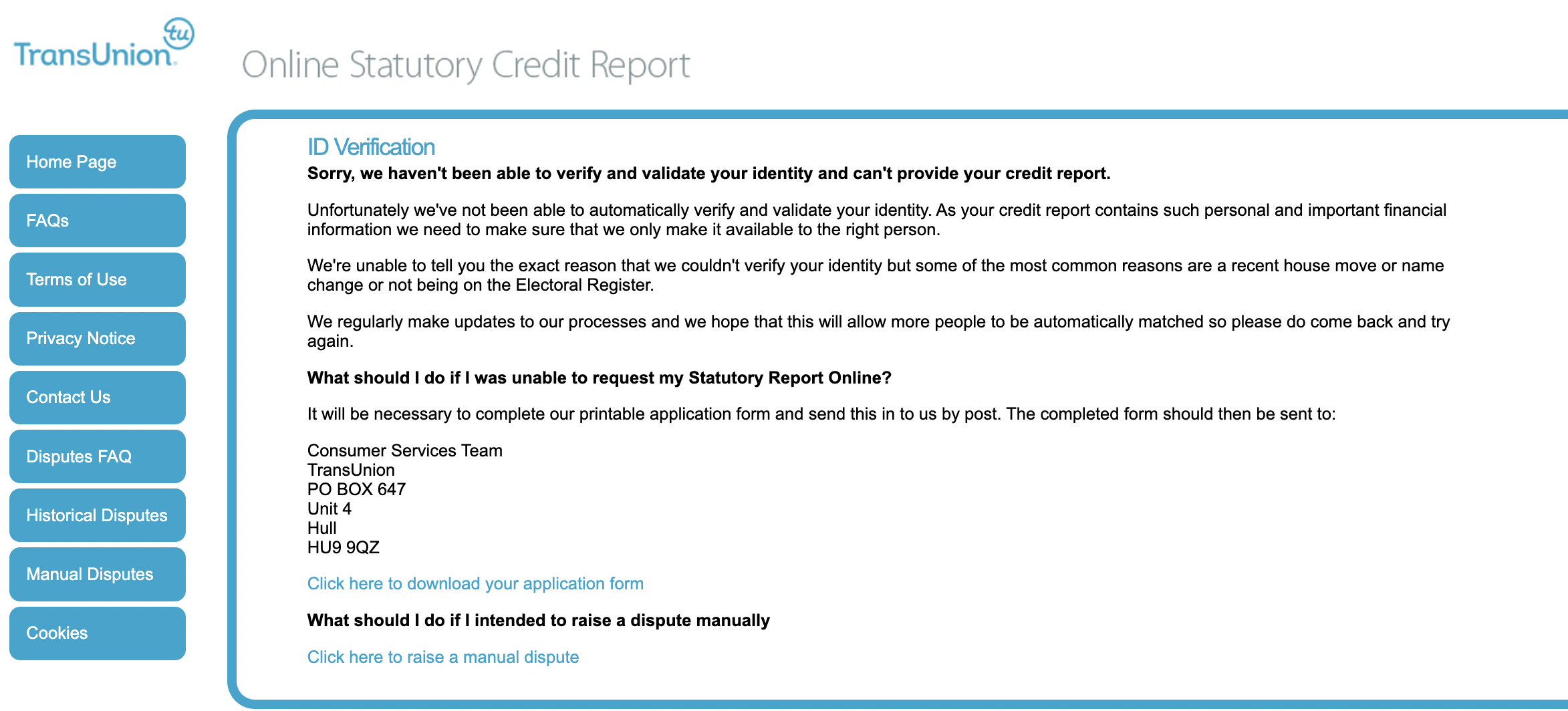

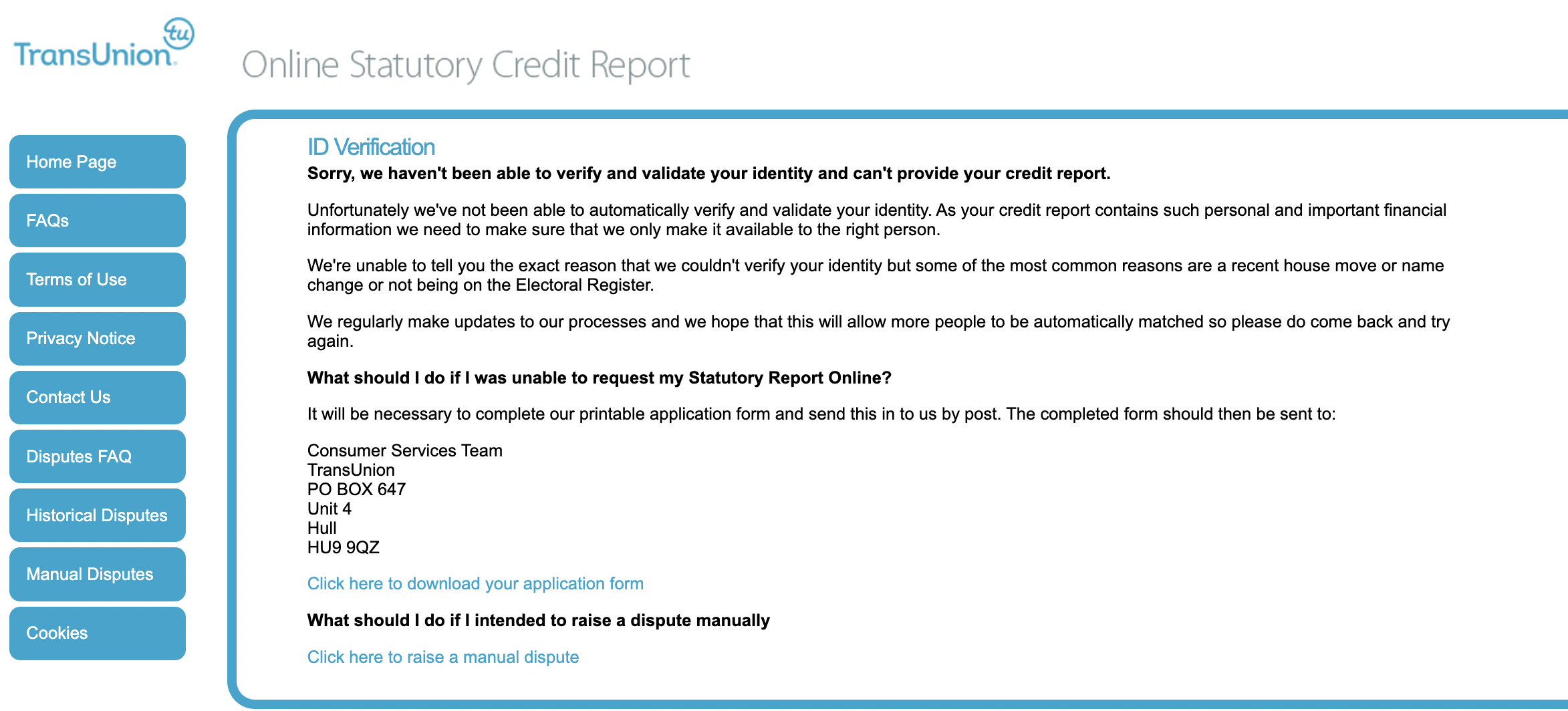

Finally, I went to Transunion website to obtain the Statutory Report. My application to see it also got declined, with all my details filled in correctly:

I am worried that HSBC places some Identity Theft / Fraud flag on my file. Yet, I can't check it! Did any of you had a situation like that? What can be done, and will my can my current credit facilities be affected? I really don't want my current lenders start cancelling cards or overdrafts.

Of note: I do have a spent money laundering and fraud conviction from 10 years ago, it's spent, which is as good as non existent for the majority of purposes, but could that have anything to do with the failed identity checks and HSBC?

My actions:

A week ago I signed up for Creditkarma and checked my credit file there. I found I have quite good credit score. I proceeded to apply for a credit card from HSBC online.

HSBC application result: 'Refer; and message 'we will contact you within soon'. But zero communication from HSBC since then, no confirmation email even so I don't have any reference number.

Today, I tried to apply for another card, Zable, thinking HSBC application is probably cancelled as I haven't heard from them for a week.

Application was pre-approved on Creditkarma card comparison, then I downloaded the Zable app, confirmed my number and email, and then my application got DECLINED.

It was strage. I was pre-approved earlier already, had a good score, and Zable is a credit building card. I went back to Creditkarma to see my report again if there is anything new. But, access was denied - I was asked to upload an ID, selfie, and after doing so they restricted access to my Creditkarma account. When I am trying to log in, I get "error, try again later" message), as below:

I went over to TotallyMoney, created an account and the same result:

I did check "Find out why" but none of the reasons are applicable to me, as my score was not restricted just last week!

Finally, I went to Transunion website to obtain the Statutory Report. My application to see it also got declined, with all my details filled in correctly:

I am worried that HSBC places some Identity Theft / Fraud flag on my file. Yet, I can't check it! Did any of you had a situation like that? What can be done, and will my can my current credit facilities be affected? I really don't want my current lenders start cancelling cards or overdrafts.

Of note: I do have a spent money laundering and fraud conviction from 10 years ago, it's spent, which is as good as non existent for the majority of purposes, but could that have anything to do with the failed identity checks and HSBC?

0

Comments

-

I have no experience in terms of credit files being restricted, but it is common knowledge that HSBC are quite poor at communicating to customers after applying for financial products. It would likely be useful to start with to give HSBC a call, and say that you applied on X date, and still haven't heard anything, and could you get an update.

The second card you applied for could have been declined as you'd applied for the HSBC one a few days earlier - they might have guessed you were desperate for credit. Can't know that for sure though.

I'm sure someone else can answer ref the restricted files - but for your HSBC card - definitely give them a call and see what they say.

You might also want to check if you have a CIFAS marker still active - this would likely result in account applications being declined:

https://www.cifas.org.uk/dsar

0 -

@fringeinvestor how is this progressing now ?

Have you checked Experian and Equifax ?

Those are the 2 main reference agencies.

Reference agencies do not offer credit facilities, lenders/lending institutions do, therefore each will use their own information held on you to assess whether, or not, you are a customer they want.

Study your files well, then take it from there.0 -

I have access to all three of the free credit score services. None have ever asked for ID, selfie. Is the OP accessing the genuine sites?0

-

I had exactly the same with Zable (Level at the time before they rebranded) - and it was caused by a CIFAS marker.fringeinvestor said:I am being denied credit and I can't pass ID checks anymore. Did someone / something me a flag? How to unlock that?

My actions:

A week ago I signed up for Creditkarma and checked my credit file there. I found I have quite good credit score. I proceeded to apply for a credit card from HSBC online.

HSBC application result: 'Refer; and message 'we will contact you within soon'. But zero communication from HSBC since then, no confirmation email even so I don't have any reference number.

Today, I tried to apply for another card, Zable, thinking HSBC application is probably cancelled as I haven't heard from them for a week.

Application was pre-approved on Creditkarma card comparison, then I downloaded the Zable app, confirmed my number and email, and then my application got DECLINED.

It was strage. I was pre-approved earlier already, had a good score, and Zable is a credit building card. I went back to Creditkarma to see my report again if there is anything new. But, access was denied - I was asked to upload an ID, selfie, and after doing so they restricted access to my Creditkarma account. When I am trying to log in, I get "error, try again later" message), as below:

I went over to TotallyMoney, created an account and the same result:

I did check "Find out why" but none of the reasons are applicable to me, as my score was not restricted just last week!

Finally, I went to Transunion website to obtain the Statutory Report. My application to see it also got declined, with all my details filled in correctly:

I am worried that HSBC places some Identity Theft / Fraud flag on my file. Yet, I can't check it! Did any of you had a situation like that? What can be done, and will my can my current credit facilities be affected? I really don't want my current lenders start cancelling cards or overdrafts.

Of note: I do have a spent money laundering and fraud conviction from 10 years ago, it's spent, which is as good as non existent for the majority of purposes, but could that have anything to do with the failed identity checks and HSBC?

Once my CIFAS marker expired I was able to successfully re-apply and have held the credit card since January.

Perform a Subject Access Request with CIFAS.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.6K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.7K Work, Benefits & Business

- 601.6K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards