We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Bank account for 16yr old?

LeadFarmer

Posts: 82 Forumite

Looking to move my sons bank account now he has reached 16yrs, his Halifax child saver account has now closed due to his age.

He has no knowledge of the account as I opened it without him knowing and have been paying money in each month, he has about £1K to date.

The Santander 123 Mini account pays 2% on that amount, rising to £3% when it gets to £1.5K, are there any other accounts to consider please?

He has no knowledge of the account as I opened it without him knowing and have been paying money in each month, he has about £1K to date.

The Santander 123 Mini account pays 2% on that amount, rising to £3% when it gets to £1.5K, are there any other accounts to consider please?

0

Comments

-

Are you looking for a current account or a savings account?0

-

At 16 I think he'd need to open it himself.Have you looked at a junior ISA, that would lock it away until he was 18. Tesco bank offer 2.25% of £1+0

-

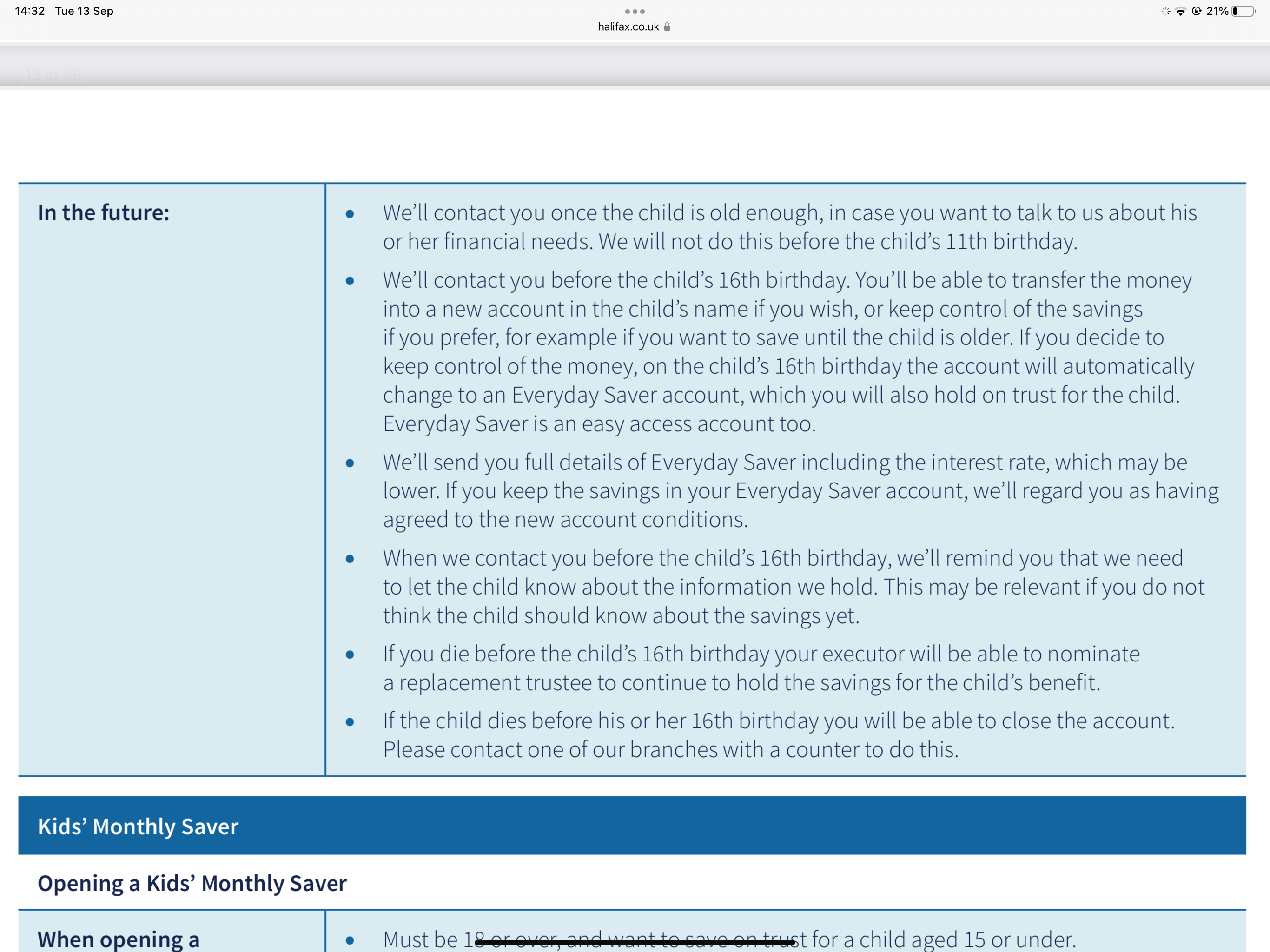

It shouldn't have closed but rather become an Everyday Saver which would continue as a bare trust. I'm guessing you actually closed it yourself?LeadFarmer said:Looking to move my sons bank account now he has reached 16yrs, his Halifax child saver account has now closed due to his age.

He has no knowledge of the account as I opened it without him knowing and have been paying money in each month, he has about £1K to date.

The Santander 123 Mini account pays 2% on that amount, rising to £3% when it gets to £1.5K, are there any other accounts to consider please?

https://www.halifax.co.uk/assets/pdf/savings/pdf/savings-account-conditions.pdf 0

0 -

No this Halifax account hasn't closed, that was just a figure of speech, but the type of account has changed.0

-

A savings account, for the next 2 yrs when he can then take it over.Daliah said:Are you looking for a current account or a savings account?0 -

There is a whole lost of savings accounts that should still be available for under 18s. https://moneyfacts.co.uk/savings-accounts/childrens-savings-accounts/?quick-links-first=falseLeadFarmer said:

A savings account, for the next 2 yrs when he can then take it over.Daliah said:Are you looking for a current account or a savings account?1 -

LeadFarmer said:

A savings account, for the next 2 yrs when he can then take it over.Daliah said:Are you looking for a current account or a savings account?Personally I'd be getting him involved in the process - you don't need to be telling him about the existing account if you don't want to. It's never too early to start learning about finance, and you sitting down with him and going through the pros and cons of the different accounts available would IMHO be a good idea ....0 -

He's already got bank accounts that he uses, but this one I don't want him knowing about yet.0

-

Until he's 18, I think (but not 100% sure) you can open / manage accounts in his name, without his knowledge, and on the understanding that any of the money in such accounts is his.LeadFarmer said:He's already got bank accounts that he uses, but this one I don't want him knowing about yet.

If you want to be in complete control of a sum of money for him, it would need to be in an account in your name, and unless he's your sole heir, you'd need to have a will that assigns the money of this account to him.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards