We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

What should I do about bond investment

Comments

-

If you do not need the money for a relatively long period, bond is not a good investment choice. I understand that "you don't need to take any income from them and I just hope that I would be able to leave something for my family"Each to their own. People might invest in Bonds for different reason. Some people invest in Bond by just following the crowd. But if your goal is to maximise your return in the long run, bond is not a good choice.This view come from experts billionaires investors legend like Warren Buffet, Peter Lynch, Charlie Munger. Not an advice, but I myself never have bond in my investment portfolio. I prefer to have it in RSA easy access saving account ready to be deployed and allocated to equity at anytime.6 Biggest Bond Risks0

-

As noted in previous replies, a proportion seems to be in equities rather than bonds.adindas said:If you do not need the money for a relatively long period, bond is not a good investment choice. I understand that "you don't need to take any income from them and I just hope that I would be able to leave something for my family"Each to their own. People might invest in Bonds for different reason. Some people invest in Bond by just following the crowd. But if your goal is to maximise your return in the long run, bond is not a good choice.This view come from experts billionaires investors legend like Warren Buffet, Peter Lynch, Charlie Munger. Not an advice, but I myself never have bond in my investment portfolio. I prefer to have it in RSA easy access saving account ready to be deployed and allocated to equity at anytime.6 Biggest Bond Risks

3 -

Thank you all so much. I am not going to worry about. I am just going to leave things as they are.

Sue0 -

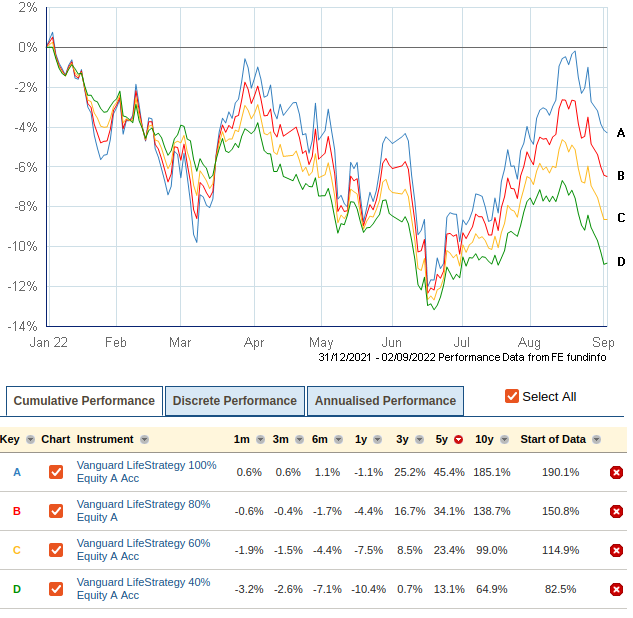

Looking at VLS60 compared to LS100 the former is -5% since i opened it at the end of january whereas LS100 is c. +1%! I'm wondering what the point is! Just in the event that i'll lose less in the event of a crash?1

-

Collyflower1 said:Looking at VLS60 compared to LS100 the former is -5% since i opened it at the end of january whereas LS100 is c. +1%! I'm wondering what the point is! Just in the event that i'll lose less in the event of a crash?LS100 should be expected to outperform LS60 most of the time over the long term, and more often than not over the short term. The reason someone might choose LS60 is that it is more of a steady ride. Steady doesn't necessarily mean you'll lose less, though often LS100 will fall further. This happens to be an example where LS60 fell further.

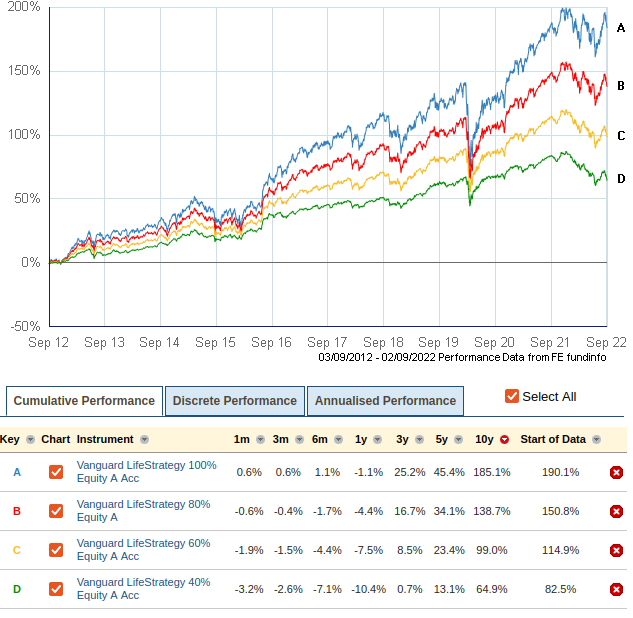

As you can see from the above LS100 was below LS60 most of the time from January-March, then bounced back, but fell again almost to LS60 levels in mid-June. Long term, the funds have performed as one might expect:

As you can see from the above LS100 was below LS60 most of the time from January-March, then bounced back, but fell again almost to LS60 levels in mid-June. Long term, the funds have performed as one might expect: 1

1 -

Thanks Masonic, i guess i was unlucky to start in january too!0

-

I got a valuation yesterday on one of my bonds.

Its says Aviva Global Equity FPLAviva Life Artemis FPSAviva Life Aegon Ethical Equity

If that means anything to anyone

I appreciate all your advice

Sue0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards