We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Your experience - Down valuations :/

Comments

-

Who’s making assumptions (and generalisations) now?lookstraightahead said:

So many assumptions. Peoples lives rarely go in a straight line. I don't understand third rung and I'm unsure what you think happens in rung one and two.WittyUserName said:

Just seen this. I’m sure the OP has moved on but I thought I’d answer the question all the same (even though it was asked two Prime Ministers ago!)BirchFozz said:

How did you know other interested parties had the money to stump up?WittyUserName said:Are you worried that you might pay more than what the property is ‘worth’ or worried about making up the difference?I absolutely agree with @Gavin83 that each party has their own bias:

- the lender values based on risk

- the estate agent values based on commission they’d like to earn

- the seller values based on what ‘profit’ they’d like to make

- the buyer values based on what the property will mean to their quality of life

I disagree that the lender’s valuation is the true value of a property. It’s just that they hold most of the cards because they are providing the funds. After all a cash buyer could sweep in and buy it for a price way above the bank’s valuation. Does that mean the cash buyer overpaid? No, they paid what it’s worth to them.To me the lender’s valuation is just one amongst many, I don’t think it’s necessarily the yardstick against which value should be measured.

Ultimately it depends on whether you consider the property to be worth what you offered, and whether you can make up the difference caused by the down valuation.

Whether the seller will be open to negotiation (in the event of a lender’s down valuation) depends on whether other interested parties have enough of a deposit to step

in and make up the difference if you drop out.

Our lender valued our property at £55k less than what we’d offered but fortunately like @k1irk1978 it didn’t affect our product, and thanks to sufficient equity we were able to make up the difference.We didn’t even bother asking the seller for a discount because the property had many others lining up and waving their wallets, all of them with enough equity from their prior properties to make up the difference if we dropped out.

With that sort of competition the seller would’ve laughed us out of the room. We really really liked the property - it’s perfect for our family - so our valuation of it is very different from the lender’s.I only ask as I don’t know this. How did you find this out?Whilst the market is competitive and we’re willing to take out a mortgage for this amount -we like most others (not all!) are unlikely to have spare cash to add to the pot.Ultimately it’s their decision - I just figured if it was me and I was told to market my home for 60k above when I bought it two years ago, with no similar properties being sold for that - I might realise that the EA saw commission £ signs - and that most other buyers would face similar issues re: lenders.

I knew that other bidders could make up the difference because:

a) the property is not likely to be an FTB purchase where there’s often not much wiggle room. The price point meant it’s a ‘third rung of the ladder’ type of property, where potential buyers would’ve had more flexibility to withstand down valuations because of equity from their previous properties (as I mentioned in my post)

b) we saw some of the other interested parties at the open house viewing and when I asked the EA about them, their careers / professions indicated that they’re high income earners, with a couple of them even working in the City = generous cash bonuses

lots of professionals have no money. Lots of first time buyers have a big deposit. Lots of city people have huge debts.Why is an estate agent telling you this information anyway?1 -

You call it FOMO, I call it no time to faff about when house prices were rocketing. Now we’re glad we didn’t waste time trying to renegotiate with the sellers (who would’ve waved us off anyway) because it means we secured the property before this madness began.BikingBud said:

I would suggest that you suspected rather than knew, and that your fear of missing out drove you to pay out £55k over askingWittyUserName said:

Just seen this. I’m sure the OP has moved on but I thought I’d answer the question all the same (even though it was asked two Prime Ministers ago!)BirchFozz said:

How did you know other interested parties had the money to stump up?WittyUserName said:Are you worried that you might pay more than what the property is ‘worth’ or worried about making up the difference?I absolutely agree with @Gavin83 that each party has their own bias:

- the lender values based on risk

- the estate agent values based on commission they’d like to earn

- the seller values based on what ‘profit’ they’d like to make

- the buyer values based on what the property will mean to their quality of life

I disagree that the lender’s valuation is the true value of a property. It’s just that they hold most of the cards because they are providing the funds. After all a cash buyer could sweep in and buy it for a price way above the bank’s valuation. Does that mean the cash buyer overpaid? No, they paid what it’s worth to them.To me the lender’s valuation is just one amongst many, I don’t think it’s necessarily the yardstick against which value should be measured.

Ultimately it depends on whether you consider the property to be worth what you offered, and whether you can make up the difference caused by the down valuation.

Whether the seller will be open to negotiation (in the event of a lender’s down valuation) depends on whether other interested parties have enough of a deposit to step

in and make up the difference if you drop out.

Our lender valued our property at £55k less than what we’d offered but fortunately like @k1irk1978 it didn’t affect our product, and thanks to sufficient equity we were able to make up the difference.We didn’t even bother asking the seller for a discount because the property had many others lining up and waving their wallets, all of them with enough equity from their prior properties to make up the difference if we dropped out.

With that sort of competition the seller would’ve laughed us out of the room. We really really liked the property - it’s perfect for our family - so our valuation of it is very different from the lender’s.I only ask as I don’t know this. How did you find this out?Whilst the market is competitive and we’re willing to take out a mortgage for this amount -we like most others (not all!) are unlikely to have spare cash to add to the pot.Ultimately it’s their decision - I just figured if it was me and I was told to market my home for 60k above when I bought it two years ago, with no similar properties being sold for that - I might realise that the EA saw commission £ signs - and that most other buyers would face similar issues re: lenders.

I knew that other bidders could make up the difference because:

a) the property is not likely to be an FTB purchase where there’s often not much wiggle room. The price point meant it’s a ‘third rung of the ladder’ type of property, where potential buyers would’ve had more flexibility to withstand down valuations because of equity from their previous properties (as I mentioned in my post)

b) we saw some of the other interested parties at the open house viewing and when I asked the EA about them, their careers / professions indicated that they’re high income earners, with a couple of them even working in the City = generous cash bonuses

Please could you explain the concept of the "third rung" and the way that the steps are managed?

As I understand having cash in hand may provide some benefits but the gaps between the rungs have been increasing for some time.

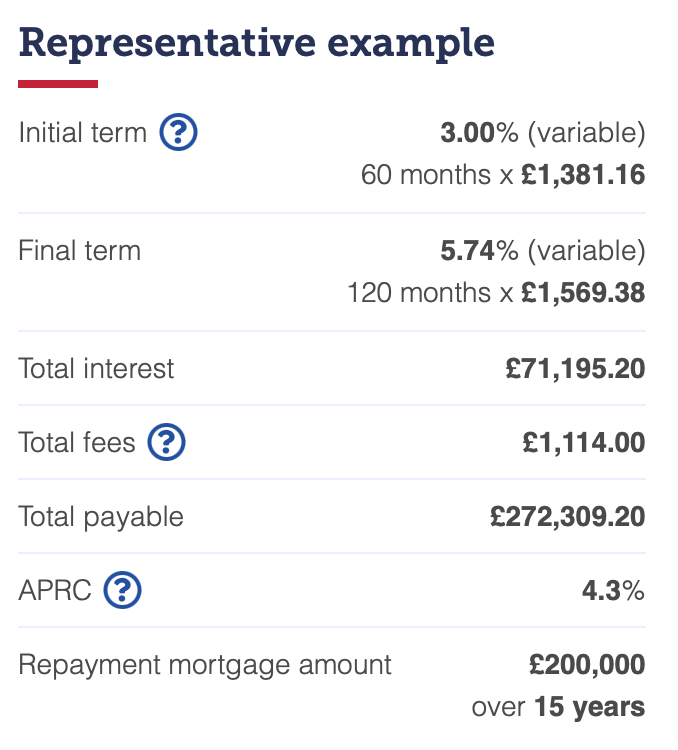

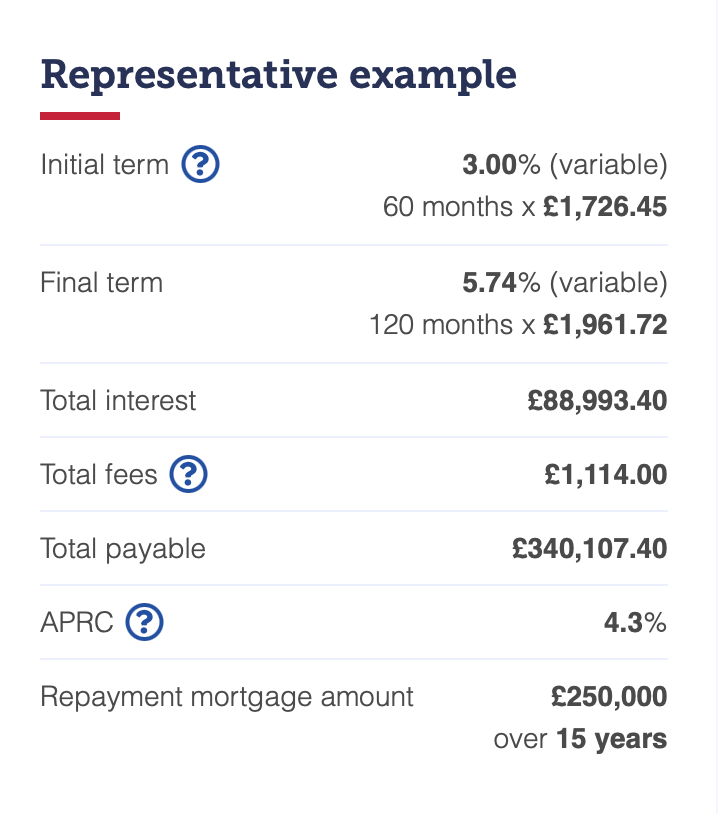

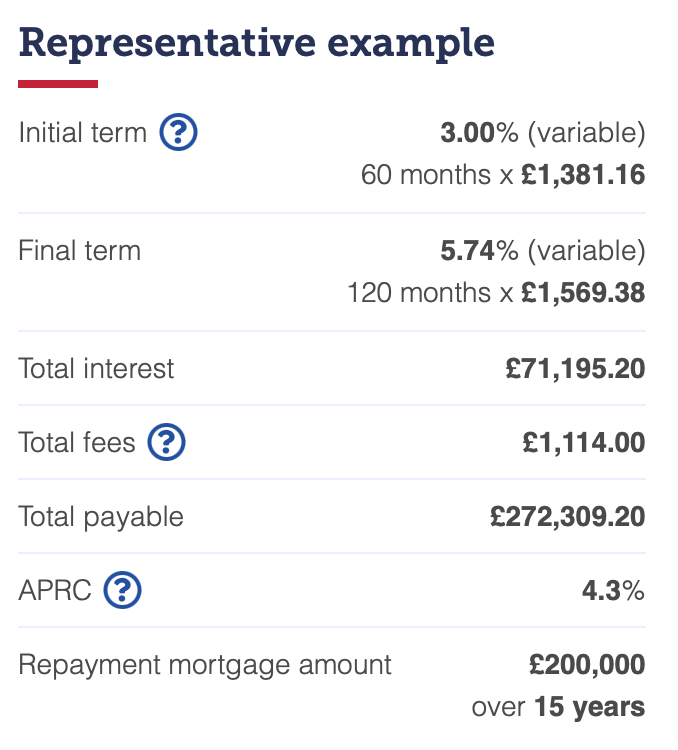

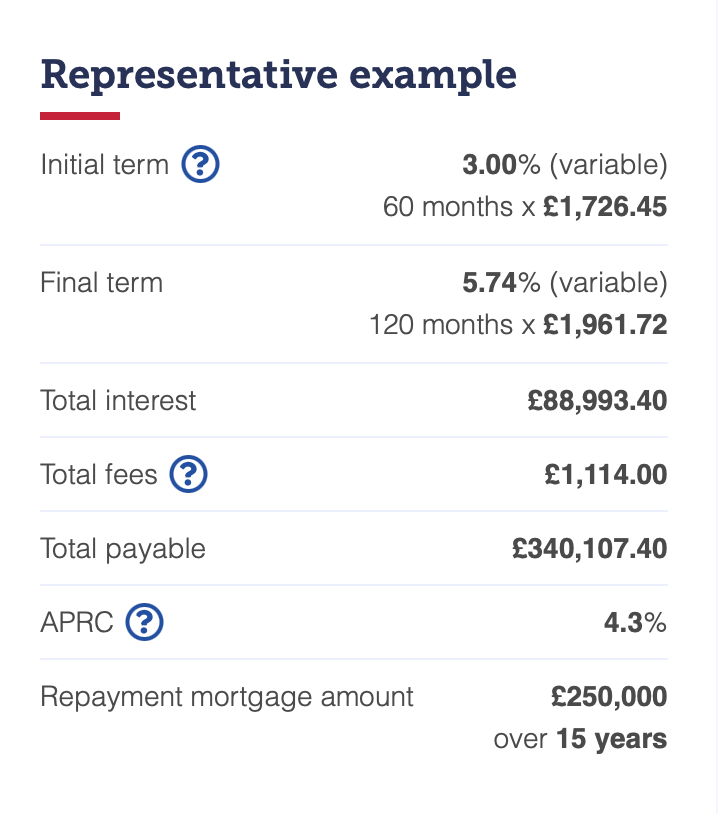

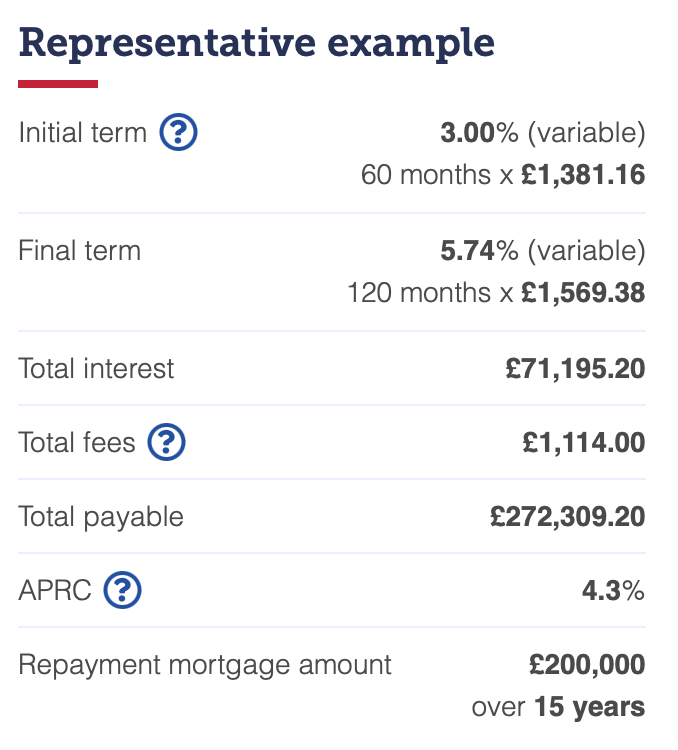

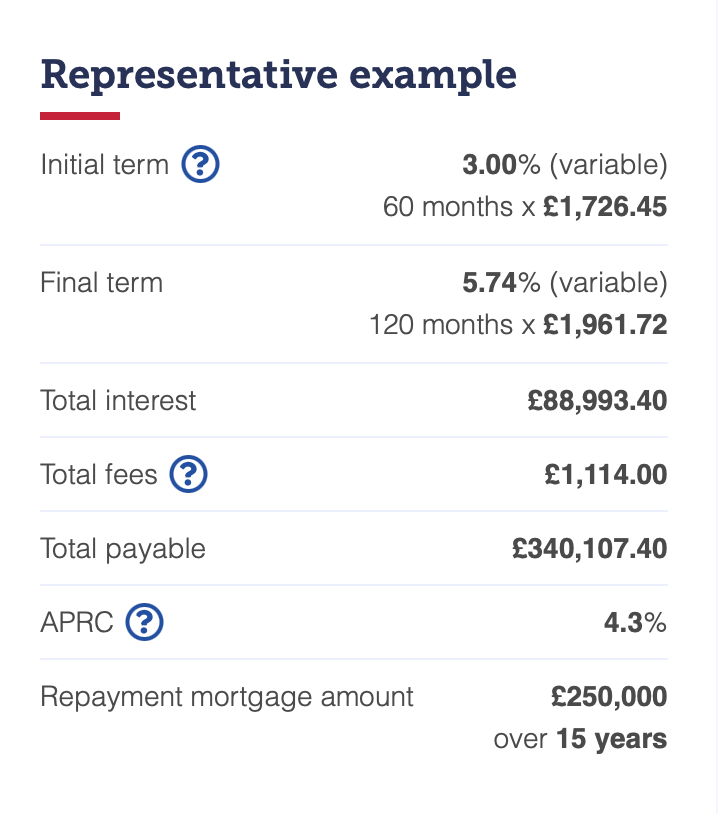

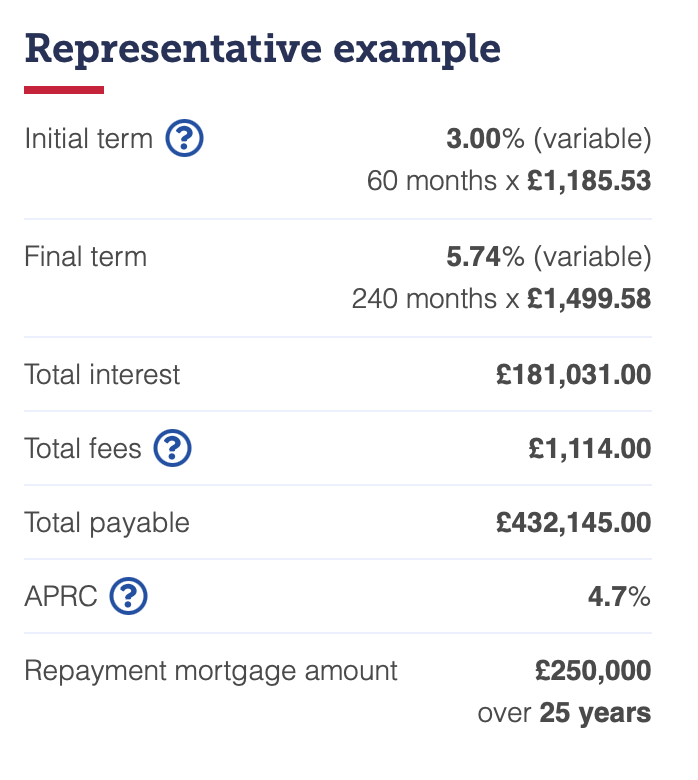

Looking at the difference between £500k and £550k, over 15 years with £300K equity brought forward gives nearly £18K difference in interest over the period and £400 per month difference in payments.

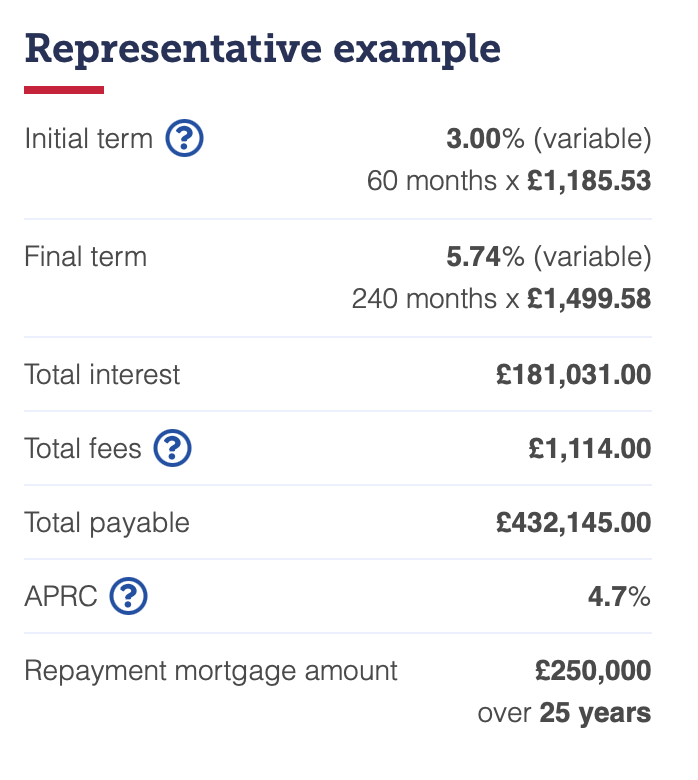

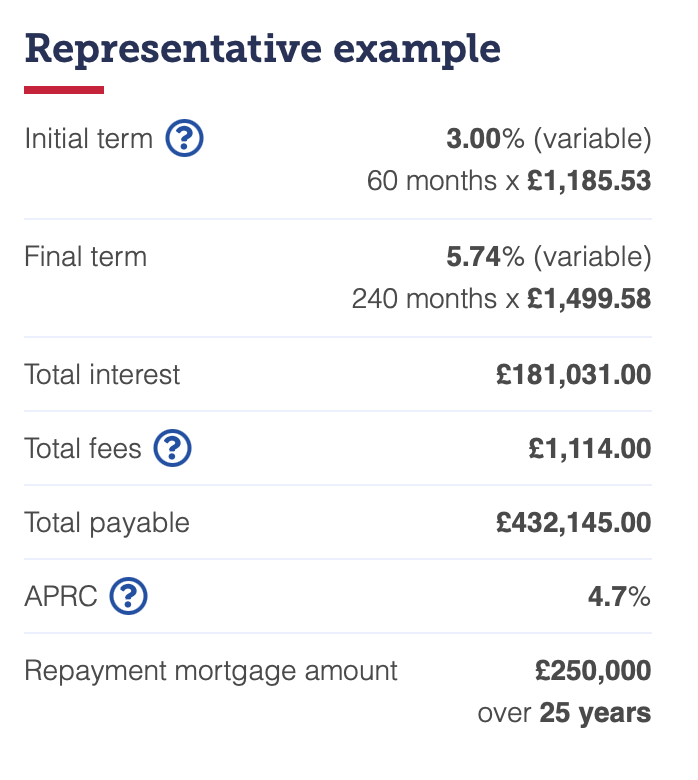

And if you push that out to 25 years then you might end up paying £181k in interest, £110k more.

At the end of the day that's entirely your decision but with actions like this it is no wonder that house prices have inflated so significantly and people are now having difficulty meeting mortgage payments.

Still cannot grasp why everybody thinks this is good.

First rung - flat approx £275k to £320k

Second rung - 3 bed approx £600k

Third rung - 4 to 5 bed £900k+

Regarding your analysis, we aren’t going to pay that much interest, we’ve always vigorously overpaid in the past and avoided a lot of interest, and are doing so so this time as usual. The mortgage rate increases are a cause for concern but we’ll dispense with nice to haves and boost our overpayments with the spare cash0 -

I think you've done ok with those amounts, you'll weather it.RM_2013 said:I know this is an old thread. We offered over asking (august) to secure the property we wanted but we knew we’d have wiggle room for deposit.Lender downvalued £10k which was what we had offered over asking. Vendor wouldn’t reduce but we knew this was a risk and we factored this into our calculations and were prepared.We have a 5 year fix mortgage offer at far less than current rates and a large deposit so as we intend to make this a long term family home we weren’t worried about immediate market falls or negative equity.

i know some wouldn’t offered over asking but this was the only place we’d seen that ticked all the boxes for less than what we had initially anticipated we’d need to pay so fits better in our budgetSome people paid lots more over valuation, or sellers asked for too much and now can't sell.1 -

I did exactly this, offered a fair bit over asking price at best and final offer in August. It doesn't bother me because I was able to use my morgage offer from June which is a 10 year fix at 3%, which i had following my first attempt at a purchase falling through. Seeing as I plan to be there at least 10 years, even if house prices fall and stay below current levels I should have decent equity when factoring my payments and the fact its not a particularly high ltv.Sarah1Mitty2 said:

Certainly does, wonder what people who bid well over asking are thinking now, hope they took long fixes at least that might offset the fall in value they are now looking at.lookstraightahead said:This makes for interesting reading now - and this was only a couple of months ago.2 -

Sarah1Mitty2 said:

wonder what people who bid well over asking are thinking now,lookstraightahead said:This makes for interesting reading now - and this was only a couple of months ago.I suspect the vast majority are loving living in their new home and very happy to be paying off their own mortgage instead of a landlord's.Similarly they'll be sleeping easy at night safe in the knowledge that their monthly payments are fixed for at least five years unlike someone renting a bedsit in Edinburgh who can pretty much guarantee their monthly payments will increase several times over the next five years... Every generation blames the one before...

Every generation blames the one before...

Mike + The Mechanics - The Living Years5 -

"No time to faff about" so fear clearly was a driver for your decision. And you have just catalysed a further jump > 5% and upped the anti by offering £50K more, this really appears to be the aspect that people don't want to recognise within the market or their own behaviour.WittyUserName said:

You call it FOMO, I call it no time to faff about when house prices were rocketing. Now we’re glad we didn’t waste time trying to renegotiate with the sellers (who would’ve waved us off anyway) because it means we secured the property before this madness began.BikingBud said:

I would suggest that you suspected rather than knew, and that your fear of missing out drove you to pay out £55k over askingWittyUserName said:

Just seen this. I’m sure the OP has moved on but I thought I’d answer the question all the same (even though it was asked two Prime Ministers ago!)BirchFozz said:

How did you know other interested parties had the money to stump up?WittyUserName said:Are you worried that you might pay more than what the property is ‘worth’ or worried about making up the difference?I absolutely agree with @Gavin83 that each party has their own bias:

- the lender values based on risk

- the estate agent values based on commission they’d like to earn

- the seller values based on what ‘profit’ they’d like to make

- the buyer values based on what the property will mean to their quality of life

I disagree that the lender’s valuation is the true value of a property. It’s just that they hold most of the cards because they are providing the funds. After all a cash buyer could sweep in and buy it for a price way above the bank’s valuation. Does that mean the cash buyer overpaid? No, they paid what it’s worth to them.To me the lender’s valuation is just one amongst many, I don’t think it’s necessarily the yardstick against which value should be measured.

Ultimately it depends on whether you consider the property to be worth what you offered, and whether you can make up the difference caused by the down valuation.

Whether the seller will be open to negotiation (in the event of a lender’s down valuation) depends on whether other interested parties have enough of a deposit to step

in and make up the difference if you drop out.

Our lender valued our property at £55k less than what we’d offered but fortunately like @k1irk1978 it didn’t affect our product, and thanks to sufficient equity we were able to make up the difference.We didn’t even bother asking the seller for a discount because the property had many others lining up and waving their wallets, all of them with enough equity from their prior properties to make up the difference if we dropped out.

With that sort of competition the seller would’ve laughed us out of the room. We really really liked the property - it’s perfect for our family - so our valuation of it is very different from the lender’s.I only ask as I don’t know this. How did you find this out?Whilst the market is competitive and we’re willing to take out a mortgage for this amount -we like most others (not all!) are unlikely to have spare cash to add to the pot.Ultimately it’s their decision - I just figured if it was me and I was told to market my home for 60k above when I bought it two years ago, with no similar properties being sold for that - I might realise that the EA saw commission £ signs - and that most other buyers would face similar issues re: lenders.

I knew that other bidders could make up the difference because:

a) the property is not likely to be an FTB purchase where there’s often not much wiggle room. The price point meant it’s a ‘third rung of the ladder’ type of property, where potential buyers would’ve had more flexibility to withstand down valuations because of equity from their previous properties (as I mentioned in my post)

b) we saw some of the other interested parties at the open house viewing and when I asked the EA about them, their careers / professions indicated that they’re high income earners, with a couple of them even working in the City = generous cash bonuses

Please could you explain the concept of the "third rung" and the way that the steps are managed?

As I understand having cash in hand may provide some benefits but the gaps between the rungs have been increasing for some time.

Looking at the difference between £500k and £550k, over 15 years with £300K equity brought forward gives nearly £18K difference in interest over the period and £400 per month difference in payments.

And if you push that out to 25 years then you might end up paying £181k in interest, £110k more.

At the end of the day that's entirely your decision but with actions like this it is no wonder that house prices have inflated so significantly and people are now having difficulty meeting mortgage payments.

Still cannot grasp why everybody thinks this is good.

First rung - flat approx £275k to £320k

Second rung - 3 bed approx £600k

Third rung - 4 to 5 bed £900k+

Regarding your analysis, we aren’t going to pay that much interest, we’ve always vigorously overpaid in the past and avoided a lot of interest, and are doing so so this time as usual. The mortgage rate increases are a cause for concern but we’ll dispense with nice to haves and boost our overpayments with the spare cash

Interesting perspective about the rungs, especially as people are looking at terms of over 25 years and scraping all resources just to buy initially at £275k -£320k, that does reinforce that there is no such thing as the property ladder for many.

Great that you have the headroom to overpay aggressively, many don't and are consequently having difficulty. Nevertheless that higher purchase price remains baked in and even if you over pay the max, likely 10% per annum, you will pay more interest than if you had borrowed less capital.

Your life is too short to be unhappy 5 days a week in exchange for 2 days of freedom!0 -

I think buyer enquiries are down about 50% since the mortgage changes kicked in?BikingBud said:

"No time to faff about" so fear clearly was a driver for your decision. And you have just catalysed a further jump > 5% and upped the anti by offering £50K more, this really appears to be the aspect that people don't want to recognise within the market or their own behaviour.WittyUserName said:

You call it FOMO, I call it no time to faff about when house prices were rocketing. Now we’re glad we didn’t waste time trying to renegotiate with the sellers (who would’ve waved us off anyway) because it means we secured the property before this madness began.BikingBud said:

I would suggest that you suspected rather than knew, and that your fear of missing out drove you to pay out £55k over askingWittyUserName said:

Just seen this. I’m sure the OP has moved on but I thought I’d answer the question all the same (even though it was asked two Prime Ministers ago!)BirchFozz said:

How did you know other interested parties had the money to stump up?WittyUserName said:Are you worried that you might pay more than what the property is ‘worth’ or worried about making up the difference?I absolutely agree with @Gavin83 that each party has their own bias:

- the lender values based on risk

- the estate agent values based on commission they’d like to earn

- the seller values based on what ‘profit’ they’d like to make

- the buyer values based on what the property will mean to their quality of life

I disagree that the lender’s valuation is the true value of a property. It’s just that they hold most of the cards because they are providing the funds. After all a cash buyer could sweep in and buy it for a price way above the bank’s valuation. Does that mean the cash buyer overpaid? No, they paid what it’s worth to them.To me the lender’s valuation is just one amongst many, I don’t think it’s necessarily the yardstick against which value should be measured.

Ultimately it depends on whether you consider the property to be worth what you offered, and whether you can make up the difference caused by the down valuation.

Whether the seller will be open to negotiation (in the event of a lender’s down valuation) depends on whether other interested parties have enough of a deposit to step

in and make up the difference if you drop out.

Our lender valued our property at £55k less than what we’d offered but fortunately like @k1irk1978 it didn’t affect our product, and thanks to sufficient equity we were able to make up the difference.We didn’t even bother asking the seller for a discount because the property had many others lining up and waving their wallets, all of them with enough equity from their prior properties to make up the difference if we dropped out.

With that sort of competition the seller would’ve laughed us out of the room. We really really liked the property - it’s perfect for our family - so our valuation of it is very different from the lender’s.I only ask as I don’t know this. How did you find this out?Whilst the market is competitive and we’re willing to take out a mortgage for this amount -we like most others (not all!) are unlikely to have spare cash to add to the pot.Ultimately it’s their decision - I just figured if it was me and I was told to market my home for 60k above when I bought it two years ago, with no similar properties being sold for that - I might realise that the EA saw commission £ signs - and that most other buyers would face similar issues re: lenders.

I knew that other bidders could make up the difference because:

a) the property is not likely to be an FTB purchase where there’s often not much wiggle room. The price point meant it’s a ‘third rung of the ladder’ type of property, where potential buyers would’ve had more flexibility to withstand down valuations because of equity from their previous properties (as I mentioned in my post)

b) we saw some of the other interested parties at the open house viewing and when I asked the EA about them, their careers / professions indicated that they’re high income earners, with a couple of them even working in the City = generous cash bonuses

Please could you explain the concept of the "third rung" and the way that the steps are managed?

As I understand having cash in hand may provide some benefits but the gaps between the rungs have been increasing for some time.

Looking at the difference between £500k and £550k, over 15 years with £300K equity brought forward gives nearly £18K difference in interest over the period and £400 per month difference in payments.

And if you push that out to 25 years then you might end up paying £181k in interest, £110k more.

At the end of the day that's entirely your decision but with actions like this it is no wonder that house prices have inflated so significantly and people are now having difficulty meeting mortgage payments.

Still cannot grasp why everybody thinks this is good.

First rung - flat approx £275k to £320k

Second rung - 3 bed approx £600k

Third rung - 4 to 5 bed £900k+

Regarding your analysis, we aren’t going to pay that much interest, we’ve always vigorously overpaid in the past and avoided a lot of interest, and are doing so so this time as usual. The mortgage rate increases are a cause for concern but we’ll dispense with nice to haves and boost our overpayments with the spare cash

Interesting perspective about the rungs, especially as people are looking at terms of over 25 years and scraping all resources just to buy initially at £275k -£320k, that does reinforce that there is no such thing as the property ladder for many.

Great that you have the headroom to overpay aggressively, many don't and are consequently having difficulty. Nevertheless that higher purchase price remains baked in and even if you over pay the max, likely 10% per annum, you will pay more interest than if you had borrowed less capital.0 -

Yes, but it isn`t just £100 on the mortgage is it? It is £100 on the groceries, £100 on the car costs, £100 on the gas and electric, to suggest that people worried about this are not the people that were buying 200 - 300k houses isn`t really very realistic.MobileSaver said:

£100 a month is a lot to many but very, very few (if any) of those many are the sort of people who are currently buying a £280,000 house - to suggest otherwise is nothing more than scaremongering; a common HPC trait.lookstraightahead said:

I do suspect that it's going to be a bit more difficult financially for folk going forwards. £100 a month is a lot to many.MobileSaver said:lookstraightahead said:

Or it becomes a huge financial commitment because you hadn't done your due diligence and got carried away in the dream. But the bank won't care as to them, as you say, it's just a pile of bricks.MobileSaver said:lookstraightahead said:

I can't get my head round why anyone would consider offering over what the professionals are willing to lend.secla said:If you have offered over valuation you should really have the funds to back it up. If it’s down valued and they have other offers on the table I’d expect them to move elsewhere and not negotiateExactly for that reason, it's not rocket science; the "professionals" are valuing the property in the best interests of the lender rather than in the best interests of the buyer.To the lender it's just a pile of bricks, to most buyers it's going to be their home for the next 5, 10 or 15 years and that usually makes a property worth somewhat more than just a pile of bricks... What is it with the HPC crowd always looking at the worst case scenario that only affects a small minority of home-owners?Buying a house is always a huge financial commitment anyway. The average UK house is around £280,000 so even if someone pays an extra £20,000 on top of that to secure their dream home then the typical mortgage payments will only be £100 a month more - it's insignificant in the grand scheme of things and all the scaremongering in the world won't change that...0

What is it with the HPC crowd always looking at the worst case scenario that only affects a small minority of home-owners?Buying a house is always a huge financial commitment anyway. The average UK house is around £280,000 so even if someone pays an extra £20,000 on top of that to secure their dream home then the typical mortgage payments will only be £100 a month more - it's insignificant in the grand scheme of things and all the scaremongering in the world won't change that...0 -

Confused about what to do about a down valuation situation as a seller. Had an offer accepted on my apartment a few months ago, pre inflation hike etc. Surveyor downvalued 7-8% lower. Buyer pulls out due to being unable to raise funds. Remarket recently, similar offer accepted, same thing happens, same down valuation figure. The surveyor who visited agreed that the offer accepted was around correct. 2-3 apartments, exactly same lease, layout, size, standard, have sold with the figure I have accepted. It seems that my property was not independently looked at and the surveyor/bank this time looked at what happened before and there's like a property downvalue black mark against it.

Agents have suggested the buyer appeal and relevant evidence submitted and I've offered to pay that if needed.

After that, what would my options be?

I understand that downvalue is going on, but the same properties are selling for higher, so it makes no sense in that instance.

Is there a way I can help this situation?0 -

As the seller it will be more about what the buyer decides to do than anything won`t it?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards