We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Investment trackers

Guildfordmover

Posts: 15 Forumite

I have some money that I’d liked to invest for my daughter and looking for some passively managed investments such as world trackers / ETFs. I have looked at the HSBC world and the Vanguard. I’m looking at a global equity tracker. Wondered if anyone have any favourites that they consider?

0

Comments

-

Vanguard FTSE Global All Cap invests in the widest range of underlying investments including both Emerging Markets and Small Companies, so that would be my choice.4

-

I second this!Linton said:Vanguard FTSE Global All Cap invests in the widest range of underlying investments including both Emerging Markets and Small Companies, so that would be my choice.Think first of your goal, then make it happen!0 -

That's definitely the safe choice, but I am a bear on the UK since the referendum, so chose Vanguard FTSE Developed World ex-UK Equity Index Acc GBP then, which has beaten Global by a good 10% over 5 years. But that's not the best choice for a single fund if you think the UK will (eventually, in the fullness of time, pass through a rough patch, float into the sunny uplands of high wage, high growth economy etc etc) catch up with other areas.0

-

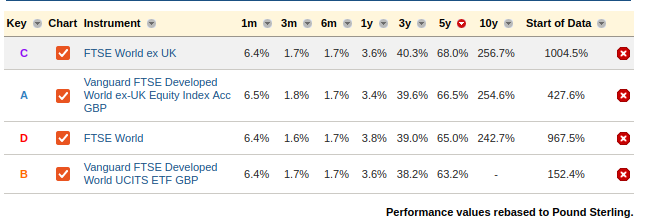

talexuser said:That's definitely the safe choice, but I am a bear on the UK since the referendum, so chose Vanguard FTSE Developed World ex-UK Equity Index Acc GBP then, which has beaten Global by a good 10% over 5 years. But that's not the best choice for a single fund if you think the UK will (eventually, in the fullness of time, pass through a rough patch, float into the sunny uplands of high wage, high growth economy etc etc) catch up with other areas.Which tracker are you comparing with? I can't get close to 10% difference over 5 years without comparing apples with oranges. Vanguard FTSE Developed World ex-UK index fund vs Vanguard FTSE Developed World ETF is just 3%, as is the FTSE World ex UK index vs FTSE World index.

The UK is such a small proportion of the global index, it probably isn't worth going to any trouble to exclude it by opting to track a less diversified index (developed world vs all-world vs all-cap) where you may be losing exposure to higher growth assets.3

The UK is such a small proportion of the global index, it probably isn't worth going to any trouble to exclude it by opting to track a less diversified index (developed world vs all-world vs all-cap) where you may be losing exposure to higher growth assets.3 -

Guildfordmover said:I have some money that I’d liked to invest for my daughter and looking for some passively managed investments such as world trackers / ETFs.The platform being used may also be a factor. Often there will be a cost difference depending on whether you choose an OEIC/UT or an ETF and the type of account. At HL for example, it's free to hold ETFs in their Fund & Share Account but there's a 0.45% platform charge in an ISA or SIPP (capped at £45 p.a. in the ISA and £200 p.a. in the SIPP). For others, such as Iweb (and others owned by Lloyds) the fees may be the same.

In general, the more stocks and regions included in a global tracker, the higher the management costs tends to be, so decide what it is you want to cover.

There's a list of what they consider to be good value trackers at https://monevator.com/low-cost-index-trackers/. Lots on ETFs at https://www.justetf.com/uk/

0 -

HSBC or Vanguard are perfectly fine, as will be many other global trackers. My personal preference is Vanguard, but just because I've been with the company for many years and their "co-op" company structure.“So we beat on, boats against the current, borne back ceaselessly into the past.”0

-

As the UK is only 4.19% of FTSE all world, how can it's underperformance ( not total collapse) drag down the whole index by 10%, even over 5 years.talexuser said:That's definitely the safe choice, but I am a bear on the UK since the referendum, so chose Vanguard FTSE Developed World ex-UK Equity Index Acc GBP then, which has beaten Global by a good 10% over 5 years. But that's not the best choice for a single fund if you think the UK will (eventually, in the fullness of time, pass through a rough patch, float into the sunny uplands of high wage, high growth economy etc etc) catch up with other areas.

The figure Masonic has calculated of 3 % over 5 years still looks a bit high, if it was a UK effect only, but the World one includes 8% emerging markets, so that may be having an effect as well.1 -

Albermarle said:

As the UK is only 4.19% of FTSE all world, how can it's underperformance ( not total collapse) drag down the whole index by 10%, even over 5 years.talexuser said:That's definitely the safe choice, but I am a bear on the UK since the referendum, so chose Vanguard FTSE Developed World ex-UK Equity Index Acc GBP then, which has beaten Global by a good 10% over 5 years. But that's not the best choice for a single fund if you think the UK will (eventually, in the fullness of time, pass through a rough patch, float into the sunny uplands of high wage, high growth economy etc etc) catch up with other areas.

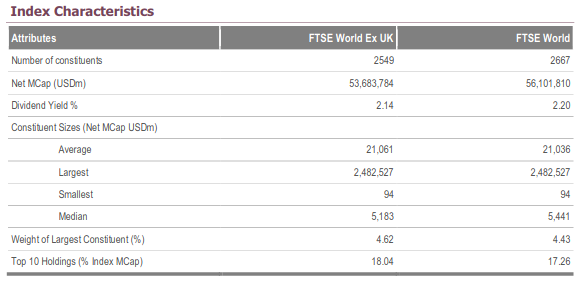

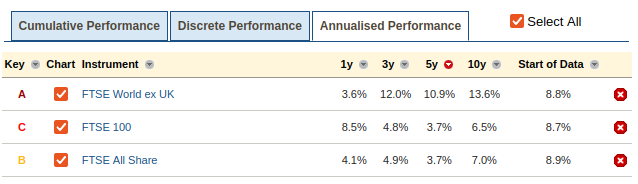

The figure Masonic has calculated of 3 % over 5 years still looks a bit high, if it was a UK effect only, but the World one includes 8% emerging markets, so that may be having an effect as well.I've assumed the "FTSE World ex-UK" is identical to the "FTSE World" with all the UK listed shares removed. Likewise that Vanguard FTSE Developed World ex-UK Index is identical to Vanguard FTSE Developed World ETF with the UK shares removed. I was not making comparisons between FTSE World and FTSE Developed World, which definitely do differ in composition.I do agree with you though that 3%/5Y seems high, so perhaps the missing UK content of the ex-UK indexes is filled in with mid-cap shares from other regions, although the following suggests not: So, if I'm reading that correctly, 4.31% of the FTSE World index is responsible for an annualised underperformance of 0.6%, which would mean the UK part of FTSE World would need to underperform the ex-UK holdings by almost 14%/year to have that impact. There's about 7%/year underperformance from FTSE100 and FTSE All Share, which is bad, but only explains half of the underperformance of the FTSE World.

So, if I'm reading that correctly, 4.31% of the FTSE World index is responsible for an annualised underperformance of 0.6%, which would mean the UK part of FTSE World would need to underperform the ex-UK holdings by almost 14%/year to have that impact. There's about 7%/year underperformance from FTSE100 and FTSE All Share, which is bad, but only explains half of the underperformance of the FTSE World. 0

0 -

I've assumed the "FTSE World ex-UK" is identical to the "FTSE World" with all the UK listed shares removed. Likewise that Vanguard FTSE Developed World ex-UK Index is identical to Vanguard FTSE Developed World ETF with the UK shares removed. I was not making comparisons between FTSE World and FTSE Developed World, which definitely do differ in composition.

Yes I agree, my comments were more in response to Telexuser who said

so chose Vanguard FTSE Developed World ex-UK Equity Index Acc GBP then, which has beaten Global by a good 10% over 5 years.

Which was comparing two funds that not only were different in UK content, but emerging market content as well.

2 -

I was obvioulsy comparing to Vanguard FTSE Global All Cap under discussion, and it is obviously apples vs oranges as acknowledged in the post as perhaps not the best choice for a single fund, but the difference is nevertheless interesting.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards