We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Vanguard funds - which to choose

Comments

-

So would you recommend the HSBC fund for 2023/24 as oppose to VanguardYou don't know which of the multi-asset funds with underlying passives will be best in any one tax year. In any single year, one could be better than the other. However, HSBC GS is cheaper and has outperformed VLS in more discrete periods than the other way around. On paper, HSBC is probably the better technical option (cheaper, unfettered and risk targetted vs more expensive, fettered and not risk targetted), but it is a bit like picking between two Granny Smith apples.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.2 -

Well, yes, however you want to describe it, VLS is more UK and less US than HSBC, and that's the reason for the performance difference. I think we're all agreeing on this substantive point. The minutiae seem very important to some people, but on the main point we all agree.Cus said:I think @zagfles has inferred an incorrect view in my opinion. The difference in performance is very likely to be linked to a UK bias for vanguard, that has led to a reduced performance. The HSBC fund performs an appropriate balance based on market caps so is not US biased, but actually correctly weighted.

0 -

Actually I dont agree that the difference in %UK is the main reason for the performance difference - if it was the performance difference would be larger. It is part of the picture but on the other hand you also need to consider that HSBC GS Balanced has a lower % equity than VLS60 which in the growth era would have led to lower performance and reduced volatility.zagfles said:

Well, yes, however you want to describe it, VLS is more UK and less US than HSBC, and that's the reason for the performance difference. I think we're all agreeing on this substantive point. The minutiae seem very important to some people, but on the main point we all agree.Cus said:I think @zagfles has inferred an incorrect view in my opinion. The difference in performance is very likely to be linked to a UK bias for vanguard, that has led to a reduced performance. The HSBC fund performs an appropriate balance based on market caps so is not US biased, but actually correctly weighted.

Other factors include HSBC GS Balanced currently having a significantly lower Gilt allocation and a greater % in US bonds. I am investigating but not yet sure whether HSBC's risk targeting strategy includes adjusting the bond investments according to market conditions.

It will be interesting to see how the two funds compare now (or perhaps if) Growth investments are less dominant.0 -

dunstonh said:So would you recommend the HSBC fund for 2023/24 as oppose to VanguardYou don't know which of the multi-asset funds with underlying passives will be best in any one tax year. In any single year, one could be better than the other. However, HSBC GS is cheaper and has outperformed VLS in more discrete periods than the other way around. On paper, HSBC is probably the better technical option (cheaper, unfettered and risk targetted vs more expensive, fettered and not risk targetted), but it is a bit like picking between two Granny Smith apples.More like an apple and a pear, as mentioned above (ignore the hysteria). The funds have different makeups, so they will perform differently, personally I think 63% US isn't very "balanced" even if does correctly reflect market cap, and VLS has a "home bias" which they have logical reasons for (they did have an article on this but can't find it).Be wary of chasing past performance, one of the biggest selling funds last year was BG American after it returned 100%+ over a year, then went down about 55% since see https://forums.moneysavingexpert.com/discussion/comment/79282564#Comment_79282564. Obviously the risk is different here, but the principle is the same.This article is interesting https://www.ftadviser.com/investments/2021/10/04/westaway-says-lifestrategy-home-bias-is-being-dialled-down/

0 -

Linton said:

Actually I dont agree that the difference in %UK is the main reason for the performance difference - if it was the performance difference would be larger. It is part of the picture but on the other hand you also need to consider that HSBC GS Balanced has a lower % equity than VLS60 which in the growth era would have led to lower performance and reduced volatility.zagfles said:

Well, yes, however you want to describe it, VLS is more UK and less US than HSBC, and that's the reason for the performance difference. I think we're all agreeing on this substantive point. The minutiae seem very important to some people, but on the main point we all agree.Cus said:I think @zagfles has inferred an incorrect view in my opinion. The difference in performance is very likely to be linked to a UK bias for vanguard, that has led to a reduced performance. The HSBC fund performs an appropriate balance based on market caps so is not US biased, but actually correctly weighted.

Other factors include HSBC GS Balanced currently having a significantly lower Gilt allocation and a greater % in US bonds. I am investigating but not yet sure whether HSBC's risk targeting strategy includes adjusting the bond investments according to market conditions.

It will be interesting to see how the two funds compare now (or perhaps if) Growth investments are less dominant.Yes there are other factors but the performance difference between UK and US equities is massive, over 5 years UK equities are up about 10% and US equities about 70%. Over 3 years it's about 5% vs 30%.So the other factors will probably have mitigated the performance difference, but not enough to eliminate it. But the massive difference in performance UK vs US will be the main reason, IMO. Of course I could be wrong.

0 -

If you look at Vanguard trackers in general, they are nearly all underperforming other comparable trackers. I suspect this is down to the fact that Vanguard use sampled replication, whereas many of the alternatives use full replication. On the upside, this seems to work better for returns but on the downside, it appears to be worse.Other factors include HSBC GS Balanced currently having a significantly lower Gilt allocation and a greater % in US bonds. I am investigating but not yet sure whether HSBC's risk targeting strategy includes adjusting the bond investments according to market conditions.I had a look but its not easy to compare as the classification of some of the underlying assets moved between regions/countries to just "international"

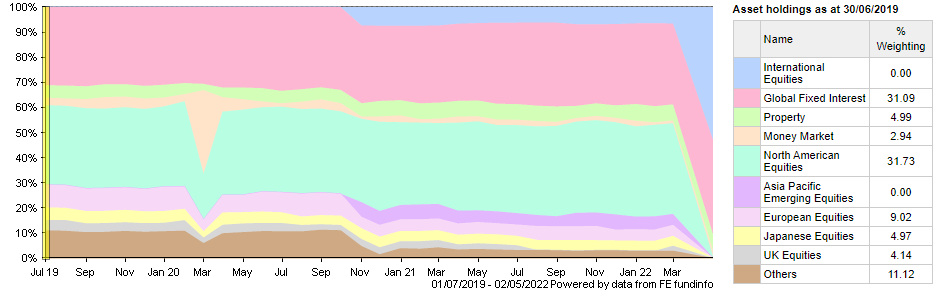

HSBC Asset Weightings:

The snapshot as of 30th April 22 showed all equities as international (53.48%), global property at 37.69%, property at 6.45% and money market at 2.38%.

The snapshot at 28th Feb 22 showed N America at 36.13% and UK at 1.97%. 6.52% was classified as international equities.

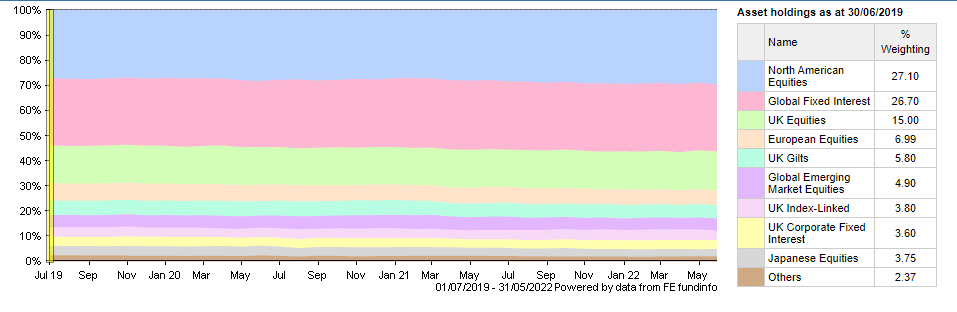

VLS60:

Due to its use of fixed equity/bond ratios, VLS is more consistent, but the ratios do change. 31/05/22 has 29.6% allocated to US compared to 27.1% at the start for example. Not as much change as HSBC as you would expect given the different nature of the funds.

As for industries, they are very similar. The standout differences are HSBC has more in financials, industrials and property. VLS has more in consumer products.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.2 -

The VLS funds aren't trackers. They're actively managed as far as selecting the mix of underlying trackers to use. If you look at the underlying trackers, they're pretty much on the market average, as you'd expect.dunstonh said:If you look at Vanguard trackers in general, they are nearly all underperforming other comparable trackers.

0 -

It looks like the overseas bonds in the multiasset VLS funds are hedged to GBP, whereas they appear to be hedged to USD in the HSBC variants.......though getting to the detail isn't easy....

If that's the case, then that would at least partly explain the performance differences....0 -

Just to add, the performance difference isn't that much between the two funds. Over the last 10 years:Linton said:

Actually I dont agree that the difference in %UK is the main reason for the performance difference - if it was the performance difference would be larger. It is part of the picture but on the other hand you also need to consider that HSBC GS Balanced has a lower % equity than VLS60 which in the growth era would have led to lower performance and reduced volatility.zagfles said:

Well, yes, however you want to describe it, VLS is more UK and less US than HSBC, and that's the reason for the performance difference. I think we're all agreeing on this substantive point. The minutiae seem very important to some people, but on the main point we all agree.Cus said:I think @zagfles has inferred an incorrect view in my opinion. The difference in performance is very likely to be linked to a UK bias for vanguard, that has led to a reduced performance. The HSBC fund performs an appropriate balance based on market caps so is not US biased, but actually correctly weighted.

Other factors include HSBC GS Balanced currently having a significantly lower Gilt allocation and a greater % in US bonds. I am investigating but not yet sure whether HSBC's risk targeting strategy includes adjusting the bond investments according to market conditions.

It will be interesting to see how the two funds compare now (or perhaps if) Growth investments are less dominant.

HSBC Global Strategy Balanced - 7.61% annualised

Vanguard LifeStrategy 60 - 7.10% annualised

Looking at them both on a graph the volatility also looks very similar.

I like the fact that the HSBC fund can vary it's percentages, but as far as I can see they don't seem to change very much as the equities total (including property) always seem to be around 60%. I'm not sure if they change the weightings of the different equity and bond indexes very often?

0 -

Blood has been spilt on this forum over less than 0.51% per year when discussing fees 😀Audaxer said:

Just to add, the performance difference isn't that much between the two funds. Over the last 10 years:Linton said:

Actually I dont agree that the difference in %UK is the main reason for the performance difference - if it was the performance difference would be larger. It is part of the picture but on the other hand you also need to consider that HSBC GS Balanced has a lower % equity than VLS60 which in the growth era would have led to lower performance and reduced volatility.zagfles said:

Well, yes, however you want to describe it, VLS is more UK and less US than HSBC, and that's the reason for the performance difference. I think we're all agreeing on this substantive point. The minutiae seem very important to some people, but on the main point we all agree.Cus said:I think @zagfles has inferred an incorrect view in my opinion. The difference in performance is very likely to be linked to a UK bias for vanguard, that has led to a reduced performance. The HSBC fund performs an appropriate balance based on market caps so is not US biased, but actually correctly weighted.

Other factors include HSBC GS Balanced currently having a significantly lower Gilt allocation and a greater % in US bonds. I am investigating but not yet sure whether HSBC's risk targeting strategy includes adjusting the bond investments according to market conditions.

It will be interesting to see how the two funds compare now (or perhaps if) Growth investments are less dominant.

HSBC Global Strategy Balanced - 7.61% annualised

Vanguard LifeStrategy 60 - 7.10% annualised

Looking at them both on a graph the volatility also looks very similar.

I like the fact that the HSBC fund can vary it's percentages, but as far as I can see they don't seem to change very much as the equities total (including property) always seem to be around 60%. I'm not sure if they change the weightings of the different equity and bond indexes very often?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards