We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Pension loosing money

Comments

-

Look back a bit further! sell to cash within the pension today and start to serious research.

0

0 -

This is a common mistake made by inexperienced investors. You saw that the price of the fund had gone up a lot recently, so you bought it at the new, expensive price. Now that the price has fallen back you will inevitably sell it at the new, cheap price. In short you buy high and sell low.deepam said:The reason I chose this fund few months back was looking at the fund performance, nothing else

If you are not careful you will make the same mistake again by buying whatever class of fund is expensive at the moment (based on its "past performance") and you will lose money again.

In short, the bit on the brochure that says "past performance is not a guide to future returns" is not put there for decoration. It means what it says.

On a broader point I hope that by "100% invested" you don't mean that you have your entire pension invested in that fund, because regardless of its performance over the last couple of years that would be a terrible way to plan for your retirement. It invests almost entirely in oil and mining companies. Why do you want to bet your retirement on oil and mining companies, to the exclusion of technology companies, manufacturing companies, pharmaceutical companies, retail companies etc etc?4 -

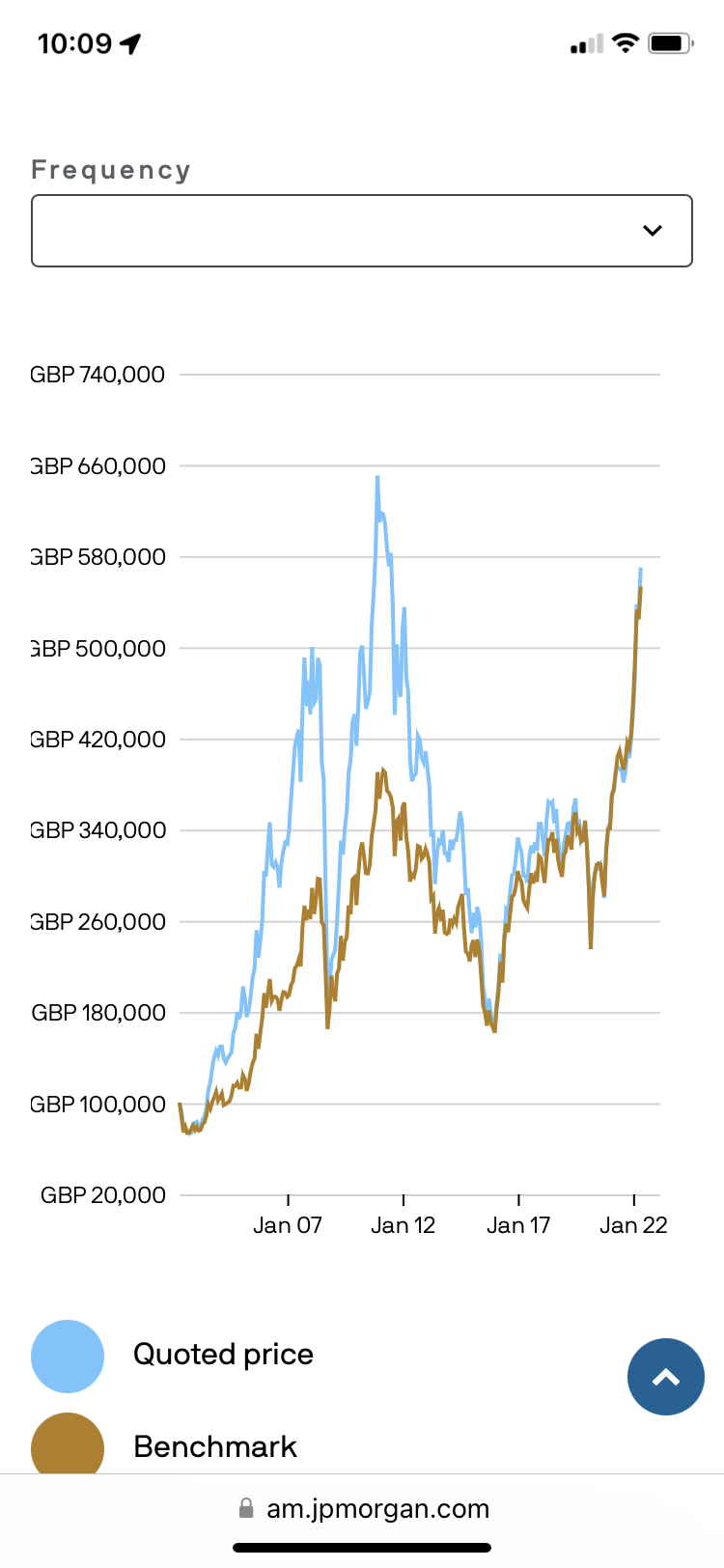

The usual advice is dont sell when down. However as the investment is totally inappropriate it would make sense to sell your JPM Nat Res ASAP and buy a broad global fund. Fortunately such funds have fallen in price as well.

If you are interested in price history I suggest you look at JPM Nat Res over the past 10 years and compare that with a broad global fund.5 -

I have lost another 5K just yesterday so now it stands -25K. Yes I am not experienced that is correct - I guess that's why I am asking for help. Could someone advice me what fund I should move on and save my rest of money instead of just....0

-

@older_and_no_wiser Could you please help me with ISIN code. I have now lost 25K (5K just yesterday). Yesterday the JP Morgan stock went up but the fund went down by more than 4%older_and_no_wiser said:

Alternatively, if you can't take the stress of this bear market impact, perhaps consider a more diverse approach like a global multi asset fund like HSBC Global Strategy or Vanguard LifeStrategy? Most of these funds have different levels based on how cautious or adventurous your approach is.

0 -

You haven't lost anything. Your fund is down but it's not lost until you sell it. I would advise against selling. The markets will rebound and recover but nobody knows how long it will take. It could be a few months or a couple of years. I would suggest to keep contributing to the pension. Think of it as buying new shares during a sale period. You're getting more for your money now.

I don't think you've said what percentage of your pot is in this one focussed (volatile) fund? Because it's only got a small number of companies in a theme, you will always get bigger movements up and down. If you sell now you may regret it when things start to recover. You are experiencing human nature. You are afraid. It's normal. Someone (WB) once said "be greedy when others are fearful and fearful when others are greedy". Which basically means don't buy high and sell low. Buy when prices are cheap(er).

How long is is before you retire and need that money? If it's next year then maybe you need to address the loss. If it's 5+ years then absolutely no need to panic. Let the fund build back up and then change/sell it for a more safe/stable one as I indicated above.

I had exactly the same problem (and still do) with the Bailie Gifford American fund....huge losses. I was naive when I bought it. Got carried away with past performance. They got lucky buying Tesla etc at the right time. However that's all gone into reverse how. I sold up a large chunk of it once it got back to green numbers for me as I couldn't take the stress. I still hold some and will probably sell more....but not yet as it's so much in the red for me again. I'll give it a few years till it comes back. But it's now only less than 8% of my portfolio so I'm not too worried. I may never need to use that money so I can sleep at night. I learnt a lesson and you will too. Everyone makes mistakes.

Just remember we're all in the same boat. Virtually everyone's funds are down currently.1 -

Markets generally went up everywhere yesterday. There may well be a reporting lag in the fund. So yesterday's loss may have been from earlier in the week.deepam said:I have lost another 5K just yesterday so now it stands -25K. Yes I am not experienced that is correct - I guess that's why I am asking for help. Could someone advice me what fund I should move on and save my rest of money instead of just....1 -

https://www.trustnet.com/factsheets/o/g1hd/hsbc-global-strategy-balanced-portfoliodeepam said

That's an example of the multi asset funds I mentioned. Please don't rush in and just swap over though! Read my previous post (and everyone else who's posted!) and think about it. Also please look into the makeup of the fund. See how this one and yours are invested. Try to understand where they are invested. Maybe watch some YouTube channels on investing. I can recommend a few:

Damien Talks Money (funny)Conversation of Money (accessible and honest)Meaningful Money (very accessible)That Finance Show (funny)

PensionCraft (serious and detailed)

Look for videos on there that explain different investment types and talk about markets and conditions.

Also listen to the Maven Money podcast.

These are all accessible and easy to understand. The more you learn about where your money is and how it all works, the better you'll feel. Less than 18 months ago I knew absolutely nothing about all this but I got interested and wanted to start controlling my own pension and get more back for money I had in poor savings accounts. I've used these channels and others to learn and really enjoyed it.4 -

You might need to look on your workplace pension website and see what funds are actually available in your plan before making any fund switching decisions.......SL may not offer the funds mentioned.1

-

I'd leave the funds invested in that JPM fund and diverisfy future contributions by adding more funds selling at a discount. You could look at funds which offer exposure to sectors other than natural resources, e.g. tech.

I earlier gave a named example to help guide your research. However, this created some controversy and I have edited my comment to remove references. Thanks everyone for the education.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards