We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Which? pension advice accurate?

roadweary

Posts: 281 Forumite

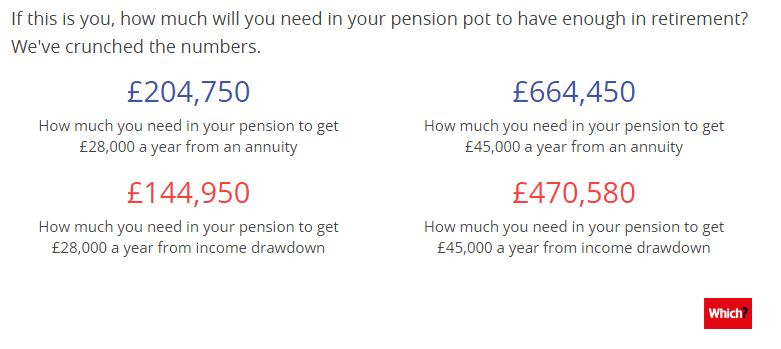

I know that all "how much do you need to retire" information is generic, based on a range of assumptions and that you probably need to pay for individual advice to get accurate figures... But all of that said, Which? seems to be more optimistic than many other sources.

For example here https://www.which.co.uk/money/pensions-and-retirement/starting-to-plan-your-retirement/how-much-will-you-need-to-retire-atu0z9k0lw3p they seem to be saying that with £471k you could achieve £45k a year with drawdown (including state pension) or £664k for an annuity providing the same annual amount.

What do you think?

R

For example here https://www.which.co.uk/money/pensions-and-retirement/starting-to-plan-your-retirement/how-much-will-you-need-to-retire-atu0z9k0lw3p they seem to be saying that with £471k you could achieve £45k a year with drawdown (including state pension) or £664k for an annuity providing the same annual amount.

What do you think?

R

0

Comments

-

I think they actually mean drawdown £25.7k not £45k.

Which is a bit higher than most suggestions on here but not ridiculously high drawdown rate.0 -

Hmm.......

0 -

Producing post-tax annual income of £45,000, including the state pension, would mean an initial pot of around £664,450 to buy a joint-life annuity or £470,580 invested in income drawdown.

£45k less two standard new State Pensions = £25.7k

1 -

Ah!

Thanks...0 -

Assuming 19k in a couple of state pensions that drawdown rate is still around 6%, which seems very optimistic to me.“So we beat on, boats against the current, borne back ceaselessly into the past.”0

-

They say the average state pensions for men and women are £8859 and £8545 respectively so they're talking about withdrawing £27.6k in drawdown, which is just under 6% of their pot. They're assuming 3% annual growth in the pot though. Dunno whether that's standard or not.Dazed_and_C0nfused said:Producing post-tax annual income of £45,000, including the state pension, would mean an initial pot of around £664,450 to buy a joint-life annuity or £470,580 invested in income drawdown.£45k less two standard new State Pensions = £25.7k

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards