We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

EDF sneaky direct debit increase

Comments

-

I'd ring them up and say no. Your DD doesn't need to increase and they don't have your permission to fudge the numbers.

fyi - I've been waiting for something like this with Eon as I'm £600 in debt with £120 month DD. But our bills are down for more reasons than it's summer. Our biggest energy user is not currently in residence (elder who last summer had the heat on full blast all day) so I know the overall debt will continue to fall for the next few months at least. Fixed til Oct 23 so plenty of time to get anything sorted.I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇🏅🏅🏅0 -

I will try to explain. Maybe I am not explaining well enough. I got my bill on 3 June saying a debt of £49.50 (after paying May DD) in the period Nov to June (I had paid £49.50 less than I used). But they say that I actually have debt of £140.50 as they count my next due DD (at end of June) as debt thus adding £91 to the actual debt of £49.50, making £140.50. And to work the £140.50 debt off I have to increase my DD. This is ignoring the fact that the £91 is not debt as it is not owed yet and will be paid on time, and also ignoring the fact that once summer is over I will be in credit with my current DD amount. Hope that explains itMobtr said:

I’m not sure what you mean by they’ve added to the debt the DD payment due at the end of the month.Malchester said:On a 3 year fix with EDF from September 2021. Paying £91 per month. Just had the latest bill and from November to 3 June we have used £49.50 worth of gas and electricity more than we have paid for by DD. That is not bad for the winter period and it will be more than covered over the summer months.

On the bill EDF have added to the debt the DD payment which is not due until the end of June making the debt, they say, £140.50. As a result they have increased my DD even though by the end of September I will be in credit as my usage for the next few months will be less than the £91 DD. Having contacted them by webchat they put the DD back to £91 in about 30 seconds.

Just a warning to keep an eye on bills and any unnecessary increases in DD amountsThey only credit payments that have been received so the last on on your bill should be the one at the end of May, they’re not going to credit a payment that’s not due for another 3 weeks or so.0 -

Nope, still makes absolutely no sense at all. How can they count your next dd which is not due yet as debt? DD’s are payments which are credits & wouldn't be added to your account. You should be billed up to the date you gave the readings, any balance from your last bill is carried forward to this one and you have a balance outstanding. I’m assuming this is your annual review. Not sure if I’m missing something here but can’t see why you have 2 outstanding balances, one of £49.50 & one of £140.50Malchester said:

I will try to explain. Maybe I am not explaining well enough. I got my bill on 3 June saying a debt of £49.50 (after paying May DD) in the period Nov to June (I had paid £49.50 less than I used). But they say that I actually have debt of £140.50 as they count my next due DD (at end of June) as debt thus adding £91 to the actual debt of £49.50, making £140.50. And to work the £140.50 debt off I have to increase my DD. This is ignoring the fact that the £91 is not debt as it is not owed yet and will be paid on time, and also ignoring the fact that once summer is over I will be in credit with my current DD amount. Hope that explains itMobtr said:

I’m not sure what you mean by they’ve added to the debt the DD payment due at the end of the month.Malchester said:On a 3 year fix with EDF from September 2021. Paying £91 per month. Just had the latest bill and from November to 3 June we have used £49.50 worth of gas and electricity more than we have paid for by DD. That is not bad for the winter period and it will be more than covered over the summer months.

On the bill EDF have added to the debt the DD payment which is not due until the end of June making the debt, they say, £140.50. As a result they have increased my DD even though by the end of September I will be in credit as my usage for the next few months will be less than the £91 DD. Having contacted them by webchat they put the DD back to £91 in about 30 seconds.

Just a warning to keep an eye on bills and any unnecessary increases in DD amountsThey only credit payments that have been received so the last on on your bill should be the one at the end of May, they’re not going to credit a payment that’s not due for another 3 weeks or so.1 -

I think what happened is that they added an estimated use of £91, not a direct debit amount.

EDF does the direct debit review every 6 months, what month does your billing year end?

The direct debit does not work the way that you make up in summer what debt you accumulated in winter, it usually is the other way around, you go with a credit into the winter months so hopefully you will end up with a small credit or zero balance.

It seems that suppliers are very aware of the Ofgem investigation and are allowing reductions of direct debits even if they don't make sense for the customer as they will end in debt at the end of winter. An increase of £10 per month would be completely justified here as we are already in June and you are still in debt.

Of course this does not take into account the £400 grant, but I assume they will not that until they see the money.

1 -

I am a bit confused. Below is an EDF payment review. It does mention the next as yet untaken DD but does not add it as a debit. Nor does it take into account any credit / debit currently on the account as it is not really relevant to the end goal of £0 balance at year end..

Working out your payments

Half-way through your billing year this is what your payments looked like. This also includes your next energy payment of £76 (due around 01 June 2022).£0.......................£532 paid.][............................£1,096Estimated annual cost

£1,096

When we get your meter reading on time, we can base this cost on your latest energy use. If not, we use the latest available information.Amount paid

£532

At your review, this is how much you'd paid towards your estimated annual cost. This also includes your next energy payment of £76 (due around 01 June 2022).Amount left to pay

£564

At your review, this is how much you still had to pay to cover your estimated annual cost.New energy payment amount

£94

At your review, you had six months to go until the end of your billing year. So we divided £564 by six to set your new monthly energy payment amount.

1 -

Isn't this all a bit like if I go into Te5cos and buy this weeks shopping and they decide to charge me for what they think I might buy next week too? Ok - obviously I'm going to need more wine but who knows if I'll want more pasta or need to get some anchovies.I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇🏅🏅🏅2 -

pochase said:I think what happened is that they added an estimated use of £91, not a direct debit amount.

EDF does the direct debit review every 6 months, what month does your billing year end?

The direct debit does not work the way that you make up in summer what debt you accumulated in winter, it usually is the other way around, you go with a credit into the winter months so hopefully you will end up with a small credit or zero balance.

It seems that suppliers are very aware of the Ofgem investigation and are allowing reductions of direct debits even if they don't make sense for the customer as they will end in debt at the end of winter. An increase of £10 per month would be completely justified here as we are already in June and you are still in debt.

Of course this does not take into account the £400 grant, but I assume they will not that until they see the money.

You are wrong. I have built up a little debt over winter which will be cleared and a credit built up over summer for next winter. It depends when you'd year starts. An increase of £10 is not justified if, over a year I am covering my usage costs.

As for your first sentence it makes no difference as they are adding a debt which has not accrued and which will be more than covered by the DD payment at the end of June and, as a result of paying my usual amount, my debt will reduce by around £15 to £20 by the end of June.

I think I will give up on replying to comments on this thread now0 -

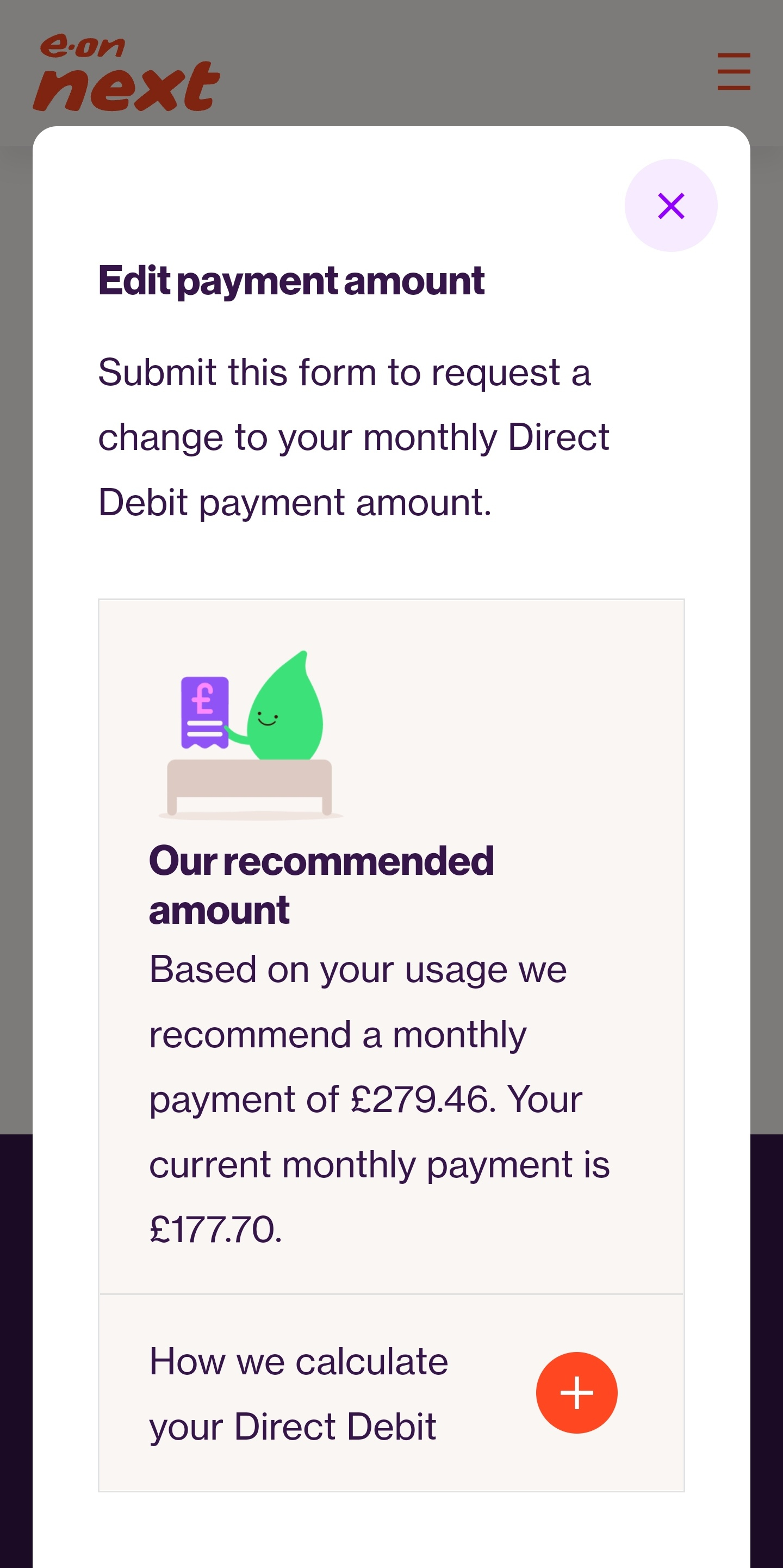

Similar situation we were with Symbio so Eon Next took us on as SoLR. Due to us cancelling the direct debit with Symbio who tried to up it 400% the day before they went bust we started in October 2021 with a £200 debit which over the past winter grew to about £500.Brie said:I'd ring them up and say no. Your DD doesn't need to increase and they don't have your permission to fudge the numbers.

fyi - I've been waiting for something like this with Eon as I'm £600 in debt with £120 month DD. But our bills are down for more reasons than it's summer. Our biggest energy user is not currently in residence (elder who last summer had the heat on full blast all day) so I know the overall debt will continue to fall for the next few months at least. Fixed til Oct 23 so plenty of time to get anything sorted.

We figure we have a year for our account to be even and if by luck come October we will be in credit but just for fun I had a look at what they might want us to pay and if they enforced this now we would be £400 in credit come October 1st and then have the £400 grant on top so let's hope they see sense.

I don't know if Eon Next check the DD annually but on our £177.70 a month we will be about £18 in credit by our calculations come our 1st year with them 3rd October 2022

0 -

I bet OP was looking at the account activity column on the web portal.For my daughter it shows a bill with a figure of -£102.31 along side it. The account is actually £102.31 in credit after this bill including the untaken DD.Mine shows the bill and a figure of £7.35. The account is £7.35 in debit.So ....An amount with a + beside it is an account creditAn amount with a - beside it is a positive balanceAn amount with nothing beside it is an account debit or negative balance0

-

Molerat: I know this!!!!!!! Webchat told me that I owed £49.50 from the last 6 months plus £91 due at the end of June (not currently owed). As a result of this they were going to increase my DD to cover a debt I don't have and will not havemolerat said:I bet OP was looking at the account activity column on the web portal.For my daughter it shows a bill with a figure of -£102.31 along side it. The account is actually £102.31 in credit after this bill including the untaken DD.Mine shows the bill and a figure of £7.35. The account is £7.35 in debit.So ....An amount with a + beside it is an account creditAn amount with a - beside it is a positive balanceAn amount with nothing beside it is an account debit or negative balance0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards