We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

40-60% Funds Worried

Comments

-

Good choice or not, no idea, but pitfalls….

Any pitfalls in the iShares 0-5 year US TIPS not hedged to sterling?

Bonds are in a portfolio less for returns than for reducing volatility. And yet not hedging brings with it exchange rate volatility. If you like volatility hold more stocks. But perhaps unhedged bond volatility comes with increased return; does it, can it?

I think it’s the case that currency has no return; it pays no interest unless you use it to buy something that pays interest, and it has no basis for capital growth. True enough, currencies move up and down in value against other currencies, and some do it for decades in one direction (Yen vs $), but intrinsically a currency doesn’t produce anything that would justify its value to grow.

As a consequence, I worry that unhedged bonds would get the return of the bonds, to which would be added the volatility of currency exchange without any return.

You’ll ‘lose out’ if the dollar tanks compared to the pounds, as you wrote, but as you can be saved if other parts of your portfolio are doing well you might get away with it.

Overall, I think it’s volatility without return, and a bit of currency speculation as part of your investing.

2 -

@aroominyork sorry to derail with a sidebar but what software/platform are you using for the funds analysis shown above, it looks good and I don't recognise it?aroominyork said:You are so emotional and panicky that you need to find an index fund that meets your risk tolerance and learn to leave it alone. If there was one house I would want for actively managing mid-risk multi-asset funds it would be Royal London, but you see them as diseased. The diversified fund is about 57% equities; over the last five years it has outperformed VLS60; you mustn't be thrown by a small recent dip. 0

0 -

Very recognisable as HL's Charts & Performance view.GazzaBloom said:

@aroominyork sorry to derail with a sidebar but what software/platform are you using for the funds analysis shown above, it looks good and I don't recognise it?aroominyork said:You are so emotional and panicky that you need to find an index fund that meets your risk tolerance and learn to leave it alone. If there was one house I would want for actively managing mid-risk multi-asset funds it would be Royal London, but you see them as diseased. The diversified fund is about 57% equities; over the last five years it has outperformed VLS60; you mustn't be thrown by a small recent dip.

2 -

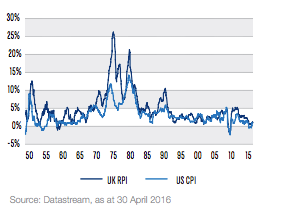

ChainsawCharlie said:Yes the time situation makes a difference.If you are buying in to the argument that your bond exposure should be GBP-relevant, then how sure are you that future inflation in the US is going to match that of the UK? The same currency volatility argument can be used to suggest it will not. Let's say inflation in the US is brought under control before it is in the UK. That will cause you to take a double hit. First from the differential between UK vs US inflation, and second due to the necessary weakening of the pound as a result of the greater local inflation rate. What use is an "inflation linked" bond fund that performs worst when your home country is experiencing disproportionate inflation, just when you need it most? If you look back to the last period of double digit inflation, comparing US with UK, you'll see what I mean.

In the period from 1974-1985, where there were bouts of excess UK inflation, the pound fell from $2.40 to $1.15. So your hedged TIPS fund would be giving you a fraction of the index linking you needed, while the hedging contract would be eroding the value of your capital in line with the halving of the value of the pound. Had you invested unhedged, you'd still lose out on that index linking, but the GBP value of your capital would double. On the other hand, if you held index linked gilts over that period, you'd still see the spending power of your capital halved, but the 10-25% per year index linked income would make up for it. Hedged US TIPS would therefore give you the worst outcome of these three options. I doubt things will be that dramatic going forward, but I'd suggest a period of modest excess inflation in the UK is likely.Unhedged is less risky in my view for the reason above, but still more risky than buying something issued by your local government linked to UK inflation. Ideally you'd just buy a short-dated index linked gilt and hold it to maturity, so as not to worry about economic differences between the US and UK over your holding period.Personally, I'm getting all of my inflation linked bond exposure through wealth preservation funds at the moment, and none of that was currency hedged at the time of last checking (but a significant part is from short-dated UK index linked gilts). Such a shame NS&I isn't in a hurry to issue more index linked savings certificates, even with a negative interest rate, as those were a perfect alternative to the non-existent short dated index linked gilt funds sector.1

In the period from 1974-1985, where there were bouts of excess UK inflation, the pound fell from $2.40 to $1.15. So your hedged TIPS fund would be giving you a fraction of the index linking you needed, while the hedging contract would be eroding the value of your capital in line with the halving of the value of the pound. Had you invested unhedged, you'd still lose out on that index linking, but the GBP value of your capital would double. On the other hand, if you held index linked gilts over that period, you'd still see the spending power of your capital halved, but the 10-25% per year index linked income would make up for it. Hedged US TIPS would therefore give you the worst outcome of these three options. I doubt things will be that dramatic going forward, but I'd suggest a period of modest excess inflation in the UK is likely.Unhedged is less risky in my view for the reason above, but still more risky than buying something issued by your local government linked to UK inflation. Ideally you'd just buy a short-dated index linked gilt and hold it to maturity, so as not to worry about economic differences between the US and UK over your holding period.Personally, I'm getting all of my inflation linked bond exposure through wealth preservation funds at the moment, and none of that was currency hedged at the time of last checking (but a significant part is from short-dated UK index linked gilts). Such a shame NS&I isn't in a hurry to issue more index linked savings certificates, even with a negative interest rate, as those were a perfect alternative to the non-existent short dated index linked gilt funds sector.1 -

Putting aside the way in which it was expressed, there is an important point in aroomininyork's comment. Getting a good night's sleep is more important than maximising returns. If you find that the volatility is too unsettling to ignore, reduce the volatility.ChainsawCharlie said:

And aroominyorks opening insult offended me too, I'm a newcomer to investing, and have my lifesaving invested, with no further income, uncalled for remarkGazzaBloom said:

@aroominyork sorry to derail with a sidebar but what software/platform are you using for the funds analysis shown above, it looks good and I don't recognise it?aroominyork said:You are so emotional and panicky that you need to find an index fund that meets your risk tolerance and learn to leave it alone. If there was one house I would want for actively managing mid-risk multi-asset funds it would be Royal London, but you see them as diseased. The diversified fund is about 57% equities; over the last five years it has outperformed VLS60; you mustn't be thrown by a small recent dip.

The way I and it would seem many other retired people handle the problem of volatility in our life savings is to hold a significant amount of cash or other assets that you are confident will still be there in 5-10 years time. Regard it as a separate portfolio. You know that whatever happens in the short-medium term will not disrupt your day to day life. Rely on equity only for long term inflation protection. What happens to it in the short/medim term is totally irrelevent and the occasional 30% fall in the equity portfolio can be handled with a shrug of the shoulders.3 -

masonic said:Personally, I'm getting all of my inflation linked bond exposure through wealth preservation funds at the moment, and none of that was currency hedged at the time of last checking (but a significant part is from short-dated UK index linked gilts).Interesting. I assumed CGT, as a fund with low volatility as its core mission, hedged its bonds. Are you certain they are unhedged? (Thrugelmir will be very upset I didn't know what was under the bonnet of my investments!)

The lack of that sector being why I hold Royal London Short Duration Global Index Linked Bond (which is hedged, despite its factsheet not saying so) since a large chunk of current inflation is globally rather than locally driven. Time will tell...masonic said:Such a shame NS&I isn't in a hurry to issue more index linked savings certificates, even with a negative interest rte, as those were a perfect alternative to the non-existent short dated index linked gilt funds sector.0 -

Out of interest why are you investing in 3 pretty much identical funds, are they all on different platforms?Your paying much more in fees for some of this funds which will be overlapping the Vanguard fund:Liontrust MA Passive Interm Passive S Acc OCF = 0.38%

£9,325 investedFund Fee = £35 PA

Royal London Sustainable Div C Acc OCF = 0.77%

£9,312 InvestedFund Fee = £71 PA

Vanguard Lifestrategy 60% OCF = 0.22%

£17,060 InvestedFund Fee = £37 PAIf your after a higher weighting in a specific index it would be cheaper to just invest in that index fund/ETF.It might not seem like much but these fees eat into your investments and reduce your returns by quite a lot over time, chipping away at your compound interest.From reading your posts I think you could benefit from looking into the Boglehead investment Idology, it might ease your mind.google bogleheads as I can't post links yet.This isn't financial advice but if it were me I'd consolidate everything into the Vanguard Lifestrategy 60%:Vanguard Lifestrategy 60% OCF = 0.22%

£35697 InvestedFund Fee = £78 PAThat would be £65 a year cheaper, which means you would get £65 more in accumulation each year.

0 -

A very good point, unfortunately this is the legacy I have been left with following my poor choice of an idiot IFA , who I have now sacked.Eschatologist said:Out of interest why are you investing in 3 pretty much identical funds, are they all on different platforms?Your paying much more in fees for some of this funds which will be overlapping the Vanguard fund:Liontrust MA Passive Interm Passive S Acc OCF = 0.38%

£9,325 investedFund Fee = £35 PA

Royal London Sustainable Div C Acc OCF = 0.77%

£9,312 InvestedFund Fee = £71 PA

Vanguard Lifestrategy 60% OCF = 0.22%

£17,060 InvestedFund Fee = £37 PAIf your after a higher weighting in a specific index it would be cheaper to just invest in that index fund/ETF.It might not seem like much but these fees eat into your investments and reduce your returns by quite a lot over time, chipping away at your compound interest.From reading your posts I think you could benefit from looking into the Boglehead investment Idology, it might ease your mind.google bogleheads as I can't post links yet.This isn't financial advice but if it were me I'd consolidate everything into the Vanguard Lifestrategy 60%:Vanguard Lifestrategy 60% OCF = 0.22%

£35697 InvestedFund Fee = £78 PAThat would be £65 a year cheaper, which means you would get £65 more in accumulation each year.

I would like nothing more to sell it all down and place everything into VLS , but my portfolio is currently down in value by approx £5000 and I am bothered I would crystallise the loss, but in my novice opinion maybe I wouldn't make such a loss, because if I did sell down and reinvest the proceeds back into VLS then I would also be buying at a lower price.....or is this inaccurate and too simplistic?1 -

Good point. There should be a chapter in every investment book on investing in retirement as opposed to investing for retirement and/or drawdown. If you are fortunate enough to have a guaranteed (even index-linked) retirement income, from a DB pension, annuity, state etc, that takes care of life day-to-day then one's investment goals can be quite different. Still only 3 years into retirement and another 3+ from the state pension, but I'm starting to get the hang of shoulder shrugging when the market drops!!Linton said:

The way I and it would seem many other retired people handle the problem of volatility in our life savings is to hold a significant amount of cash or other assets that you are confident will still be there in 5-10 years time. Regard it as a separate portfolio. You know that whatever happens in the short-medium term will not disrupt your day to day life. Rely on equity only for long term inflation protection. What happens to it in the short/medim term is totally irrelevent and the occasional 30% fall in the equity portfolio can be handled with a shrug of the shoulders.0 -

There should be a chapter in every investment book on investing in retirement as opposed to investing for retirement and/or drawdown.Nice thought. It invokes Bernstein’s idea of a liability matching ‘portfolio’; safe assets to address spending needs, with an ‘at risk’ portfolio for money left over.

But that aside, how should investing for and in retirement differ if one considers the essential elements of: #1 take as much risk as is appropriate for you, #2 factor in your spending horizon (or ‘duration’), have the appropriate amount of liquidity for your stage?

What’s missing, and do any not apply to investing for and in?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards