We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Guide discussion: Voluntary national insurance contributions

Comments

-

Because the reference number is to specifically pay the the years requested when getting the reference. You don't get the reference from FPC, you need to contact HMRC for that. You could always send a cheque in the post. The process is not broken and has worked fine for many years and likely will do for many years in the future. The problem is the public leaving something that was set up in 2013 until the last 3 months of the timeline.BrookMole said:I wrote to PT Operations on the 14th January this year detailing which years I wished to make up the shortfall and requesting the 18 character reference number that is needed. Two months later, I have not had reply and the letter was sent recorded delivery.

After seeing Martins program this week, I have phoned the Future Pension Centre over 20 times.

Each time after going through the recorded message pre amble and selecting the options, the call just blips and cuts off.

The process seems entirely broken - Martin, can you apply any pressure to simplify and resolve this process?

Why do we have to apply for an 18 reference digit number? why can't we just quote our NI number on the website and pay?

2 -

That is true molerat. But equally DWP, Future Pensions, HMRC et al have all had 10 years to inform us of the upcoming deadline.Via tax returns, P60s etc.But I never received anyhting from the above.I did do an online check several years ago of NI contributions (before I was aware of the deadline) to find the same message about unchecked years? If the system is aware of this, why hasn't the system followed through and updated over the years?The cynic in me would say because its not in the Government's interest to make people aware of pension shortfall in an unsustainable system.However, I and many others are very, very grateful for your enormous contribution to this matter on the forum. If only the DWP were so inclined, matters would be alot easier!Keep up the excellent work.If you're new. read The FAQ and Vauban's Guide

The alleged Ringleader.........1 -

People doing tax returns and receiving P60's aren't statistically likely to be the same ones with gaps in their NI records, however.JPears said:That is true molerat. But equally DWP, Future Pensions, HMRC et al have all had 10 years to inform us of the upcoming deadline.Via tax returns, P60s etc.

And be honest - Would you have really paid much attention if there was something printed there ? The only people likely to actually read and follow up on such messages would have been those canny enough to be aware anyhow,

I can't recall exactly where I found out about the new state pension, the ability to top up with voluntary contributions and the deadline, but the information on it has been around for years; on this board, mentioned on programs like the BBC's Moneybox and in documentation produced by Pension companies (the excellent Royal London guide on topping up your state pension, for example).

State Pension forecasts have also been available for a long while now and I've certainly seen publicity encouraging people to get them. And if you do, then it tells you quite clearly what your current and maximum forecast is, how many years you potentially still have available going forward and, if that is not sufficient, tells you if you have gaps in your record that can increase your forecast.

The information is, and has been, out there.

There really is a limit to how much you can spoon feed people to make them take an interest in such things.

If that was really the case, then the simplest way would be to no longer allow people to make voluntary contributions at all, but to insist that they either earn them via employment or qualify for them via certain benefit creditsJPears said:The cynic in me would say because its not in the Government's interest to make people aware of pension shortfall in an unsustainable system.0 -

As a newbie to this forum ( frustrated ,and almost in tears, by trying to play telephone tennis with gov depts over the last week or so ), I also would like to thank contributors for their comments. I have picked up a lot of information regarding pre and post 2016 years, COPE and problems in understanding the complexity that lies behind the necessary number of years of full years of contributions if you were contracted out at any stage of your career. I must admit I was initially lulled into complacency as I knew I had over 35 years of full contributions.

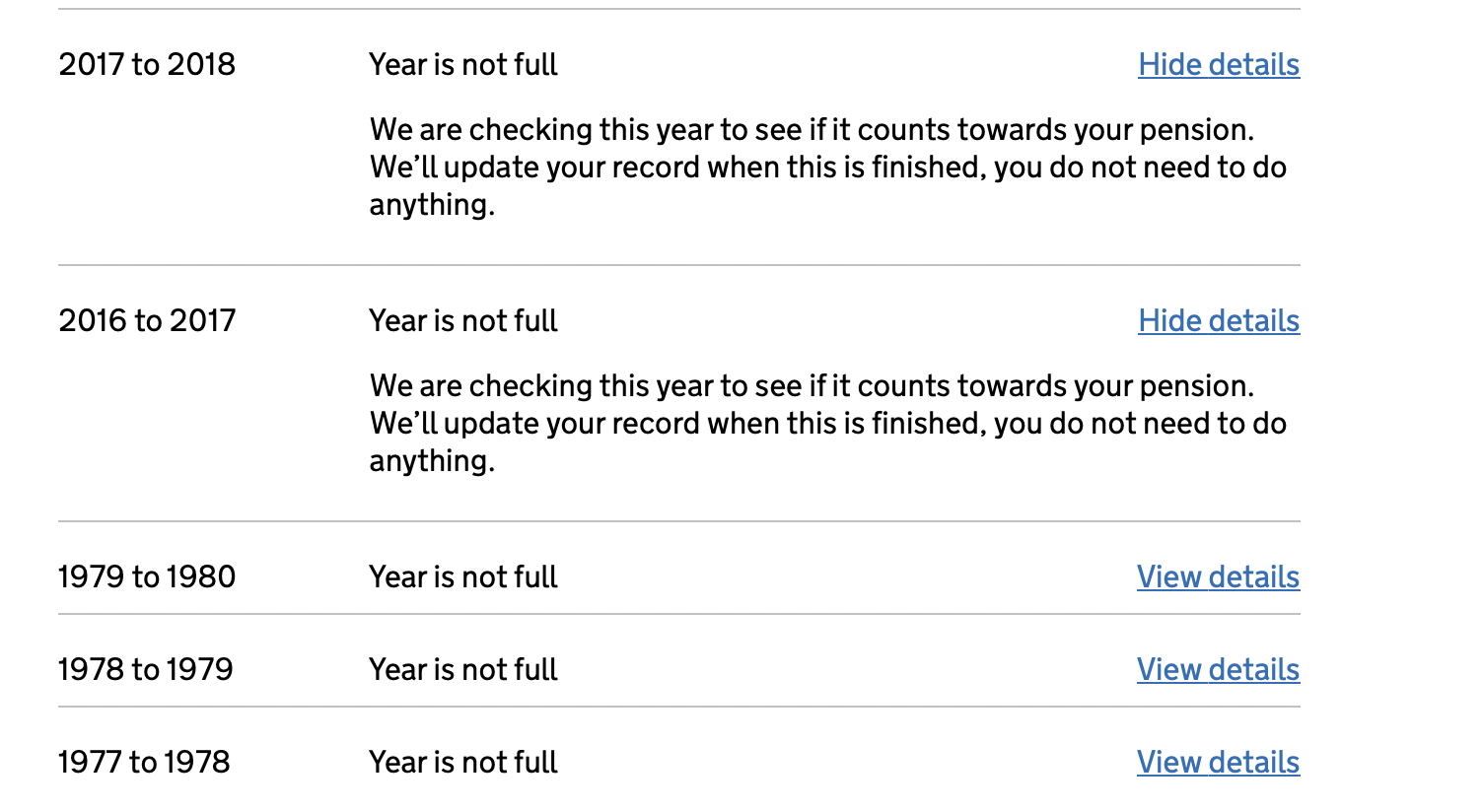

Also I agree with the previous post about messages being left unchecked or amended on the online website - especially in view of the imminent deadline for paying contributions for key years including 2016/17. The statements against my 2016/17 and 2017/18 record still state : ' We are checking this year to see if it counts towards your pension. We'll update your record when this is finished, you do not need to do anything'.

Could I ask for comments on my case please - just to make sure that I have understood everything........

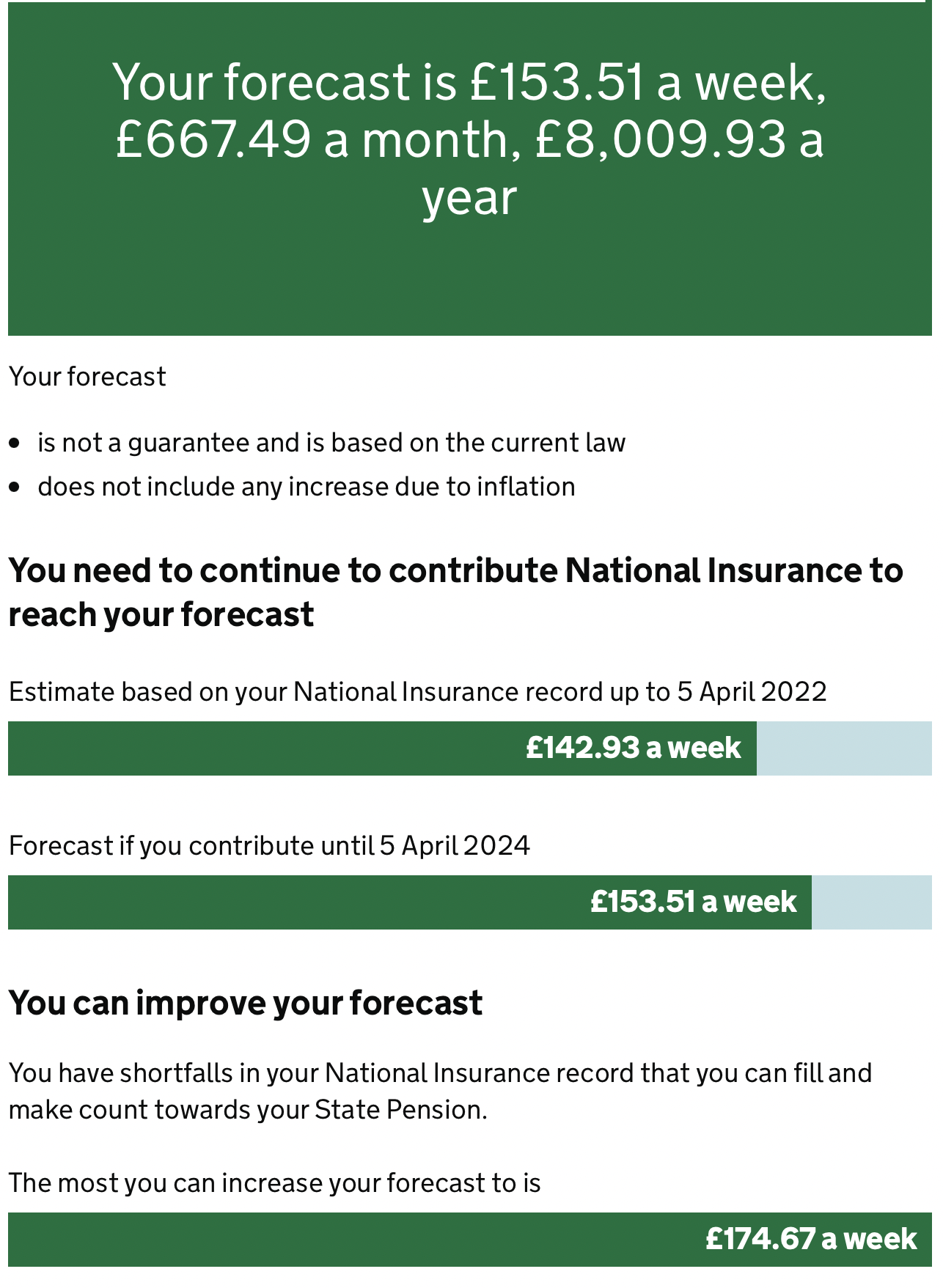

I am due to take my state pension in May 2024

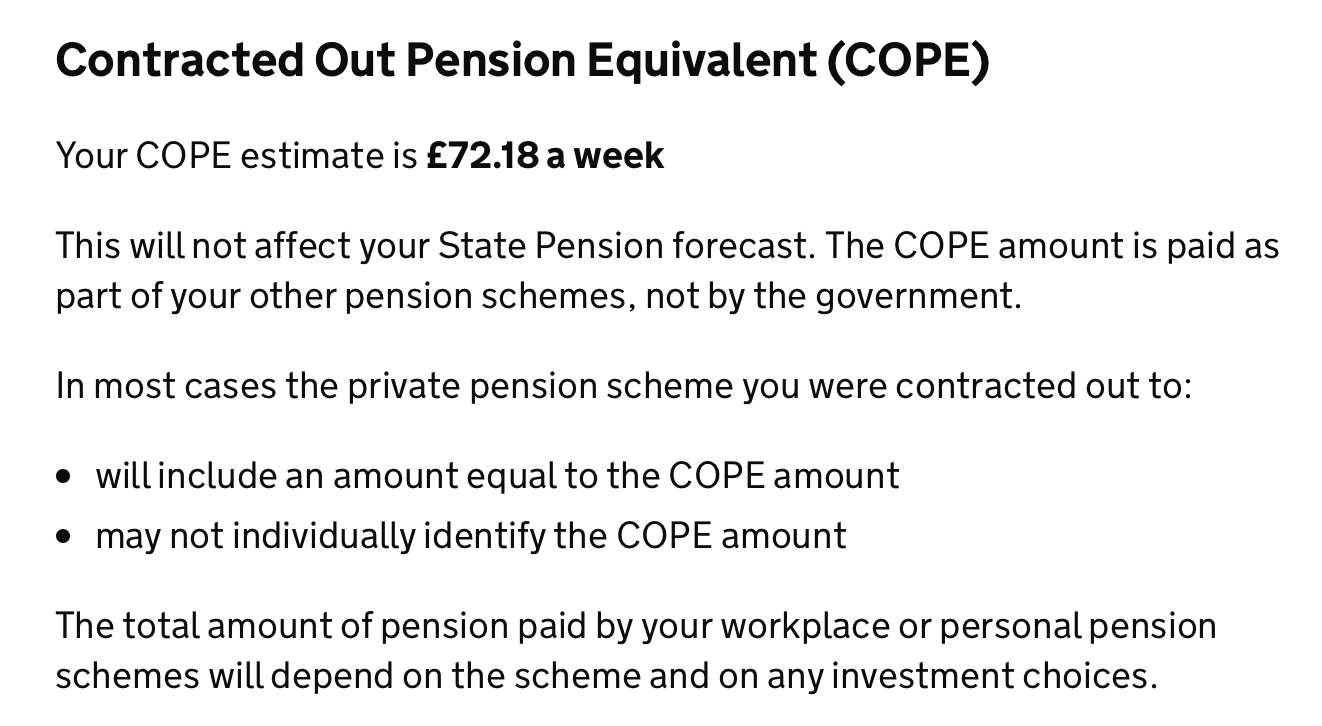

I was ' contracted out' for most of my career and have a COPE figure of £72.18

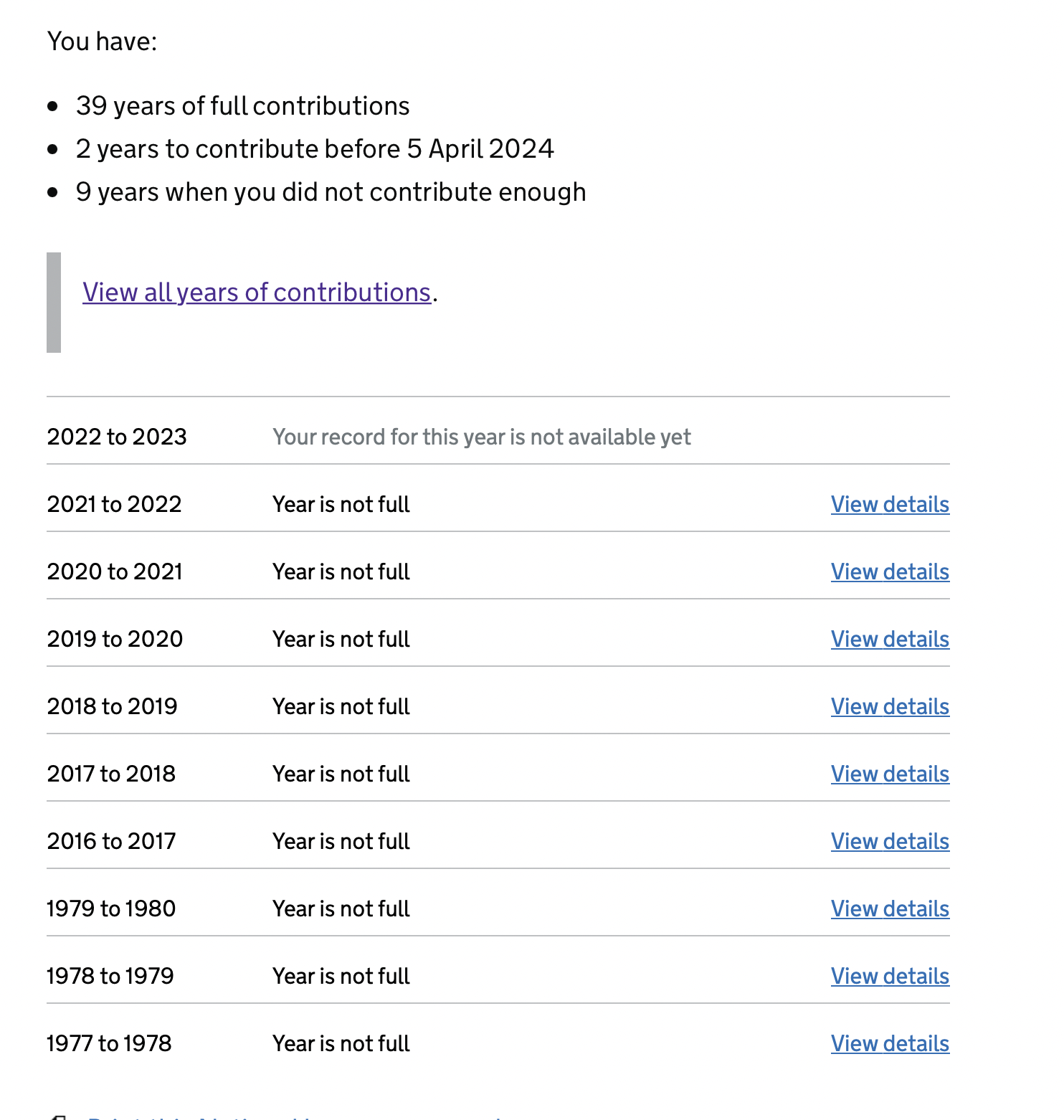

My online NI record shows that I have 39 years of full contributions

2 years to contribute before 5th April 2024

9 years when I did not contribute enough

The forecast is £ 151.51 state pension and the statement that I need to contribute NI to reach my forecast .

There is also a statement saying that the most I could increase my forecast is to £ 174.67.

I have investigated the years showing as 'not full' and attach screenshots to show the relevant information.

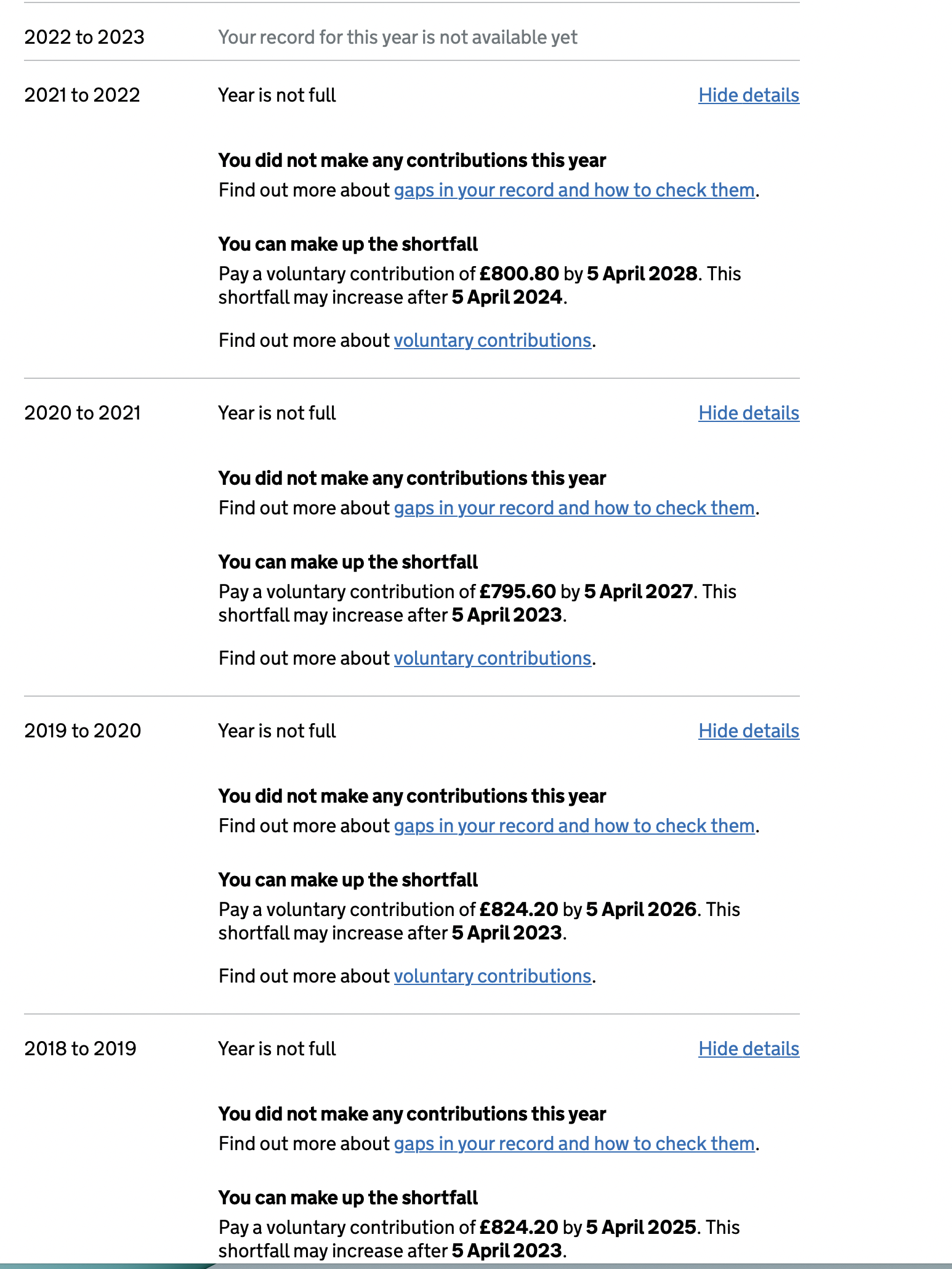

The key six years of concern are between the years 2016/17 - 2021-22

A phone call to a HMRC representative told me that there had been a problem with the system affecting my ( and presumably others' data) and the Future Pension Centre was not aware of the amounts calculated .Therefore the data was incomplete for the current forecast. The representative was able to tell me the shortfall amounts were £ 824.20 for 2016/17 ands £ 713.25 for 2017-2018 and gave me the 18 figure reference number . Therefore I now have full figures for the six missing years . The total is now £ 4782.25.

I think I will also need to pay shortfalls for 2022-23, when details become available , and also for the tax year 2023-24. I will claim my pension one month after the end of end of that tax year.

Does this sound correct ?

This equates to 47 years of full contributions in total !

I presume my NI record for the missing years will then be amended once they receive payment and that the forecast for £ 174.67 will then be updated to meet the full pension amount of £ 185.15.

I

0 -

Were you self employed (and not paying class 2) for those "checking" years, that is the usual reason. In which case class 2 may be available.You currently need another 8 years of contributions to reach the max £185.15.47 years is near the top end of what we see, generally around 42-45 seems to be the average contracted out requirement although 50 has been mentioned. Those numbers point to a very small S2P amount, around 88p, which would account for the higher number of years required.0

-

I have some NI gaps from the 80's but worked full time till my accident in 2017, I can no longer drive or travel abroad because of my disability, passport and driving license are no longer valid and I don’t receive any of the required benefits. So I can’t prove who I am to the government online and I’m having no success by phone.0

-

You won't be able to fill any gaps that far back. Only years from 2006-7 and later are currently available to buy.chris675 said:I have some NI gaps from the 80's but worked full time till my accident in 2017, I can no longer drive or travel abroad because of my disability, passport and driving license are no longer valid and I don’t receive any of the required benefits. So I can’t prove who I am to the government online and I’m having no success by phone.

Years between then and 2016-17 will cease to be available after the newly extended deadline of July this year.

If you can afford it, I'd personally recommend renewing your passport even if you have no intention of travelling abroad, as more and more things are requiring you to show photoid and it avoids a lot of hassle.

0 -

So I am 40 years old, I have 8 years of full NICs and 10 missing ones prior to these.

Should I top up all 10 missing years if I want to retire early at 50 ?

Any advice welcome. Thank you.0 -

MJP61 said:So I am 40 years old, I have 8 years of full NICs and 10 missing ones prior to these.

Should I top up all 10 missing years if I want to retire early at 50 ?

Any advice welcome. Thank you.More information needed to make any sensible commentCurrent £.pp amount accrued up to April 2022

Number of pre 2016 NI years full

Number of post 2016 NI years full

Financial year you reach state retirement

Any COPE amount shown

Years which show not full and prices

0 -

I'm not sure if OP will be able to get a meaningful State Pension as yet as they don't yet have the ten years necessary to qualify for one ?molerat said:MJP61 said:So I am 40 years old, I have 8 years of full NICs and 10 missing ones prior to these.

Should I top up all 10 missing years if I want to retire early at 50 ?

Any advice welcome. Thank you.More information needed to make any sensible commentCurrent £.pp amount accrued up to April 2022

Number of pre 2016 NI years full

Number of post 2016 NI years full

Financial year you reach state retirement

Any COPE amount shown

Years which show not full and prices0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards