We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Lifestrategy 60 or 80 ?

Comments

-

Now that base rate has reached 1%. The BOE can start to consider selling bonds it already owns in accordance with it's current QT policy.0

-

Although the short term ones did .masonic said:

The current 10 year gilt yield is 1.85%, and prices have barely moved after today's expected result.Albermarle said:My reading of the financial press is that interest rates still have some way to rise, hopefully without causing a recessionWhat I read today is that the financial markets are pricing in that BofE rate will go to 2.5%, but the expectation of negative GDP growth later this year, probably means that will be a maximum and could be less. If the market has priced this in , then hopefully means bond prices should stabilise?

LONDON (Reuters) - Short-dated British government bond prices surged on Thursday as investors judged that the Bank of England's gloomy economic growth outlook would slow the pace of interest rate rises, despite inflation being set to reach double figures.

1 -

Quite a surprising headline, and I can't see data supporting the assertion. Looking at their example of 2 year gilts, the opening and closing yield today was 1.66% to 1.62%, yesterday it went from 1.60% to 1.66%, and looking back over the previous week a day change of +/- 0.05% seems well within the noise. As for the term "surged", the current price is £98.945 and at the previous close it was £98.922, so the price has "surged" by 0.023%. Quite how a risk free asset so close to maturity and priced so close to par could "surge" is beyond me.Albermarle said:

Although the short term ones did .masonic said:

The current 10 year gilt yield is 1.85%, and prices have barely moved after today's expected result.Albermarle said:My reading of the financial press is that interest rates still have some way to rise, hopefully without causing a recessionWhat I read today is that the financial markets are pricing in that BofE rate will go to 2.5%, but the expectation of negative GDP growth later this year, probably means that will be a maximum and could be less. If the market has priced this in , then hopefully means bond prices should stabilise?

LONDON (Reuters) - Short-dated British government bond prices surged on Thursday as investors judged that the Bank of England's gloomy economic growth outlook would slow the pace of interest rate rises, despite inflation being set to reach double figures.

0 -

Looks like a bit of journalistic exaggeration . Thanks for the reality check.masonic said:

Quite a surprising headline, and I can't see data supporting the assertion. Looking at their example of 2 year gilts, the opening and closing yield today was 1.66% to 1.62%, yesterday it went from 1.60% to 1.66%, and looking back over the previous week a day change of +/- 0.05% seems well within the noise. As for the term "surged", the current price is £98.945 and at the previous close it was £98.922, so the price has "surged" by 0.023%. Quite how a risk free asset so close to maturity and priced so close to par could "surge" is beyond me.Albermarle said:

Although the short term ones did .masonic said:

The current 10 year gilt yield is 1.85%, and prices have barely moved after today's expected result.Albermarle said:My reading of the financial press is that interest rates still have some way to rise, hopefully without causing a recessionWhat I read today is that the financial markets are pricing in that BofE rate will go to 2.5%, but the expectation of negative GDP growth later this year, probably means that will be a maximum and could be less. If the market has priced this in , then hopefully means bond prices should stabilise?

LONDON (Reuters) - Short-dated British government bond prices surged on Thursday as investors judged that the Bank of England's gloomy economic growth outlook would slow the pace of interest rate rises, despite inflation being set to reach double figures.

However I think the view that increasing worries about recession/gloomy forecasts about GDP are moderating the outlook for how high interest rates will go is probably true.0 -

Yes, I think the underlying narrative around the impact of further hikes is correct, and this appears to have been discussed within the meeting. The currency markets seem to have had a more noticeable reaction, probably linked to the downgrade for GDP growth. Recession + high inflation is certainly not a good place to be.Albermarle said:

Looks like a bit of journalistic exaggeration . Thanks for the reality check.masonic said:

Quite a surprising headline, and I can't see data supporting the assertion. Looking at their example of 2 year gilts, the opening and closing yield today was 1.66% to 1.62%, yesterday it went from 1.60% to 1.66%, and looking back over the previous week a day change of +/- 0.05% seems well within the noise. As for the term "surged", the current price is £98.945 and at the previous close it was £98.922, so the price has "surged" by 0.023%. Quite how a risk free asset so close to maturity and priced so close to par could "surge" is beyond me.Albermarle said:

Although the short term ones did .masonic said:

The current 10 year gilt yield is 1.85%, and prices have barely moved after today's expected result.Albermarle said:My reading of the financial press is that interest rates still have some way to rise, hopefully without causing a recessionWhat I read today is that the financial markets are pricing in that BofE rate will go to 2.5%, but the expectation of negative GDP growth later this year, probably means that will be a maximum and could be less. If the market has priced this in , then hopefully means bond prices should stabilise?

LONDON (Reuters) - Short-dated British government bond prices surged on Thursday as investors judged that the Bank of England's gloomy economic growth outlook would slow the pace of interest rate rises, despite inflation being set to reach double figures.

However I think the view that increasing worries about recession/gloomy forecasts about GDP are moderating the outlook for how high interest rates will go is probably true.

0 -

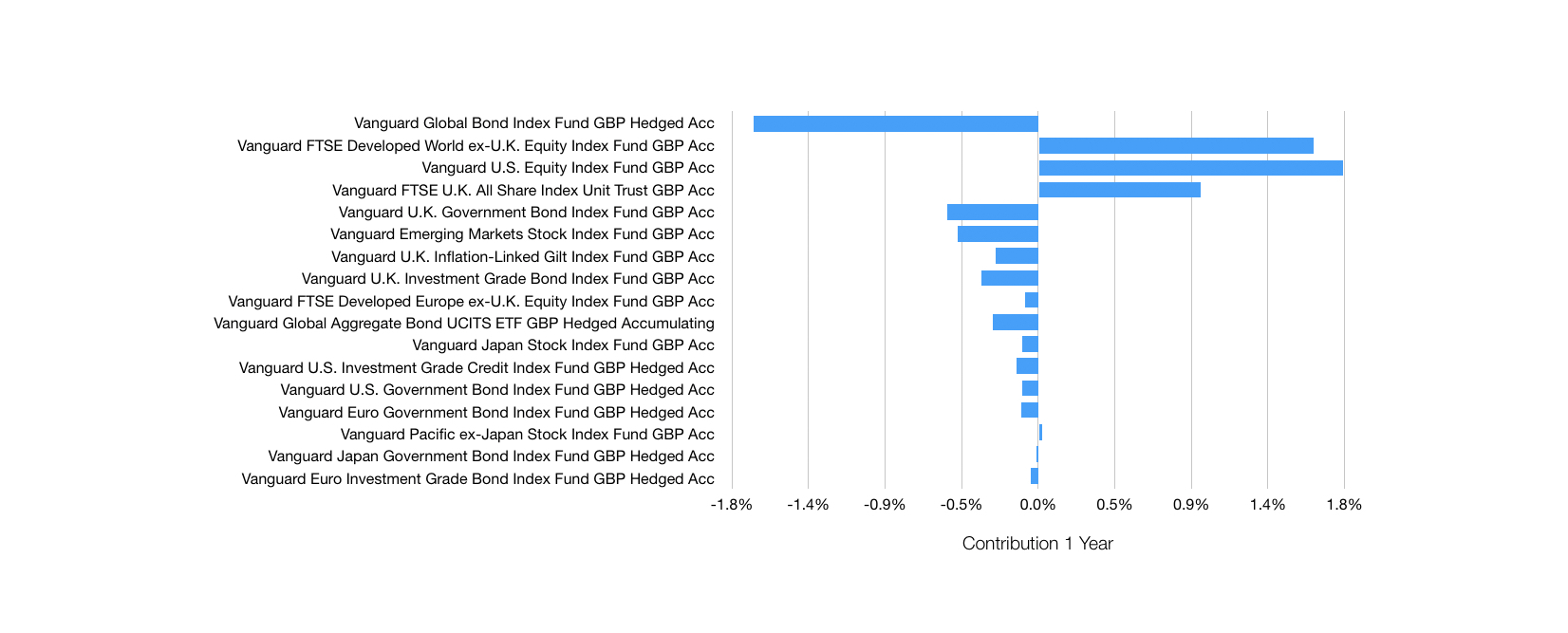

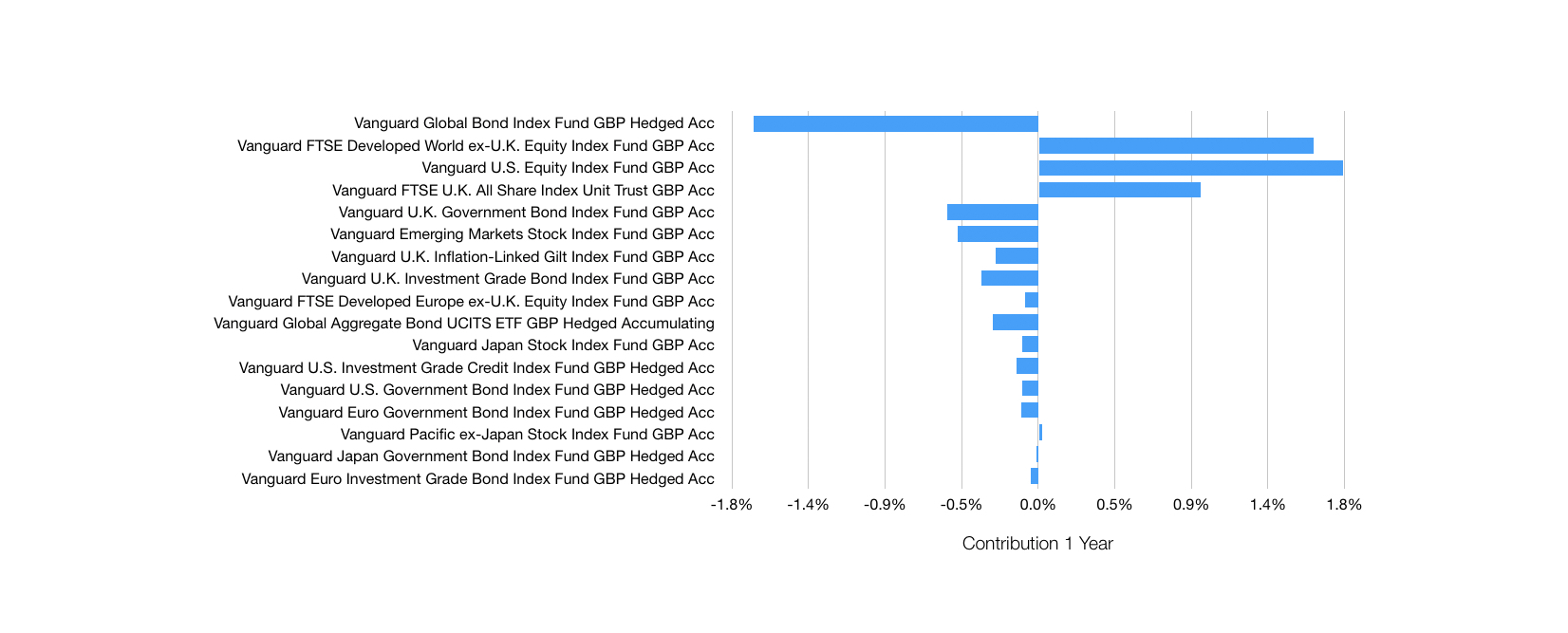

Having suggested it might not be the best use of time to delve into multi-asset funds, I had some time on my hands so did just that, out of curiosity and to see how easy it was to produce an automatically updated spreadsheet akin to a Trustnet portfolio! Easy it turns out. This is not 100% accurate, but an indication of the relative contribution of underlying funds to VLS60 performance over the past 12 months, down ca. 0.65% overall.

While the BOE seems increasingly concerned over recession and a hard landing, the Fed still sees solid growth and hopes for a possible soft landing for the US economy. Time will tell, the drivers of inflation are certainly different to anything in my lifetime, especially for Europe and the UK.1

While the BOE seems increasingly concerned over recession and a hard landing, the Fed still sees solid growth and hopes for a possible soft landing for the US economy. Time will tell, the drivers of inflation are certainly different to anything in my lifetime, especially for Europe and the UK.1 -

For the UK , maybe some positives ( to partly outweigh the obvious negatives ).Iain_For said:Having suggested it might not be the best use of time to delve into multi-asset funds, I had some time on my hands so did just that, out of curiosity and to see how easy it was to produce an automatically updated spreadsheet akin to a Trustnet portfolio! Easy it turns out. This is not 100% accurate, but an indication of the relative contribution of underlying funds to VLS60 performance over the past 12 months, down ca. 0.65% overall. While the BOE seems increasingly concerned over recession and a hard landing, the Fed still sees solid growth and hopes for a possible soft landing for the US economy. Time will tell, the drivers of inflation are certainly different to anything in my lifetime, especially for Europe and the UK.

While the BOE seems increasingly concerned over recession and a hard landing, the Fed still sees solid growth and hopes for a possible soft landing for the US economy. Time will tell, the drivers of inflation are certainly different to anything in my lifetime, especially for Europe and the UK.

Until recently there was high demand in the economy, notably in the housing market . Buying and selling but also higher demand for home improvements . Clearly this will dampen down, but relatively well off people amassed a huge amount of savings in lockdown, and there is still suppressed demand in this area, due to skill and raw material shortages.

Also unemployment remains low historically, and there are severe staff shortages in some areas. This is not usual in a recessionary environment.0 -

hi all,

thanks for all the comments, very interesting read and insights.

several have asked about my risk tolerance.

for my SIPP i went for LS80 because i know i am not going to need that money for a very long time (and can't access it). i also have an active multi assett fund (BG managed) which focuses on growth. it has underperformed in the last year but again not too concerned due to long term horizon.

however, as for my ISA.... when will i need that money? the honest answer is i don't know.

it could be 5 years or it could be 20 years. it just depends what my circumstances are at any moment (for example if i want a house deposit, or if i ever have kids etc).

i see that bizarrely the more equity you have in a chosen LS fund, the less it has fallen over the last 12 months - as pointed out above it is the bonds that have dragged performance. but clearly when equities underperform then the drops would be even steeper.

in terms of risk profile of the LS funds... on the KID - LS60 has a risk profile of 4, LS80 is also 4, and LS100 is 5.

i will have a good think what to do.0 -

Bonds will react instanteously to changes in Central Bank policy. Equities, generally, are more dependent upon the trading financial performance of the companies themselves and the nature of the debt that's sitting on the balance sheet. Impact of interst rate changes as a consequence take time to filter through and for analysts/investors to digest on a case by case basis. Like people with fixed term mortgages. The hit is going to come months/years down the line. When the facility comes up for review.eastmidsaver said:hi all,

thanks for all the comments, very interesting read and insights.

several have asked about my risk tolerance.

for my SIPP i went for LS80 because i know i am not going to need that money for a very long time (and can't access it). i also have an active multi assett fund (BG managed) which focuses on growth. it has underperformed in the last year but again not too concerned due to long term horizon.

however, as for my ISA.... when will i need that money? the honest answer is i don't know.

it could be 5 years or it could be 20 years. it just depends what my circumstances are at any moment (for example if i want a house deposit, or if i ever have kids etc).

i see that bizarrely the more equity you have in a chosen LS fund, the less it has fallen over the last 12 months - as pointed out above it is the bonds that have dragged performance. but clearly when equities underperform then the drops would be even steeper.

in terms of risk profile of the LS funds... on the KID - LS60 has a risk profile of 4, LS80 is also 4, and LS100 is 5.

i will have a good think what to do.2 -

Specifically, it is the average duration of the bond funds (ca. 9-9.5 years), and critically their interest rate sensitivity, making up the LS range that have impacted their performance. Just over 60% of the bond funds in LS60 have average durations between 7.5 and 21 years. If you contrast LS60 with a very similar DIY 60/40 portfolio but with an average duration for its bond component of 5 years, you can see the difference. Actively managed multi-asset funds such as A J Bell’s balanced have even shorter durations for their bond component and it shows over the past 6 months. As is often said, it’s worth checking out Lars Kroijer’s videos in which he emphasises the importance of matching bond duration to investment timeframe.eastmidsaver said:i see that bizarrely the more equity you have in a chosen LS fund, the less it has fallen over the last 12 months - as pointed out above it is the bonds that have dragged performance. but clearly when equities underperform then the drops would be even steeper. 1

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards