We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Personal Savings Allowance

Comments

-

So, is HMG/HMRC wrong about the 0% tax on £5,000 Starting Rate for savings?

"You may also get up to £5,000 of interest and not have to pay tax on it. This is your starting rate for savings.

The more you earn from other income (for example your wages or pension), the less your starting rate for savings will be" (website: gov.uk/apply-tax-free-interest-on-savings)

Google it as I'm prevented from using hyperlinks

Same website states (copied direct from it):

"Personal Savings AllowanceYou may also get up to £1,000 of interest and not have to pay tax on it, depending on which Income Tax Band you’re in. This is your Personal Savings Allowance."

(my NB: £1,000 is for Basic Rate 20% Payers)I earn less than £18,570 so both £5k Savings Starting Rate and Personal Savings Allowance apply.

See also moneysavingexpert website Tax-free savings & the starting savings rate. You'll have to copy/paste and Google it as my attempt to use hyperlinks is preventing publishing this0 -

Sorry, Wasn't meant to appear so bold, seems copying from web link caused this0

-

You may be able to use all three of these,

Personal AllowanceSavings starter rate (0%)

Savings nil rate (0%)

But the amount of each one depends on your overall tax position.

Unless a high earner or you have applied for Marriage Allowance the Personal Allowance will be £12,570 and that is used first.

The savings starter rate is reduced to zero for a lot of people as a result of their earnings being £5,000 more than their Personal Allowance.

This might be a more helpful guide.

https://www.litrg.org.uk/tax-guides/tax-basics/what-tax-rates-apply-me#toc-how-does-the-starting-rate-for-savings-work-0 -

Thanks, although I do fully understand how these allowances work for my situation. I need to reiterate what I originally said, that HMRC is not allowing them when they are valid, as in my case for both of them.

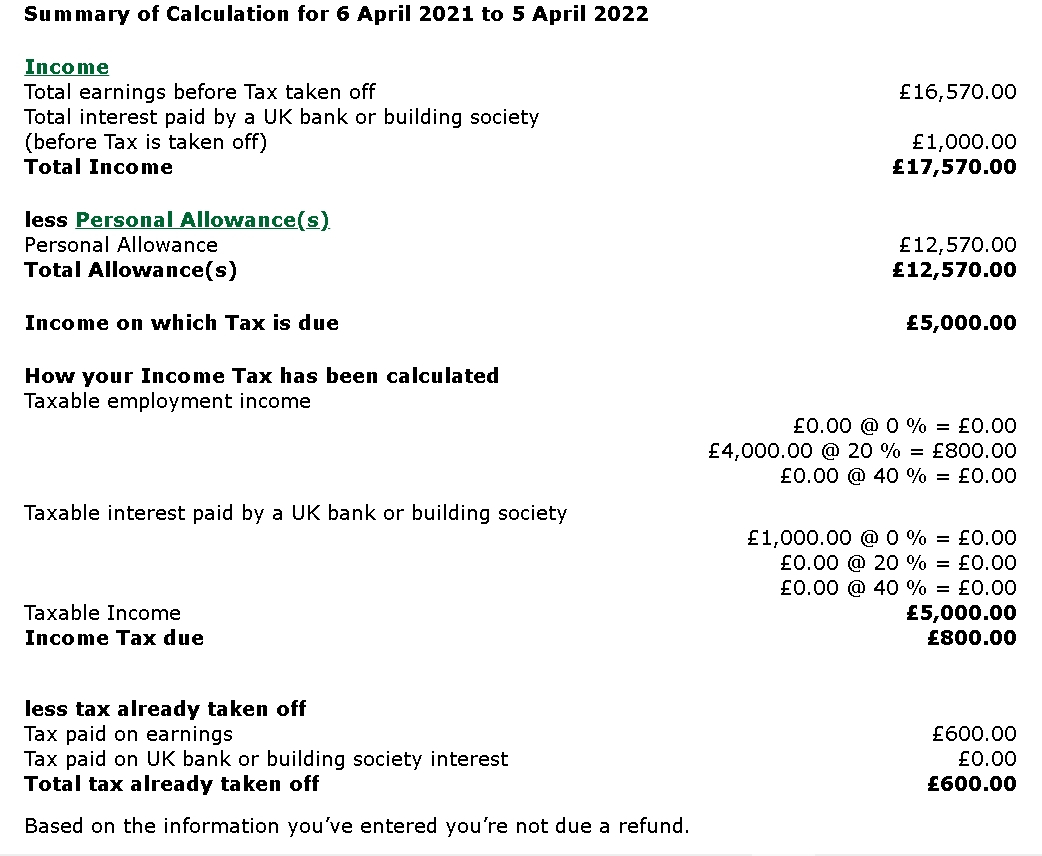

Their official means calculating tax is found here stccalculator.hmrc.gov.uk/UserDetails.aspx and if you use figures that do qualify (I suggest £16570 total before tax, total tax paid £600, total interest paid Bank etc £1000, total tax paid on that £0, interest not taxed £0, Gift Aid £0)

Press "Calculate" then press "Show summary of calculation"

You'll see that while the tax paid (via PAYE) is correct at £600, the calculation Income Tax Due is £800.

I shall be interested in your comments!

Having tried yet again to use a hyperlink am getting blocked with message "You have to be around a little longer to post hyperlinks" whatever that means, so use http etc then copy stc...etc above.

I also attach an image of this result if unable to access the HMRC calculator

0 -

Why do you think £600 is correct?

You have £4,000 of earnings above your Personal Allowance, which need to be taxed at 20%.

£4,000 x 20% = £800. Not £6000 -

Because earnings above PA have a £5000 Starting Savings Rate Allowance at 0% in addition to ther £12570 Personal Allowance, as well as a £1000 Personal Savings Allowance.

Check MSE advice - moneysavingexpert.com/savings/tax-free-savings/

Check Which - which.co.uk/money/tax/income-tax/income-tax-on-savings-and-investments/tax-on-savings-a4gts3t6h06x

Check moneytothemasses.com/tax/income-tax-2/what-is-the-personal-savings-allowance-and-how-you-can-boost-it-by-5000

They can't all be wrong - or have I got it all wrong?

(You can copy/paste these links to hyperlink)0 -

There is no £5,000 rate band for earnings.

It is just for interest.0 -

According to Martin Lewis: “You earn between £12,570 and £17,570. This is where it gets a little complicated. To find your combined tax-free allowance, subtract your annual income (excluding anything you earn from savings) from £18,570. So if you earn £13,570/yr, you could then get a further £5,000 in savings interest and pay no tax (though any amount above this would be taxable – done so through your tax code).”

Following his example, for me: Subtract £16,570 income excluding savings interest from £18,570 = £2,000, meaning I could earn up to £2,000 in savings interest and pay no tax on it. HMRC calculation arrives at my owing £200 tax on half that amount of £1,000!

Perhaps you should take it up with him as a case of severe misinformation.

0 -

In your example you only have £1,000 of interest, not £2,000.0

-

Have you read the HMRC tax calculation stating £200 tax is due on £1000 of interest, when Mr Lewis clearly states I could earn £2000 of interest without tax?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards