We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

We're aware that some users are experiencing technical issues which the team are working to resolve. See the Community Noticeboard for more info. Thank you for your patience.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

How many people actually get to the LTA?

Options

Comments

-

My thinking is the tax breaks(especially 40 %), ss, etc allow people to use their pensions as a vehicle to pass on inheritance. Seems odd the taxman allows it. Im not sure why higher rate tax payers need the extra incentive to save.EdSwippet said:

I'm unsure what thinking lies behind this question, but it certainly seems clear from the LTA freeze for half a decade that the government would very much like this number to be considerably larger than 2%.Kim1965 said:If only 2 %of people have a pot equal to lta, does this make the freeze on lta seem more reasonable??

Could argue the gov would be better giving basic rate taxpayers extra incentives to save. Basic rate tax payers are more likely to be state reliant, pension credits, houding benefit. Or is my thinking flawed??4 -

Think Andrew beat me to it0

-

I think you are mixing up three issues a little.Kim1965 said:

My thinking is the tax breaks(especially 40 %), ss, etc allow people to use their pensions as a vehicle to pass on inheritance. Seems odd the taxman allows it. Im not sure why higher rate tax payers need the extra incentive to save.EdSwippet said:

I'm unsure what thinking lies behind this question, but it certainly seems clear from the LTA freeze for half a decade that the government would very much like this number to be considerably larger than 2%.Kim1965 said:If only 2 %of people have a pot equal to lta, does this make the freeze on lta seem more reasonable??

Could argue the gov would be better giving basic rate taxpayers extra incentives to save. Basic rate tax payers are more likely to be state reliant, pension credits, houding benefit. Or is my thinking flawed??

The LTA is there to stop/limit people benefitting too much from the generous tax relief on pension contributions , especially higher rate relief. In the past high earners would max out pension contributions and LTA effectively limits how much you can do this , along with the £40K annual allowance. It is a bit of a blunt and complicated instrument though.

The inheritance tax issue is tied to the fact that pensions are kept in trust , so is a completely different legal minefield.

Ideas are regularly put forward , especially around budget time that 40% tax relief should be reduced, and maybe 20% increased . It is a political issue and some of the ideas would complicate the tax system even more.

In many cases poorer people are better off without a pension , as it reduces their claim for benefits , so the pensions argument becomes part of a wider discussion about benefits etc

Why do the self employed tend undrrfund their pensions?

Most do not underfund but never actually start one .

Lack of trust /understanding

Not semi forced into it via auto enrolment

No employer contributions so the advantage of pensions is reduced

Tradespeople can do better at BTL etc as they can have some direct low cost input.0 -

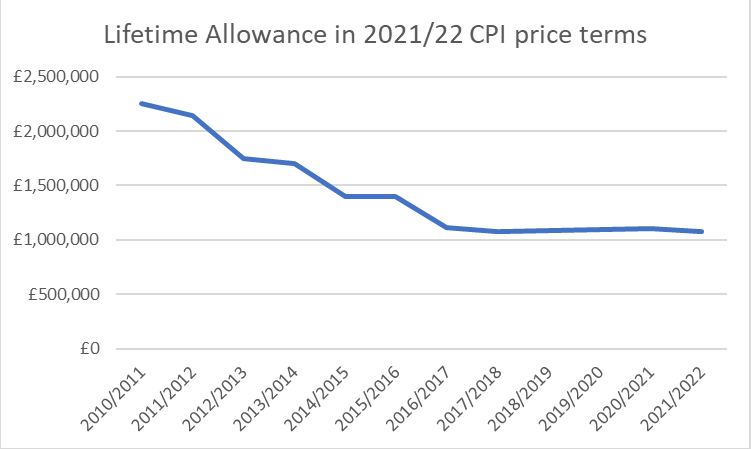

I think a major issue with the Lifetime Allowance is that as it refers to saving over a lifetime it should be stable and predictable. As the chart below shows, it has been more than halved in real terms over the last 12 years, with a further unknown but significant real terms reduction over the coming 5 years depending on the level of inflation.

If you extrapolate the trend, vast numbers would be affected relatively soon in the future. That seems unlikely, but then you are into guessing games about future political decisions, and that is not a good basis for financial planning.Or perhaps large numbers will start to be routinely affected, just like once upon a time very few were affected by higher rate income tax but now that is commonplace.Currently at age 44 I am using 80% of my Lifetime Allowance assuming I took my DB pension at NPA (60). I can reduce this to 68% by taking my DB pension early at 55. If future inflation averages 3% and my DC pension grows by 4% p/a, I will reach the current Lifetime Allowance even taking my DB pension at age 55 and making no further contributions. That all makes pension contributions a guessing game, based on the whims of future Chancellors and it seems such a serious matter as the political framework of pension saving incentives should have more stability.3

If you extrapolate the trend, vast numbers would be affected relatively soon in the future. That seems unlikely, but then you are into guessing games about future political decisions, and that is not a good basis for financial planning.Or perhaps large numbers will start to be routinely affected, just like once upon a time very few were affected by higher rate income tax but now that is commonplace.Currently at age 44 I am using 80% of my Lifetime Allowance assuming I took my DB pension at NPA (60). I can reduce this to 68% by taking my DB pension early at 55. If future inflation averages 3% and my DC pension grows by 4% p/a, I will reach the current Lifetime Allowance even taking my DB pension at age 55 and making no further contributions. That all makes pension contributions a guessing game, based on the whims of future Chancellors and it seems such a serious matter as the political framework of pension saving incentives should have more stability.3 -

Poorer renters are more likely to be disadvantaged by having a small pension on top of sp.

I think the self employed generally feel a lack of wage security committing to pension payments. Personally ive only ever paid £200 pm on a dd, I have however manually paid whatever is left after paying my set monthly wage and materials.

0 -

Quite the opposite IMO.Kim1965 said:If only 2 %of people have a pot equal to lta, does this make the freeze on lta seem more reasonable??

If the LTA is set at a level that only impacts the "richest" 2% then that can be honestly stated as a tax on the elite and not affecting "ordinary" masses. (It is more complex than that because the wealthier members of society will divert pension investment elsewhere once it becomes apparent that LTA may be reached.)

However, a tax on the "richest" ceases to be that if the threshold is frozen and eroded by inflation - it ends up being a tax on the majority. Same as the £40k punitive VED. Same as removal of the personal allowance above £100k. No great fuss at their introduction because the perception was that the taxes only affected the "rich". Then, the levels are fixed and soon they will affect the majority.1 -

If you are a government, and your aim is to reduce the attraction of pensions to 40% taxpayers, then you would reduce the annual allowance. Or, if you aim to end IHT avoidance through pensions, you would somehow (not easy) change the laws around this.Kim1965 said:

My thinking is the tax breaks(especially 40 %), ss, etc allow people to use their pensions as a vehicle to pass on inheritance. Seems odd the taxman allows it. Im not sure why higher rate tax payers need the extra incentive to save.EdSwippet said:

I'm unsure what thinking lies behind this question, but it certainly seems clear from the LTA freeze for half a decade that the government would very much like this number to be considerably larger than 2%.Kim1965 said:If only 2 %of people have a pot equal to lta, does this make the freeze on lta seem more reasonable??

Could argue the gov would be better giving basic rate taxpayers extra incentives to save. Basic rate tax payers are more likely to be state reliant, pension credits, houding benefit. Or is my thinking flawed??

If however you are a government, and your aim is to create a stealth tax trap that punitively taxes efficient investment selection, above-inflation performance, and decent pension husbandry, retroactively turns past good decisions regarding pension contributions into arguably bad ones, and pushes some experienced people to simply retire earlier than otherwise planned in order to avoid it, then freezing or reducing the lifetime allowance is indeed the way forwards.

1 -

I accept that it works against certain proffessions like doctors in db schemes for example.

As a point, I would have thought that tax breaks for pensions should be for retirement not inheritance.

I would also think a flat rate incentive would also be fairer a 30 % rate would benefit lower paid savers.

Also salary sacrifice, as i understand allows a person to avoid /divert national insurance into pension funds. Many do not have access to ss, seems unfair.

I have no idea how such changes could be implemented, but it will be interesting to see what happens after a change if government.0 -

The fairness or otherwise of a tax rule - whether it's child benefit and HRB earner in household, LTA (as repeatedly cut) for DC, DB or hybrid - is not changed by how few or how many people are affected. It's fair or it's not. We can agree that the political salience to do anything to reform or fix such a thing absolutely is impacted.

If only a few are touched then there are no votes in tidying up a broken tax rule of which LTA is one.

Perhaps it is best to look at the fairness concepts used by government for this around consultations. The relevant two ideas are horizontal fairness (the idea that people with the same income/wealth/gain are treated basically the same). LTA fails this test in a number of ways.

The other concept is vertical fairness - nature and linearity of progressive taxation. Benefits clawback being a problem area for this much discussed around the planned if botched simplification for Universal Credit. Higher rate tax relief on pensions also being in its way a violation of vertical fairness.

A flatter tax, with a fixed but higher annual allowance, indexed, and stable as an assumption over decades - the timescale for pension would be a better system.

As others have stated - it is non-trivial to get from here to a better and simpler system without a stable political consensus for long term reform

3 -

Just like to say, im planning to do what most of folk on this forum will do. Build up a decent dc fund, and pass it onto my kids. The fact that i could do this and not be slapped by some tax bill amazes me.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351K Banking & Borrowing

- 253.1K Reduce Debt & Boost Income

- 453.6K Spending & Discounts

- 244K Work, Benefits & Business

- 598.9K Mortgages, Homes & Bills

- 176.9K Life & Family

- 257.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards