We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Switching banks to Santander?

savvymum1

Posts: 37 Forumite

Hi,

Currently with Nationwide have never benifited from them. Thinking of switching to Santander 123 lite or the ordinary account. Both have the retail rewards but only the 123 lite has the bill Cashback. Is the £2 fee worth it in your opinion or should I keep to the ordinary account with no fees but still has the retail rewards? Thank you for your help!

Currently with Nationwide have never benifited from them. Thinking of switching to Santander 123 lite or the ordinary account. Both have the retail rewards but only the 123 lite has the bill Cashback. Is the £2 fee worth it in your opinion or should I keep to the ordinary account with no fees but still has the retail rewards? Thank you for your help!

0

Comments

-

https://www.santander.co.uk/personal/current-accounts/123-lite-current-account

There's a calculator which you can use to see the amount of cashback you'd earn based on your bills. If you make a profit after the monthly fee (ie. >£2/month cashback) then it's probably worth it. The retail rewards are nothing special - nothing that you can't also get from the likes of Top Cashback and/or Quidco IMO.

If you're just after the switch incentive, then I'd suggest opening a second current account at Nationwide and switching that instead into a Santander Everyday account - once the incentive is paid you could then switch that Santander account back into your main Nationwide account to take advantage of the current Nationwide incentive as well.0 -

I wouldn't recommend that you switch to Santander - it has very poor customer service and I know that from my own experience..savvymum1 said:Hi,

Currently with Nationwide have never benifited from them. Thinking of switching to Santander 123 lite or the ordinary account. Both have the retail rewards but only the 123 lite has the bill Cashback. Is the £2 fee worth it in your opinion or should I keep to the ordinary account with no fees but still has the retail rewards? Thank you for your help!0 -

I have been with Santander since 2011 and don't have a single complaint about them. I made literally thousands in those 10 years from Santander interest, cashback and multiple switch offers. I very rarely need to speak to them, or visit a Branch, as I find I can do everything online or in the app.[Deleted User] said:

I wouldn't recommend that you switch to Santander - it has very poor customer service and I know that from my own experience..savvymum1 said:Hi,

Currently with Nationwide have never benifited from them. Thinking of switching to Santander 123 lite or the ordinary account. Both have the retail rewards but only the 123 lite has the bill Cashback. Is the £2 fee worth it in your opinion or should I keep to the ordinary account with no fees but still has the retail rewards? Thank you for your help!

@savvymum1: you don't have to switch your main account. It's easy enough to open a second current account at Nationwide and then switch that one. If you kept your Nationwide account, you would have to move your DDs and SOs manually - which isn't difficult to do. If you need extra DDs, just set up a couple of small ones to charities, and cancel them once you have had the switch bonus.

Switching your main account away from Nationwide would mean you have lost an account of many years from your credit reference files. This could be a negative factor if you need a larger credit facility (mortgage, loan, credit card) in the next few years as lenders look at your ability to manage a credit account (which a current account is) over a longer period of time.

Also, I don't understand why you never benefitted from Nationwide. They often have superb offers - e.g. the FlexDirect interest for 12 months, a 2.5% Flex Regular Saver, and you are entered into a monthly prize draw. You don't get any of this from Santander. Whether the Santander DD cashback is worth it depends entirely on the size of your DDs - see above for the calculator.0 -

Why not I’ve been with them for 12 years and not had a problem with them and I’ve received quite a lot of cashback and interest from them over the years.[Deleted User] said:

I wouldn't recommend that you switch to Santander - it has very poor customer service and I know that from my own experience..savvymum1 said:Hi,

Currently with Nationwide have never benifited from them. Thinking of switching to Santander 123 lite or the ordinary account. Both have the retail rewards but only the 123 lite has the bill Cashback. Is the £2 fee worth it in your opinion or should I keep to the ordinary account with no fees but still has the retail rewards? Thank you for your help!The 2 times I’ve ever had cause to speak to customer services over they years they have been efficient and dealt with it quickly.Time is a path from the past to the future and back again. The present is the crossroads of both. :cool:0 -

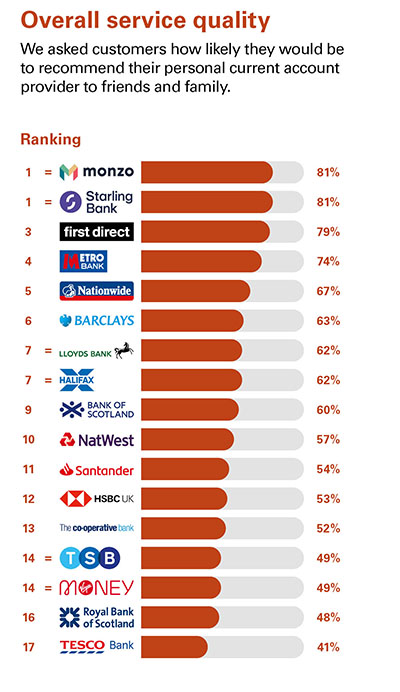

Individual opinions about customer service, while usually valid in themselves, are inevitably subjective, so anyone looking to select a bank based on views about service quality would probably do better to review data that's as objective as possible, such as the bi-annual 'official' survey commissioned by the CMA, questioning over 17,000 people in a reasonably scientific way - in the most recent survey, Santander are far from the best but also far from the worst....

4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards