We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Fixed Interest Savings Discussion Area

Comments

-

How does one buy gilts?

0 -

Zopa just brought out top of table 3, 4, and 5 year fixed terms (4.11, 4.12, 4.15% respectively) - and then SmartSave have topped their 5 year rate by 0.01% (4.16%).

Edit: Also same thing on 2 year as well by the looks of it (4.01% then SmartSave increased theirs to 4.02%!).

Hope they are reviewing their easy access/boosted pot rates as well 1

1 -

Suddenly all of the long term rates available look paltry in the context of today's events. Bond yields have risen even more since this afternoon. I think we'll be seeing some extraordinary rises over the next few months.0

-

Yes I wouldn't fix either until there's some signs of stabilisation in rates (which there definitely aren't at the moment).1

-

Won't long-term rates decrease a bit once rates become stable/look like they're about to fall?t1redmonkey said:Yes I wouldn't fix either until there's some signs of stabilisation in rates (which there definitely aren't at the moment).

0 -

You need a stockbroker that offers them e.g., AJ Bell, Hargreaves Lansdown.Oasis1 said:How does one buy gilts?

You can find them listed on the DMO website and also on the LSE's. They all have stockmarket tickers and the maturity date is usually in it so e.g., TR25 matures in 2025 and if you enter that into HL's or the LSE's website you'll find the quotes page.

If you don't already know you should try to educate yourself on bond basics, like understanding yield to maturity.

https://www.dmo.gov.uk/data/pdfdatareport?reportCode=D1A

https://www.hl.co.uk/shares/shares-search-results/t/treasury-5-07032025-gilt

2 -

Well yes, but you'd have an idea of when that would happen by following business/economic news.Oasis1 said:

Won't long-term rates decrease a bit once rates become stable/look like they're about to fall?t1redmonkey said:Yes I wouldn't fix either until there's some signs of stabilisation in rates (which there definitely aren't at the moment).0 -

Investec 4.25% 2 year fixed via Raisin

3 -

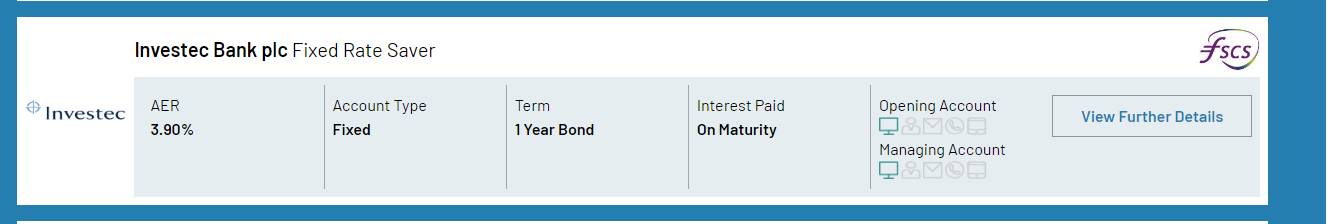

3.9% 1 year from Investec

5

5 -

Good stuff, looks like they're already moving on implied market rates. Not surprising, as there's probably some good money to be made for them even at market leading rates at the moment with how fast the landscape has changed.

FWIW, I quite like Investec since they've overhauled their website, much better to use.

Though >4% on a 1 year fix by the end of the week? I wouldn't be surprised.

Remember what feels about 10 minutes ago when the rather sketchy Union bank of India released that 'needlessly high' rate of 3.2% for a 1 year fix? Things change fast!1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards