We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Fixed Interest Savings Discussion Area

Comments

-

1

-

Band7 said:

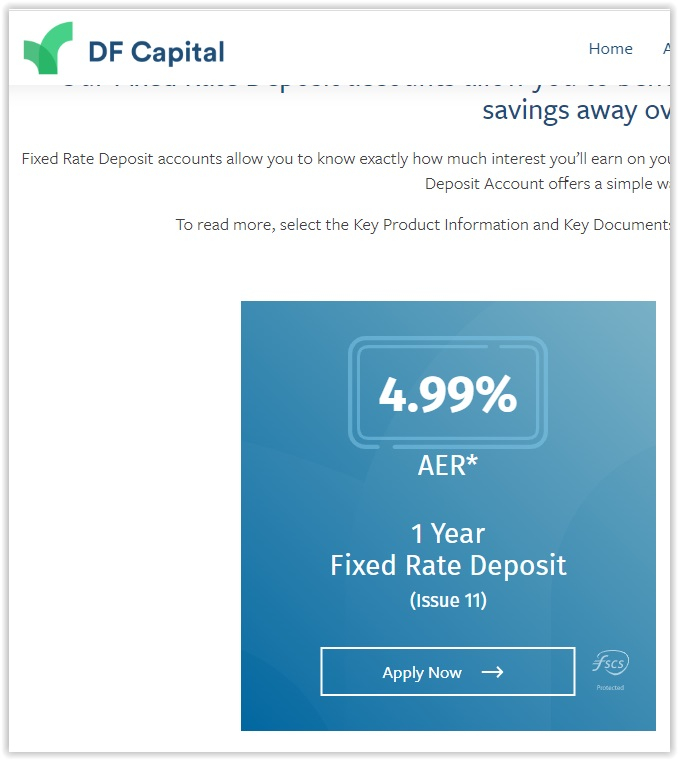

This is so weird, on my laptop I can only see 1 year issue 10 @ 4.90%

On my phone I can see 1 year issue 11 @ 4.99%

I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.0 -

Have you been on DF Capital's site before ? I've found on certain banking sites that you have to refresh the page if you've visited it before, otherwise you'll just see the cached page from your last visit.trickydicky14 said:This is so weird, on my laptop I can only see 1 year issue 10 @ 4.90%

On my phone I can see 1 year issue 11 @ 4.99%2 -

Gatehouse 1y, 18m, 2y all up to 4.90% AER... the longer terms remain at 4.52% AER2

-

Afternoon all

I have read the above comments re possible future of interest rates, after seeing the outcome of Wednesday’s inflation figures, and have opened a couple of higher interest 1 year fixed accounts, ALLICA at 5% and DF’s at 4.99%. I have already funded ALLICA with £30k as no other rates matched 5% but am now wondering whether to put another £30k into this, before my funding time is up in a couple of days or does anyone think that rates may still increase in the near future?

I do have lots of cash waiting in my 3.65% easy access (not too worried for the short term as this is a bonus compared to the 1-1.5% we were getting for fixed rates last year!). I also have another fixed bond maturing early June so I could do with finalising and putting this cash away securely for the next year.

I know no one has a crystal ball but what are people’s thoughts on whether we have peaked with interest rates on savings or is there room for more increases?0 -

A wild guess says the official UK inflation print will fall tomorrow to 7-9% (from 10-11%) and this will catalyze a fall in savings rates by perhaps 0.1-0.5%.

Rising inflation = rising savings rates.

Falling inflation = falling savings rates.0 -

I think the lower end of 7% is optimistic - you can see how the headline CPI has moved, month by month over the past year, here: Consumer price inflation, UK - Office for National StatisticsMillyonare said:A wild guess says the official UK inflation print will fall tomorrow to 7-9% (from 10-11%) and this will catalyze a fall in savings rates by perhaps 0.1-0.5%.

Rising inflation = rising savings rates.

Falling inflation = falling savings rates.

If the index were static, ie the same for April 2023 as March 2023, that'd be 128.9, which is 7.4% above the April 2022 120.0 figure. While wholesale fuel prices may now be falling, the consumer petrol price hardly has, and it doesn't feel like anything else has for consumers yet - I'd say it'll be still over 8%, since I think some things are still increasing.2 -

I think that is the general consensus of opinion but I sure hope that we consumers see such a decrease in the cost of our energy, fuel and food prices, in the near future! Then I can believe that the BofE and bankers know what they are talking about!

0 -

Latest food inflation is 17.1%, down 0.1% from April. This is not good for CPI. Or for those of us who eat…….2

-

The IMF has said today that they expect the UK to avoid recession in 2023 with inflation remaining "stubbornly high", requiring interest rates to stay higher for longer. They're also predicting inflation won't return to 2% until mid-2025. It's a prediction, not a guarantee, but it suggests there's still some uncertainty out there about not only the extent of inflation, but also the longevity.Millyonare said:A wild guess says the official UK inflation print will fall tomorrow to 7-9% (from 10-11%) and this will catalyze a fall in savings rates by perhaps 0.1-0.5%.

Rising inflation = rising savings rates.

Falling inflation = falling savings rates.

3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards