We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Time to remortgage - Some advice?

Options

mickym

Posts: 457 Forumite

Hi,

Our 10 year fixed rate mortgage with YBS ended at the end of last year. Our fixed interest rate rate from 2011 to 2021 was 4.39% on a mortgage of £115,000 based on a 25 year term. £631pm . We bought our property for £155,000 and now it is worth approx £290,000.

So we now looking for a new deal.

So we are looking to remortgage our outstanding balance (£82,869). In an attempt to save hassle and stress (no need for lender checks etc), we may be looking to continue with YBS.

Ideally we would have liked to have done a 7 year fix (which did appear at one time on their remortgaging offers we got in the post) but they only seem to display 5 and 10 year fixes on their website.

I just wondered what others thought of the deals they currrently have on offer, and which seem the best value?

Thanks

Our 10 year fixed rate mortgage with YBS ended at the end of last year. Our fixed interest rate rate from 2011 to 2021 was 4.39% on a mortgage of £115,000 based on a 25 year term. £631pm . We bought our property for £155,000 and now it is worth approx £290,000.

So we now looking for a new deal.

So we are looking to remortgage our outstanding balance (£82,869). In an attempt to save hassle and stress (no need for lender checks etc), we may be looking to continue with YBS.

Ideally we would have liked to have done a 7 year fix (which did appear at one time on their remortgaging offers we got in the post) but they only seem to display 5 and 10 year fixes on their website.

I just wondered what others thought of the deals they currrently have on offer, and which seem the best value?

Thanks

0

Comments

-

Is 65% LTV the lowest that they proce for? I ask as you are below 30% LTV now, so if there are any deals for 60% or lower LTV then you'd be eligible for those too.

1 -

Also one other question.

When I originally took out our first mortgage, I used MSEs great guide on Life Assurance, Sickness and redundancy cover etc and arranged cover via vCavendish online.

If I were to remortgage, would I need to revisit doing these all again? Thanks0 -

YBS send details of mortgage transfer products out a couple of months before your rate finishes, why let it go onto the SVR?

Your mortgage value is low so go with the £0 few options1 -

Remortgaging can take months..... a product transfer will take seconds.1

-

Look at their retention/ product transfer products, these are rates available to new customers.

The rares are on pdf document on their website1 -

@penners324 Thanks. Unfortunately due to circumstmces at the end of last year (family covd issues etc) it delayed me sorting it.

Im eagar to get something done before the BoE interest rate review again on 3rd Feb.0 -

There is a chance the £999 fee will be better depending on your planned payment

~£83k with a 0.3% difference for a £999 fee

Max saving over 5 year £1245 with interest only

You need to narrow down your options with real deals.

1 -

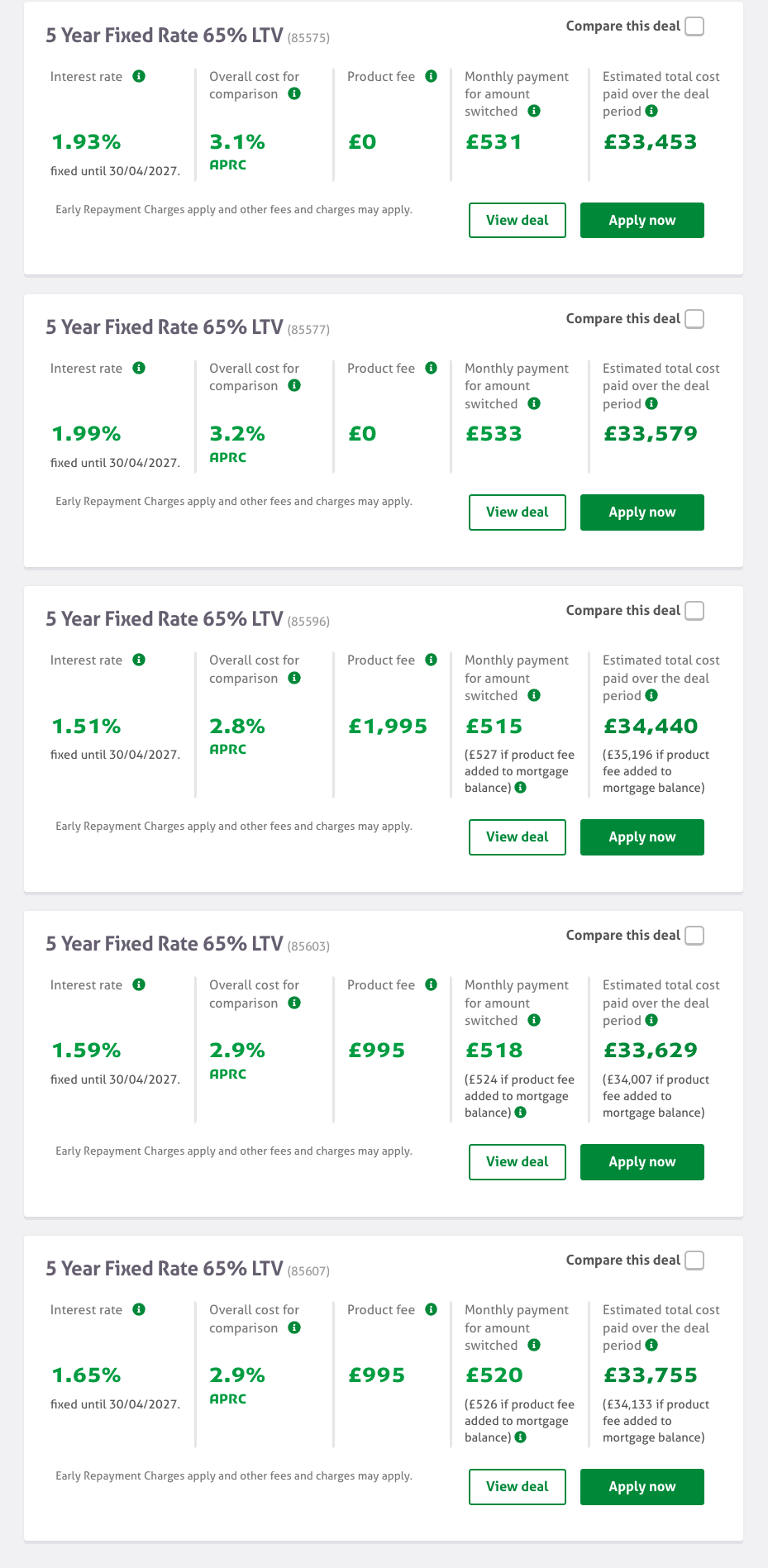

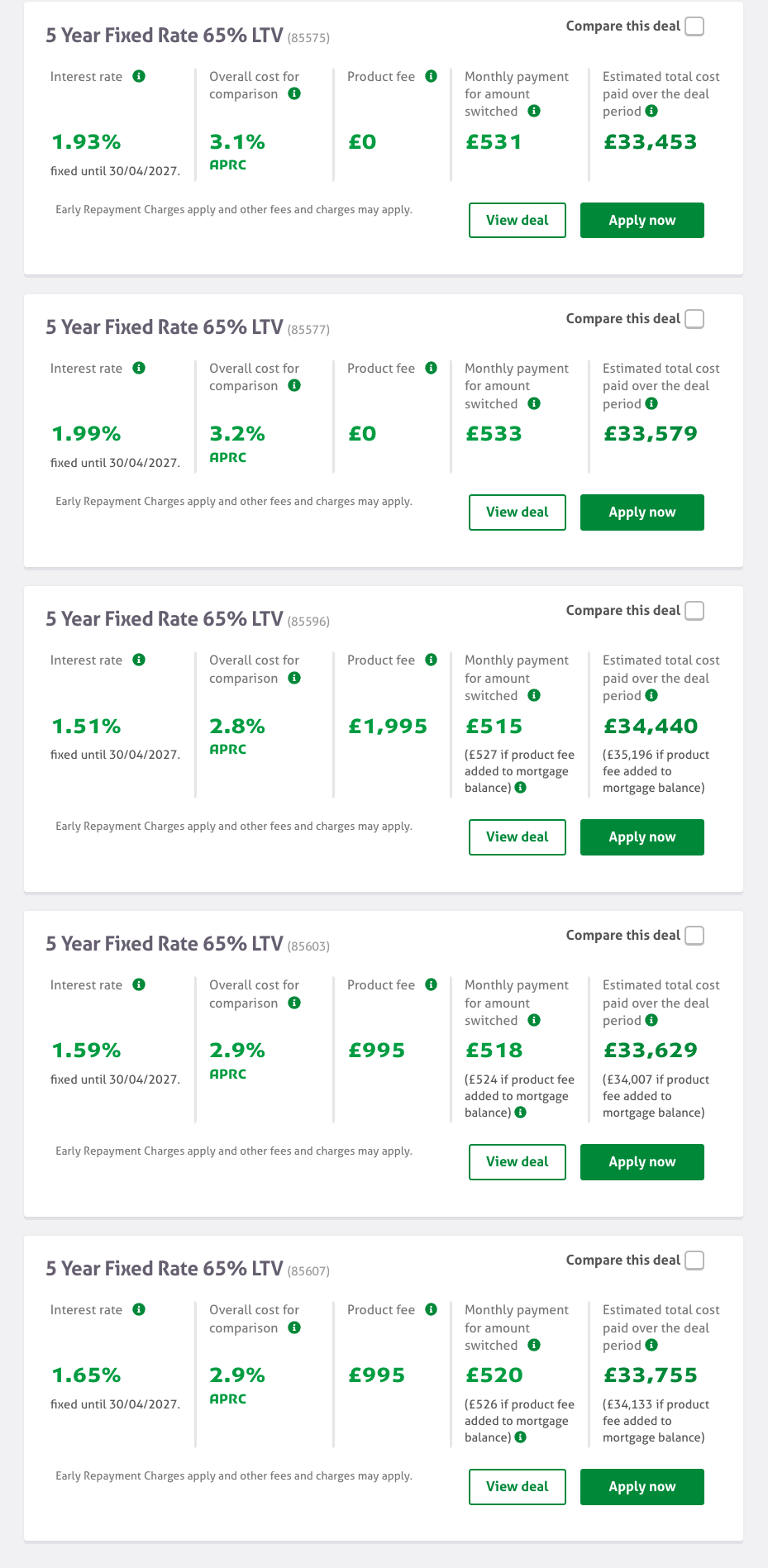

So, ive had a proper look at what YBS is offering to switch products.

Ive posted screenshot below.

Am I right in thinking that the 5 yr fixed at 1.99% with a total cost of £34,821 is the best value here?

I do have some savings to cover a product fee...but I am in the process of getting some repairs done on our home (some roof repairs and also looking to build a garden office), so was saving it for that.

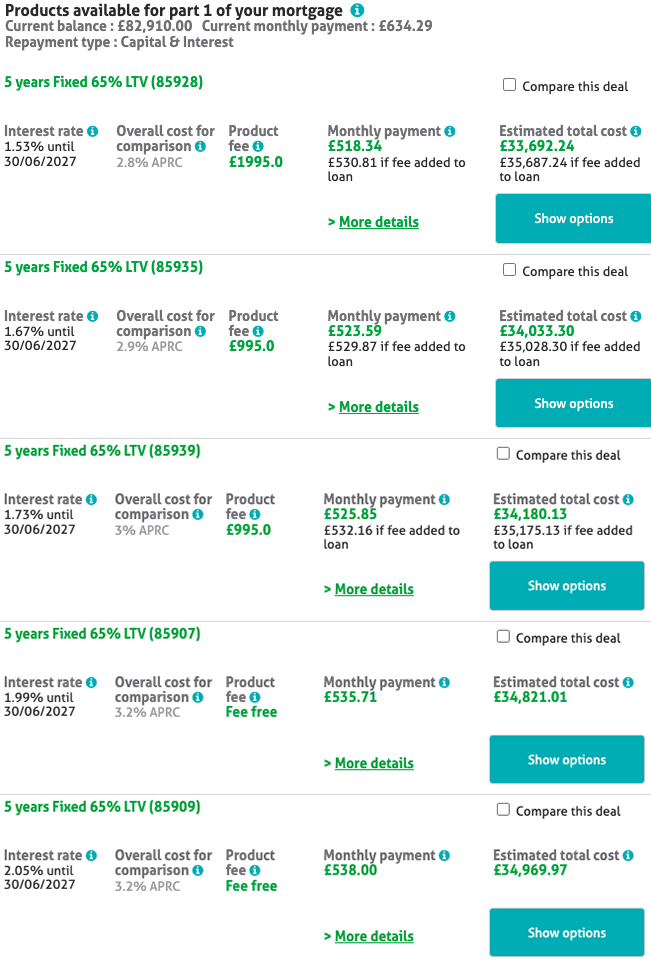

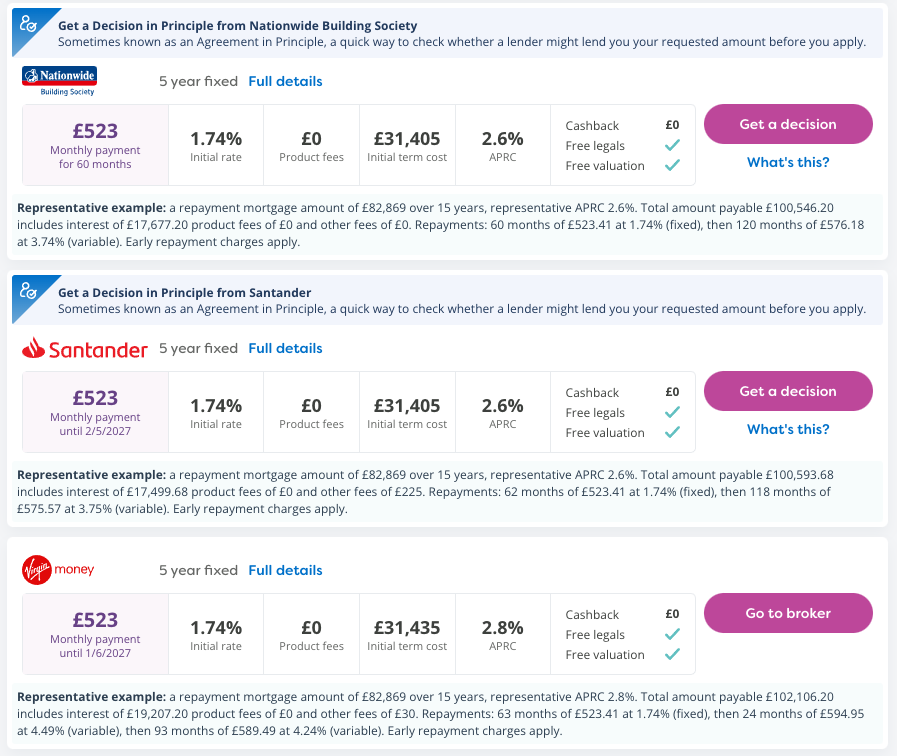

Doing some market comparison, these YBS products dont seem the cheapest on the market (see below).

I usually like to be frugal and go for the cheapest / best value deal... however im concerned how long a remortgage will take (hiccups in application, any issues with lender has with affordablity, surveys picking up any roof damage to house etc).

0 -

Am I right in thinking that the 5 yr fixed at 1.99% with a total cost of £34,821 is the best value here?

Total Cost gets the wrong answers but that's what they have to use due to regulators so we have been told.

YBS product comparisons

Assume end of Feb 2022 to end June 2027 5y4m

Add fees make the payment the same(£600pm) see what's left in 5y4m

(£600 is between what you pay now and the £516-£536 the products would cost pm)amount rate payment owing £84,905.00 1.53% £600.00 £52,135.30 £83,905.00 1.67% £600.00 £51,582.55 £83,905.00 1.73% £600.00 £51,811.95 £82,910.00 1.99% £600.00 £51,708.90 £82,910.00 2.05% £600.00 £51,939.01

1.67% 999 fee leaves you with the smallest debt for the same money.

the 1.99% no fee needs a payment of £820+ to be the better option

Will you be overpaying?

Looking at the others over the same period(they all look a month or two shorter)amount rate payment owing £82,910.00 1.740% £600.00 £50,758.58 £83,909.00 1.540% £600.00 £51,092.55 £83,905.00 1.580% £600.00 £51,239.92

those 1.75% no fee are going to leave with lower debt if no more fees and you can get it1 -

Thank you.

Ideally, in non higher cost of living times my plan was to pay the same i pay now £630, so about £100 over payment per month, however, i may use the saving on paying higher bills in the short term until fuel / cost of living prices drop.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.1K Banking & Borrowing

- 253.1K Reduce Debt & Boost Income

- 453.6K Spending & Discounts

- 244.1K Work, Benefits & Business

- 599K Mortgages, Homes & Bills

- 177K Life & Family

- 257.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards